- Home

- »

- Reports

- »

-

Flexible Packaging Supplier & Cost Intelligence Report, 2030

![Flexible Packaging Supplier & Cost Intelligence Report, 2030]()

Flexible Packaging Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Oct, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10552

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Flexible Packaging Category Overview

“The flexible packaging category’s growth is driven by the rising demand for packaged foods and the need for companies to adopt sustainable measures of packaging.”

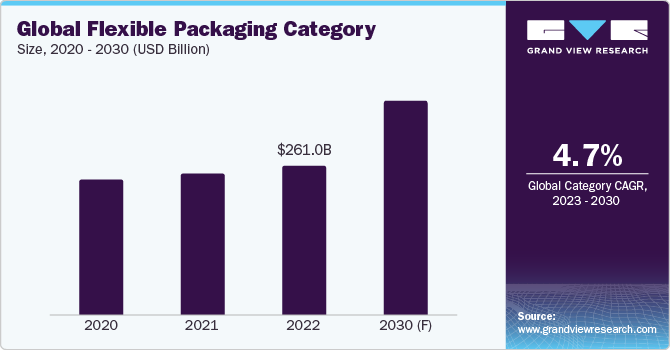

The flexible packaging category is expected to grow at a CAGR of 4.7% from 2023 to 2030. The convenience of use and affordability of the product, along with the rising demand for packaged foods, are the main drivers of the category expansion. Some of the major benefits offered are materials and resource efficiency, protection of products, reduction in food waste, reusability and recyclability, and fewer products being sent to landfills. Flexible packaging production requires less material than conventional types of packaging, which helps conserve resources and promote sustainability. It uses less energy to transport, as it requires fewer vehicles for transportation. Throughout the shipping process, flexible packaging protects products from denting and breakage. In 2022, Asia Pacific, accounting for 38% of the total share, dominated the global flexible packaging category. Due to the expanding organized retail and e-commerce sectors, and the ease of obtaining raw materials, APAC nations such as China and India are also anticipated to present prospective growth prospects for the companies.

The global flexible packaging category was estimated at USD 261.04 billion in 2022. Flexible packaging for foods and beverages accounted for nearly 55% of all flexible packaging applications, both retail and institutional in 2022. High spending on cereal or granola bars, coffee, short-run ready meals, hot chocolate sticks, chocolate pouches, dehydrated and dry foods (such as sauce or gravy packets, instant soups or rice mixes), snack foods, nuts, sweets and chocolates, spice foods, ice-cream novelty items, and bakery products (e.g., cookies or biscuits, chips, cakes, etc.) and the growing popularity of single or small-portioned snacks and convenience foods are among the key variables driving the sector. The food industry uses pillow pouches and stand-up gusseted pouches extensively as flexible packaging products. Pillow pouches have also observed significant gains because of the dairy, food, and beverage industries' growing use of them.

Two of the major trends are the increasing preference for sustainable plant-based packaging solutions to reduce carbon footprint and fuel consumption and the rise of digital printing. According to Flexpack-Europe's report in 2022, using flexible packaging solutions for food packaging could reduce the overall carbon footprint of packaging by 40% in the continent of Europe. This is equivalent to less than 1% of all GHG emissions in the EU. For instance, for the same amount of food, flexible pouches require 4% less freight room than glass containers. Additionally, it occupies 4% less landfill space and takes up less space than other packaging. According to recent studies, flexible packaging can now be produced using paper or polyethylene resin derived from plants.

Secondly, with the ability to print on-demand in virtually any amount or size, such as biscuit packs and retail pouches, digital printing is poised to play a crucial role in maintaining product safety through flexible packaging and shrink sleeves. One-to-one client engagement using changing print designs, QR codes, and increased sustainability are some of the main advantages. Due to these benefits, many printing ink solution suppliers are attempting to develop fresh approaches for flexible packs for various industries. For instance, Siegwerk announced in 2022 that it would be providing next-generation NC inks for flexible packaging applications made at its facility in Germany using the most cutting-edge manufacturing tools.

Supplier Intelligence

“What is the nature of the flexible packaging category? Who are some of the leading players?”

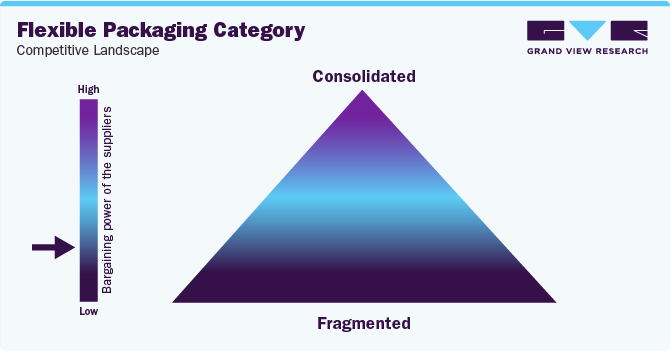

The global flexible packaging category features a fragmented landscape with the presence of several international and regional players. Globally, consumers are increasingly interested in flexible packaging. Pouch manufacturers are literally and figuratively going the extra mile to meet the needs of consumers by providing a variety of unique shapes and general conveniences that are well-suited to each particular use. There is an increasing trend for pouches to be regarded as one of the most versatile flexible packaging formats, which, in terms of form and function, means that the category is becoming more and more fragmented.

The bargaining power of the suppliers is low due to increased fragmentation. In 2021, flexible packaging accounted for almost 39% of all packaging globally and around 19% - 22% in the U.S. According to a 2021 study, it was found that approximately 60% of consumers were ready to pay a higher price for flexible packaging that is easy to open and store, can be resealed, and will last a longer period. Consumers are willing to pay 12% more money for flexible packaging that is easy to open and/or better for the environment. They are ready to pay 14% more money for packages having a resealability option. Buyers have moderate to high bargaining power since the switching costs are low.

Overall, in Q2 2023, however, M&A activity in the total packaging sector slowed, with deal volume and valuations both modestly declining. A number of factors have contributed to this, including rising interest rates, increased inflation, and limited access to debt globally, particularly in the U.S. and the European region. Profits have improved for both flexible and rigid packaging because of a drop in raw material packaging inputs. The ongoing global plastics treaty negotiations (which started in March 2022) are expected to have a significant effect on the flexible packaging sector.

Key suppliers covered in the category:

-

Bemis Company, Inc.

-

Amcor plc

-

Mondi plc

-

Huhtamaki Oyj

-

SEE (Sealed Air Corporation)

-

Constantia Flexibles International GmbH

-

Sonoco Products Company

-

Ukrplastic Corporation

-

Ampac Holdings LLC

-

Wipak Walothen Gmbh (Wipak Group)

-

SIG Group

-

Aluflexpack AG

Pricing and Cost Intelligence

“What are some of the major cost components and cost drivers involved in this category?”

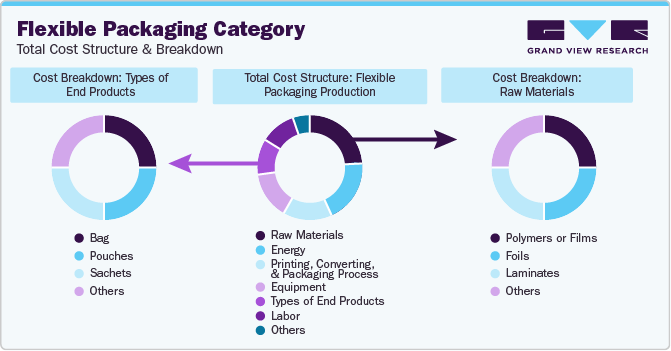

The major cost components associated with the production of flexible packaging are raw materials, energy, printing-converting-and packaging processes, equipment, types of end products chosen for production, labor, and other costs. Other costs can include transportation, SG&A, R&D, infrastructure, utilities, depreciation, tax, profit, etc. Raw materials can be further broken down into polymers or films, foils, and laminates chosen. The type of end product can include cost components such as bags, pouches, sachets, etc. Raw materials, energy, processes, and equipment can account for between 50% - 60% of the total costs. A number of variables, including material type, efficiency of the manufacturing process, volume, design complexity, and supplementary features like custom finishes or closures, influences the total cost.

For instance, the efficiency of the manufacturing process can have a significant impact on the production cost. Multiple layers of specially designed film are laminated together to create printed flexible bags like spouted pouches (in case of liquids), stand-up pouches, uniform flat barrier bags, or pillow pouches. Each layer, including the printed layer, is intended to fulfill a specific function, such as providing strength, puncture resistance, or moisture protection. By comparison, fabricating tiny layers of film requires far less energy and time than producing glass or plastic jars. Flexible packaging is an energy-efficient packaging option (it uses 50% less energy than rigid packaging) since it is lighter (manufactured with less material) and uses less fuel on a per unit basis of production/shipment than rigid packaging.

Similarly, as for material costs, even though the packaging is made of multiple layers of film, certain flexible packaging styles, such as flat-bottom flexible box bags, require up to 12% less material, which in turn is more cost-effective for the company. On average, for the same amount of goods, a flexible pouch requires 75% less material than a rigid container.

The chart below illustrates the major cost components associated with the category:

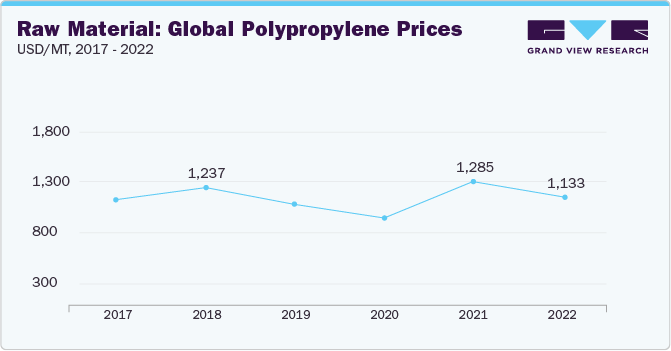

Some of the major raw materials used in this industry are polyethylene, laminated foil, polypropylene, polyester, Tyvek, and others. Compared to 2020, the price of polypropylene (PP) increased by 36% in 2021 due to shortages in upstream propylene and higher energy costs. In 2021, PP prices averaged about USD 1,285 per ton. The chart below illustrates the global raw material price trend for polypropylene between 2017 and 2022 in USD per metric ton.

In Q2 2023, polypropylene (PP) prices declined in the North American region mainly due to a reduction in feedstock propylene and crude oil prices, weak demand for upstream PP, and fluctuations in the interest rate (U.S. market). In the domestic Mexican market, PP prices reduced by 5.5% in April, 6.3% in May, and 5.2% in June 2023 owing to a sharp drop in feedstock propylene prices. Propylene prices dropped by 10% - 13% between April to June 2023 throughout the North American region.

The report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“What kind of strategies are considered in this category? What kinds of models are adopted by different companies?”

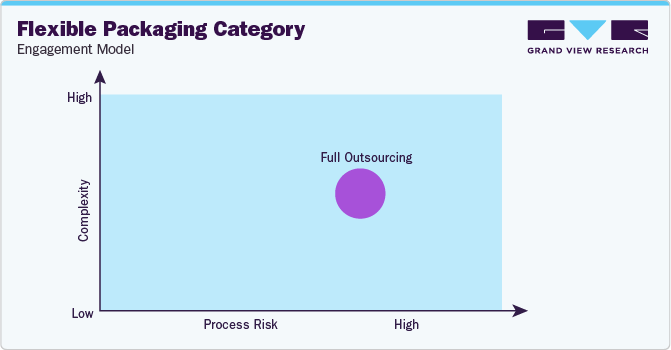

The largest end-use industries of flexible packaging are food & beverages, health and pharmaceutical. Together they account for almost 50% - 70% of total consumption. According to the 2022 PMMI report, more than 60% - 65% of pharmaceutical companies fully outsource their packaging requirements due to its complexity to a third-party contractor.

Consumer goods manufacturers (CPG) and package suppliers can benefit from the most recent advancements made by specialized printers through outsourcing. Several repeating designs can be created on a single roll of packaging material utilizing the "variance in repeat" printing capability.

As packaging involves a high degree of technical, operational, and design complexity, suppliers of packaging solutions must manage packaging as a holistic process, including design, packing, engineering, aggregation and serialization, foreign-trade zone, qualified personnel, stability, and identification testing. Outsourcing can additionally give a partner who can offer a variety of regulatory and quick launch requirements, including international regulatory requirements for multi-market launches.

In the pharmaceutical supply chain, manufacturers are concerned about a variety of issues, including cost and lead times. To maintain a competitive edge, pharmaceutical companies place a high priority on "speed-to-market". Other issues involve adhering to strict quality control specifications as well as fulfilling sustainability obligations. According to industry experts in packaging, it has been observed that the increased use of personalized medicine and injectables and the rapid pace of new product development, have contributed to the increased interest in outsourcing pharmaceutical production.

"In the full services outsourcing model, the client outsources the complete operation/manufacturing to single or multiple companies."

In terms of flexible packaging sourcing intelligence, the most preferred countries are India, China, Vietnam, Turkey, and Germany. As of May 2023, India is the world's leading exporter of flexible packaging material, shipping the majority of its products to the UK, the U.S., and South Africa.

As of May 2023, India, Vietnam, and China are the top 3 countries exporting flexible packaging materials accounting for 159,062 shipments, 4,424 shipments, and 1,207 shipments, respectively. On the other hand, the top 3 exporters of flexible packaging film are India (18,424 shipments), Turkey (776 shipments), and Colombia (225 shipments), respectively as of May 2023.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Flexible Packaging Procurement Intelligence Report Scope

Report Attribute

Details

Flexible Packaging Category Growth Rate

CAGR of 4.7% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

15% - 25% (Annually)

Pricing Models

Single, bundled, volume-based pricing model

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

By types of roll stock (barrier films, cold seal, resealable), pouch type (retort and hot fill pouch, stand up, closure option pouch), lidding types (retail package lid film, peel and reseal, non-food package lid films, food service lidding), operational capabilities, quality measures, technology, certifications, data privacy regulations, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Bemis Company, Inc., Amcor plc, Mondi plc, Huhtamaki Oyj, Sealed Air Corporation, Constantia Flexibles International GmbH, Sonoco Products Company, Ukrplastic Corporation, Ampac Holdings LLC, Wipak Walothen Gmbh, SIG Group, and Aluflexpack AG

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 376.95 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global flexible packaging category size was valued at USD 261.04 billion in 2022 and is estimated to witness a CAGR of 4.7% from 2023 to 2030.

b. The flexible packaging category is driven by the rising demand for packaged foods, convenience of use and affordability of the product, and the increasing need for companies to adopt sustainable measures of packaging.

b. According to the LCC/BCC sourcing analysis, India, China, and Vietnam are the preferred countries for sourcing flexible packaging materials and solutions.

b. The global flexible packaging category features a fragmented landscape with the presence of several international and regional players. Some of the key players are Bemis Company, Inc., Amcor plc, Mondi plc, Huhtamaki Oyj, SEE (Sealed Air Corporation), Constantia Flexibles International GmbH, Sonoco Products Company, Ukrplastic Corporation, Ampac Holdings LLC, Wipak Walothen Gmbh (Wipak Group), SIG Group, and Aluflexpack AG

b. Raw materials, energy, printing, converting and packaging processes, and equipment form the major components in this category. Other key components include the type of end products, labor, and others (such as transportation, infrastructure or facilities and utilities, depreciation, tax, etc.)

b. Selecting suppliers who can provide prototypes, pre-production and small series, samples for product launches or sampling campaigns, evaluating suppliers on good manufacturing practices (GMP) certifications for industries in addition to quality measures such as International Organization of Standardization (ISO) 9001, ISO 22000, ISO / TS 22002-1, ISO 22716, ISO 13485, etc., sourcing materials and films from low-cost countries are some of the key strategies considered in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified