- Home

- »

- Sector Reports

- »

-

Biomarkers Industry Growth, Outlook & Data Book, 2022-2030

![Biomarkers Industry Growth, Outlook & Data Book, 2022-2030]()

Biomarkers Industry Data Book - Cardiac Biomarkers, Cancer Biomarkers, Non-alcoholic Steatohepatitis Biomarkers, Neurological Biomarkers Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

- Published Date: Jan, 2023

- Report ID: sector-report-00109

- Format: Electronic (PDF)

- Number of Pages: 300

Database Overview

Grand View Research’s biomarkers industry data book is a collection of market sizing & forecasts insights, regulatory & technology framework, pricing intelligence, competitive benchmarking analyses, and macro-environmental analyses studies. Within the purview of the database, such information is systematically analyzed and provided in the form of summary presentations and detailed outlook reports on individual areas of research. The following data points will be included in the final product offering in four reports and one sector report overview.

Biomarkers Industry Data Book Scope

Attributes

Details

Research Areas

- Cardiac Biomarkers Market

- Non-alcoholic Steatohepatitis Biomarkers Market

- Cancer Biomarkers Market

- Neurological Biomarkers Market

Details of the Product

- 4 Individual Reports - 4 PDFs

- 4 Individual Reports - Excel

- 1 Sector Report - PPT

- 1 Data book - Excel

Cumulative Country Coverage

25+ Countries

Cumulative Product Coverage

25+ Level 1 +Level 2

Highlight of Product

- Type Revenue, by Country

- End-use Revenue, by County

- Competitive Landscape

- Regulatory Framwork, by County

- Pricing Analysis

Total number of tables (Excel) in the bundle

325+

Total number of figures in the bundle

160+

Biomarkers Industry Data Book Coverage Snapshot

Markets Covered

Biomarkers Industry

USD 41.62 billion in 2021

14.2% CAGR (2022-2030)

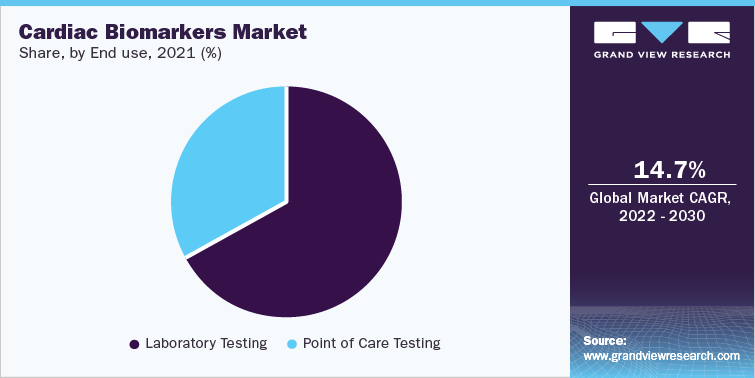

Cardiac Biomarkers Market Size

USD 13.98 billion in 2021

14.7% CAGR (2022-2030)

Non-alcoholic Steatohepatitis Biomarkers Market Size

USD 800.6 million in 2021

23.6% CAGR (2022-2030)

Cancer Biomarkers Market Size USD 19.99 billion in 2021

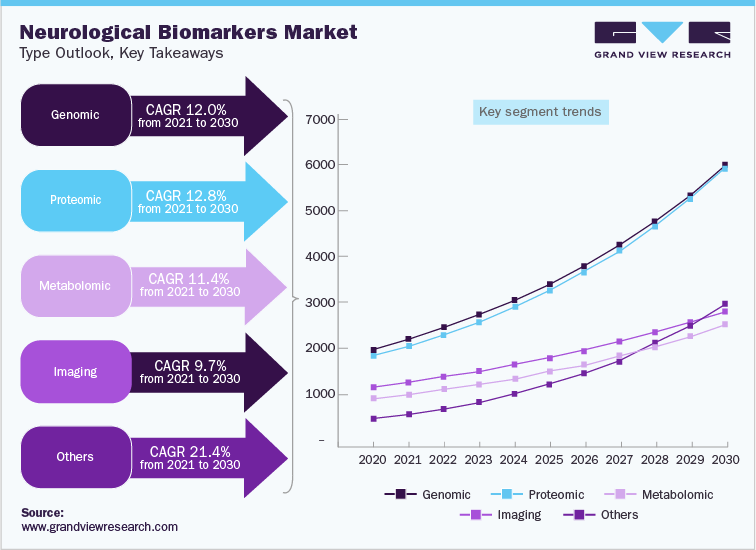

13.9% CAGR (2022-2030)Neurological Biomarkers Market Size

USD 6.85 billion in 2021

12.8% CAGR (2022-2030)The global biomarkers markets combine to account for USD 41.62 billion revenue in 2021, which is expected to reach USD 137.76 billion by 2030, growing at a cumulative rate of 14.2% over the forecast period. The combination bundle is designed to provide a holistic view of these highly dynamic market spaces.

Cardiac Biomarker Market Analysis & Forecast

The global cardiac biomarkers market was valued at USD 13.98 billion in 2021 and is anticipated to witness growth at a rate of 14.7% over the forecast period. CVDs are one of the main causes of death globally, and hypertension & its pathological adverse effects pose a significant risk for other cardiac diseases, such as heart failure & stroke. Identifying early-stage biomarkers of hypertension and other CVDs is of high significance in predicting & preventing major mortality & morbidity related to these diseases. In addition, new research is focused on discovering second-generation biomarkers for CVDs. Constant advancements in this field to discover novel biomarkers are anticipated to boost segment growth.

Several market players are working toward the discovery of new cardiac biomarkers and their potential usage that would help in early treatment decisions. For instance, in April 2021, Roche announced five new intended uses of key cardiac biomarkers to help identify cardiovascular risk, improve patient diagnosis, and support early treatment. Similarly in June 2019, researchers in IIT Hyderabad developed a microfluidic device that could detect low concentrations of biomarkers. This would further help in the early diagnosis of a heart attack.

Moreover, the enhanced usage of cardiac biomarkers in COVID-19 patients to minimize the risk of cardiac diseases is driving the demand. For instance, as per NCBI in 2021, biomarkers for cardiac injuries were elevated in complicated cases of COVID-19 patients and were directly associated with adverse disease outcomes. Thus, the use of cardiac biomarkers enabled the disease management of severely ill patients. Furthermore, as per a 2021 NCBI study, cardiac biomarkers used in COVID-19 patients allow the prognosis and management of severely ill patients. This could play a significant role in patient treatment, as 30% to 35% of COVID-19 patients have underlying cardiovascular conditions, such as coronary artery disease.

In this market, the BNP and NT-proBNP segment is expected to witness substantial attributes to its usage in the detection of stress and heart damage. New players are entering the market with the test in order to generate lucrative revenues. For instance, in June 2022, LumiraDx Limited announced diversification of its portfolio with CE Mark for its D-Dimer test and NT-proBNP test. The commercialization of the Dimer test and NT-proBNP test is projected by the end of 2022, which is expected to facilitate clinical decision-making.

Laboratories are considered the largest end-use segment for this market in 2021 with revenue share of more than 65%. With the advent of technologically advanced homecare lateral flow assays, the reliance of clinicians on laboratories has significantly decreased. Cardiac biomarkers provided by Merck for ELISA assays are C - Reactive Protein (CRP); Troponin I; Brain Natriuretic Peptide (BNP); Cystatin C; Pregnancy-associated Plasma Protein A (dPAPPA); N Terminal (NT) BNP; myoglobin; Creatine Kinase MB Enzyme (CKMB); Troponin T; Fatty Acid Binding Protein; Myeloperoxidase; and insulin-like growth factor binding protein 4. Therefore, a rise in the availability of assays for diagnostic laboratories is expected to boost the market growth.

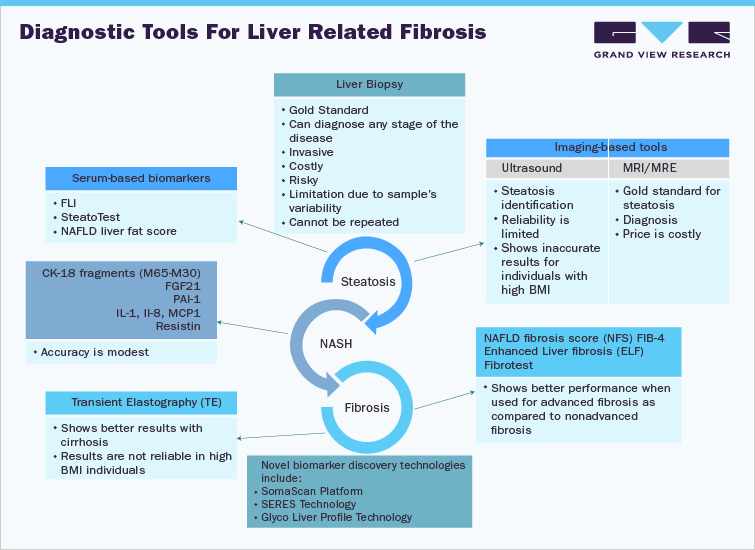

Non-alcoholic Steatohepatitis Biomarkers Market Analysis & Forecast

The global NASH biomarkers market was valued at USD 800.6 million in 2021 and is anticipated to witness growth at a rate of 23.6% over the forecast period. Currently, early-phase clinical trials are investigating several NASH biomarkers, including those based on biochemical, imaging, genetic, and various omics platforms. The use of defined definitions, identification of the right context of usage(s), qualification for the specific demands of drug development, and validation through multiple studies are some of the crucial regulatory concerns regarding the use of biomarkers in drug development. For acquiring a potential correlation of results between these modalities, the practicality of optional/voluntary biopsies conducted concurrently with noninvasive testing, as well as outcome assessments, should be taken into consideration in NASH clinical studies

The serum biomarkers segment held the largest market share of 33.15% in 2021 which is attributed to associated benefits such as its ability to distinguish simple steatosis from NASH coupled with efficient outcomes. Such advantages can reduce the need for liver biopsy, which provides added advantages compared to other types of biomarkers available. Noninvasive serum biomarkers favor patients and physicians more in a dynamic clinical practice since they are easier, more accessible, & repeatable. Numerous novel biomarkers are discovered in experimental and clinical trials, with an increasing understanding of fibrosis pathophysiology. Increasing evidence supports the biological functions of Extracellular Vesicles (EVs) and non-coding RNAs (ncRNAs) in liver fibrosis. Before they can be utilized as accurate serum biomarkers of liver fibrosis, many miRNAs are still in the in vitro investigation phase and require extensive clinical efficacy evaluations.

The pharma and CRO industry segment led the market in 2021 and is expected to witness the fastest growth rate over the forecast period. The growth of the segment can be attributed to the increasing prevalence of liver disorders, which can boost the demand for noninvasive diagnostic tools to detect chronic liver disease. For instance, in May 2020, SomaLogic declared the launch of NASH Bundle as a SomaSignal test. SomaSignal test is available for research use purpose for academic and pharma customers only and includes four NASH tests: inflammation, steatosis, fibrosis, and ballooning. These tests can be performed on patients using a single small blood sample without the need for a biopsy. Such advancements can highlight how using biomarkers early in the diagnosis and treatment of diseases can optimize benefits for patients.

Cancer Biomarkers Market Analysis & Forecast

The global cancer biomarkers market was valued at USD 19.9 billion in 2021 and is anticipated to witness growth at a rate of 13.9% over the forecast period. Genetic biomarkers owing to their extensive usage, high-reliability rate, and easier analysis held a significant market share. Over 85% of malignancies are reported to be detected with the help of genetic and proteomic biomarkers. Furthermore, an increase in the demand for personalized medicines, coupled with growing collaborations between pharmaceutical and diagnostic companies, is anticipated to drive the segment. In October 2021, DarwinHealth entered into a scientific collaboration with Prelude Therapeutics for the development of novel biomarkers for several oncology candidates. Such collaborations are anticipated to drive novel developments in the cancer biomarkers space, which can positively affect market growth.

Asia Pacific is expected to grow at the fastest CAGR of 15.6% over the forecast period. Some of the factors attributed to its high growth are the presence of stabilizing economies, supportive government policies, rapid urbanization, rapid, increase in R& D investments, and joint collaborations of research agencies. However, in this segment, unmet medical needs are still high due to discoveries of biomarkers being limited to specific types of cancer. For instance, neck and head neoplasms have a poor prognosis rate. As per Frontiers in Oncology in 2020, neck and head cancers account for 5% of all cancers and lead to over 300,000 deaths annually. Hence, the discovery of new biomarkers for early diagnosis is expected to reduce mortality and improve biomarker demand in the market.

Neurological Biomarkers Market Analysis & Forecast

The global neurological biomarkers market was valued at USD 6.85 billion in 2021 and is anticipated to witness growth at a rate of 12.8% over the forecast period. Proteomic biomarkers are useful as high functional implications of several post-translational modifications cannot be concluded from mRNA expression. In that case, proteomic biomarkers are required for accurate diagnosis of disease onset and progression due to the careful detection of protein signatures and post-translational modifications. These have been very useful for the identification of underlying cellular changes involved in multifactorial and idiopathic diseases such as AD.

North America accounted for the highest market share of over 40.85% in 2021 and is expected to witness a significant growth rate over the forecast period. Funding for R&D of novel biomarkers by major players such as Merck & Co., Inc, ThermoFisher Scientific, Inc, and Abbott, among others is one of the major reasons responsible for the high market share. In addition, an increase in the number of research initiatives undertaken for studying neurological diseases is expected to fuel market growth. For instance, in January 2022, Cleveland Clinic launched a 20-year study for the collection of data from 200,000 neurologically healthy individuals to identify brain disease biomarkers and targets for prevention and cure of neurological disorders.

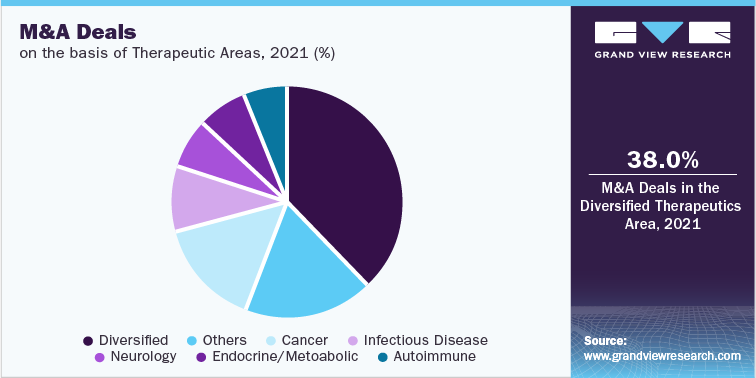

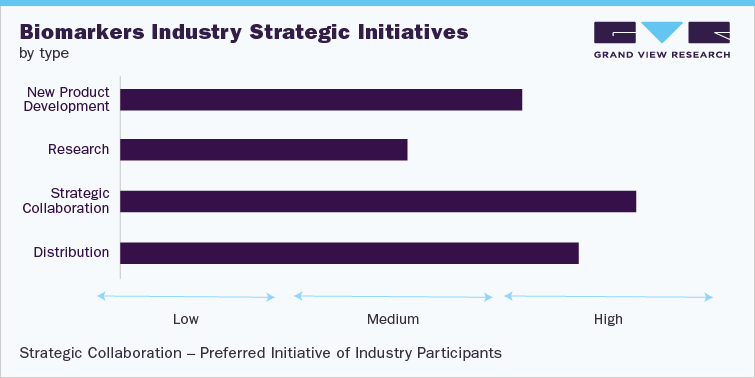

Competitive Landscape

The market has become intensely competitive, and products must successfully clear rigorous assessments, which puts them at a significant clinical advantage over existing products. However, existing brands are constantly renovating and improvising their products to maintain their market position. Consequently, new entrants must demonstrate improved performance in terms of safety, efficiency, precision, accuracy, speed, and user convenience. In addition, aggressive marketing and promotion of the products are key strategies adopted by players entering the market.

Strategy

Spearheads

Distribution

F. Hoffmann-La Roche Ltd.

Strategic Collaboration

Abbott, Johnson & Johnson Services, Inc.

Research

Epigenomics AG; Thermo Fisher Scientific, Inc.

New Product Development(NPD) Bio-Rad Laboratories, Inc.

Some of the key players in the market are F. Hoffmann-La Roche Ltd.; Abbott Laboratories; Bio-Rad Laboratories, Epigenomics AG; Thermo Fisher Scientific, Inc.; Siemens Healthineers AG; Johnson & Johnson Services, Inc; and QIAGEN N.V. Key players are introducing novel products in the market to strengthen their product portfolio. For instance, in August 2022, the company announced the availability of its ELF Test developed in collaboration with Labcorp and Quest Diagnostics across the U.S. The test is available in the U.S. market through De Novo marketing authorization obtained from the U.S. FDA.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified