- Home

- »

- Reports

- »

-

Helium Cost, Supplier & Sourcing Intelligence Report, 2030

![Helium Cost, Supplier & Sourcing Intelligence Report, 2030]()

Helium Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Oct, 2023

- Base Year for Estimate: 2021

- Report ID: GVR-P-10554

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Helium Category Overview

“The helium category is being driven by increasing investments in technology and widespread applications in aerospace and deep-sea exploration.”

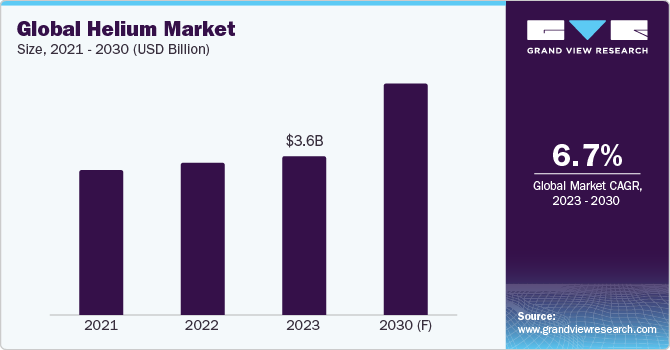

The helium category is expected to grow at a CAGR of 6.7% from 2024 to 2030. Due to the increasing demand for helium use across aerospace, healthcare, deep-sea exploration, automotive, and manufacturing sectors, the category is anticipated to expand quickly throughout the forecast period. The growth is driven by factors such as increased investment in technology and rising demand for helium in research and development to improve GPS in submarines and airplanes. Firstly, advancements in nuclear energy, cryogenics, and semiconductors have broadened the areas of applications and demand for helium industry-wide. Secondly, owing to its frictionless property and its ability to produce auditory sensations, it is used to enhance the GPS in aircraft and submarines. In a similar vein, NASA's ongoing research on this category for deployment in space projects is anticipated to drive growth in the near future.

The global helium market was estimated at USD 3.61 billion in 2023. Among noble gases, this category dominates with 47% of the overall share in 2023. Two of the major trends are the strong demand from the medical and electronics industry. One of the many uses of this category in the medical field, for instance, is the cooling of superconductive magnets in MRI and NMR equipment using liquid helium. A few eye procedures also employ liquid helium. For instance, in 2023, Samsung Electronics announced an investment of USD 230 billion in the world’s largest semiconductor facility in South Korea. This will enable and propel the category towards a greater requirement for helium utilization in the electronics industry.

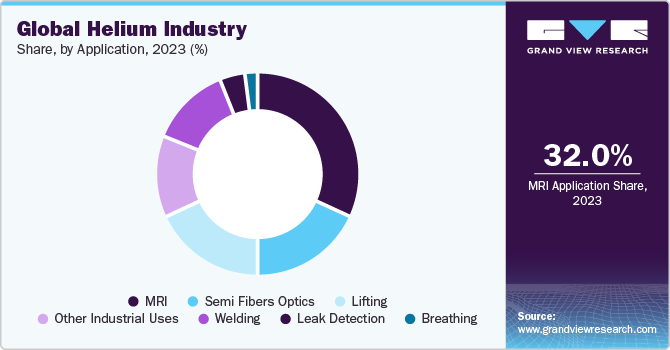

There are almost negligible replacements for this category in many industries, with MRI having the highest utilization (32%), and semi-fiber optics coming in second (18%), followed by other industrial uses in 2023. The use of helium in semiconductors and fiber optics sectors has grown rapidly since 2021. Between 2019 and 2021, helium was a key component of the global refrigeration and shipping of COVID-19 vaccines.

Supplier Intelligence

“What is the nature of this category? Who are some of the leading players?”

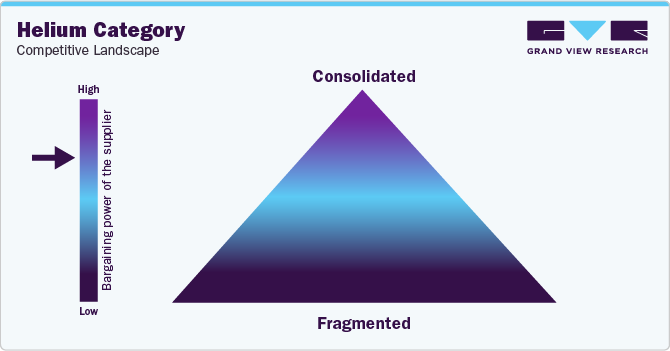

The global helium category features an oligopolistic landscape with five major players dominating the market share. These companies have very strong and widespread distribution and production channels that enable them to offer finished products across the world. The top five players (Linde, Air Liquide, Air Products, Taiyo Nippon Sanso, and Iwatani) contribute around 80% of the market share. Despite having many medium to small players regionally, these large gas companies are skilled at controlling the prices. Prices during times of shortage can rise fast and significantly.

Suppliers actively engage in multiple mergers and acquisitions, capacity expansion, partnerships and collaborations, launch new products, develop new technologies, and invest heavily in R&D to gain competitive advantage. For instance, to recover the helium stored in Freeport LNG's Texas production facility, Linde declared that it has struck a new, long-term helium off-take agreement in April 2022. Linde also proposed to develop a new processing facility in Freeport for the purpose of cleaning and liquefying the recovered helium in order to secure a second source of liquid helium in the U.S.

The bargaining power of the suppliers is high due to increased consolidation. The suppliers also specialize in the production of different gases such as hydrogen, oxygen, and many other cryogenic gases. They cater to multiple industries such as petroleum oil and gas, automotive, pharma and medical, electronics, welding, technical research, and many others which further increases their power. Companies such as Messer and Linde have their own specialized vacuum containers and cryogenic transportation vehicles for helium which gives them an added edge.

Key suppliers covered in the category:

-

Linde Plc

-

Nippon Sanso Holdings Corporation

-

Messer SE & Co. KGaA

-

Air Products and Chemicals, Inc.

-

Air Liquide S.A.

-

Iwatani Corporation

-

STRANDMOLLEN A/S

-

Axcel Gases

-

Gulf Cryo

-

The Southern Gas Limited

-

Ellenbarrie Industrial Gases Limited

-

Qatargas Operating Company Limited

-

Buzwair Industrial Gases Factories

-

nexAir, LLC

-

Exxon Mobil Corporation

Pricing and Cost Intelligence

“What are some of the major cost components and variables influencing the total cost of the category?”

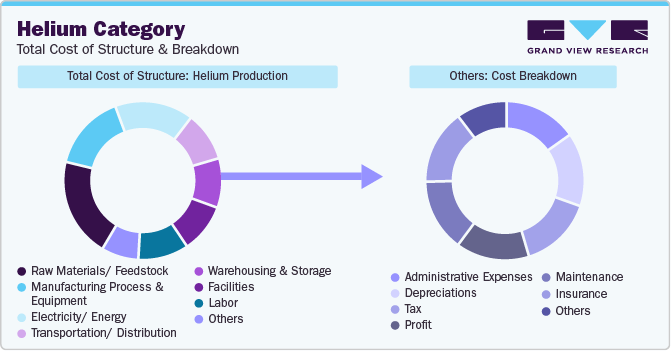

The major cost components associated with the production of helium are raw materials/feedstock, manufacturing process and equipment, electricity/energy, transportation/distribution, warehousing and storage, facilities, labor, and other costs. Other costs can include administrative expenses, depreciation, tax and profit, maintenance, and insurance, etc. Raw materials can include different cost components such as natural gas, methane, ethane, activated carbon, and nitrogen. Raw materials together with electricity, manufacturing process and equipment, and transportation can account for around 50% - 60% of the total costs of production. There is a wide range of helium content in natural gas deposits, ranging from almost none to as much as 4% by volume which can in turn impact the cost structure. The cost of electricity is predominantly used in the pre-treatment, separation, and purification of helium or natural gas.

Some of the factors influencing the total cost are purity of the gaseous or liquid helium, frequency of purchase, volume, natural gas and oil price fluctuations, customizations, quality, freight, logistics, etc. For instance, a high value of production is involved with complex design and custom-made gas products. Because these goods are only available through certain channels, this influences their costs. The primary energy source used in air separation is electricity, which also affects how much industrial gases cost to produce. Smaller units have a disadvantage over large-scale operations because they need more electricity specifically. Final gas prices can also be influenced by the purity level of the gas, and the demand for high-purity gas sets those prices.

The following chart below illustrates the major cost components associated with the category.

Although the actual price of helium is not publicly known, since helium shortage 4.0 began in 2021, most helium users have seen a rise in its prices of between 50% and 100%. The price of this category in Asia's domestic market increased during the first quarter of 2023. Despite declining natural gas prices, there was a global product scarcity, which led to an increase in the price of helium gas. Tilted import prices also affected the final pricing since there was a lack of adequate supply in India. As the supply chain remained unbalanced and transit durations grew, product prices spiked towards the end of Q1 2023. The demand for the commodity was stronger in the semiconductor manufacturing and healthcare sectors of India.

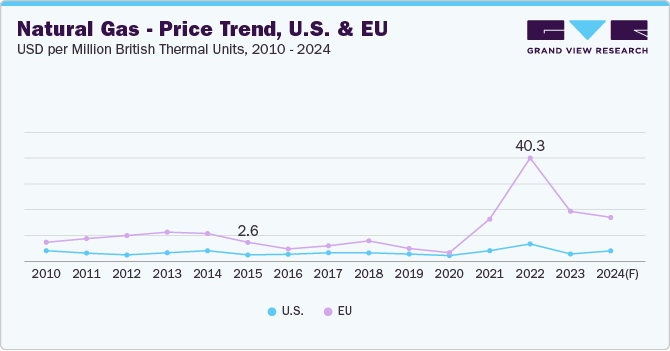

Natural gas is one of the most important raw materials in this category. A cryogenic pipe system is typically used to remove helium from natural gas. Depending on the area, the concentration of helium ranges from trace quantities to 4%. For instance, the major components of natural gas in Alaska are 90% methane, 7% nitrogen, and around 3% helium. Furthermore, helium concentrations greater than 0.3% are regarded as economically viable for extraction. The chart below illustrates the price trend of natural gas in the United States and Europe between 2010 and 2024.

In 2022, on average, natural gas prices reached around USD 6.4 per million British thermal units in the U.S. as compared to USD 40.3 in Europe. In particular, in August 2022, natural gas prices in the EU reached USD 70 per million British thermal units. A steep rally in prices in the European region was the result of the Russia-Ukraine war, supply chain disruptions, and the energy supply shortage that began in 2021. However, in June 2023, the national average price of natural gas in the U.S. dropped to USD 2.18 per million British thermal units. One of the key reasons for the price drop in the U.S. has been attributed to the country's rising natural gas production.

The report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“What kind of sourcing strategies are considered in this category? What kinds of models are adopted by different companies?”

The largest end-use industries of this category are cryogenics and aerospace. Industrial gases such as helium are used in a variety of processes that require varying amounts, purities, and pressures. The technology for recovering high-grade helium has substantially advanced over time. The need for the latest technology such as advanced cryogenic distillation systems, pretreatment, separation, and purifying systems has enabled manufacturers to outsource some of their operations. Outsourcing can provide solutions that are tailored to the client's operation and needs with reduced cost of capital.

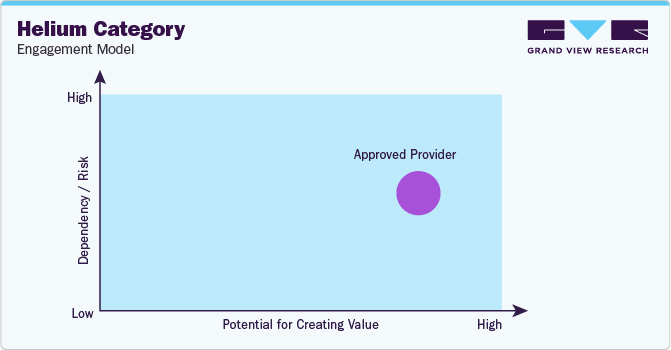

Hybrid/bundled outsourcing is the most preferred engagement model in this category. Companies are actively engaging with third-party suppliers that demonstrate exploratory skills to help and find new natural gas bases in order to safeguard them for long-term supply. They are also partnering with technology owners and engineering firms to merge technologies and increase efficiency while creating supply schemes for their products.

"An approved provider is a supplier that meets a predefined set of qualifications, quality standards, prior-proven performances, or other selection criteria."

In terms of helium sourcing intelligence, companies look for approved providers that can provide quality raw materials with certain predefined qualifications and are chosen based on their past proven performances. Certain methods as well as techniques such as extraction and mode of supply are used by companies to source gases for their use in varied industries. To achieve high purity levels from suppliers, large-scale companies frequently use cutting-edge technology like cryogenic separation processes to comply with quality production. Companies involve in long-term supply contracts with approved providers of raw materials to attain materials at a certain cost with specified qualities to improvise and maintain consistency in their product development.

The U.S. is the world's leading producer of helium as of 2022. About 75 million cubic meters of helium were produced in the United States in 2022. The top five countries preferred for sourcing the commodity are the U.S., Qatar, Algeria, Australia, and China.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Helium Procurement Intelligence Report Scope

Report Attribute

Details

Helium Category Growth Rate

CAGR of 6.7% from 2024 to 2030

Base Year for Estimation

2023

Pricing Growth Outlook

15% - 20% (Annually)

Pricing Models

Volume-based, contract-based pricing model

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Application areas served, supply type, production capacity, purity level, type of helium provided, sources of helium, sub-helium brands, operational capabilities, quality measures, technology, certifications, data privacy regulations, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Linde Plc, Nippon Sanso Holdings Corporation, Messer SE & Co. KGaA, Air Products and Chemicals, Inc., Air Liquide S.A., Iwatani Corporation, STRANDMOLLEN A/S, Axcel Gases, Gulf Cryo, The Southern Gas Limited, Ellenbarrie Industrial Gases Limited, Qatargas Operating Company Limited, Buzwair Industrial Gases Factories, nexAir, LLC, and Exxon Mobil Corporation

Regional Scope

Global

Revenue Forecast in 2030

USD 6.07 billion

Historical Data

2021 - 2022

Quantitative Units

Revenue in USD billion and CAGR from 2024 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global helium category size was valued at USD 3.61 billion in 2023 and is estimated to witness a CAGR of 6.7% from 2024 to 2030.

b. The increasing demand for helium applications across aerospace, healthcare, deep-sea exploration, automotive, and manufacturing sectors in addition to the increasing R&D investments by companies is driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, the U.S., Qatar, Algeria, Australia, and China are the preferred countries for sourcing helium.

b. The global helium category features an oligopolistic landscape with the dominance of a few major players. Some of the key players are Linde Plc, Nippon Sanso Holdings Corporation, Messer SE & Co. KGaA, Air Products and Chemicals, Inc., Air Liquide S.A., Iwatani Corporation, STRANDMOLLEN A/S, Axcel Gases, Gulf Cryo, The Southern Gas Limited, Ellenbarrie Industrial Gases Limited, Qatargas Operating Company Limited, Buzwair Industrial Gases Factories, nexAir, LLC, and Exxon Mobil Corporation.

b. Raw materials, manufacturing process and equipment, electricity, and transportation form the largest cost components in this category. Together they account for between 50 – 60% of the total cost of production. Other costs include warehousing and storage, labor, facilities, depreciation, tax and insurance, profit, etc.

b. Selecting suppliers who can obtain helium by direct extractions or from manufacturers who can refine the helium from natural resources, negotiating with more than one vendor to gain flexibility in terms of customizations, and evaluating suppliers on certifications and purity of helium provided are some of the strategies adopted in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified