- Home

- »

- Reports

- »

-

HDPE Cost, Supplier & Sourcing Intelligence Report, 2030

![HDPE Cost, Supplier & Sourcing Intelligence Report, 2030]()

HDPE Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Sep, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10543

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

HDPE Category Overview

“The HDPE, owing to its special property of being chemical resistant, high ductility is widely being used in varied industries such as packaging and automotive for the use in various forms such as food wraps and automotive fuel tanks.”

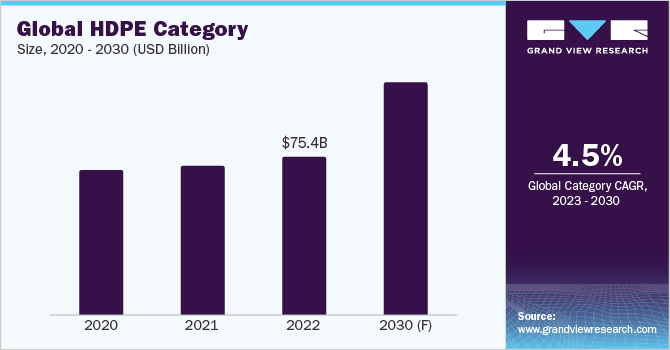

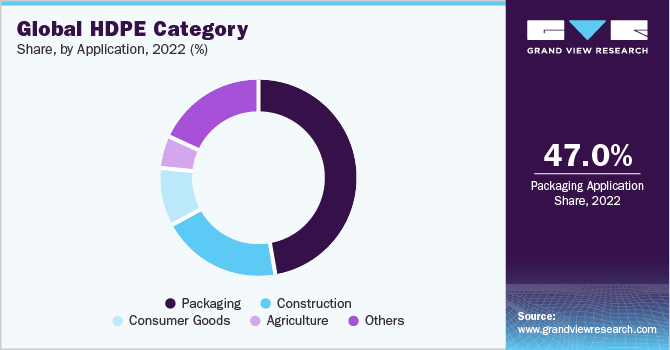

The HDPE (High Density Polyethylene) category is expected to grow at a CAGR of 4.45% from 2023 to 2030. Factors such as high ductility, excellent chemical resistance, increased impact strength, and reduced weight allow HDPE to be used in varied industries. Wide applications of this product in automotive, packaging, healthcare & pharmaceuticals, infrastructure & construction, electrical & electronics, and agricultural industries are fueling the category growth. It is majorly being used in the form of products such as detergent bottles, food wraps, shopping bags, and automobile fuel tanks, globally. The packaging industry holds the largest segment in the category accounting for 45%-50% of the total share. Research & development and technological innovation in High Density Polyethylene bag design and manufacturing are further driving the category growth.

The global HDPE category size was valued at USD 75.43 billion in 2022. One of the key trends is the increasing R&D and technological innovation in the category of developing eco-friendly and more sustainable products. Advanced closure systems and tamper-evident features are increasingly becoming popular which portrays the feature of providing visible indications of unauthorized access or tampering to the bag’s content. Tear strips, tamper-evident seals, and specialized closure mechanisms ensure consumers the safety and integrity of products stored inside.

Continual research in this field has added chemicals that increase HDPE bags' capacity to decompose to make them more environmentally friendly.

The largest segment in the packaging industry uses this product for film production. Health and safety concerns post-COVID-19 have increased the demand for packaged food items to maintain hygiene. To develop an eco-friendly solution for packaging, a blend of cassava starch and HDPE is used with green tea by melt extrusion, aiming for a greener food packaging solution.

Innovation and technology have rapidly advanced the recycling sector in this category. In 2023, Calgary-based company Nova Chemicals Corp. is pushing sustainability by starting a new project and constructing its first mechanical recycling facility in Indiana, U.S. This facility's function is to transform used plastic sheets into Nova's Syndigo recycled polyethylene, which is used commercially. Players are also collaborating with firms to develop sustainable plastics for the packaging industry. The solutions have helped in enhancing the quality of recycled HDPE. For instance, in 2022, Baerlocher, a plastic additives supplier collaborated with machinery OEMs and polyethylene supplier ExxonMobil to innovate and develop new sustainable plastic for the packaging industry. Innovative Baeropol T-Blends from Baerlocher significantly enhance the quality of recycled HDPE.

Production planning and innovation in manufacturing processes have allowed players to enter large-scale production of HDPE products. For instance, Formosa Plastics Corporation invested USD 207 million in 2022 towards a new production facility in Texas, U.S. The project is predicted to be finished by October 2025. Alpha olefins, which are required to generate HDPE and other products, can be produced at the plant at 100,000 tonnes per year capacity after the setup.

Supplier Intelligence

“What is the nature of the HDPE category? What are the initiatives taken by the suppliers in this category?”

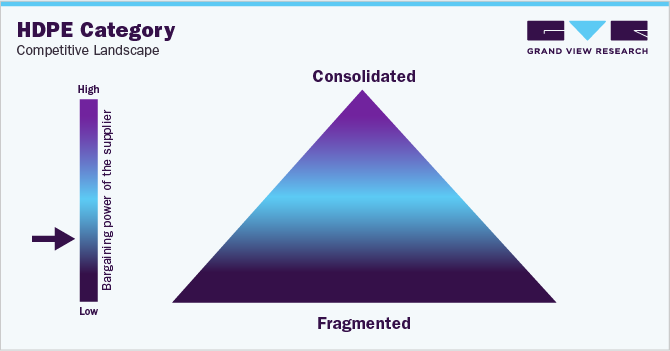

The global HDPE category is fragmented with the presence of several players in the market. Category participants are focusing on making innovations in the product category to excel in the competition. Strategic partnerships and alliances have helped in expanding the reach to the wider market with a range of products and services, making use of economies of scale and resources and their brand reputation. For instance, in 2021, Sao Paulo-based petrochemical company, Braskem launched a new polyethylene resin specifically created for the packaging industry. This innovation led them to fulfill the high standards of the chemical and agrochemical industry. The resin provided essential characteristics including impact resistance, rigidity, cracking resistance, and improving product safety in the packaging industry.

Major players are collaborating with various organizations to innovate various recycling tools, launch innovative products, and develop solutions for sustainability. For instance, in Jan 2022, two companies SABIC and ExxonMobil formed a joint venture called Gulf Coast Growth Ventures, aimed to build a new petrochemical complex in Texas, U.S. This collaboration allowed the companies to capitalize on the growing demand for HDPE in the U.S. and strengthen their position in the market.

The competition is intense between players as many large and small players offer a range of services. This category's suppliers offer raw materials, manufacturing, and designing of the products, as well as the latest technology solutions. Growing business usage reduces the marginal gap, allowing suppliers to gain significant negotiation strength in this category.

Key suppliers covered in the category:

-

Borealis AG

-

Lotte Chemical Corporation

-

The Dow Chemical Company

-

PetroChina Company Limited

-

Abu Dhabi Polymers Company Limited

-

Formosa Plastics Corporation

-

Exxon Mobil Corporation

-

LyondellBasell Industries N.V.

-

SCG Chemicals Public Company Limited

-

INEOS AG

Pricing and Cost Intelligence

“What are some of the major cost components involved in the HDPE category? Which factors impact the cost of HDPE?”

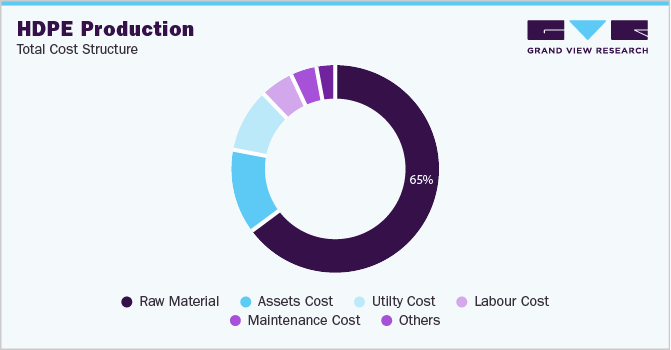

Raw materials, assets, and utilities form the major cost components when it comes to producing HDPE. Several factors can affect the cost of the category, including the type of product, the size and complexity of the product, and the volume of production. Production made using injection or extrusion molding type also impacts the price of production. Injection molding is considered to be more expensive than extrusion since it produces better results while manufacturing the product. Other factors such as utilities, labor, and assets cost must be taken into consideration during production, for businesses to remain profitable and competitive at the same time.

The following chart provides various costs incurred during the production of the category. The major cost heads are shown below:

HDPE granules are one of the core raw materials for producing various items such as plastic tanks, toys, pipes, kitchenware, jerry cans, and other household items. Raw material constitutes about 60-65% of the total cost during production. Product prices are heavily influenced by raw material price fluctuations, market demand, production costs, quality, and supply, affecting the overall production cost. The price of HDPE granules ranges between USD 1300 to 1700/tonne. Recycled granules are comparatively available for a lesser price ranging between USD 800 to 1000/tonne in the U.S. market. The prices for HDPE granules also depend upon market conditions, location preference, production costs, and the availability of raw materials. For instance, prices are lower in the APAC market owing to the low production cost and abundant supply of raw materials in comparison to the market prices in the U.S. and Europe which are on the higher side due to high standards and strict regulations in manufacturing and the environmental protection.

Extrusion, injection, and injection stretch blow mold are some of the types of machines that are utilized in the HDPE category for production, and each has a different pricing. Extrusion-style packaging is often less expensive than packaging made by injection molding. The price is more affected by equipped technology, which includes 3D printing, miniaturization, lightening, and automation utilized during the production.

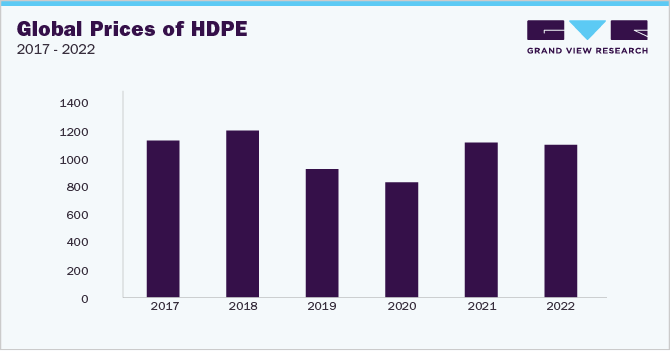

COVID-19 had a drastic effect on the prices of HDPE, with prices dropping from USD 1200 per metric tonne in 2018 to USD 850 in 2020. Prices started climbing with an increase in demand from the packaging industry post-recovery from the pandemic to reach USD 1130 per metric tonne in June 2022.

The report provides a detailed analysis of the cost structure of HDPE and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“Which countries are the leading sourcing destinations for HDPE production?”

Asia Pacific is the major region involved in the production of HDPE due to the availability of various raw materials, the latest technology, and cheap labor. China is one of the largest producers of HDPE in the world. In March 2023, China's production capacity of HDPE reached 4.16 million metric tons, the highest among all other countries after the US. In terms of HDPE sourcing intelligence, the top six countries preferred for this category are China, India, U.S. Japan, Brazil, and Germany.

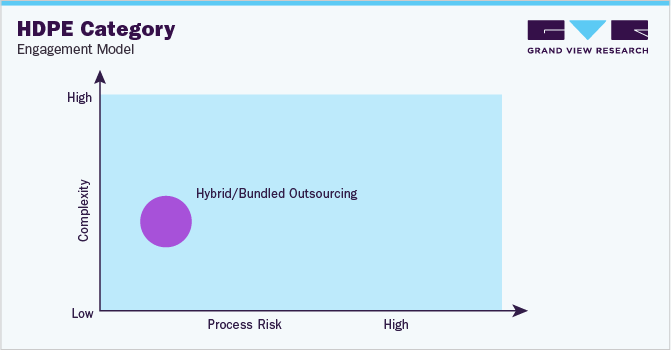

In the hybrid outsourcing model, suppliers outsource some parts of the overall operation to third parties. Generally, the client carries out critical operations in-house.

In terms of engagement, suppliers of HDPE adopt a hybrid model. Many industries are rushing to adopt the power that comes with cutting-edge technologies. HDPE is required to make products in various forms such as blow-molded or injection-molded. China has cheap labor and the latest technology that allows the manufacturers to outsource some of their operations which helps them in cutting costs and have economies of scale. Wide logistics connectivity from China allows manufacturers to expand their reach to the global market. Ning E-Plastics is the leading supplier and manufacturer of HDPE in China which offers customization of HDPE products with customizations that are based on the requirements of the clients. Its HDPE sheets are widely used for heat-resistant firework mortars, geothermal heat transmission piping systems, natural gas circulation pipe systems, and other demanding areas, unlike other HDPE sheet suppliers. Due to the certifications and complexity involved during production, many suppliers outsource critical operations to third-party vendors to have better productivity.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

HDPE Procurement Intelligence Report Scope

Report Attribute

Details

HDPE Category Growth Rate

CAGR of 4.45% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

2% - 4% (Monthly)

Pricing Models

Cost plus pricing model, volume-based pricing model

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

By type, packaging options, operating capability, durability, quality measures, technology, certifications, regulatory compliance, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Borealis AG, Lotte Chemical Corporation, The Dow Chemical Company, PetroChina Company Limited, Abu Dhabi Polymers Company Limited, Formosa Plastics Corporation, Exxon Mobil Corporation, LyondellBasell Industries N.V., SCG Chemicals Public Company Limited, INEOS AG.

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 106.86 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global HDPE category size was valued at approximately USD 75.43 billion in 2022 and is estimated to witness a CAGR of 4.45% from 2023 to 2030.

b. Wide applications of HDPE in automotive, packaging, healthcare & pharmaceuticals, infrastructure & construction, electrical & electronics, and agricultural industry are fueling the category growth.

b. According to the LCC/BCC sourcing analysis, China, the U.S., and India are the ideal destinations for sourcing HDPE.

b. This category is fragmented with the presence of many large players competing for market share. Some of the key players are Borealis AG, Lotte Chemical Corporation, The Dow Chemical Company, PetroChina Company Limited, Abu Dhabi Polymers Company Limited, Formosa Plastics Corporation, Exxon Mobil Corporation, LyondellBasell Industries N.V., SCG Chemicals Public Company Limited, INEOS AG.

b. Raw materials, assets, and utility costs are the major key cost components of this category. Other key costs include labor, and maintenance costs.

b. Supplier evaluation, material quality testing, price consideration, and meeting regulatory compliance are the best sourcing practices considered for this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified