- Home

- »

- Reports

- »

-

Outplacement Services Procurement Intelligence Report, 2030

![Outplacement Services Procurement Intelligence Report, 2030]()

Outplacement Services Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Mar, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10581

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Outplacement Services Category Overview

“Regular hirings and lay-offs on a large scale is fueling the category’s growth.”

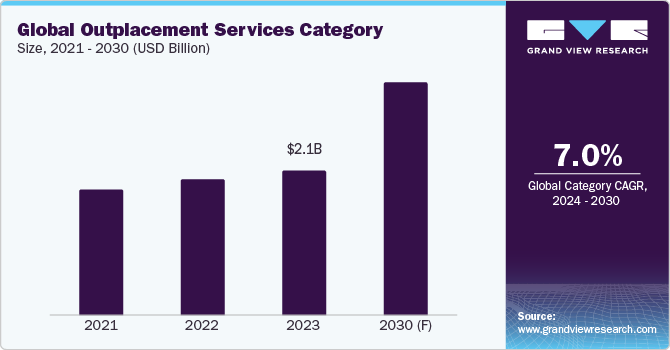

The global outplacement services category is anticipated to grow at a CAGR of 7.0% from 2024 to 2030. It is being driven by factors such as large-scale hiring and layoffs, protection against legal action, financial viability, growing globalization and the prevalence of remote work, and rising uptake of connected device applications and analytical solutions. In the past, outplacement was mostly known to businesses that offered skills-enhancement services. Nevertheless, with the rapid advancement of technology, it is now imperative that employees be able to leave their jobs easily and conveniently. In order to preserve the company's identity and brand, over 79.9% of businesses across the globe believe that it is critical to assist departing employees. However, concerns such as the breach of personal employee data and the presence of fraudulent service providers may hinder the growth of the global category during the forecasted timeframe.

Services offered in the category increase the number of people resettled, which raises the caliber of services offered in addition to strengthening ties with the neighborhood's business community. It aids in streamlining workflows and boosting efficiency. Expert consultation and direction enable the optimal use of a person's skill while defending their rights and ensuring their professional safety. Before selecting an outplacement service provider, businesses typically consider a number of aspects to make sure their resources are receiving the finest assistance at a cost that is affordable for the employers. This is done to reevaluate the success of the programs. Many sectors, such as BFSI, healthcare, manufacturing, government & public sector, retail, IT & telecom, and others gets benefitted by the solutions offered in the category. The BFSI sector dominates the category, holding largest share in the market, being supported in efficient transition of employees to new roles.

The global outplacement services category was valued at USD 2.1 billion in 2023. It is witnessing growth as a result of the increased reliance of business enterprises and individuals on the services offered. Many players in the industry opt for conventional channels to deliver their services, however, technological integration has enabled developing the solutions that offer more comprehensive support to those suffering redundancy. It is evident that individuals utilizing technological advancements and trends can return to work twice as quickly as those enrolled in more traditional job search assistance programs. Cutting-edge placement services, advances in technology, and emerging trends allow several services to be managed from a single location. As a result, there is less effective distance between the supplier and the customer. The development of technology permits more individual one-on-one assistance.

Key technologies that are supplementing the growth of the global category include artificial intelligence (AI), virtual career coaching platforms, integration of cloud, analytics, and blockchain.The job search environment is evolving due to artificial intelligence (AI). Employers/job seekers are not required to laboriously go through hundreds of postings in an attempt to locate the ideal fit. AI-powered systems examine candidate profiles and job postings using sophisticated algorithms. After determining the best fit, these technologies help companies find the right people and provide prospects with pertinent job possibilities. In addition, the virtual career-coaching platform entails collaborating with a qualified career coach who offers direction, encouragement, and knowledge to assist people in navigating their career paths and realizing their full potential. The technology provides individuals with the tools they need to achieve their goals and build the skills they need to succeed in their chosen sector.

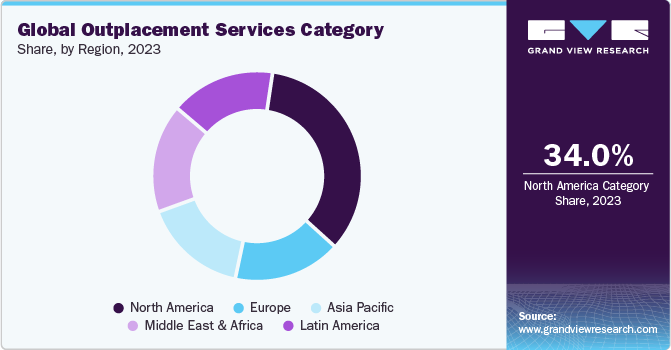

North America dominates the global category, accounting for a substantial share of the market. The regional growth can be attributed to the economic hegemony of the U.S. over the region, and its extremely diverse industrial sector. The region is anticipated to grow positively in the upcoming years because of the competition among local firms for customers, which limits resources and promotes employee turnover.Some of the factors driving the regional growth include intensifying competition and the rising costs of staff retraining and restructuring. In addition, due to its rapid growth, enterprises based out of Canada are experiencing a greater need for layoffs. Europe holds the second-highest share in the market due to rising demand for services offered in the category in countries such as Spain, Italy, the UK, France, and Germany.

Supplier Intelligence

“What best describes the nature of the outplacement services category? Who are the key players operating in the industry?”

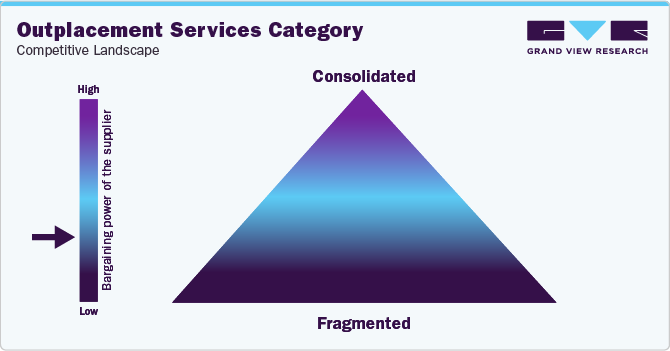

The global outplacement services category witnesses intense competition with the presence of a large number of service providers both at global and regional levels, displaying the fragmented nature of the market. Key players in the industry are focusing on cost-effectiveness, innovation, and service quality with an objective to enhance their share in the industry. In addition, they are developing new price and operational tactics to outcompete their rivals. Furthermore, the players are employing a variety of strategies, such as joint ventures, mergers and acquisitions, product line extension, and service portfolio growthto create long-term competitive advantages.In addition, in order to guarantee more interpersonal and value-driven subcontracting, players providing the solutions and businesses looking for the services provided in the category are attempting to capitalize on differences in contractual arrangements.

Due to the abundance of international vendors in the market, buyers have significant negotiating advantage. A vast array of products that suit the buyer's needs in terms of price and services are available. When there is minimal value, addition and distinctiveness offered by the product, the power is even greater. Given the initial financial outlay required to establish the infrastructure and process large numbers of information effectively and efficiently, the threat of new entrants is low to moderate. To effectively compete in the market, new entrants must raise the value of their brands. They must be fully conversant with the statutory requirements for every region. In order to continue investing in developing an outplacement program, volume and scale are necessary. Establishing trust in the technology solution is crucial, as it can have a significant impact on employee happiness during the program.

Key suppliers covered in the category:

-

Adecco Group AG

-

Career Insight Group

-

Careerminds Group Inc.

-

Chiumento Limited

-

Frederickson Partners

-

Hays plc

-

INTOO, LLC

-

ManpowerGroup Global Inc.

-

Mercer LLC

-

Prima Careers Pty. Ltd.

-

RiseSmart, Inc. (d.b.a. Randstad RiseSmart)

-

VelvetJobs LLC

Pricing and Cost Intelligence

“What are the key cost components for outplacement services category? What factors influence the charges / prices?”

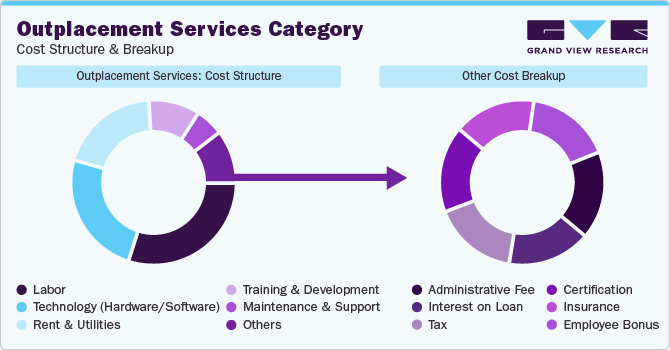

The cost structure of the global outplacement services category is constituted by labor, technology (hardware/software), rent & utilities, training & development, maintenance & support, and others.Other costs can be further bifurcated into administrative fees, interest on loans, taxes, certifications, insurance, and employee bonuses. Labor costs make up for the highest percentage of the cost component.Key variables that influence the charges for the services offered in the category include the type of the plan, number of personnel impacted by layoff/termination, duration of the support required, experience of the service provider, and technology deployed while offering the services.

Service providers offer employees (the takers) with varying degrees of assistance. For instance, simple programs provide just rudimentary services such as cover letter preparation; resume building, and job search coaching. Since this does not include offering personalized attention, they are less expensive.In addition, the majority of service providers base their program fees on the number of workers who would be affected by layoffs/termination. A business needs to pay more if it decides to mass layoff. The charges will depend on the specific services rendered. The seniority level of each individual also affects the cost per person.

The price of services offered in the category can differ significantly based on a number of variables, as mentioned above. Services provided individually are more expensive than those provided in groups, and executive services may be considerably more expensive. However, the industry-wide average cost of services is roughly between USD 1,800 per employee to USD 2,000 per employee in the U.S.

The cost structure is broken down in the accompanying chart. Other costs can depend on multiple cost components, which have been illustrated below:

The report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

”How do buyers of outplacement services engage? What is the type of engagement model?”

For sourcing intelligence in the global outplacement services category, buyers (the businesses/service takers) in the category typically prefer for full-service outsourcing model to engage with their suppliers. Since running an outplacement program in-house can be very expensive and requires personnel dedicated to this, it is financially viable for business enterprises to outsource it completely to a third party and just concentrate on their core operations. Outplacement takes place when there is a layoff /termination, which is the outcome of downsizing, hence keeping it in-house is not a feasible option.

The possibility of layoffs can damage the brand image of a business enterprise; therefore, it needs to handle the situation with pragmatism and after considering how its actions will be interpreted by the public while preparing for something as significant as firing. Therefore, outsourcing the outplacement enables businesses to reduce their risk of being sued for unemployment benefits, stay an attractive employer, and prevent retaliation, which is typical when workers feel aggrieved. In addition, it leads to increased retention as the existing employees feel a sense of belongingness when they find what the company is doing for the people who are not the part of organization anymore.

”In the full services outsourcing model, the client outsources the complete operation/manufacturing to single or multiple companies.”

The buyers (the businesses/service takers) in the category opt for an approved provider-operating model when selecting their supplier. A supplier who satisfies certain selection criteria, quality requirements, prior performance history, or predetermined characteristics is considered approved. One of the key reasons why buyers select an approved provider is the presence of fraudulent agencies in the industry who pose a potential threat in terms of not just compromising crucial data of job-less individuals but also leading to financial losses for both the business enterprise who select them and for the laid-off employees as well.

In Asia Pacific, Singapore can be considered the best country for sourcing outplacement services. The nation's job market is expanding and it is a worldwide economic powerhouse. Professionals looking for varied job prospects will find the nation or a city to be a favorable environment due to its advantageous location, pro-business policies, and multiculturalism. On the other hand, the U.S. can be considered the best country for sourcing outplacement services in North America as it is one of the most popular places in the world for job seekers. Professionals from a variety of industries are drawn to the U.S. because of its entrepreneurial spirit, diverse economy, and strong need for skilled labor.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Outplacement Services Category Procurement Intelligence Report Scope

Report Attribute

Details

Outplacement Services Category Growth Rate

CAGR of 7.0% from 2024 to 2030

Base Year for Estimation

2023

Pricing Growth Outlook

5% - 10% increase (Annually)

Pricing Models

Cost-plus pricing, bundled pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Geographical service provision, industries served, years in service, employee strength, revenue generated, certifications, career coaching, e-learning / upskilling courses, social network integration, transition guides, job search, resume review, and alerts, technology support, and others

Report Coverage

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Adecco Group AG; Career Insight Group; Careerminds Group Inc.; Chiumento Limited; Frederickson Partners; Hays plc; INTOO, LLC; ManpowerGroup Global Inc.; Mercer LLC; Prima Careers Pty. Ltd.; RiseSmart, Inc. (d.b.a. Randstad RiseSmart); VelvetJobs LLC

Regional Scope

Global

Revenue Forecast in 2030

USD 3.4 billion

Historical Data

2021 - 2022

Quantitative Units

Revenue in USD billion and CAGR from 2024 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global outplacement services category size was valued at approximately USD 2.1 billion in 2023 and is estimated to witness a CAGR of 7.0% from 2024 to 2030.

b. Large-scale hiring and layoffs on a regular basis, protection against legal action, financial viability, growing globalization and the prevalence of remote work, and rising uptake of connected device applications and analytical solutions are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, Singapore and U.S. are the ideal destinations for sourcing outplacement services.

b. This category exhibits a fragmented landscape with intense competition. Some of the key players are Adecco Group AG, Career Insight Group, Careerminds Group Inc., Chiumento Limited, Frederickson Partners, Hays plc, INTOO, LLC, ManpowerGroup Global Inc., Mercer LLC, Prima Careers Pty. Ltd., RiseSmart, Inc. (d.b.a. Randstad RiseSmart), and VelvetJobs LLC.

b. Labor, technology (hardware / software), rent & utilities, training & development, maintenance & support, and others are the major cost components of this category. Other costs can be further bifurcated into administrative fee, interest on loan, tax, certification, insurance, and employee bonus.

b. Reviewing the number of services on offer by a supplier, assessing the extent to which a supplier can be flexible and support with customized solutions as per business need, evaluating the technological capabilities of a supplier, and comparing the prices charged by different suppliers are some of the best sourcing practices considered in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified