- Home

- »

- Reports

- »

-

Office Supplies Procurement & Cost Intelligence Report, 2030

![Office Supplies Procurement & Cost Intelligence Report, 2030]()

Office Supplies Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Mar, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10580

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Office Supplies Category Overview

“Expansion of commercial settings, and surge in purchases from e-commerce platforms are fueling the growth of the category.”

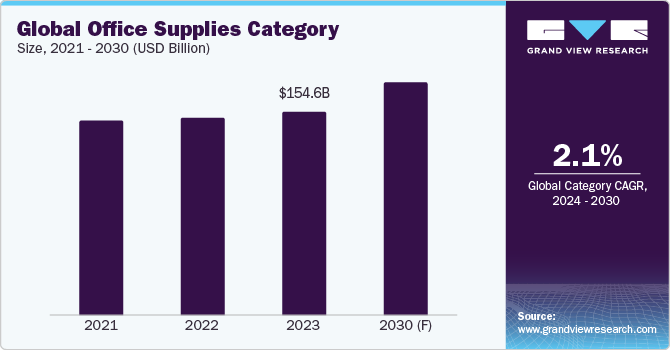

The global office supplies category is anticipated to grow at a CAGR of 2.1% from 2024 to 2030. This growth can be attributed to factors such as the expansion of commercial settings, rising number of working professionals, high demand from the educational sector, and surge in purchases from e-commerce platforms. A few of the key challenges being faced by the category are increased market competition, a rise in raw material costs, and a decline in demand for traditional products.

In the current office supplies landscape, there's a noticeable shift towards sustainability, with a strong demand for eco-friendly materials and recyclable products. Additionally, ergonomic office supplies are gaining traction, reflecting a growing concern for employee well-being. Customization options, such as personalized stationery and branded office supplies, are increasingly gaining value among end-users for reinforcing corporate identity.

In terms of end-use, office supplies are utilized by various end-users such as corporations, educational institutes, hospitals, hotels, and NGOs. For instance, educational institutes require office supplies for conducting exams, event planning, and as educational materials. Hotels utilize these products for administrative purposes, guest services, and communication. Corporates leverage these items for meetings, presentations, and financial management.

The global office supplies category was valued at USD 155.9 billion in 2023. The demand in this category declined during the COVID-19 pandemic, as corporate offices implemented a work-from-home model. Similarly, the demand from educational institutes dropped due to the closure of these institutes during lockdowns. Since 2023, the demand has recovered significantly and is poised to rise further during the next few years. Post the pandemic, key suppliers are increasingly leveraging e-commerce platforms to distribute products, as consumer purchases have seen an upward trend from these platforms. Moreover, suppliers are increasingly focusing on pricing, product innovation, and customer service. One of the major trends in this category is changing customer demands, as customers are increasingly looking for value-added services and eco-friendly products.

Key technologies that are driving the growth of this category include smart notebooks and pens, IoT-enabled office stationery, AI-powered inventory management, collaborative whiteboards, and smart toners. Smart notebooks enable users to upload handwritten notes to a digital or cloud device. Smart pens can be used to automatically detect handwriting or a picture of the notes may be uploaded to a digital device. Smart notebooks are equipped with Bluetooth connectivity and easily synchronize with mobile applications, thus enabling seamless editing, sharing, and organization of notes across different devices. IoT-enabled office stationery integrates digitally connected sensors to enhance the functionality and efficiency of office supplies. It facilitates real-time tracking of equipment usage and helps measure inventory levels. This results in enhanced control and visibility, optimizes cost savings, and improves operational efficiency. It also helps reduce inventory losses and enables automation of restocking processes.

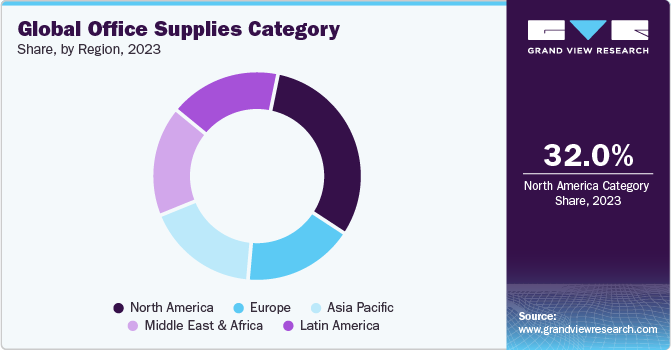

North America dominates the global category, accounting for 32% of the global market share. The regional growth of this category can be attributed to a high demand for customized stationery, technological advancements, and growing demand for eco-friendly products. Asia Pacific is expected to grow at the fastest pace during the projected period. Rapid urbanization, increasing demand for innovative products, growth of large conglomerates, and surge in demand from emerging economies such as China, India, and Philippines are few of the key growth drivers for this region.

Supplier Intelligence

"What are the characteristics of the office supplies category, and who are the key players involved?"

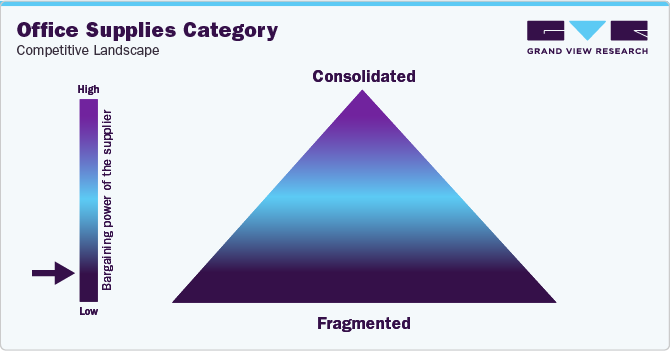

The global office supplies category is characterized by fragmentation and heightened competition among key suppliers. Therefore, suppliers are prioritizing product quality, technological innovations, cost-effectiveness, sustainability initiatives, and customer service. Key players that offer office supplies compete based on pricing strategies, profit margins, product personalization and customization, sustainability initiatives, lead time reduction, and regulatory compliance. Suppliers in this category are increasingly prioritizing building resilient supply chains in light of recent disruptions such as the COVID-19 pandemic and geopolitical conflicts. Currently, customers are increasingly embracing digital platforms for the procurement of office supplies, which is driving suppliers to offer seamless online catalogues, automate purchase orders, and invoice systems. Customers in this category have a wide array of choices in terms of product variety, budget flexibility, adaptable payment terms, value-added offerings, post-purchase assistance, and competitive benchmarking. Currently, key suppliers are actively implementing strategic measures such as expanding their presence geographically, establishing partnerships and alliances, investing in e-commerce platforms, and diversifying product offerings to reinforce their market position, due to evolving customer needs and a progressively competitive environment.

Key metrics to evaluate the performance of office supplies vendors include total supply sales, customer acquisition growth, gross margin percentage, repeat customers, customer ratings, percentage of product returns, and on-time delivery rate. The profit margins available to suppliers are typically low, in the range of 5% - 10%, depending on the type of products, geographic location, total costs of production, and distribution expenses. Customers hold high bargaining power due to the intense market competition, thus facilitating customers with the ease of switching to better alternatives. Customers can be quite selective as they aim to purchase the best available products at feasible rates. This increases pressure on suppliers concerning pricing and product quality. Besides, regulatory laws in several regions require suppliers to comply with rigorous standards related to product safety, manufacturing, environmental impact, and material recycling.

Key suppliers covered in the category:

-

3M Company

-

ACCO Brands Corporation

-

Deli Group Co., Ltd.

-

Global Office Supplies Ltd.

-

Nauticon Office Solutions

-

Novatech, Inc.

-

SASCO Group

-

Stanley Black & Decker, Inc.

-

Staples, Inc.

-

The Lyreco Group

-

The ODP Corporation

-

W.W. Grainger, Inc.

Pricing and Cost Intelligence

“What are the main components of the cost structure for office supplies, and what are the factors impacting the prices?"

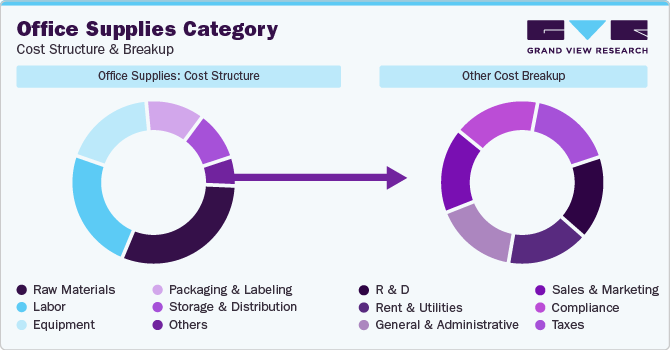

The cost structure of the global office supplies category is constituted by raw materials, labor, equipment, packaging and labeling, storage and distribution, and other costs as the key components. Other costs are further divided into R&D, rent and utilities, general and administrative, sales and marketing, compliance, and taxes. Raw material costs constitute the major chunk in the cost structure, followed by labor costs.

The prices of office supplies fluctuate based on several variables. Key factors leading to price variations include product range, production costs, distribution and logistics costs, and market competition. Production costs vary based on raw material and labor cost fluctuations. Key raw materials include plastic, polymers, pulp, paper, adhesive materials, and metals. Labor costs fluctuate based on labor supply shortages and skill requirements. Similarly, the costs of materials used in packaging and labeling also impact the overall production costs.

Distribution and logistics costs vary based on several factors such as fuel, warehousing, and transportation. Moreover, import/export costs may be involved while shipping products across countries, with factors such as import duties and regional taxes being prominent in such scenarios. Additionally, freight volume and mode of transport also influence such costs. Notable exporters of office supplies include China, Germany, the Netherlands, Japan, and the U.S. The office supplies exports by India are also witnessing significant growth, with export value rising from USD 210 million in 2022 to USD 298 million in 2023.

The average monthly cost per employee for office supplies varies significantly according to number of employees in the buyer’s organization. For instance, the average monthly cost per employee is in the range of USD 70 - USD 95 for a business size of 1 - 4 employees. This cost declines with an increase in company size. For instance, the average monthly cost per employee ranges from USD 40 - USD 60 for a business size of 40 - 50 employees. Furthermore, the average monthly cost is in the range of USD 25 - USD 35 for a business size of 200 or more employees. B2B prices of office supplies vary as per the product type. For instance, in the U.S., prices of notebooks (single) are in the range of USD 2 - USD 6, prices of copy papers (set of 500 sheets) are in the range of USD 3 - USD 7, prices of binder clips (set of 50 clips) are in the range of USD 3 - USD 9, and prices of staplers are in the range of USD 5 - USD 18.

Suppliers in the office supplies category adopt several pricing structures. One of the prominent pricing structures being used is cost-plus pricing. This model aims to increase the profit for suppliers. It involves adding up all costs associated with the product and adding on a percentage for profit. This model offers benefits such as providing a consistent rate of return, ease of calculation, and reliability. However, it does not provide a competitive advantage and may not reflect the true value of a product. Another key pricing model used is bundled pricing, wherein two or more complementary items are sold together at a discounted price. It helps suppliers to increase sales and average order value. Other key pricing models used are demand-based pricing and competition-based pricing.

The accompanying chart breaks down the cost structure. Breakup of other costs may be influenced by various cost components, as depicted below.

The report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“What methods do vendors of office supplies implement to engage with buyers? What type of engagement model is deployed?”

For sourcing intelligence in the global office supplies category, buyers commonly follow a full-service outsourcing model to engage with suppliers. In the full services outsourcing model, the buyers purchase all products and ancillary services from single or multiple vendors. Full services outsourcing helps buyers to choose from a wide portfolio of products, minimize costs, ensure product customization/personalization, optimize procurement lead time, enhance inventory management, gain access to expert after-sales support, and obtain product warranty or replacement. Buyers favor long-term contract agreements with suppliers for added security, increased stability, dedicated assistance, and strong partnerships. Moreover, long-term contracts enable buyers to consolidate suppliers and negotiate pricing and payment terms.

“In the full services outsourcing model, the client outsources the complete operation/manufacturing to single or multiple companies.”

Buyers commonly prefer a ‘basic provider’ operating model for sourcing office supplies, wherein they typically pay a set ‘transaction’ price for products sourced. This operating model is widely preferred as products in this category are readily available, have standard market options, and are low-cost items having multiple suppliers. However, certain buyers who require items with a predefined set of qualifications, quality standards, prior-proven performances, or other such selection criteria prefer an ‘approved provider’ operating model to engage with suppliers.

Businesses prefer to source office supplies locally or regionally to reduce supply chain and procurement costs. Within Asia Pacific, India is the preferred low-cost/best-cost country for office supplies. India is a cost-effective destination due to its relatively cheap raw material costs, labor costs, equipment costs, packaging and labeling costs, and distribution costs. For instance, costs of key raw materials used in office supplies such as plastic, polymers, pulp, paper, adhesive materials, and metals are relatively cheap in India. Moreover, fuel and energy costs are also comparatively low in India. The office supplies market in India is poised to grow significantly from USD 7.4 billion in 2023 to USD 9.1 billion in 2028, at a CAGR of 4.3%.

China is another low-cost country to source office supplies due to its large manufacturing base, abundance of raw materials, well-established supply chain, and low labor costs. Additionally, countries such as Vietnam and Indonesia are also cost-effective destinations due to favorable trade agreements, conducive government incentives to attract foreign investments, and competitive pricing. Within Europe, countries such as Poland, Bulgaria, and Romania are considered cost-effective destinations due to a favorable commercial landscape, beneficial subsidies, tax concessions, and relatively low manufacturing costs. Within South America, countries such as Brazil, Colombia, and Peru are considered economic destinations due to a well-developed manufacturing setup, strategic trade agreements, and relatively cheap labor costs.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Office Supplies Category Procurement Intelligence Report Scope

Report Attribute

Details

Office Supplies Category Growth Rate

CAGR of 2.1% from 2024 to 2030

Base Year for Estimation

2023

Pricing Growth Outlook

5% - 10% increase (Annually)

Pricing Models

Cost-plus pricing, bundled pricing, demand-based pricing, competition-based pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Geographical service provision, industries served, years in service, employee strength, revenue generated, key clientele, regulatory certifications, product range, delivery mode (online/offline), sustainable product offerings, lead time, and others

Report Coverage

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

3M Company; ACCO Brands Corporation; Deli Group Co., Ltd.; Global Office Supplies Ltd.; Nauticon Office Solutions; Novatech, Inc.; SASCO Group; Stanley Black & Decker, Inc.; Staples, Inc.; The Lyreco Group; The ODP Corporation; and W.W. Grainger, Inc.

Regional Scope

Global

Revenue Forecast in 2030

USD 180.3 billion

Historical Data

2021 - 2022

Quantitative Units

Revenue in USD billion and CAGR from 2024 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global office supplies category size was valued at approximately USD 155.9 billion in 2023 and is estimated to witness a CAGR of 2.1% from 2024 to 2030.

b. Expansion of commercial settings, rising number of working professionals, increasing demand from the educational sector, and surge in purchases from e-commerce platforms are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, India and China are the ideal destinations for sourcing office supplies.

b. This category displays a fragmented landscape, with an intense level of competition. Some of the key players are 3M Company, ACCO Brands Corporation, Deli Group Co., Ltd., Global Office Supplies Ltd., Nauticon Office Solutions, Novatech, Inc., SASCO Group, Stanley Black & Decker, Inc., Staples, Inc., The Lyreco Group, The ODP Corporation, and W.W. Grainger, Inc.

b. Raw materials, labor, equipment, packaging and labeling, storage and distribution, and other costs are the major cost components of office supplies category. Other costs include R&D, rent and utilities, general and administrative, sales and marketing, compliance, and taxes.

b. Comparing the prices offered by multiple vendors, assessing the range of products offered, evaluating the experience level, comparing testimonials and references of clients, evaluating the vendors’ location capabilities, and comparing payment terms are some of the best sourcing practices considered in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified