- Home

- »

- Reports

- »

-

Payroll Outsourcing Services Cost Intelligence Report, 2030

![Payroll Outsourcing Services Cost Intelligence Report, 2030]()

Payroll Outsourcing Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Dec, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10568

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Category Overview

“Growing need for transparency in payroll-related expenses is fueling the category’s growth.”

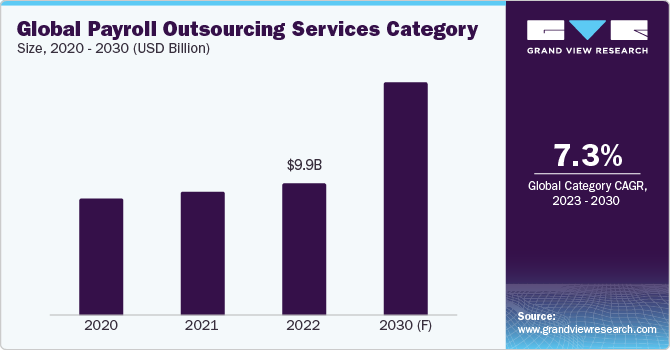

The global payroll outsourcing services category is anticipated to grow at a CAGR of 7.32% from 2023 to 2030. The rising adoption of these services by business enterprises across sectors in order to reduce expenses incurred on hiring & training internal staff and deploying software platforms, growing need for transparency of expenses related to payroll, and rising intricacy of regulations governing payroll. Payroll cost awareness is becoming more and more necessary due to factors like lean methodology adoption, manufacturing processes being extended across geographic borders, and economic and cultural globalization. Multinational corporations often look for contracts that offer aggregate reporting of payments, personnel information, and other services, as well as worldwide cost awareness.

Growth of the category can be hindered by the possible risk associated with data privacy and security. Payroll data includes sensitive personnel information, such as financial, tax, and personal details. Outsourcing such as crucial and sensitive information to a third-party service provider raises concerns around data breaches, illegal access, and adherence to data protection laws. For uninterrupted operations, outsourced technical support providers might need to centralize their data and grant everyone access. Although an upgrade of this kind can increase productivity, it can also increase the danger of data leaks. Confidential information management might also give rise to security breach concerns. Businesses need to carefully evaluate the security measures and processes of the outsourcing service providers in order to ensure the employee data security and privacy.

The global payroll outsourcing services category was estimated at USD 9.97 billion in 2022. The demand for outsourcing services is driven by the complexity of payroll legislation becoming more and more complex, as well as the necessity for rapid and accurate processing. It is anticipated that the industry's highest market share would belong to the large size business segment. The complicated payroll needs of major businesses, which include broad employee bases, several locations, varied pay structures, and complex regulatory compliance, are the driving force behind this prediction. Large companies frequently choose to outsource their payroll activities to specialized providers due to operational difficulties and resource limitations that arise from managing payroll processes internally.

Technologies that are driving this category’s growth include cloud computing, mobile payroll application, employee self-service (ESS), artificial intelligence (AI) & machine learning (MI), data analytics, and internet of things (IoT). Cloud-based payroll systems provide cost-effectiveness, flexibility, and scalability. They lower the cost and complexity of IT infrastructure by enabling simple changes, instant data access, and smooth connectivity with other HR and finance systems. This data can be integrated with HR technology platforms to provide a uniform method of managing employee data and processes. The effectiveness of departmental collaboration is enhanced by this integration, which benefits payroll, HR, and other divisions. Besides, an ESS enables individuals to take care of tasks like requesting time off, updating personal information, and examining paystubs alone, all without assistance from HR.

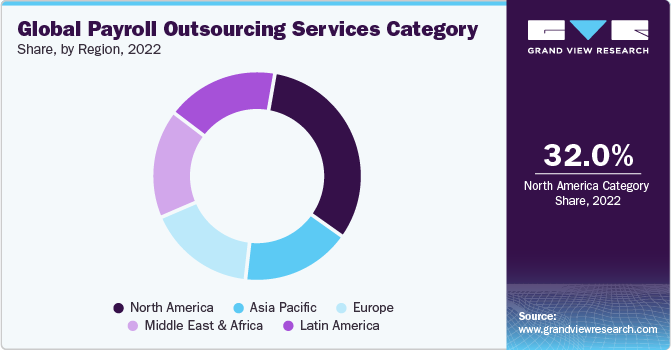

North America dominates the global payroll outsourcing service category, holding a substantial revenue share. The presence of numerous multinational business enterprises operating in various sectors, generate high demand for these services. The regions intricate and dynamic payroll laws and compliance standards necessitate specialist knowledge, which outsourcing providers can offer. Furthermore, the region has a thriving outsourcing industry made up of seasoned service providers with strong technological and infrastructure backgrounds. Asia Pacific holds the second position in terms of global market share and is witnessing the fastest growth rate, with diverse range of economies, which covers rapidly globalizing and industrializing developing markets. The growth of businesses and sophisticated payroll processes leads to rising need of service providers in these countries.

Supplier Intelligence

“What best describes the nature of the payroll outsourcing services category? Who are some of the main participants?”

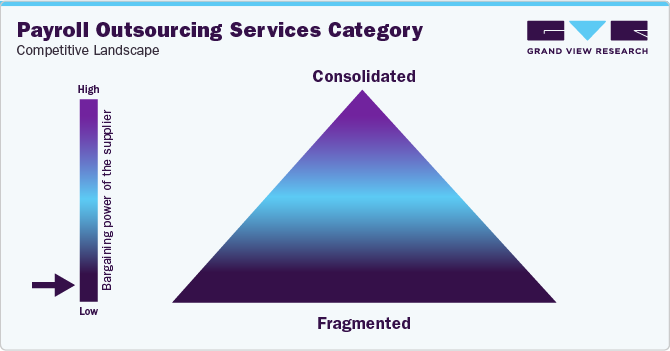

The global category for payroll outsourcing services exhibits a fragmented landscape with the presence of large number of global and regional players, who are employing a range of tactics, such as introduction of new products and services, growth in geographical presence, mergers and acquisitions, and joint ventures to increase their market share. The players are also framing strategies to enhance their services with an objective of improved customer satisfaction. For instance, the first-ever payroll product with integrated HR advice “Guided Payroll” was introduced in early 2022 by Bambee, the HR solution recognized for automating HR processes for small businesses and assigning each of its clients to a real, dedicated HR manager. The product is free for the startups and businesses having as less as 19 employees, meaning over 3.9 million American business enterprises, employing over 29.9 million employees can utilize the product at no extra cost.

Due to the abundance of global market players, buyers in the category possess significant negotiating leverage. A vast array of products that suit a buyer's needs in terms of price and services are available. The power is even greater when there is little value addition and distinctiveness offered by the product. On the other hand, there is an extremely low exit barrier after a customer has subscribed to a specific product or service. As a result, there is intense competition between the current forces. Integrated products that include specialized payroll services in addition to a platform lessen the possibility of substitution for some participants. Also, consumer loyalty is highest when statutory compliance is maintained but drastically lowers when there are violations because it directly affects employee happiness.

Key suppliers covered in the category:

-

ADP, Inc.

-

Ceridian HCM, Inc.

-

CGI Inc.

-

CloudPay Inc.

-

Deloitte Touche Tohmatsu Limited

-

Infosys Limited

-

Intuit Inc.

-

KPMG International Limited

-

Paychex Inc.

-

Ramco Systems Ltd.

-

Workday, Inc.

-

ZenPayroll, Inc. (d.b.a. Gusto)

Pricing and Cost Intelligence

“What is the cost structure for payroll outsourcing services? What variables affect the prices?”

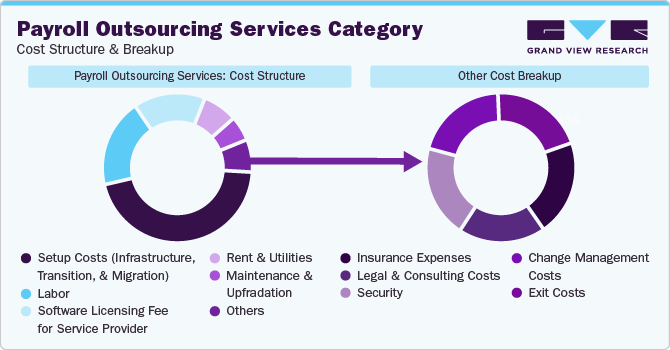

The cost structure of the global payroll outsourcing services category is constituted by setup costs (infrastructure, transition, and migration), labor, software licensing fee for service provider, rent & utilities, maintenance & upgradation, and other costs as the key components. Other costs are further divided into insurance expenses, legal & consulting costs, security, change management costs, and exit costs. The largest cost component is held by the setup costs. These are the costs related to establishing the outsourcing contract, which could cover the price of setting up the infrastructure and moving services, functions, or data to the outsourced business. In addition, many hidden costs are associated with the category, such as expenses incurred on overseeing and organizing service providers, warranties and additional benefits, and expense incurred on improper operations & sales strategy.

Different services providers follow various pricing structures, however, below few are most common:

a) Per employee per month: This structure is suitable for businesses with several pay runs for bonuses and commissions among others. Regardless of the frequency of payout, a business needs to pay for each paid employee once in a month.

b) Per frequency: This structure is suitable for businesses with predictable payrolls. The fees that payroll firms charge vary depending on how frequently a business pays. Base fees as well as fees per employee are frequently included in the charges.

c) Fixed pricing: This structure works well for small businesses with steady staffing levels. A set monthly payment is required to cover the number of employees. There are payroll solutions that restrict how many employees a business can add.

Players in the category offer services in several tiers that vary greatly depending on the provider. A business needs to evaluate the contents of the bundle in order to compare the providers and their prices carefully. Some common auxiliary items that raise the price include onboarding & recruitment, employee tracking, tailored file transfer, ledger interface, complete human resource information system (HRIS), performance management, periodic reporting, payment cards & paper checks as additional mode of payments, and tax filings (particularly for entities that are multi-state and have different regulatory frameworks). While the prices vary depending on a variety of factors, a business can generally expect to pay between USD 199 to USD 249 per employee, annually.

The cost structure is broken down in the accompanying chart. Other costs can depend on multiple cost components, as illustrated below:

The report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“How do payroll outsourcing services providers engage? What is the type of engagement model?”

In terms of sourcing intelligence for global payroll outsourcing services category, businesses typically follow hybrid / bundled outsourcing model to engage with their service providers. This model dominates the global category in terms of service type and integrates internal skills with external payroll services. Businesses across the sectors highly rely on this model as it offers control over important areas of payroll management while striking a balance between outsourcing manual and time taking payroll activities to focused providers. Having a hybrid solution guarantees that the HR staff is capable of managing the payroll on their own, independent of third parties. In addition, it reduces the cost by almost half because the work is split between the company and a third party.

“In the hybrid outsourcing model, the client outsources some parts of the overall operation to third parties. Generally, critical operations are carried out in-house by the client.”

Each business requires a unique set of payroll services. A business can avail of specialized services from a capable service provider with the expertise required to fulfill all their business requirements. Such service providers offer an optimal combination of fundamental and updated features after analyzing a business. Such service providers understand the concerns and challenges of the business well, are capable of addressing all the concerns, and can offer online do-it-yourself (DIY) assistance. In addition, to protect client data, a payroll service provider needs to have appropriate policies and procedures in place.

India is the preferred low-cost / best-cost country for sourcing payroll outsourcing services. It is a cost-effective outsourcing destination for businesses due to its competitive labor costs, which result in significant cost savings. In addition, the workforce in India has a strong command of the English language, which facilitates cooperation and communication. In addition, players in the country place a strong emphasis on implementing the latest infrastructure and technologies. The foundation of their strategy is educating the workers on the newest technologies. Outsourcing industry is one of primary sources of foreign currency in India. The nation’s outsourcing rules are very accommodating, enabling foreign companies to easily outsource their operations to India.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Payroll Outsourcing services Category Procurement Intelligence Report Scope

Report Attribute

Details

Payroll Outsourcing services Category Growth Rate

CAGR of 7.32% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

5% - 10% increase (Annually)

Pricing Models

Fixed pricing, per frequency pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Industries served, years in service, geographic service provision, revenue generated, employee strength, payroll processing (salary / wage), time & attendance management, tax management, self-service portal, recordkeeping & reporting, regulatory compliance, and others

Report Coverage

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

ADP, Inc., Ceridian HCM, Inc., CGI Inc., CloudPay Inc., Deloitte Touche Tohmatsu Limited, Infosys Limited, Intuit Inc., KPMG International Limited, Paychex Inc., Ramco Systems Ltd., Workday, Inc., and ZenPayroll, Inc. (d.b.a. Gusto)

Regional Scope

Global

Revenue Forecast in 2030

USD 17.54 billion

Historical Data

2020 - 2021

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global payroll outsourcing services category size was valued at approximately USD 9.97 billion in 2022 and is estimated to witness a CAGR of 7.32% from 2023 to 2030.

b. Rising adoption of services offered in the category by business enterprises across sectors in order to reduce expenses incurred on hiring & training internal staff and deploying software platforms, growing need for transparency of expenses related to payroll, and rising intricacy of regulations governing payroll are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, India and Philippines are the ideal destinations for sourcing payroll outsourcing services.

b. This category is fragmented with high level of competition. Some of the key players are ADP, Inc., Ceridian HCM, Inc., CGI Inc., CloudPay Inc., Deloitte Touche Tohmatsu Limited, Infosys Limited, Intuit Inc., KPMG International Limited, Paychex Inc., Ramco Systems Ltd., Workday, Inc., and ZenPayroll, Inc. (d.b.a. Gusto).

b. Setup costs (infrastructure, transition, and migration), labor, software licensing fee for service provider, rent & utilities, maintenance & upgradation, and other costs as the key components are the major key cost components of this category. Other costs are further bifurcated into insurance expenses, legal & consulting costs, security, change management costs, and exit costs.

b. Assessing if the service provider offers round the clock customer support, ensuring that the service provider offers access to human resource specialists who are qualified and experienced to answer queries in real time, evaluating if the solution offered by the service provider can easily be integrated to existing accounting system, and comparing pricing terms of the service provider are some of the best sourcing practices considered in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified