- Home

- »

- Reports

- »

-

Tax Advisory Services Procurement Intelligence Report, 2030

![Tax Advisory Services Procurement Intelligence Report, 2030]()

Tax Advisory Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Jan, 2024

- Base Year for Estimate: 2022

- Report ID: GVR-P-10573

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Tax Advisory Services Category Overview

“Increasing focus on tax optimization and planning is fueling the growth of the category.”

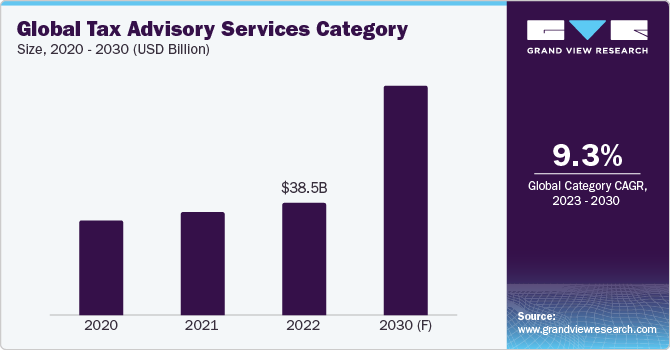

The global tax advisory services category is anticipated to grow at a CAGR of 9.3% from 2023 to 2030. Key factors that drive this growth include the rising significance of risk management and compliance, focus on tax optimization and planning, growing intricacy of tax laws, rising number of international transactions, and advancements in technology. Compliance has been a key responsibility for firms due to stringent rules and increased scrutiny from tax authorities. Services offered in the category support business enterprises in lowering the risk of fines and legal proceedings by assisting them in ensuring compliance with tax laws and regulations. However, concerns such as the scarce supply of qualified professionals, challenges of security and privacy of data, and cost restraints for small & medium-sized businesses enterprises (SMEs) may hinder the category’s growth.

Due to improved money management and wise investment choices, the number of high-net-worth individuals (HNWIs) is rising globally. High-net-worth people also need extra services from wealth managers and financial advisors because of their significant holdings. For HNWIs, services offered in the category encompass assistance with trusts and estates, hedge funds, private equity firm access, and tax filing & advice. In addition, over 12.9% of clients of tax advisors are considered high net worth. HNWIs are also in great demand for tax consulting services because maintaining and preserving their assets requires more labor to manage their money. These people typically require individualized estate and tax planning assistance, among other services. Therefore, the continuous rise of HNWIs is fueling the category’s growth.

The global tax advisory services category was estimated at USD 38.5 billion in 2022. Tax consultants are required to stay updated as per the latest developments in tax laws at the local, national, and international levels and modify their approaches as and when required. Instead of focusing on reactive compliance-focused services, businesses are turning to tax consultants for strategic and proactive help. To succeed in the market, one must meet customer expectations and offer value-added services. Based on the types of services, the direct tax segment held 2/3rd of the market and is anticipated to remain dominant. On the other hand, the indirect tax segment is anticipated to witness the fastest growth rate over the projected timeframe. The banking, financial services and insurance (BFSI) sector, which accounts for over 24.9% of the global market, held the largest share by industry vertical and is predicted to continue leading during the projected period.

Technologies that are driving the growth of the category include cloud computing, artificial intelligence (AI), blockchain, data analytics, and robotic process automation (RPA). Taking advantage of cloud computing's capabilities which extends beyond practicality by giving customers access to real-time information. It is also unnecessary for an accounting business to hire IT specialists to configure internal servers and obtain software updates. Cloud-based tax preparation refers to the hosting of tax planning programs on cloud servers. Businesses are gaining access to top tax software solutions and revolutionizing the tax preparation process by implementing cloud technologies. Since hosted tax software is available on the cloud and has a subscription model, it eliminates the requirement for costly in-house servers. It offers real-time access, enabling the advisor to review client’s tax information and applications from any location with an internet connection, providing more freedom.

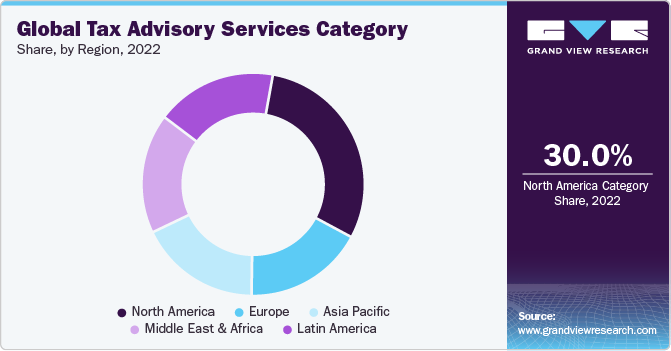

North America dominates the global tax advisory services category, holding a substantial revenue share. Due to the presence of numerous multinational firms and complicated tax laws, the region has a developed market for tax advisory services. In addition, significant demand for the services offered in the category can be witnessed in the U.S. due to its complex tax structure system. The region is followed by Europe and Asia Pacific in terms of demand.The tax systems of various European nations contribute to the high demand for tax consultancy services as they face challenges with cross-border taxes, needing specialized expertise. The demand for the tax advisory services offered in Asia-Pacific is rising due to factors like China's and India's rapid economic expansion, foreign investments, and increased corporate activity.

Supplier Intelligence

“What best describes the nature of the tax advisory services category? Who are some of the main participants?”

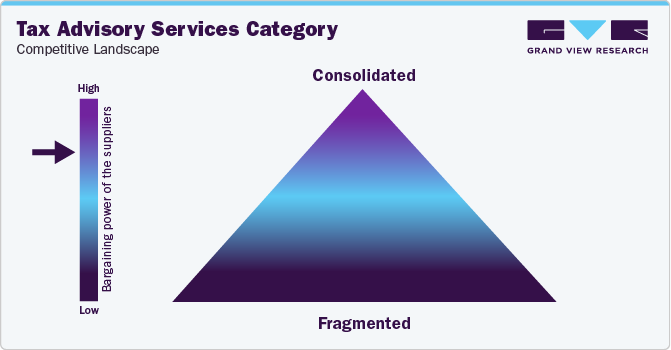

The global tax advisory services category exhibits a moderately consolidated landscape, with the presence of a few large players (particularly the Big 4s i.e. Deloitte, KPMG, PwC, and E&Y) holding the majority of the market share. A large number of global and regional players operating in the industry are constantly working on enhancing their services with an objective to increase their overall industry share. They primarily compete with each other based on technological capability, client relationship, service quality, reputation, and expertise.

Buyers in the category possess low to moderate bargaining power sincethere is less control over the prices.Legal requirements for both privately held and publicly listed businesses obligate them to avail tax services, which makes them pay for the services to be performed. In addition,since it is expensive to switch tax firms, buyers generally stick with the company they started with, which further reduces their bargaining power. Furthermore, the industry faces minimal threat of substitution since tax services must be obtained through regulatory organizations.

Key suppliers covered in the category:

-

BDO International Limited

-

CliftonLarsonAllen LLP

-

Crowe LLP

-

Deloitte Touche Tohmatsu Limited

-

DPNC Global LLP

-

Ernst & Young Global Limited

-

Grant Thornton LLP

-

KPMG International Limited

-

Marcum LLP

-

PricewaterhouseCoopers International Limited

-

RSM International Ltd.

-

USM-SBC Consulting LLP

Pricing and Cost Intelligence

“What is the cost structure for tax advisory services? What variables affect the prices?”

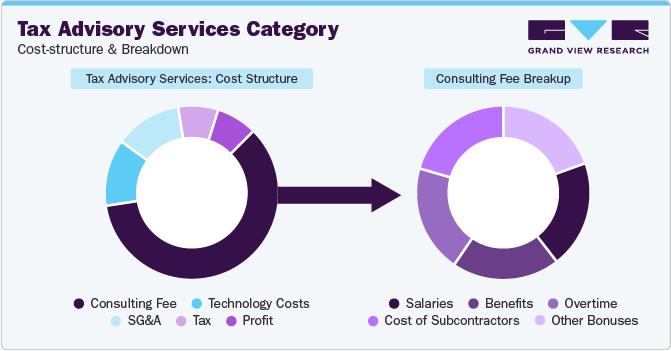

The cost structure of the global tax advisory services category is constituted by consulting fees, technology costs, selling general & administrative (SG&A) expenses, tax, and profit. Consulting fees can be further bifurcated into salaries, benefits, overtime, cost of subcontractors, and other bonuses. Consulting fee / direct cost of service delivery contributes to approximately 60% of the total revenue. Increasing revenue or reducing expenses are what drive profits.

As tax advisory businesses typically rely heavily on human resources, the majority of their income will be derived based on the initiatives that are performed by the expert staff such as cross-selling to current clientele to improve fee collection, encouraging staff members to upsell, boosting the billable utilization of employees, leveraging contract-based professionals rather FTEs, and stringent oversight and management of nominal and variable cost items.

Since the primary cost-driver for a tax advisory firm is the cost of human resources, mark-ups can gradually raise the nominal payroll cost in the case of employee payroll by over 3.9% (federal holidays), 15.9% (employment tax), 12.9% (nonbillable hours spent on the business), 16.9% (personal days), 19.9% (idle time in between jobs), and 29.9% (career development of employee).

A few of the key services offered by firms such as EY and Deloitte include tax planning, tax accounting, tax compliance, digital tax strategy, tax controversy management, cross-border tax advisory, inbound structuring, multi-country planning, audit assistance, indirect tax optimization, and diagnostic reviews. Tax managers in Deloitte are paid an average salary of USD 100,000 - USD 141,000 per year, and the same position in PwC commands an average salary of USD 102,000 - USD 151,000 per year. The average salary for tax managers in EY is USD 93,000 - USD 133,000 per year.

The cost structure is broken down in the accompanying chart. Other costs can depend on multiple cost components, as illustrated below:

The report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“How do tax advisory services providers engage? What is the type of engagement model?”

In terms of sourcing intelligence for the global tax advisory services category, businesses typically follow a full service outsourcing model to engage with their service providers. One of the primary objectives for business enterprises to fully outsource their tax services is cost reduction. Businesses save money by outsourcing taxes because they don't have to pay teams or full-time personnel. They can also save money on the software needed to manage taxes and training expenses. Time saving is another benefit of outsourcing taxes. The time-consuming process of tax management can be avoided by outsourcing. Businesses can assign additional jobs that will help them to expand by freeing up their employees.

“In the full services outsourcing model, the client outsources the complete operation/manufacturing to single or multiple companies.”

Employing a competent tax advisory firm guarantees that the business enterprise fulfills its tax filing and compliance requirements. In addition, it provides access to a thorough and current understanding of tax laws, various filing alternatives, and rulings. Tax advisors can offer reliable guidance on minimizing taxes and avoiding fines. Their comprehensive understanding of tax rules enables them to provide creative solutions that are suited to the particular requirements of a company. This can save costs and help businesses get the most out of their deductions. Businesses can stay in compliance with local, state, and federal tax laws and regulations by outsourcing their business tax services as the professional support will ensure that the company is always compliant because they are knowledgeable about the most recent tax developments.

India is the preferred low-cost / best-cost country for sourcing tax advisory services. CPA firms can increase their return on investment (ROI) significantly by outsourcing their tax services to India. It is evident that hiring specialists in India is less expensive than in the US; this is because the values of the currencies in the two countries differ. Businesses can more easily obtain experienced and skilled workers by outsourcing to India. There are many qualified accountants, tax specialists, auditors, and other professionals in India who are familiar with US tax laws. In addition, Indian tax advisory firms place a lot of emphasis on advancing their business's technological infrastructure. They always push their employees to experiment with new technology and creative thinking to provide top-notch services.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Tax Advisory Services Category Procurement Intelligence Report Scope

Report Attribute

Details

Tax Advisory Services Category Growth Rate

CAGR of 9.3% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

4% - 8% increase (Annually)

Pricing Models

Fixed pricing, FTE-based pricing, time & materials pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Industries served, years in service, revenue generated, employee strength, geographic service provision, international tax services, indirect taxes, financial services tax, tax controversy & dispute resolution, tax reporting & strategy, tax policy & administration, and others

Report Coverage

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

BDO International Limited, CliftonLarsonAllen LLP, Crowe LLP, Deloitte Touche Tohmatsu Limited, DPNC Global LLP, Ernst & Young Global Limited, Grant Thornton LLP, KPMG International Limited, Marcum LLP, PricewaterhouseCoopers International Limited, RSM International Ltd., and USM-SBC Consulting LLP

Regional Scope

Global

Revenue Forecast in 2030

USD 78.4 billion

Historical Data

2020 - 2021

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global tax advisory services category size was valued at approximately USD 38.5 billion in 2022 and is estimated to witness a CAGR of 9.3% from 2023 to 2030.

b. Rising significance of risk management and compliance, increasing focus on tax optimization and planning, growing intricacy of laws pertaining to tax, rising number of international transactions, and advancements in technology are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, India and U.S. are the ideal destinations for sourcing tax advisory services.

b. This category exhibits a moderately consolidated landscape. Some of the key players are BDO International Limited, CliftonLarsonAllen LLP, Crowe LLP, Deloitte Touche Tohmatsu Limited, DPNC Global LLP, Ernst & Young Global Limited, Grant Thornton LLP, KPMG International Limited, Marcum LLP, PricewaterhouseCoopers International Limited, RSM International Ltd., and USM-SBC Consulting LLP.

b. Consulting fee, technology costs, selling general & administrative (SG&A) expenses, tax, and profit are the major key cost components of this category. Consulting fee can be further bifurcated into salaries, benefits, overtime, cost of subcontractors, and other bonuses.

b. Assessing the reputation of the service provider, reviewing the range of services offered by a service provider, evaluating the technology & data security solutions possessed by the service provider, and comparing the service fee for different service providers are some of the best sourcing practices considered in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified