- Home

- »

- Reports

- »

-

Personal Computing Procurement Intelligence Report, 2030

![Personal Computing Procurement Intelligence Report, 2030]()

Personal Computing Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Apr, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10584

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Personal Computing - Procurement Trends

“Rise in the adoption of BYOD, and surge in laptop usage by educational institutions are fueling the growth of the personal computing market.”

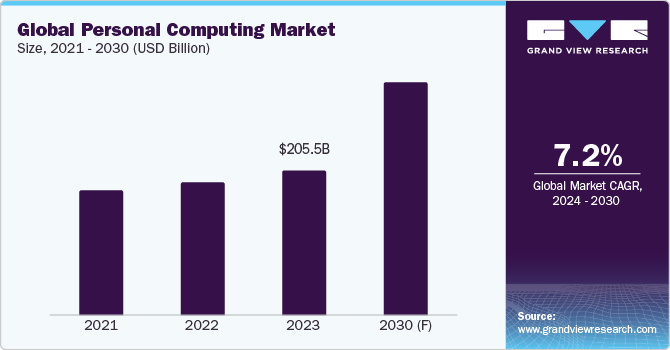

Personal computing procurement enables significant advantages to buyers such as reduction in costs, improvement in accessibility, process transparency, and ease of scalability. The global market is predicted to expand at a CAGR of 7.2% from 2024 to 2030. This growth is driven by factors such as an increased adoption of Bring Your Own Device (BYOD) by organizations, growth of Information Technology (IT) and Information Technology-enabled Services (ITES), surge in laptop usage by educational institutions, rise in disposable income, and technological advancements. A few of the key challenges being faced in the industry are semiconductor shortages and price fluctuations, supply chain and logistics issues, and an increase in competition among suppliers.

In the current personal computing landscape, suppliers are increasingly using sustainable and recyclable materials for manufacturing various items. Moreover, there is an increased demand for personalization features in these products, such as unique aesthetics, tailored colors and graphics, and bespoke performance features. Additionally, suppliers are focusing on advancements in product performance and design, to meet end-user demands for efficient, powerful, and aesthetically pleasing products.

Personal computing products are utilized by various end-users such as commercial offices, educational institutions, government agencies, finance and accounting firms, and other end-use sectors such as healthcare, hospitality, retail, engineering, and marketing. For instance, commercial offices are using PCs to streamline workflows and enhance productivity. Educational institutions are utilizing these items for online lectures, research, and student records.

The global personal computing market size was estimated at USD 205.5 billion in 2023. The demand increased during the COVID-19 pandemic, with a surged usage of these products to facilitate remote working trends such as virtual meetings and seamless communication in work-from-home settings. At the same time, demand for these products from educational institutions also grew to facilitate the need for conducting online lectures and accessing e-learning platforms during lockdowns. Post the pandemic, key suppliers are increasingly providing enhanced security features, higher resolution screens, and extended battery options in these products to accommodate changing customer demands.

Key technology trends that are driving the growth of the personal computing industry include thin clients, Organic Light-Emitting Diode (OLED) panels, convertible 2-in-1 Designs, AR and VR integration, and slim and lightweight design. Thin clients are lightweight, low-cost devices used to access data and applications on remote servers or centralized systems. These devices enable the minimization of local processing and storage requirements. Moreover, thin clients typically use low processing power and storage capacity, thus making them affordable and easy to manage, as compared to traditional PCs. OLED panels are energy-efficient innovative display technologies deployed in laptops and desktops that utilize organic compounds to emit light during the passage of electric current. These displays have a self-emitting light source and facilitate enhanced user control with respect to brightness and color accuracy. Moreover, OLED panels contain high contrast ratios, vibrant screen colors, and deep blacks, leading to better visual experiences for users.

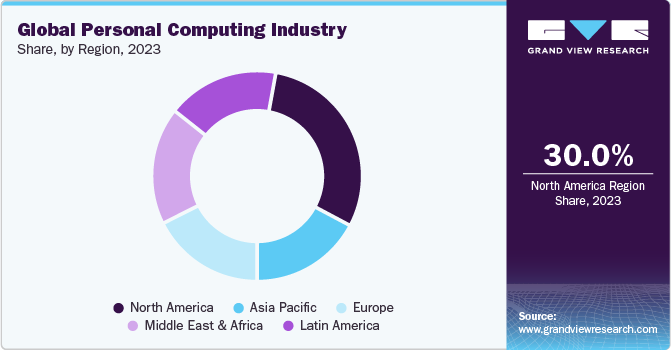

North America dominates the personal computing industry, accounting for 30% of the global market share in 2023. This region’s growth can be attributed to the presence of large corporations, the advent of high-speed internet infrastructure, advancements in laptop performance and designs, product innovation initiatives by key players, and a rise in e-commerce activities. Asia Pacific is expected to grow the fastest during the projected period. Key growth drivers for this region are a surge in demand from various commercial entities, rapid urbanization, a swift increase in product usage in emerging countries such as India and China, a growing presence of key suppliers, technological improvements, and a rise in government initiatives.

Supplier Intelligence

"What are the characteristics of the personal computing market, and who are the key players involved?"

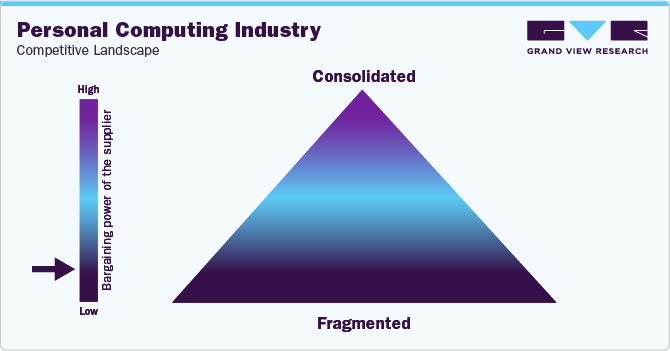

The global personal computing industry is characterized by fragmentation and intensified competition among key suppliers. Therefore, key suppliers are highlighting product quality, facilitating the use of eco-friendly and recyclable materials, focusing on budget-friendly product options, enhancing after-sales support, and providing supplementary services. Prominent manufacturers are competing based on product pricing, customization, adherence to environmental standards, lead time reduction, innovation in design features, and enhancement of security options. Additionally, major players are increasingly focusing on building resilient supply chains and managing supply chain risk in light of recent incidents such as geopolitical conflicts and the COVID-19 pandemic. Currently, competitors are actively enhancing their geographical presence, capitalizing on novel distribution channels such as specialty stores and direct-to-consumer, fostering alliances and partnerships, and strengthening their product portfolio to emphasize their market position and cater to changing buyer needs.

In terms of the demand landscape, buyers are increasingly focusing on product durability and reliability, prioritizing enhanced security features and battery life, embracing e-commerce platforms for sourcing, and assessing sustainability track records while engaging with suppliers. Moreover, the buyers have a wide variety of choices for budget range, product specifications, secondary services, product warranty, and post-purchase options. Buyers can consider such factors for supplier selection and price negotiation.

The profit margins available to suppliers in this industry are typically low, in the range of 5% - 14%, depending on product type, manufacturing expenses, geographic location, shipping expenses, and taxes. Buyers have high bargaining power due to market competition, enabling them to switch to better alternatives and source high-quality products at feasible rates with selectivity. This exerts pressure on suppliers to lower product prices and establish competitive pricing rates while maintaining quality standards. Besides, regulatory directives in several countries require suppliers to comply with rigorous standards related to product durability, performance, safety, sustainability, and environmental footprint. Key metrics to evaluate the performance of personal computing suppliers include product lifespan and durability, customer feedback, software upgrades and compatibility, on-time delivery rate, and profit margins.

Key suppliers covered in the industry:

-

Acer Inc.

-

Apple Inc.

-

ASUSTeK Computer Inc.

-

Dell Inc.

-

HP Development Company, L.P.

-

Huawei Technologies Co., Ltd.

-

Lenovo Group Ltd.

-

LG Electronics Inc.

-

Samsung Electronics Co., Ltd.

-

Sony Group Corporation

Pricing and Cost Intelligence

“What are the main components of the cost structure for personal computing, and what are the factors impacting the prices?"

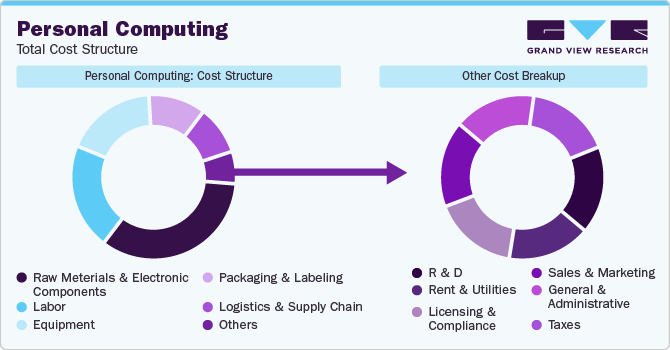

Personal computing procurement is associated with several variables comprising pricing and cost elements. The cost structure is comprised of raw materials and electronic components, labor, equipment, packaging and labeling, and logistics and supply chain costs as the key components. Other costs include R&D, rent and utilities, licensing and compliance, sales and marketing, general and administrative, and taxes. Raw materials and electronic components constitute the major element in the cost structure, followed by labor costs.

The accompanying chart breaks down the cost structure. The breakup of other costs may be influenced by various cost components, as depicted below:

The prices of products in the personal computing industry alter based on several variables. Key factors leading to price variations include fluctuations in the prices of raw materials and electronic components, supply chain and logistical challenges, labor cost variations, and licensing and compliance requirements. Prices of raw material components such as plastic, glass, metals, aluminum, arsenic, and silicon vary significantly depending on feedstock and energy costs. Similarly, costs of electronic components such as semiconductors, batteries, and motherboards fluctuate due to inventory shortages, rise in production expenses, and transportation-related disruptions, among other reasons. For instance, prices of Polyethylene Terephthalate (PET), a prominent plastic used to manufacture laptops / desktops, increased in the U.S. from USD 996 per MT in October 2023 to USD 1040 per MT in January 2024, which contributed to a rise in the prices of laptops / desktops in the U.S. during this period.

Similarly, the prices of Acrylonitrile Butadiene Styrene (ABS), another commonly used plastic raw material for manufacturing laptops, increased by 5.6% in North America in March 2024, as compared to the previous month. Similarly, prices of ABS in Europe grew by 9.1% in March 2024, standing at USD1.91/kg. All these changes contributed to a rise in laptop prices in North America and Europe during this period. Suppliers in the personal computing market deploy several pricing models. One of the key pricing structures being used is cost-plus pricing. This pricing model offers advantages such as ease of calculation, providing a consistent rate of return, and reliability. Other key pricing models used are competition-based pricing, bundled pricing, demand-based pricing, and penetration pricing.

The average prices of personal computing items in the U.S. vary according to the type of product. For instance, in 2023, the average prices of laptops were in the range of USD 200 - USD 2,400. The average prices of desktops were in the range of USD 180 - USD 2,100. The average prices of tablets fell within the spectrum of USD 100 - USD 900. Moreover, prices also vary according to product specifications. For instance, in 2023, prices of low-range office laptops in the U.S. spanned within USD 200 - USD 550, mid-range laptops fell within USD 450 - USD 950, and high-end laptops spanned in the range of USD 1,100 - USD 2,400.

Sourcing Intelligence

“What methods do suppliers of personal computing implement to engage with buyers? What type of engagement model is implemented?”

In terms of sourcing and procurement intelligence for global personal computing, buyers follow a full-service outsourcing model to engage with suppliers. In this model, buyers fulfill procurement of all products and ancillary services from single or multiple suppliers. This model enables buyers to select from a wide product range during procurement, optimize the costs associated with the procurement, improve lead time, and obtain the required customization features in products. Moreover, buyers can select from a variety of sustainable products for procurement, attain dedicated warranty and after-sales support, and leverage other benefits such as supplementary services and quick replacement. Buyers prefer to sign long-term contract agreements with suppliers for supplier consolidation, enhanced security, improved stability, strong partnerships, and dedicated support. Additionally, long-term contracts enable buyers to effectively negotiate product prices and payment terms.

“In the full services outsourcing model, the client outsources the complete operation/manufacturing to single or multiple companies.”

However, buyers prefer an ‘approved provider’ operating model for sourcing personal computing items, as these items are accompanied by predefined quality standards, qualifications, performance capabilities, or other such specific criteria. However, buyers may sometimes adopt a ‘basic provider’ operating model wherein a fixed ‘transaction’ price is paid for products sourced. This operating model is preferred when sourcing low-cost items with standard availability and purchase options.

Businesses usually choose to procure these products either locally or regionally to improve supply chain-related costs and procurement costs. China is the preferred low-cost/best-cost country in Asia for personal computing. China has significant cost advantages due to the low costs of electronic components such as semiconductors, cheap costs of raw materials such as plastic, metals, and silicon, and economical labor costs. For instance, in 2023, the average silicon prices in China were ~30% lower as compared to those in the U.S. The size of the personal computing market in China was approximately USD 23.3 billion in 2023 and is poised to expand at a CAGR of 4% to reach USD 28.3 billion in 2028. This indicates that the China market for laptops is poised for significant growth during the forecasted period, making it a lucrative destination for procurement.

Taiwan, Vietnam, and Malaysia are other cost-effective countries within Asia to source personal computing items due to the presence of low-cost production facilities, inexpensive raw materials, a resilient supply chain, and cheap labor costs. Within North America, the U.S. is a relatively cheap destination to source these items due to the presence of several key suppliers, large manufacturing hubs, and economies of scale. Within Europe, countries such as Poland and the Czech Republic are considered cost-effective destinations due to relatively low costs of raw materials and components, reasonable pricing strategies, and supportive tax measures and subsidies. Within South America, countries such as Peru, Colombia, and Paraguay are considered economical destinations due to low-cost production facilities, conducive trade contracts, and favorable government policies.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis. In this report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape - the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). Raw materials and electronic components form the largest cost component while producing personal computing products. Similarly, the supply chain practices under sourcing and procurement are also covered. One such instance is the operating model that encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Personal Computing Procurement Intelligence Report Scope

Report Attribute

Details

Personal Computing Market Growth Rate

CAGR of 7.2% from 2024 to 2030

Base Year for Estimation

2023

Pricing Growth Outlook

5% - 10% increase (Annually)

Pricing Models

Cost-plus pricing, competition-based pricing, bundled pricing, demand-based pricing, penetration pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Geographical service provision, industries served, years in service, employee strength, revenue generated, key clientele, regulatory certifications, product range, processor type, storage type, use of sustainable materials, delivery mode, customer service, and others

Report Coverage

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Acer Inc.; Apple Inc.; ASUSTeK Computer Inc.; Dell Inc.; HP Development Company, L.P.; Huawei Technologies Co., Ltd.; Lenovo Group Ltd.; LG Electronics Inc.; Samsung Electronics Co., Ltd.; Sony Group Corporation

Regional Scope

Global

Revenue Forecast in 2030

USD 334.3 billion

Historical Data

2021 - 2022

Quantitative Units

Revenue in USD billion and CAGR from 2024 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global personal computing market size was estimated at approximately USD 205.5 billion in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030.

b. An increase in the adoption of BYOD (Bring Your Own Device) by organizations, growth of IT and Information Technology enabled Services (ITES), surge in laptop usage by educational institutions, rise in disposable income, and technological advancements are driving the growth of this industry.

b. According to the LCC/BCC sourcing analysis, China, Taiwan, and the U.S. are the cost-effective countries in their respective regions for sourcing personal computing products.

b. This industry displays a fragmented landscape, with an intense level of competition. Some of the key players are Acer Inc., Apple Inc., ASUSTeK Computer Inc., Dell Inc., HP Development Company, L.P., Huawei Technologies Co., Ltd., Lenovo Group Ltd., LG Electronics Inc., Samsung Electronics Co., Ltd., and Sony Group Corporation.

b. Raw materials and electronic components, labor, equipment, packaging and labeling, logistics and supply chain are the major cost components in personal computing. Other costs include R&D, rent and utilities, licensing and compliance, sales and marketing, general and administrative, and taxes.

b. In procurement, the best practices for finding suppliers include comparing pricing options, evaluating product specifications, assessing suppliers' experience levels, analyzing client feedback, evaluating service capabilities, and comparing lead times.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified