- Home

- »

- Reports

- »

-

Loyalty Programs Sourcing & Cost Intelligence Report, 2030

![Loyalty Programs Sourcing & Cost Intelligence Report, 2030]()

Loyalty Programs Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Feb, 2024

- Base Year for Estimate: 2022

- Report ID: GVR-P-10575

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Loyalty Programs Category Overview

“With growing competition among businesses, senior executives are seeking to enhance customer engagement and retention with loyalty programs, which is driving the growth of the category.”

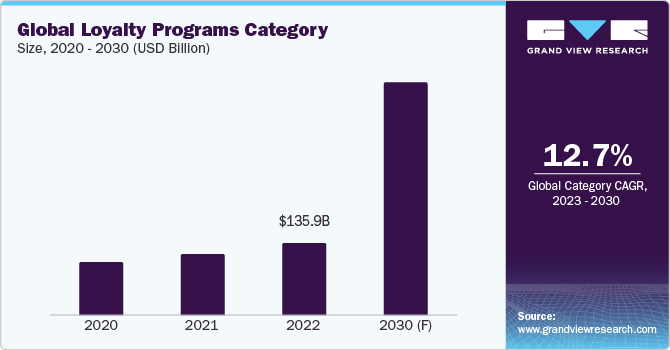

The loyalty programs category is expected to grow at a CAGR of 12.7% from 2023 to 2030. To retain customers and increase customer engagement, experience, and purchase frequency, businesses continuously rely on purchase discounts and loyalty programs. According to the TechJury 2023 report, 70% - 75% of consumers will favor brands if they offer prizes to the loyalty program participants. As a result, customers’ faithfulness has become a key part of any business strategy. Moreover, consumers will likely spend more on the brands providing discounts, cashback offers, and other rewards. For instance, according to the same 2023 report, 43% of consumers spend more on the brands they are loyal to as compared to the other brands. Such factors drive the growth of the category.

The global loyalty program category size was valued at USD 135.9 billion in 2022. Current social trends and new technology are evolving the category. Trends, such as loyalty partnerships, gamification, tiered benefits, and personalization, are fueling the category growth. To achieve large audiences, brands are entering into several partnerships. For instance, in October 2022, Starbucks teamed up with Delta SkyMiles to offer a reward program for customers. This means that customers can now earn points at both companies. For every dollar spent at Starbucks, customers can earn one mile on their Delta SkyMiles account. Moreover, when members have a scheduled flight with Delta, they will earn double stars on authorized spending made at Starbucks stores. This partnership is a smart move for Starbucks as it helps them attract more customers as well as retain them.

In recent years, offering rewards in the form of game-like elements, also known as gamification, is also witnessing growth. According to the Antavo 2022 report, brands integrating gamification into their loyalty program strategies have seen a 47% rise in engagement, a 15% rise in brand awareness, and a 22% increase in brand loyalty. Gamification establishes a digital environment that aligns with the audience's familiarity and pleasure. Consequently, it instills a desire for increased interaction with brands as individuals seek to accumulate additional rewards.

Preference for personalized programs is rising as members get access to their own personalized dashboard with respect to the data of their points collected and how to redeem their rewards. According to Queue.it 2023 report, 80% of consumers are likely to engage with a company offering a personalized experience. Personalized programs can increase the number of experiences that customers have with brands. Starbucks has modernized its Starbucks Rewards by integrating its proprietary mobile application with advanced digital capabilities, increasing personalization and loyalty components through more rewards.

A premium program requires customers to pay for membership. While there are both advantages and disadvantages to this type of program, a significant benefit is that it indicates genuine loyalty. Unlike other programs where customers can accumulate points over time, premium services offer immediate benefits to its participants. As a result, only consumers who genuinely value and are passionate about a brand and its offerings are likely to enroll in a premium category.

Supplier Intelligence

“What are the characteristics of the loyalty programs category?”

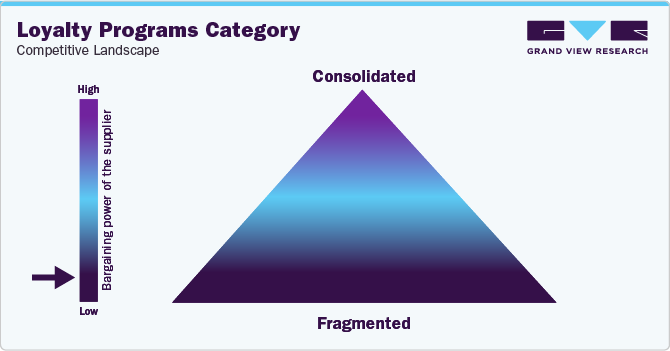

The global loyalty program category is a fragmented and undifferentiated line of business. Most of the buying or partnering companies (or, brands), such as Starbucks, Sephora, or CVS, operating in different industries find it challenging to obtain an economic customer loyalty loop or override brand preferences in this highly competitive market. It has been observed that customers have been moving away from the “points-only loyalty” program since 2021 due to the availability of new brands and new products.

Buyers, which are typically businesses or organizations, implementing the category, may have moderate to high bargaining power. This depends on the uniqueness of the program, the number of available options, and the cost of switching between service providers. Buyers are also collaborating with loyalty solution providers to offer rewards to their customers. For instance, in December 2023, Bata India collaborated with Easyrewardz, an end-to-end solution provider, for the launch of the Bata Club loyalty program. Through this partnership, Bata will offer an enhanced shopping experience to PAN India customers.

Key suppliers covered in the category:

-

Ascendant Loyalty LLC

-

Kobie Marketing

-

Emakina Group

-

Gotoclient S.L.U

-

Capillary Technologies

-

XGate Corporation Limited

-

Zinrelo (Velocita, Inc.),

-

Exponential Media

-

Loyalty Gator Inc.

- LoyaltyLion Ltd.

Pricing and Cost Intelligence

“What are some of the major cost components in the loyalty programs? How are these components impacting the category?”

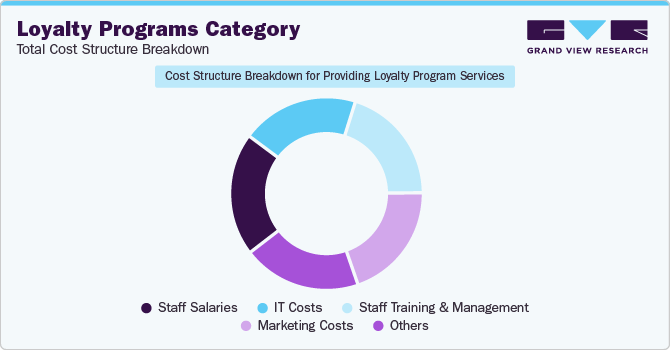

Staff salaries, IT costs, staff training and management, and marketing are some of the key cost components incurred in designing and providing the solutions. Other costs usually include rent, utilities, and office supplies costs. IT costs include all the hardware and software required for designing and implementing programs. The cost to establish a program for the first year can be approximately USD 30 million. Moreover, the cost of creating, running, and managing a stamp-based loyalty program can start from USD 100. The ongoing expenses for maintaining a personalized loyalty application can reach up to thousands or even millions of dollars. The initial expenses are influenced by the complexity of the software selected for designing & developing a loyalty program.

Loyalty Cards Cost Breakdown

Specialization

Range (USD)

Printing and Designing Expenses

75 - 1,000

Distribution Cost

300 - 1,500

Staff Training Management

500 - 2,500

Loyalty Cards Replacement Costs

3 - 10 per card

The expenses of printing and designing loyalty cards can range from USD 75 to USD 1,000. Similarly, the distribution cost can range from USD 300 to USD 1,500. Training staff and management can cost between USD 500 to USD 2,500 per year. For a business serving a sizable customer base, this cost has the potential to increase rapidly, possibly amounting to several hundred or even thousands of dollars on an annual basis based on the number of customers the company wishes to cover. If a customer misplaces or damages their tangible loyalty card, the business may incur an expense of USD 3 to USD 10 per card for the production and mailing of replacements. As a result, certain enterprises are adopting the digital type of programs. It eliminates the need for a physical card, offering a more cost-effective and convenient solution for both the business and its clients.

The following table indicates the average annual cost for small- and medium-sized businesses:

Average annual cost for small and medium-sized loyalty programs in different countries

Country

Price Range (USD)

U.S. and Canada

100 - 500

UK

95 - 510

Australia and New Zealand

98 - 500

The cost of the category is affected by various factors, such as types of programs, technology costs, implementation costs, marketing & customer support, and locations. For instance, the average cost per device for small- and mid-sized programs in the U.S. and Canada can range between USD 100 to USD 500 each year. In Australia and New Zealand, it can cost from USD 98 to USD 500 annually.

The report provides a detailed analysis of the cost structure of loyalty programs and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“What are some of the best sourcing practices considered for loyalty programs?”

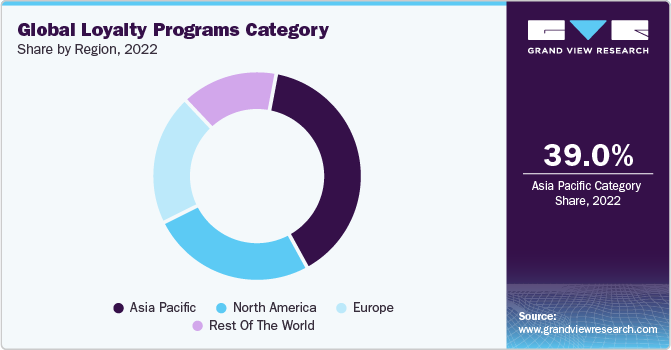

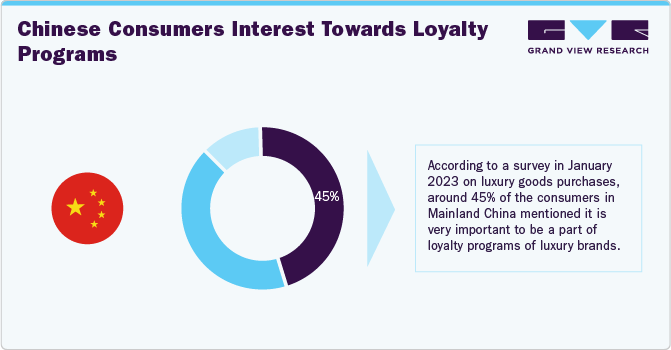

Asia Pacific is the major region that dominated the category in 2022. The category in the Asia Pacific region is experiencing significant transformation, with entities ranging from retailers and banks to telecommunications companies adapting to the evolving loyalty landscape. According to Capillary's January 2024 report, 92% of shoppers in Southeast Asian countries consider that they would be more attracted by programs while making purchase decisions. The rising interest in the category among the expanding middle classes in countries, such as mainland China, Indonesia, Vietnam, India, and the Philippines, is driving the growth. According to OC&C Strategy Consultants 2023 report, a majority of Chinese consumers show strong dedication to the programs. Around two-thirds of residents in China participate in 15 or more programs, and more than 80% express a willingness to invest in an upgraded membership product.

India is evolving swiftly as a market where customer loyalty is becoming increasingly significant. As per YouGov Profiles October 2023 data, 26% of individuals residing in urban areas in India exhibit a keen interest in loyalty programs. Thus, Indian companies are changing the traditional concept of customer loyalty. For instance, Reliance One is the loyalty program offered by Reliance Retail. The program rewards customers who shop at Reliance Retail stores, receiving various benefits. The anticipated growth in India is expected to be propelled by companies taking initiatives to provide rewards to customers.

European loyalty programs play a crucial role in establishing customer connections over the long term. According to research conducted by Antova Loyalty Cloud in 2023, 61.3% of adults are members of at least one program across 24 European countries. As of March 2023, the top countries for membership in the category include Norway with 85% membership, Sweden with 83%, and Great Britain with 77% membership.

China, Norway, and Sweden are the preferred target countries for businesses looking to grow or expand in this category. Such programs or rewards are now considered a fundamental expectation in the Nordic region, as businesses acknowledge their importance in both attracting and retaining customers. As of 2023, 78% of individuals were enrolled in at least one program. The Nordic Countries have the greatest loyalty programs market penetration rates in the world.

“The full services outsourcing model envisages the client outsourcing the complete operations/manufacturing to single or multiple companies.”

In terms of loyalty program sourcing intelligence, businesses usually opt for a full outsourcing services model. This is because building programs in-house means hiring designers, developers, and project managers. However, creating a program is not easy, and it requires planning and execution. For medium-large-scale businesses, outsourcing is the preferred choice. Collaborating with an experienced service provider ensures that businesses can tap into the knowledge of professionals who excel in designing effective rewards programs. Their expertise in the category enables enterprises to create a program that truly caters to both business needs and customer preferences.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Loyalty Programs Procurement Intelligence Report Scope

Report Attribute

Details

Loyalty Programs Category Growth Rate

CAGR of 12.7% from 2023 to 2030

Base Year for Estimation

2022

Pricing growth Outlook

5% - 9% (Annually)

Pricing Models

Tier-based pricing, subscription-based pricing, competition-based pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier selection criteria

Diversified types of programs, end-to-end services, technology-driven services, expertise in the field, multi-channel support, global reach, data privacy regulations, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key companies profiled

Ascendant Loyalty LLC, Kobie Marketing, Emakina Group, Gotoclient S.L.U, Capillary Technologies, XGate Corporation Limited, Zinrelo (Velocita, Inc.), Exponential Media, Loyalty Gator Inc., and LoyaltyLion Ltd.

Regional scope

Global

Historical data

2020 - 2021

Revenue Forecast in 2030

USD 353.7 billion

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Customization scope

Up to 48 hours of customization free with every report.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global loyalty programs category size was valued at approximately USD 135.9 billion in 2022 and is estimated to witness a CAGR of 12.7% from 2023 to 2030.

b. The desire to enhance customer retention, foster brand loyalty, and capitalize on personalized and incentivized customer experiences is driving the growth of the category.

b. China, Norway, and Sweden are the preferred target countries for businesses looking to grow or expand in this category.

b. A loyalty program is a fragmented and undifferentiated business. Some of the key players are Ascendant Loyalty LLC, Kobie Marketing, Emakina Group, Gotoclient S.L.U, Capillary Technologies, XGate Corporation Limited, Zinrelo (Velocita, Inc.), Exponential Media, Loyalty Gator Inc., and LoyaltyLion Ltd.

b. Staff salaries, IT costs, staff training and management, and marketing costs are some of the key cost components of this category. Other costs usually include rent, utilities, and office supplies costs.

b. While seeking loyalty program services, buyers usually look for types and expertise in designing the programs, technology integration, multi-channel support, transparency in the services, and customer data privacy. Buyers also check the geographical presence and technical support and compare the prices of different service providers.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified