- Home

- »

- Reports

- »

-

Sugar Processing Market Procurement Intelligence Report, 2027

![Sugar Processing Market Procurement Intelligence Report, 2027]()

Sugar Processing Market Procurement Intelligence, Supplier Intelligence, Supplier Ranking, Pricing & Cost Structure Intelligence, Best Practices, Engagement Model, Low & Best Cost Country, Day One Analysis Report, 2021 - 2027

- Published Date: Nov, 2021

- Base Year for Estimate: 2020

- Report ID: GVR-P-10513

- Format: Electronic (PDF)

- Historical Data: 2018-2019

- Number of Pages: 60

Category Overview

“The growing demand of sugar from food and beverages industry is driving the growth of sugar processing”

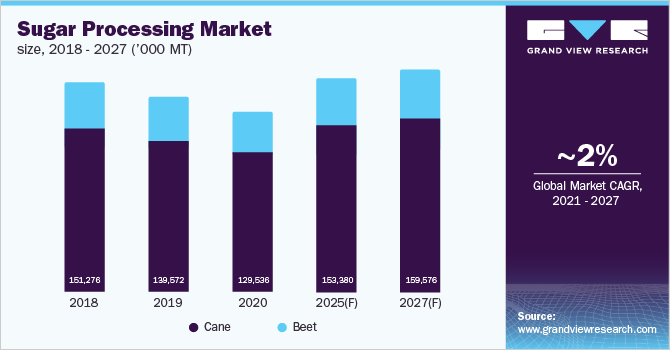

The global sugar processing market was valued at 166 million MT in 2020 and it is expected to grow at a CAGR of ~2% from 2021 to 2027 to cross 200 million MT in terms of volume in 2027. The growth of the market is majorly driven by the high demand generated from the food and beverages industry. However, a supply shortage due to the COVID-19 pandemic and the substantial reduction in output from Brazil, India, the EU, and Thailand resulted in a decrease in production in 2020.

Based on type, white sugar has the highest market share (60%), followed by brown sugar and liquid sugar. Brazil (39.5 million tons) stood as the largest producer of sugar, followed by India (33.7 million tons) and the European Union (17.7 million tons) in 2020. Production in Brazil dropped by 5% in 2020 due to the low availability of sugarcane. Unfavorably dry weather and incidences of fire outbreaks in sugarcane fields lowered production volumes. Additionally, steady grain prices have encouraged the shift of marginal sugarcane areas to soybeans and corn.

Supplier Intelligence

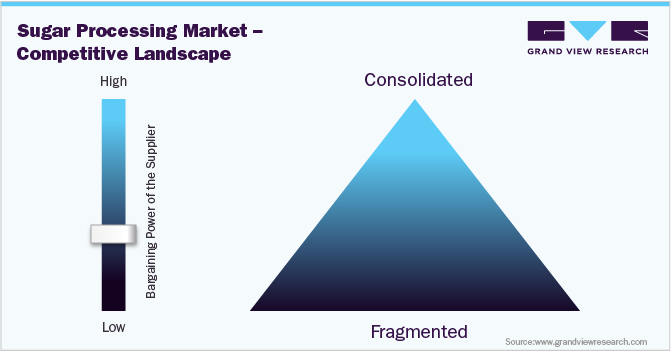

“The global sugar processing market is moderately fragmented & competitive with strategic partnerships between several large market players and small regional sugarcane suppliers to get higher profit margins.”

The presence of a high number of sugarcane producers and with a relatively low number of sugar processing companies reduces the bargaining power of sugarcane suppliers. However, the bargaining power can shift to either side based on region and climatic conditions for sugarcane harvesting. Furthermore, with the growing demand for sugar across the food and beverage industry, more buyers are dealing with a comparatively lesser number of suppliers. Hence, the bargaining power of buyers is low.

Companies such as Cosan, Biosev, Mitr Phol, and Nordzucker are aggressively investing in developing efficient sugar processing methods and improving profit margins.

Pricing and Cost Intelligence

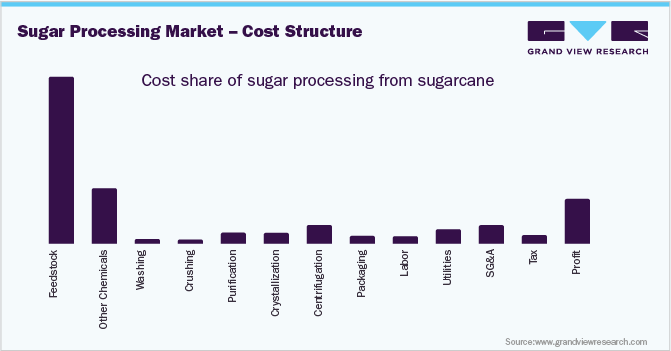

“Feedstock (Sugarcane) cost is the most important cost component of sugar processing. It accounts for more than 40% of the overall processing cost.”

Sugarcane is the key feedstock used for sugar processing. Brazil is the largest producer of sugarcane across the globe. Hence, sugarcane price fluctuations in Brazil play an important role in determining sugar processing costs. Sugar production in Brazil witnessed a decline in 2020 due to the COVID-19 pandemic and drier weather conditions. It resulted in a steep increase in price in 2021. The rate of price increase is expected to slow down in 2022 and grow steadily till 2025.

The report provides a detailed analysis of the cost structure of sugar processing and the pricing models opted by prominent suppliers in the market.

Sourcing Intelligence

“Countries like Brazil, India, and Thailand, being the largest producers of sugarcane in the world, are turning out to be the preferred sourcing destinations for sugar processing.”

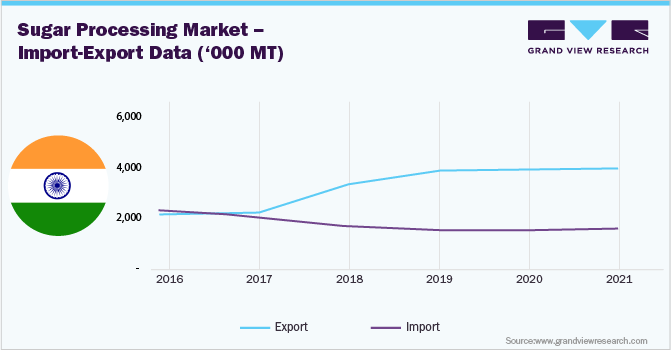

India is one of the world’s leading exporters of sugar. Sugar production in India has been witnessed a steady rise since 2017.

Earlier, Indonesia imported more than 90% of its sugar from Brazil. However, as the pandemic slowed down production in Brazil, India took the opportunity to tap the Indonesian market and make it one of its leading export destinations.

From a sourcing perspective, sugar processing suppliers outsource sugarcane harvesting to local sugarcane producers to reduce additional cost risks and improve flexibility in processing.

Suppliers often prefer approved provider operating models to reduce risks and improve the potential for value creation. As such, suppliers are expected to move gradually to proprietary services in the near future.

The report also provides details regarding quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Frequently Asked Questions About This Report

b. The global sugar processing market size was valued at 166 million MT in 2020 and is expected to reach 204 million MT by 2027.

b. The global sugar processing market is expected to grow at a CAGR of 2% from 2021 to 2027.

b. The increasing demand from the beverage, pharmaceutical, and cosmetic industries is driving the growth of the sugar processing market.

b. According to the LCC/BCC sourcing analysis, India and Brazil are the most favorable sugar processing destinations.

b. The key sugar processing suppliers include Cosan, Biosev, Mitr Phol, and Nordzucker, among others.

b. The global sugar processing market can be described as a moderately fragmented and competitive market characterized by several large players that are focused on striking strategic partnerships with small- and mid-sized companies in an attempt to strengthen their position in the market.

b. Feedstock, including sugarcane and sugar beet, is the largest cost component, accounting for almost 45% of the total cost of sugar processing.

b. Adopting innovative sourcing practices, increasing spend transparency, shifting to low-cost countries for sourcing, and standardizing the contract period can be considered some of the sourcing best practices in the sugar processing market.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified