- Home

- »

- Reports

- »

-

Media Buying and Planning Sourcing Intelligence Report, 2030

![Media Buying and Planning Sourcing Intelligence Report, 2030]()

Media Buying and Planning Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Feb, 2024

- Base Year for Estimate: 2022

- Report ID: GVR-P-10576

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Media Buying and Planning Category Overview

“Rising digital penetration, increase in ad spending, and surge in programmatic advertising are fueling the growth of the category.”

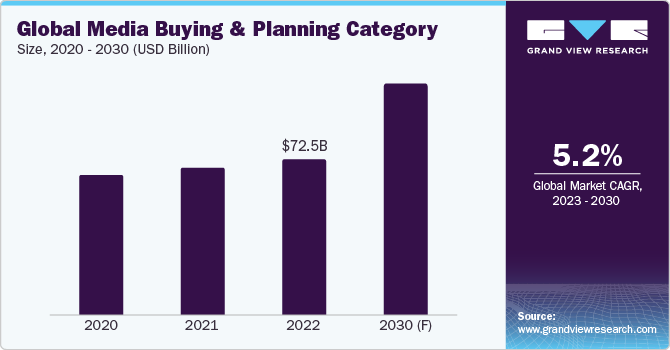

The global media buying and planning category is anticipated to grow at a CAGR of 5.2% from 2023 to 2030. Growth of the category is attributed to factors, such as rising digital penetration, increase in ad spending, revival of investments in TV ads, growth of non-traditional media channels, and surge in programmatic advertising. A few of the key challenges being faced by the category are the evolving technological landscape, complex market conditions, and difficulties in audience measurement.

Media buying and planning services are deployed as a part of paid marketing efforts to categorize and acquire ad spaces on channels. The ads must be relevant to the target audience at the optimal time and must lead to cost savings for buyers. Media buying and planning activities usually involve negotiation, strategy, and ad placement. These agencies commonly purchase and plan media activities that comprise SEO, SEM, PPC, Social Media ads, TV ads, OTT ads, and digital display advertising.

In terms of end-user, these services are utilized by various industries, such as BFSI, FMCG, healthcare, IT & telecom, and automotive. For instance, the healthcare sector is required to promote its offerings via health awareness campaigns. Similarly, IT & Telecom companies are required to effectively advertise their offerings to reach the target audience.

The global media buying and planning category was valued at USD 72.5 billion in 2022. The demand for the category has recovered significantly post the decline during the COVID-19 pandemic, in which customers were forced to slash their media and advertising budgets. Key players are adopting an omnichannel approach wherein a mix of social, traditional, and digital channels are being utilized to provide a consistent brand experience to consumers. Moreover, key players are increasingly focusing on ROI and real-time optimization by leveraging advanced analytics tools. One of the major trends in this category is increasing personalization due to enhanced control and choices available for consumers from a variety of formats, devices, and platforms.

Key technologies that are driving the growth of this category include geotargeting, programmatic media buying, retargeting, native advertising, and Artificial Intelligence (AI) & Machine Learning (ML). Geotargeting ensures customized ads or content is catered to users according to their geographic location. By leveraging the physical data of users acquired via GPS or IP addresses, relevant and localized campaigns are created that resonate with users in specific locations or regions. This allows media planning agencies to improve their messaging based on cultural or regional preferences. Programmatic media buying uses automated tools for media buying in place of traditional digital advertising methods. It utilizes algorithms and insights to deliver ads to appropriate users at the right place, time, and suitable pricing rates. This technology is deployed via Real-Time Bidding (RTB), in which inventory prices are auctioned in real time. Private Marketplaces (PMPs) are also used wherein select advertisers apply for invitations.

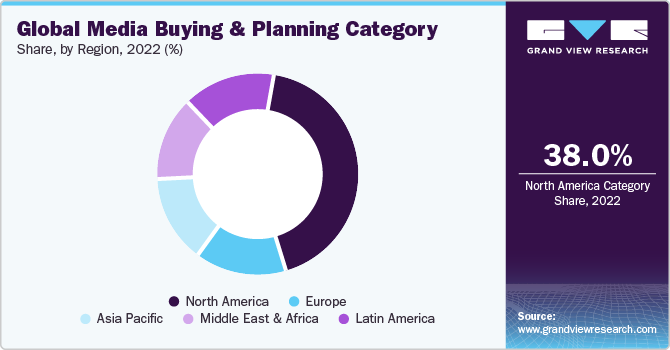

North America dominates the global category, accounting for 38% share of the global market. Growth of the category in this region is attributed to a high concentration of network agencies, centralized contracts, wide geographical presence, and high technology adoption. Asia Pacific is anticipated to witness the fastest growth rate during the forecasted period. Key drivers of this growth include rising technological penetration, increasing competition in the market, surge in demand for programmatic media buying, rising consumption of digital content and extensive usage of mobile devices. The Asia Pacific market is anticipated to expand further during the forecasted period owing to a rise in the usage of digital media channels and a rise in mobile or in-app programmatic advertising.

Supplier Intelligence

“What best describes the nature of the Media Buying and Planning category? Who are some of the main participants?”

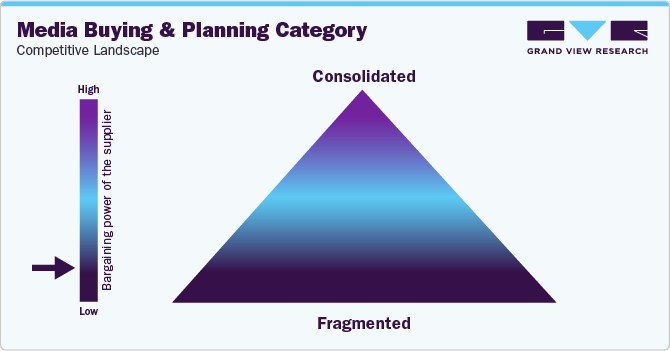

The global media buying and planning category is fragmented, exhibiting intense competition among the agencies present in the industry. As a result, agencies are emphasizing service quality, innovation, and cost-effectiveness. Key players that are offering media buying and planning services are competing based on pricing strategy, service innovation, technology integration, targeting & personalization, multi-channel expertise, customization, flexibility, and efficiency. Customers in this category have diverse options to service scope, price range, end-use, enhanced access to media campaigns, and increasing access to measurement and analytics tools. Currently, key service providers in this category are implementing strategic initiatives, such as partnerships and acquisitions, to reinforce their market position, due to changing customer demands and an increasingly competitive environment. Furthermore, certain key players are actively investing in programmatic media buying and programmatic advertising to optimize ROI, reach, scale, and improve targeting.

Key metrics to evaluate the performance of media buying and planning agencies include Cost Per Click (CPC), Cost Per Mille (CPM), and Cost Per Acquisition (CPA). Other key metrics comprise Return on Ad Spend (ROAS), Share of Voice (SOV), viewability rate, frequency, and reach. The profit margins available to agencies are typically moderate to low, in the range of 5% - 15%, depending on service scope, service cost, type of media channels used, and service performance. Customers in this category possess high negotiating capability, enabling them with the flexibility to switch to a better alternative. Customers can be quite selective as they aim to purchase the best available service options at the lowest possible cost. This increases pressure on the agencies about pricing and service quality. Moreover, regulatory laws in several regions require agencies to comply with rigorous standards related to the safety and privacy of consumers’ personal data.

Key suppliers covered in the category:

-

Dentsu International

-

Ideon Media

-

Kubient, Inc.

-

McKinney Ventures, LLC

-

Mindshare Media Ltd.

-

MiQ Digital Limited

-

Omnicom Group Inc.

-

Publicis Groupe

-

Starcom Worldwide, Inc.

-

The Interpublic Group of Companies, Inc.

-

Vivendi SE

-

WPP Plc

Pricing and Cost Intelligence

“What is the cost structure for Media Buying and Planning Services? What variables affect the prices?”

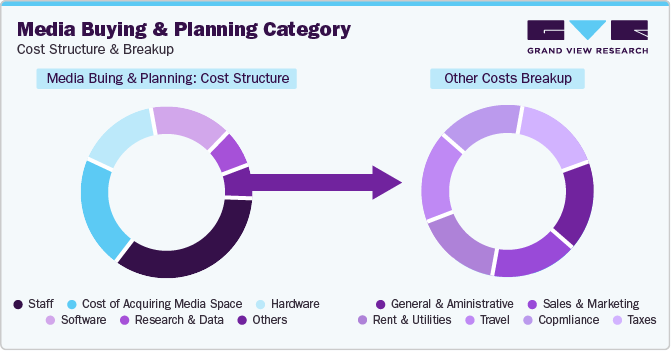

The cost structure of the global media buying and planning category is constituted by staff, cost of acquiring media space, hardware, software, research and data, and other costs as the key components. Other costs are further bifurcated into general and administrative, sales and marketing, rent and utilities, travel, compliance, and taxes. Staff costs constitute the major chunk in the cost structure, followed by technology and software costs.

The prices of media buying and planning services are influenced by several variables. Key factors affecting the pricing include service scale and complexity, media channels and platforms, technology integration, and length of contract. For instance, extensive campaigns that are spread across geographical regions and cater to a wide audience segment are priced higher due to additional resources allocated to negotiations, strategic planning, and co-ordination. Similarly, campaigns that have a wide coverage of media channels comprising national TV and numerous leading social media platforms have higher pricing rates. This is because the media buying costs vary according to demand, competition, and targeting capabilities that change as per media channel coverage.

The prices of media buying and planning services vary according to the type of service. A few of the common types of media buying services are Out-of-Home (OOH), print, radio, and TV. Under OOH media buying services, customers are allotted placements based on the extent of time required for the ad to be displayed to the audience. Popular ad platforms under OOH include transit ads, bench ads, and billboards. Under print, customers and media planning agencies concurrently earn placements according to ad size and location requirements. In 2024, the prices of OOH services in the U.S. were in the range of USD 95 - USD 155, and those of print services were in the range of USD 75 - USD 145. The prices of radio services varied in the range of USD 145 - USD 205, whereas the rates of TV services were in the range of USD 90 - USD 160. In 2024, the average cost per hour of media buying and planning services in the U.S. was USD 95 - USD 155, the average cost per hour in the U.K. was USD 145 - USD 205, and the same in India was USD 20 - USD 55.

The cost structure is broken down in the accompanying chart. Other costs can depend on multiple cost components, which have been illustrated below:

The report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“How do Media Buying and Planning agencies engage? What is the type of engagement model?”

In terms of global media buying and planning category sourcing intelligence, clients commonly follow a full-service outsourcing model to engage with agencies. In the full services outsourcing model, clients outsource the complete service scope to single or multiple agencies. Full services outsourcing helps clients minimize their operational costs, ensure quicker project implementation, gain access to an expert team, scale or customize the media buying/planning campaign, obtain access to premium marketing tools, and increase focus on core activities. Clients prefer to sign long-term contracts with agencies for increased stability, security, dedicated support, and strengthening of partnerships. However, in some instances, clients may opt for medium-term or short-term contracts with agencies for ad-hoc requirements.

“In the full services outsourcing model, the client outsources the complete operation/manufacturing to single or multiple companies.”

India is the preferred low-cost/best-cost country for media buying and planning services. India is a cost-effective destination due to its cheap labor costs and technology costs. CPC and CPM costs are relatively cheap in India as compared to other countries. A growing number of international agencies have entered the Indian market, leading to increased industry competition, competitive pricing, and rise in innovation. Moreover, leading domestic agencies are competing with international agencies. The total ad spend size in India was approximately USD 10.1 billion in 2020, and it is forecasted to rise to USD 17.5 billion in 2026, exhibiting a CAGR of ~9.6%. Key agencies in India offer a wide service portfolio comprising a variety of digital and traditional media channels. In addition, programmatic media buying is also witnessing a surge in India due to the rise of digital ad platforms and automated processes.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Media Buying and Planning Category Procurement Intelligence Report Scope

Report Attribute

Details

Media Buying and Planning Category Growth Rate

CAGR of 5.2% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

5% - 10% increase (Annually)

Pricing Models

Project-based pricing, Commission-based pricing, Hourly rate pricing, Performance-based pricing, Retainer pricing, Value-based pricing

Supplier Selection Scope

Cost and pricing, Past engagements, Productivity, Geographical presence

Supplier Selection Criteria

Geographical service provision, industries served, years in service, employee strength, revenue generated, key clientele, certifications, service portfolio, media channel coverage, key technologies used, and others

Report Coverage

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Dentsu International, Ideon Media, Kubient, Inc., McKinney Ventures, LLC, Mindshare Media Ltd., MiQ Digital Limited, Omnicom Group Inc., Publicis Groupe, Starcom Worldwide, Inc., The Interpublic Group of Companies, Inc., Vivendi SE, and WPP plc.

Regional Scope

Global

Revenue Forecast in 2030

USD 108.8 billion

Historical Data

2020 - 2021

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global media buying and planning category size was valued at approximately USD 72.5 billion in 2022 and is estimated to witness a CAGR of 5.2% from 2023 to 2030.

b. Rising digital penetration, increase in ad spending, revival of investments in TV ads, growth of non-traditional media channels, and surge in programmatic advertising are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, India and Philippines are the ideal destinations for sourcing media buying and planning.

b. This category is fragmented, with intense level of competition. Some of the key players are Dentsu International, Ideon Media, Kubient, Inc., McKinney Ventures, LLC, Mindshare Media Ltd., MiQ Digital Limited, Omnicom Group Inc., Publicis Groupe, Starcom Worldwide, Inc., The Interpublic Group of Companies, Inc., Vivendi SE, and WPP plc.

b. Staff, cost of acquiring media space, hardware, software, research and data, and other costs are the major cost components of media buying and planning category. Other costs include general and administrative, sales and marketing, rent and utilities, travel, compliance, and taxes.

b. Comparing the prices offered by agencies, assessing the range of services provided by agencies, evaluating the experience level of agencies, comparing testimonials and references of clients, and evaluating the agencies’ location capabilities are some of the best sourcing practices considered in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified