- Home

- »

- Reports

- »

-

HR Consulting Procurement & Cost Intelligence Report, 2030

![HR Consulting Procurement & Cost Intelligence Report, 2030]()

HR Consulting Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Dec, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10563

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

HR Consulting Category Overview

“Rising organizational changes, demand for talent management, automation in HR solutions, and skill shortages are driving the demand for HR consulting services.”

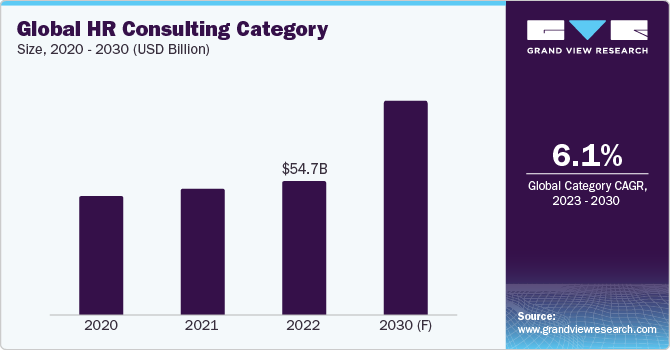

The HR consulting category is expected to grow at a CAGR of 6.1% from 2023 to 2030. The paradigm shift brought by the post-pandemic era has transformed companies to adopt remote work policies and flexible work arrangements. HR consulting companies are curating their solutions to meet these the changing needs of their clients and helping them with employee engagement, onboarding, and other employee management services. Additionally, consulting firms are focusing on providing services such as implementing diversity at all levels including in the leadership positions within the client’s organization which is in lieu of companies’ efforts to increase their diversity & inclusion adoption within their organizations. For instance, in February 2022, The Boston Consulting Group (BCG) conducted a study that suggested companies having a diversified team recorded 19% to 20% higher revenue. As a result, companies such as BCG, Bain & Company, McKinsey and Company, and others are emphasizing on these services. Employees’ mental health has also brought employees’ well-being into the limelight of the current trends for the service providers. HR consulting firms are investing heavily in resources to support the psychological and emotional needs of their client organizations’ employees while suggesting policies/measures to follow in order toto maintain employee well-being.

The global HR consulting category size was valued estimated at USD 54.7 billion in 2022. Automation has changed how consulting companies help organizations in the recruiting, managing, and employee development process in that organization. Human resource consulting firms are using Artificial Intelligence (AI) that can help them in providing functions such as employee onboarding, and candidate screening. AI-powered tools enhance the employee experience, streamline processes, and improve decision-making for the companies reaching out to consulting firms. Consulting companies are continuously seeking to incorporate automation into their human resource process. For instance, in October 2023, as part of the partnership agreement between EY and IBM, EY.ai workforce, a new HR solution powered by IBM Watson, was launched. This solution enables organizations to integrate AI into their HR business processes.

Human resources experts within consulting firms are leveraging data analytics to provide clients with well-informed strategies. This is done by utilizing HR metrics, workforce analytics, and predictive analytics that steer talent management strategies, enabling organizations to enhance their hiring procedures and performance assessments. Consulting firms are emphasizing the importance of continuous learning and skill development services such as employee training programs, re-skilling, and upskilling that can make it easier for end-user organizations to retain their employees.

Human resource consulting firms are designing and implementing strategies such as employee feedback, rewards, recognition, diversity, inclusion, and communication to help clients create better experiences for their employees throughout their employment. These services focus on the complete interaction of the client with its employees right from the recruitment process to the exit from the organization.

Supplier Intelligence

“What are the characteristics of the HR Consulting category?”

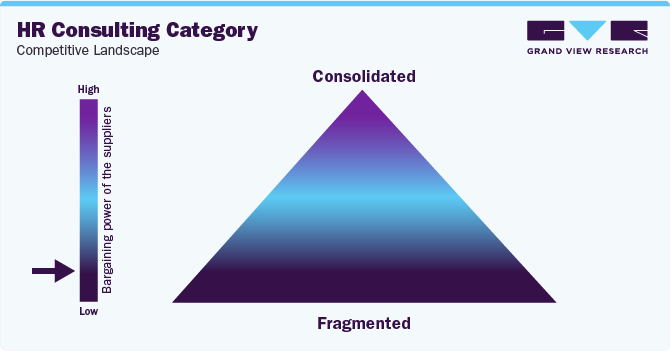

The global HR consulting category is highly fragmented due to the presence of various players offering a wide range of services including talent acquisition, employee training, compensation and benefits, digital learning tools, and platforms for integrated employee management. Companies such as BCG, EY, KPMG, Bain & Company, McKinsey & Company, and other large firms offer a range of services and have already established their presence in the industry. The presence of multiple Tier 2 and Tier 3 firms, that specialize in offering consulting services specific to a HR software or service segments further adds to the fragmentation.

MBB and the top 10 - 15 HR consulting companies have superior bargaining power due to the availability of domain expertise and tools/software in addition to a significant dominant presence in this industry. Large corporations prefer choosing consulting firms having with a strong reputation. However, due to the presence of multiple vendors, the switching costcost s in this category is is low which in turn increases the bargaining power of buyers. SMEs usually prefer engaging with Tier 3 HR consultants owing to tight budgets.

Key suppliers covered in the category:

-

Boston Consulting Group

-

Bain & Company

-

McKinsey & Company

-

KPMG

-

PWC

-

EY

-

Oliver Wyman

-

Accenture

-

Mercer

-

Hewitt

Pricing and Cost Intelligence

“What are some of the major cost components in the HR consulting services category? How are these components impacting the category?”

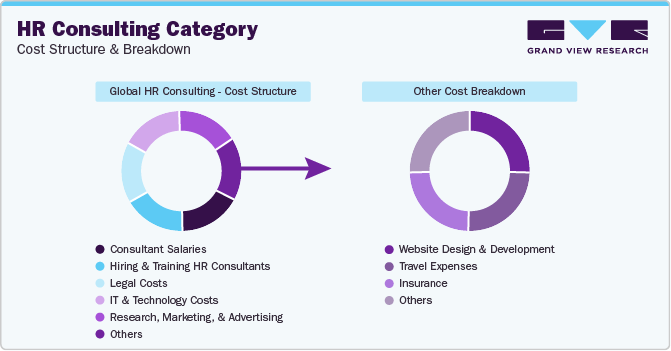

Consultant salaries, hiring and training HR consultants, legal costs, IT and technology costs, and research, marketing, and advertising are some of the key cost components incurred in providing the services. Consultant salaries, hiring and training HR consultants, legal costs, and IT and technology costs account for a major part of the total cost structure. Other costs include website design and development, travel expenses, and insurance. The IT and technology costs which include computer systems, high-speed internet connection, scanners, and printers can generally cost around USD 1,000 to USD 3,000. For large firms that require complex IT infrastructure can cost around USD 50,000 per year. Similarly, for small firms, it can cost around USD 5,000 to USD 10,000 per year.

In general, the total cost of software systems such as applicant tracking systems (ATS), learning management systems (LMS), and human resource information systems (HRIS) can cost be in the range of USD 500 USD to 20,000 per year. Systems can be bought only for one application or can be in the form of a suite. For small and medium-sized firms, ATS and HRIS systems can cost between USD 500 and USD 1,000 per year respectively.

Hiring and training HR consultants, which is one of the main cost components of the business requires heavy investment in the process that includes advertising, screening, interviewing, and background checks. This can cost around USD 2,000 to USD 5,000 per hire depending on the number of candidates, experience, location, and source of recruitment. Additionally, it is also essential to train and develop HR consultants to keep them up to date with the industry trends. The cost of training and development can range from USD 1,500 to USD 3,500 per consultant which may vary depending on the level of specialization, and training program.

Providing human resource consulting services also incurs research, marketing, and advertisement (RMA) costs which include conducting market research, developing a business plan, identifying target customers, and creating a marketing strategy. According to the FINMODELSLAB 2023 report, the cost of market research for a human resource consulting firm can be around USD 10,000 - 20,000, on average.

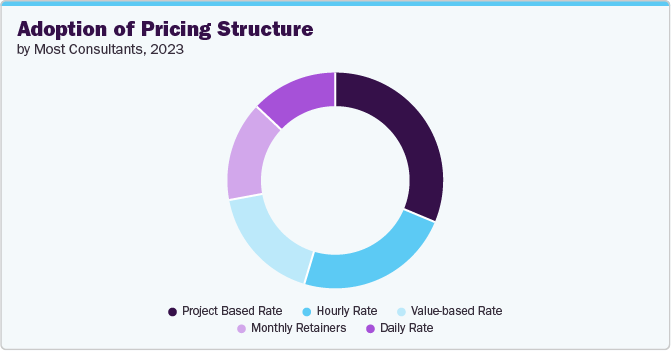

The chart below indicates the most common pricing structures used by consultants:

The HR consulting firms usually use project-based, hourly rate, value-based rate, monthly retainer, or daily rate pricing structures. Around 31% of the consultants use a project-based pricing structure. High-level consultants such as BCG, McKinsey, and Bain usually use project-based pricing for large companies due to the high demand for management advisory and strategic planning jobs. Consultants, in their hourly rate pricing structure, often set their base pay based on the pay they received from their previous company or from their existing company on an hourly basis with little markup. For small companies who do not want to establish long-term agreements and minimize the complications of complex contracts with these HR consulting firms, often end up using hourly or daily rate pricing structures.

The report provides a detailed analysis of the cost structure of HR consulting services and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“What are some of the best sourcing practices considered for HR consulting services?”

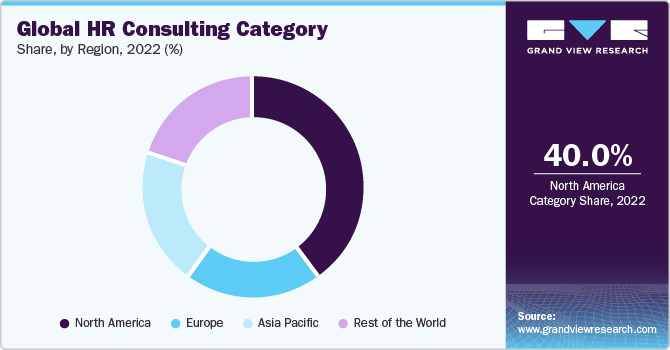

North America is the major region that dominated the category in 2022. The average hourly rate for an HR consultant in the U.S. is USD 40 as of 2023. However, the typical hourly rate ranges between USD 36 to USD 44 per hour depending on factors such as level of experience, additional skills, certifications, and others. The average salary for a consultant in the U.S. is USD 81,000 per year. There are were around 45,230 human resource consulting firms in the U.S. as ofin 2022.

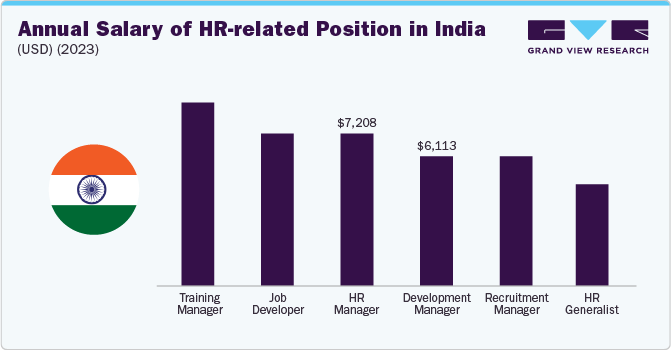

India, Singapore, and Canada are the preferred countries for sourcing these services. India is the hub for offshoring various services. Due to the strong capabilities of Indian HR consulting firms, presence of a large pool of consulting talent, and low labor costs, India is preferred as the most cost-effective nation for this category. A human resource consultant in India makes an average salary from USD 15,000 to USD 20,000 each year. The salary for entry-level positions starts at USD 5,200 per year in India. However, experienced consultants can make up to USD 29,000 yearly. The salary of a consultant in India is expected to increase due to rising inflation, talent wars, booming demand for advice, and consultancy firms competing for talent.

The average salary of an HR consultant in Singapore is around USD 64,000 per year. The entry-level consultant with experience of 1-2 years earns in the range of USD 40,000 to USD 45,000. A senior-level HR consultant with more than 8 years of experience earns around USD 79,000 - USD 82,000 each year. The influx of numerous international investors has resulted in the establishment of a large number of consulting firms in Singapore, thereby establishing the professional services sector. Among the key elements that make Singapore an excellent place for business is its strategic location, which makes it one of Asia's biggest and most significant financial hubs.

Similarly, the average salary for a consultant in Canada is around USD 88,800 per year, or USD 45.5 per hour. Over the last two to three years, Canada has witnessed massive improvements in technology and a high growth of different types of consulting businesses, which in turn drives up the competition. According to a survey conducted by Chartered Professionals in Human Resources (CPHR) Canada in 2022, over 60% of the firms in Canada have implemented diversity, equity, and inclusion (DEI) initiatives. HR consultants in Canada can help in creating a culture of belonging, respect, and equality for the employees within the organization.

“The full services outsourcing model envisages the client outsourcing the complete operations/manufacturing to single or multiple companies.”

In terms of HR consulting services sourcing intelligence, big consulting firms such as Boston, Bain, McKinsey, and EY usually have a complete internal team of expert HR consultants providing a wide level of services, and managing responsibilities based on the needs of the organizations reaching out to them. With so many HR processes such as recruiting, interviewing potential candidates, and employee training and development tasks, end-use organizations focus on core business by outsourcing their HR-related operations. The level of experience of the consultants, knowledge about the field, and expertise give their clients exposure to the best solutions along with saving on time, and cost.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

HR Consulting Procurement Intelligence Report Scope

Report Attribute

Details

HR Consulting Category Growth Rate

CAGR of 6.1% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

3% - 6% (Annually)

Pricing Models

Value-based pricing, service-based pricing, competition-based pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Services provided, end-to-end services, project timeline, global reach, regulatory compliance, operational capabilities, quality measures, certifications, data privacy regulations, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Boston Consulting Group, Bain & Company, McKinsey & Company, KPMG, PWC, EY, Oliver Wyman, Accenture, Mercer, and Hewitt

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 87.8 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global HR consulting category size was valued at approximately USD 54.7 billion in 2022 and is estimated to witness a CAGR of 6.1% from 2023 to 2030.

b. The increasing complexity of labor laws and regulations, coupled with a growing demand for talent management and organizational effectiveness from the clients are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis India, Singapore, and Canada are the ideal destinations for sourcing HR consulting services.

b. This category is highly fragmented due to the presence of competitive players providing specialized services. Some of the key players are Boston Consulting Group, Bain & Company, McKinsey & Company, KPMG, PWC, EY, Oliver Wyman, Accenture, Mercer, and Hewit.

b. Consultant salaries, hiring and training HR consultants, legal costs, IT and technology costs, and research, marketing & advertising costs are some of the key cost components of this category. The other costs include website design and development, travel expenses, and insurance.

b. To procure HR consulting services, companies usually evaluate suppliers based on their ability to handle the number of employees, how quickly they can provide solutions to the problems, their experience in the field, and whether they can offer end-to-end services. Other considerations include the time taken to research and the firm’s reputation. Clients also seek how much data transparency the firm keeps with the clients, and whether firms adhere to the standards and guidelines.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified