- Home

- »

- Reports

- »

-

Lab Equipment Procurement & Cost Intelligence Report, 2030

![Lab Equipment Procurement & Cost Intelligence Report, 2030]()

Lab Equipment Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Dec, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10566

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Category Overview

“Rise in investments and funding for research & development activities in biotechnology and pharmaceutical sectors are fueling the growth of the category.”

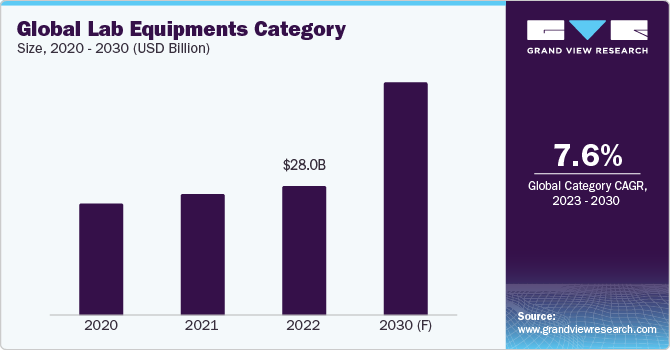

The global lab equipment category is anticipated to grow at a CAGR of 7.62% from 2023 to 2030. Growth of the category can be attributed to factors such as a rise in investments and funding for research & development activities in the biotechnology and pharmaceutical sectors, expansion and developments in the medical equipment sector, and an upsurge in the adoption of advanced equipment for efficient & accurate results. However, the integration of modern technologies to boost efficiency and productivity has made the equipment expensive. This is anticipated to hinder the growth of the global category and detrimentally affect the emerging world's market potential.

In terms of end-user industry, the healthcare sector holds the highest revenue share of 43.08% amongst other sectors.The sector is one of the largest users of the industry’s products due to the growing need for diagnostic testing, medical research, and pharmaceutical creation. It utilizes equipment offered in the category for conducting experiments, evaluating samples, and researching numerous facets of illnesses and therapies. Healthcare professionals depend on accurate and dependable laboratory equipment to track patients' health, identify illnesses, and provide novel therapies.Large sums of money are invested in R&D initiatives by the healthcare sector in an effort to improve patient care, create novel treatments, and expand medical knowledge.

The global lab equipment category was valued at USD 28.03 billion in 2022. The growth of laboratory equipment services is strongly correlated with the growing need for equipment. Thus, the category will rise as a result of the increasing requirement for the prompt and accurate identification of illnesses. In addition, it is anticipated that the global incidence of acute and chronic illnesses, which may call for laboratory equipment, will speed up the category’s overall expansion.The need for cell media, gloves, Petri dishes, test tubes, and other consumables for cell culture is enormous. Besides, the need for laboratory disposables, such as cell culture media, is also anticipated to rise in light of the increased emphasis on personalized treatment and the expanding usage of cell-based therapies.

Technologies that are driving the growth of the global category include cloud computing, digital data, automation, simulation, and visualization. Modern lab equipment can record data and store it in the cloud. In a similar vein, it can even notify a scientist or a lab technician in case of any malfunction.

Cloud computing enables scientists to share their research results more quickly than in the past. In addition, data can be uploaded to and can be accessed by various project contributors, including individuals in separate laboratories. Furthermore, utilizing digital technologies can raise productivity and accelerate the process of analysis. The data can be utilized to revolutionize the discovery-to-delivery process, save expenses, and expedite procurement.

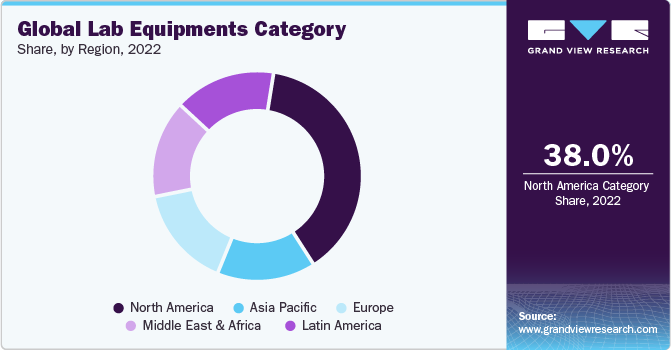

North America region dominates the category, holding 38% of the global market share. Growth of the category in this region can be attributed to the strong healthcare system, sophisticated diagnostic tools, the presence of significant pharmaceutical and biotech businesses, and the high level of research and development. Further, the presence of key market players and the continuous development and launch of new products in the category are driving the region’s growth.North America's strict quality requirements and laws governing diagnostic testing, along with other regulatory factors, are poised to propel the use of premium lab equipment.

The Asia-Pacific region is anticipated to witness the fastest growth rate during the projected timeframebecause of the improvements in technology in the healthcare sector.The region is renowned for having embraced cutting-edge laboratory technologies early, including automated systems, sophisticated diagnostic platforms, and molecular diagnostic techniques.

The products offered in the category are expected to witness heightened demand as a result of these developments.Leading countries driving the growth in APAC are South Korea, Japan, India, and China (China holds the largest market share among all).

Supplier Intelligence

“What best describes the nature of the Lab Equipment category? Who are some of the main participants?”

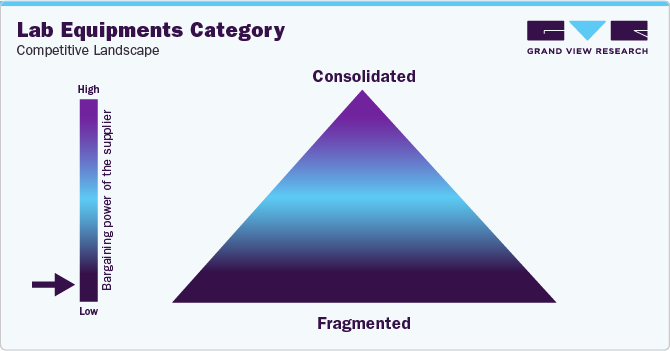

The global lab equipment category is fragmented, exhibiting intense competition among the players present in the industry. Currently, major industry players are proactively implementing strategic initiatives to fortify their market positions. It is a reaction to the changing demands of customers and the competitive environment. They are making significant investments in R&D to launch cutting-edge and innovative products, such as accurate and effective lab instruments, disposables with improved functionality, and automation systems that optimize laboratory operations. In addition, the players are establishing strategic alliances and partnerships with academic institutions, research centers, and other business stakeholders to enable information sharing, access to novel technology, and the creation of tailored solutions. Furthermore, major firms are growing their global footprint to serve their customers better by setting up local businesses in new regions or purchasing subsidiaries there.

The majority of businesses in the sector purchase their raw materials from a variety of sources. The suppliers that hold a dominant position in the market may reduce the profit margins available to producers of laboratory equipment in the market. Strong suppliers in the industry utilize their influence in negotiations to force lab equipment producers to pay more. As a result, an uptick in supplier negotiation generally results in decreased profitability for the producers.

On the other hand, end-use customers can be quite demanding. Their goal is to purchase the greatest options at the lowest feasible cost. This creates pressure on the manufacturers of lab equipment in the long run. Customers have more negotiating power and are more likely to look for rising discounts and offers if manufacturers of lab equipment have a smaller and more powerful client base.

Key suppliers covered in the category:

-

Agilent Technologies, Inc.

-

Becton, Dickinson and Company

-

Bio-Rad Laboratories, Inc.

-

Danaher Corporation

-

Global Scientific Ltd.

-

Hilton Instruments Ltd.

-

PerkinElmer Inc.

-

Sartorius AG

-

Shimadzu Corporation

-

Th. Geyer GmbH & Co. KG

-

Thermo Fisher Scientific Inc.

-

Waters Corporation

Pricing and Cost Intelligence

“What is the cost structure for Lab Equipment? What variables affect the prices?”

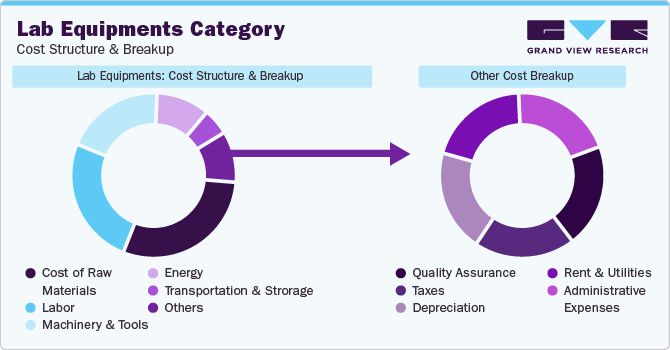

The cost structure of the global lab equipment category is constituted by the cost of raw materials, labor, machinery & tools, energy, transportation & storage, and other costs as the key components. Other costs include quality assurance, taxes, depreciation, rent & utilities, and administrative expenses. The cost incurred in purchasing raw materials constitutes the major chunk in the production of the products that are offered in the category, followed by labor costs as manufacturing of any of the products is labor intensive.

The price of laboratory instruments is influenced by a few different variables, including the price of raw materials, cost incurred on research & development, and production expenses. The need for routine maintenance and calibration for products such as centrifuges, microscopes, and other delicate instruments further increases costs. In addition, some laboratory tools can be more expensive because they are specialist instruments meant to be used exclusively for a particular type of research.

In terms of raw materials used in the products that are offered in the category, the price of silicon dioxide ranges from USD 80 - USD 570 for different sizes of packing, such as 5 gm, 10 gm, 15 gm, etc. It is used to make optical glass for a microscope. The price of borosilicate glass ranges from USD 33.25 - USD 102.75, depending on the thickness of the sheet, which is usually between 0.05 mm to 1.1 mm. The average price of steel rebar has ranged between CNY 3,600 - CNY 3,900 per ton since January 2023. The price of aluminum has ranged between CNY 2,200 - CNY 2, 300 per ton since January 2023.

The cost structure is broken down in the accompanying chart. Other costs can depend on multiple cost components, which have been illustrated below:

In terms of products, the price of test tubes offered in the category ranges from USD 0.25 – USD 2.25 per piece depending on the size and type (disposable or reusable). The price of a magnetic stirrer with a hot plate aluminum stirrer ranges from USD 20 - USD 330, based on the volume, RPM speed, and plate size. The price of centrifuges offered in the category ranges from USD 27 to USD 63,000 depending on the type of centrifuge (mini, micro and benchtop), RPM speed and relative centrifugal field (RCF). The price of incubators offered in the category ranges from USD 31 to USD 49,900 depending on chamber size, temperature ranges, and features (smartphone notification, alarms, etc.)

The report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“How do Lab Equipment providers engage? What is the type of engagement model?”

In terms of global lab equipment category sourcing intelligence, businesses follow a hybrid / bundled outsourcing model to engage with their suppliers. There are various equipment that are offered in the category and few of them are sophisticated machineries (such as incubators, hematology analyzer, centrifuge, microscope, etc.) that carry components for which the manufacturers rely on multiple suppliers, as they may not be capable of developing every component in-house, rather sourcing it from an outside vendor and assemble it in its facility, acting as an OEM for that particular product.

The flexibility and scalability of the hybrid model enable manufacturers to minimize their requirement for an additional/specialist workforce to carry out those activities that can be outsourced. It helps them minimize their operational cost and increase focus on their core activities. It is effortless to increase or decrease resources from various locations in accordance with the requirements.

“In the hybrid outsourcing model, the client outsources some parts of the overall operation to third parties. Generally, critical operations are carried out in-house by the client.”

There are certain factors that need to be considered when sourcing any product from the range of different available in this category. The cost of buying equipment would be one of the most important things to take into account. In addition, maintenance costs should also be considered, as certain pieces of equipment require routine maintenance in order to operate at optimal efficiency. Another element that must be pondered upon is the accessibility of replacement parts and consumables. The machinery will occasionally malfunction and require maintenance or repairs. Customers expect the required parts to be easily accessible in the market and at a reasonable cost. Third, the technical support required from the manufacturer should also be considered before making the purchase. Businesses are expected to have an agreement with the manufacturer to provide technical assistance as and when required.

India is the preferred low-cost / best-cost country for sourcing Lab Equipment. The growth of the lab equipment manufacturing sector in India has been aided by supportive government policies, including tax breaks and funding for research & development. As a result, a number of international companies have entered the Indian market, increasing industry competition and spurring innovation.

Rising investments in research & development and the continuous expansion of the scientific community in India have been fueling the growth of the lab equipment manufacturing sector in the nation for the past few years. Manufacturers in India are covering a wide product portfolio, catering to industrial laboratories, universities, and research institutions.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Lab Equipment Category Procurement Intelligence Report Scope

Report Attribute

Details

Lab Equipment Category Growth Rate

CAGR of 7.62% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

5% - 10% increase (Annually)

Pricing Models

Cost-plus pricing, Competition-based pricing

Supplier Selection Scope

Cost and pricing, Past engagements, Productivity, Geographical presence

Supplier Selection Criteria

Industries served, years in service, geographic service provision, certifications, types of equipment, number of features in a product, new and/or refurbished products, warranty & after-sales support, regulatory compliance, lead time, and others

Report Coverage

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Agilent Technologies, Inc., Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Danaher Corporation, Global Scientific Ltd., Hilton Instruments Ltd., PerkinElmer Inc., Sartorius AG, Shimadzu Corporation, Th. Geyer GmbH & Co. KG, Thermo Fisher Scientific Inc., and Waters Corporation

Regional Scope

Global

Revenue Forecast in 2030

USD 50.44 billion

Historical Data

2020 - 2021

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global lab equipment category size was valued at approximately USD 28.03 billion in 2022 and is estimated to witness a CAGR of 7.62% from 2023 to 2030.

b. Rise in investments and funding for research & development activities in biotechnology and pharmaceutical sectors, expansion and developments in the medical equipment sector, and rise in adoption of advanced equipments for efficient & accurate results are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, India and U.S. are the ideal destinations for sourcing lab equipment.

b. This category is fragmented with high level of competition. Some of the key players are Agilent Technologies, Inc., Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Danaher Corporation, Global Scientific Ltd., Hilton Instruments Ltd., PerkinElmer Inc., Sartorius AG, Shimadzu Corporation, Th. Geyer GmbH & Co. KG, Thermo Fisher Scientific Inc., and Waters Corporation.

b. Cost of raw materials, labor, machinery & tools, energy, transportation & storage, and other costs are the major key cost components of this category. Other costs are further bifurcated into quality assurance, taxes, depreciation, rent & utilities, and administrative expenses.

b. Assessing the range of products offered by a supplier, lead time being guaranteed by a supplier, ensuring that the supplier offers technical assistance post sales, comparing the prices offered by different suppliers are some of the best sourcing practices considered in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified