- Home

- »

- Sector Reports

- »

-

Cancer Diagnostics Industry Overview Data Book, 2023-2030

![Cancer Diagnostics Industry Data Book - Breast Cancer Diagnostic, Cervical Cancer Diagnostic, Lung Cancer Diagnostic, Liver Cancer Diagnostic, Pancreatic Cancer Diagnostic and Ovarian Cancer Diagnostic Market Size, Share, Trends Report]()

Cancer Diagnostics Industry Data Book - Breast Cancer Diagnostic, Cervical Cancer Diagnostic, Lung Cancer Diagnostic, Liver Cancer Diagnostic, Pancreatic Cancer Diagnostic and Ovarian Cancer Diagnostic Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

- Published Date: Jul, 2023

- Report ID: sector-report-00180

- Format: Electronic (PDF)

- Number of Pages: 350

Database Overview

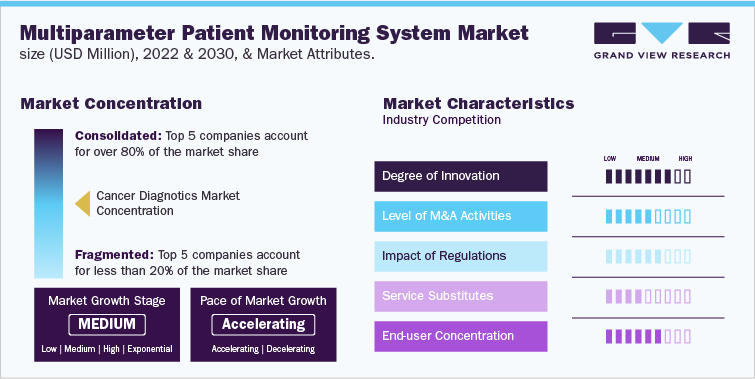

Grand View Research’s cancer diagnostics industry data book is a collection of market sizing & forecasts insights, regulatory & technology framework, pricing intelligence, competitive benchmarking analyses, and macro-environmental analyses studies. Within the purview of the database, such information is systematically analyzed and provided in the form of summary presentations and detailed outlook reports on individual areas of research.

The following data points will be included in the final product offering in six reports and one sector report overview.

Cancer Diagnostics Industry Data Book Scope

Attribute

Details

Research Areas

- Breast Cancer Diagnostics Market

- Cervical Cancer Diagnostics Market

- Lung Cancer Diagnostics Market

- Liver Cancer Diagnostics Market

- Pancreatic Cancer Diagnostics Market

- Ovarian Cancer Diagnostics Market

Details of Product

- 6 Individual Reports - 6 PDFs

- 6 Individual Reports - Excel

- 1 Sector Report - PPT

- 1 Data book - Excel

Cumulative Country Coverage

25+ Countries

Cumulative Product Coverage

25+Level 1 +Level 2

Highlights of Datasets

- Induction Revenue, By Countries

- Product, By Country Type, By Country Test Type, By Country End-use, By Country Regulatory Framework, By Country

- Competitive Landscape

- Pricing Analysis

Total Number of Tables (Excel) in the bundle

425+

Total Number of Figures in the bundle

300+

Cancer Diagnostics Industry Data Book Coverage Snapshot

Markets Covered

Cancer Diagnostics Industry

USD 45.66 billion in 2022

5.9% CAGR (2023-2030)

Breast Cancer Diagnostics Market Size

USD 16.26 billion in 2022

7.24% CAGR (2023-2030)

Cervical Cancer Diagnostics Market Size

USD 4.55 billion in 2022

5.65% CAGR (2023-2030)

Lung Cancer Diagnostics Market Size

USD 10.82 billion in 2022

7.59% CAGR (2023-2030)

Liver Cancer Diagnostics Market Size

USD 5.99 billion in 2022

5.96% CAGR (2023-2030)

Pancreatic Cancer Diagnostics Market Size

USD 3.63 billion in 2022

5.43% CAGR (2023-2030)

Ovarian Cancer Diagnostics Market Size

USD 4.41 billion in 2022

4.93% CAGR (2023-2030)

Cancer Diagnostics Sector Outlook

The global cancer diagnostics market is combine to account for USD 45.66 billion revenue in 2022, which is expected to reach USD 89.02 billion by 2030, growing at a cumulative rate of 5.97% over the forecast period. The combination bundle is designed to provide a holistic view of these highly dynamic market spaces.

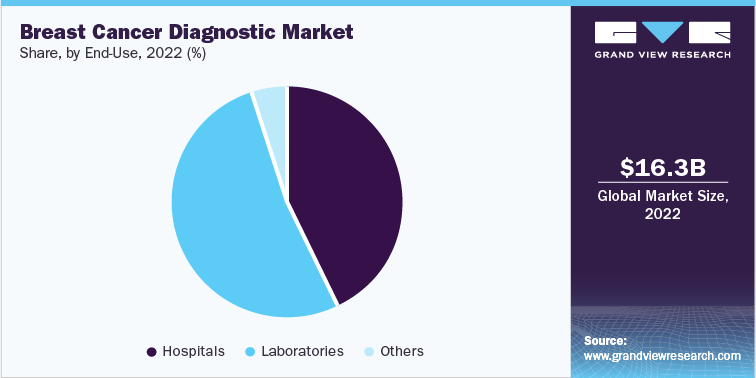

Breast Cancer Diagnostic Market Analysis And Forecast

The global breast cancer diagnostics market size was valued at USD 16.26 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.24% from 2023 to 2030. The growth can be attributed to the increasing prevalence of cancer and rising government initiatives to increase the screening and diagnostic rate. Increased R&D in advanced breast cancer screening tools is anticipated to boost the market significantly.

The UK Research and Innovation, in February 2020, received over USD 1300 million from the Engineering and Physical Sciences Research Council to develop a novel Raman spectroscopy platform for noninvasive and in vivo diagnostics of breast cancer. The approach would allow immediate and accurate diagnosis in conjunction with mammography by improving surveillance or screening techniques that would lead to better treatment outcomes & early diagnosis. Moreover, increased product launch is anticipated to boost market growth over the forecast period. In February 2023, NGeneBio launched an NGS-based breast cancer diagnostics test in Thailand. Moreover, in October 2022, NAMIDA LAB announced plans to launch Auria, an at-home breast assessment test. Thus, an increase in such initiatives undertaken by market players is expected to propel the adoption of breast cancer diagnostic tests in the near future.

The instrument-based testing segment held the largest market share for breast cancer diagnostics, contributing to a significant revenue share of 72.7% in 2022. Imaging techniques remain the primary method for screening breast cancer among the general population.

Cervical Cancer Diagnostic Market Analysis And Forecast

The global cervical cancer diagnostic market was valued at USD 4.55 billion in 2022 and is projected to grow at a CAGR of 5.65% over the forecast period. Women between the age group of 20 and 60 years are usually more prone to this ailment, which is expected to increase cervical cancer screening and diagnostics procedures.

New approvals and product launches due to high investments by market players are likely to boost the market. In November 2021, Hologic, Inc. announced the Genius Digital Diagnostics System launch and made it commercially available in Europe. This innovative NGS system combines advanced volumetric imaging technology with AI. In March 2023, Roche entered into a partnership with CAPED for the launch of a cervical cancer screening program in India to enhance and promote cancer care globally. The increase in the use of novel products by major market players for various cervical screening programs is expected to boost the market during the forecast period.

The Pap test held the majority market share in 2022. This diagnostic test is instrumental in identifying abnormal cervical cells that have the potential to develop into cancer at a later stage. The Pap test is widely favored due to its high efficiency, making it the preferred choice for many individuals. The growing awareness surrounding the importance of early diagnosis has also contributed to the expansion of this segment.

Furthermore, HPV testing is expected to experience significant growth with a promising compound annual growth rate (CAGR). This can be attributed to the increasing demand for technologically advanced diagnostic procedures at affordable prices and advancements in the use of various biomarkers in conjunction with regular screening methods. The improved accuracy and sensitivity of these screening tests are crucial factors that are projected to drive growth in the coming years.

Lung Cancer Diagnostic Market Analysis And Forecast

The global lung cancer diagnostics market size was estimated at USD 10.82 billion in 2022. Technological advancements in tumor diagnosis contribute to market growth. An increase in the availability of various technologically advanced products for cancer diagnostics is a major factor anticipated to fuel the market during the forecast period. Companies such as Oncocyte offer DetermaDx, a multigene assay that can help measure gene expression in circulating blood cells to identify lung nodules, avoiding invasive biopsy procedures. In January 2020, Oncocyte acquired Insight Genetics to develop a PCR-based Immune Modulation (IM) Score Test. The test is expected to help measure the state of the immune system during a biopsy procedure and identify patient response to PD-1/PD-L1 immunotherapies.

Similarly, in March 2023, Roche Diagnostics Korea announced the launch of uPath PD-L1, an automated AI tool used to detect PD-L1 biomarkers in NSCLC patients. Moreover, in June 2022, Biocartis received a CE marking for Idylla GeneFusion Panel, which is an IVD-based lung cancer screening solution for laboratories. Such innovative product launches are anticipated to drive the market growth over the forecast period.

Company Categorization

Attributes/Company Category

Mature Players

Emerging Players

Market Players

GE Healthcare, Abbott, F. Hoffmann-La Roche Ltd., BD, Siemens Healthcare GmbH, Thermo Fisher Scientific; Inc.

- QIAGEN N.V.

- Hologic, Inc.

Operating Strategies

The players focus on innovation and technology advancements to develop cutting-edge diagnostic solutions. They also emphasize partnership and collaborations to expand their reach in the market.

Hologic specializes in women’s health and molecular diagnostics, with a focus on cancer screening including breast and cervical cancer. They leverage their molecular biology and diagnostics expertise to develop innovative testing solutions.

Competitive Edge

Mature players have a strong global presence, a diverse portfolio of diagnostic products, and a well-established brand reputation in the healthcare industry, which gives them a competitive edge.

Emerging players may be more agile and flexible than mature players in responding to market needs and trend, allowing them to adapt and develop new products quickly.

Weakness

To keep up with rapid technological advancements and intense competition from established and emerging players could act as one of the weakness.

The players may lack the brand recongnition of mature players, which can be a barrier to entry in the market

The imaging tests segment dominated in 2022, primarily driven by the widespread adoption of various imaging techniques such as MRI, CT scan, and X-ray. These techniques are extensively utilized as the primary screening methods for cancer diagnosis. Imaging tests play a critical role in the initial screening of lung cancer and throughout the treatment process, providing valuable insights and support. Additionally, the molecular tests segment is expected to witness substantial growth in the foreseeable future. Advances and innovations in molecular diagnostic technology have led to the development of new applications for diagnostic tests. These advancements are anticipated to contribute to the expansion of the molecular tests segment over the forecast period.

Liver Cancer Diagnostic Market Analysis And Forecast

The global liver cancer diagnostics market size was valued at USD 5.99 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 5.96% by 2030. Liver cancer is a significant contributor to cancer-related deaths worldwide. According to the American Cancer Society, the incidence of liver cancer has tripled in the last three decades, with death rates also doubling. In 2022, it was approximately 41,260 new cases of liver cancer will be diagnosed in the U.S., resulting in approximately 30,520 deaths. The global prevalence of liver cancer, combined with the continuous exposure of the population to risk factors, will drive the rapid growth of the screening and diagnosis market.

Various risk factors contribute to the development of liver cancer, including lifestyle choices such as smoking, alcohol consumption, and tobacco chewing, as well as underlying conditions like chronic viral hepatitis (hepatitis B virus or hepatitis C virus), cirrhosis, type 2 diabetes, and obesity. The presence of one or more risk factors increases the likelihood of liver cancer. Accurate early detection, diagnosis, and staging are crucial for improving survival rates.

Consequently, many institutes and companies have undertaken extensive initiatives to develop innovative screening solutions. For instance, in October 2022, researchers presented the findings of the DELFI platform, an AI liquid biopsy technology developed by Delfi Diagnostics, Inc., demonstrating its accurate detection of liver cancer patients cost-effectively.

In terms of revenue, the laboratory tests segment held the largest share in 2022, capturing a share of over 33.7%. This dominance can be attributed to several key factors, including the accuracy and cost-efficiency of laboratory tests, which are highly preferred by the population. High-risk patients primarily undergo screening via laboratory tests, which aid in determining appropriate treatment strategies. Furthermore, these tests facilitate the evaluation of treatment plans and their potential impact on other organs.

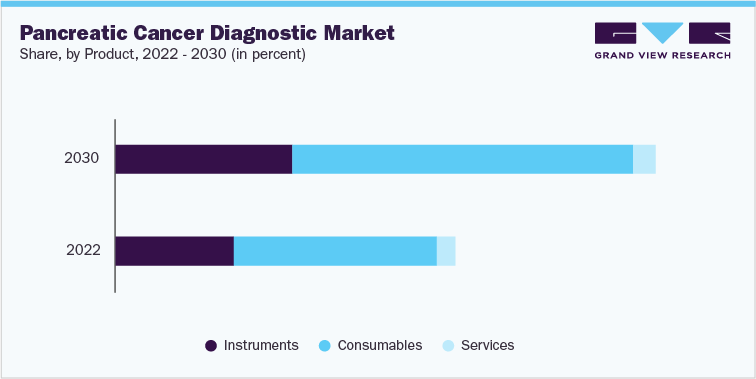

Pancreatic Cancer Diagnostic Market Analysis And Forecast

The global pancreatic cancer diagnostic market size was valued at USD 3.63 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.43% from 2023 to 2030. Several key factors are driving the global market for pancreatic cancer diagnostics. Factors include the increasing prevalence of pancreatic cancer and a growing awareness of the importance of early disease diagnosis. Additionally, advancements in technology have led to improved accuracy and sensitivity of diagnostic tests and the evolution of molecular diagnostics and biomarker tests for detecting malignancies. These factors collectively propel the market demand for pancreatic cancer diagnostic solutions.

Early diagnosis plays a crucial role in achieving positive treatment outcomes for pancreatic cancer. Consequently, market players and healthcare organizations are actively raising funds, conducting awareness programs, and initiating research initiatives to promote routine checkups and screenings. For example, in August 2022, the Pancreatic Cancer Action Network (PanCAN) awarded USD 10.5 million in grants to support 16 new research and development projects focused on early detection and improved treatment options for pancreatic cancer.

Within the market, the consumables segment held the largest revenue share of 48.4% in 2022 and is expected to experience steady growth in the projected period. This growth can be attributed to the increasing adoption of consumables in diagnostic procedures, higher investments in research and development, and the introduction of technologically advanced diagnostic kits and reagents. As an illustration, in August 2021, Immunovia received approval to commence patient testing for the 'IMMray PanCan-d' blood test, which is specifically designed for the early detection of pancreatic cancer.

Ovarian Cancer Diagnostic Market Analysis And Forecast

The global ovarian cancer diagnostics market size was estimated at USD 4.41 billion in 2022 and is expected to grow at a CAGR of 4.93% during the forecast period. An increase in the number of R&D activities to develop novel diagnostic tests for ovarian cancer is expected to propel the market. For instance, scientists from the University of Gothenburg and Uppsala University developed a blood test that can provide precise diagnostics for ovarian cancer, which could eliminate the requirement for exploratory surgery. This novel test can decrease the requirement for surgery and aid in the early detection and treatment of affected women.

In February 2020, a study conducted by two hospitals in Australia focused on women with advanced ovarian cancer. It used an immune marker for inflammation and other cancer markers to detect epithelial ovarian cancer. The test can be used by women staying in remote areas or disadvantaged communities, where there are limited resources for diagnosis of ovarian cancer, thus improving their chances of survival. The blood test is used to measure a body’s immune response to enhance the diagnosis of ovarian cancer.

The development of technologically advanced products by various academic and research organizations is anticipated to propel the market growth during the forecast period. In November 2022, Roche received FDA approval for VENTANA FOLR1, an IHC-based assay developed for the diagnosis of ovarian cancer in patients eligible for treatment with ELAHERE, an ADC therapy. Such initiatives are expected to boost the adoption of blood-based cancer diagnostic tests.

Imaging techniques accounted for the largest share in 2022, owing to the increasing importance of early diagnosis and cancer staging. Transvaginal ultrasound remains the preliminary imaging technique to view internally and measure its size. CT scan is preferred for cancer staging but is limited to small tumors. More advanced imaging techniques, such as MRI and PET scans, are used to detect metastasis and disease severity.

Competitive Insights

Key players in this market are implementing various strategies including partnerships, mergers and acquisitions, geographical expansion, and strategic collaborations to expand their market presence. For instance, in February 2023, F. Hoffmann-La Roche Ltd. announced extending its collaboration with Janssen to advance personalized healthcare by focusing on companion diagnostics.

Key Players

-

GE Healthcare

-

Abbott

-

F. Hoffmann-La Roche Ltd.,

-

QIAGEN

-

BD

-

Siemens Healthcare GmbH,

-

Thermo Fisher Scientific; Inc.

-

Hologic, Inc.

-

Koninklijke Philips N.V. (Philips)

-

IIumina, inc.

Similarly, in April 2023, GE HealthCare announced the release of the next-generation bkActiv, a cutting-edge technology designed to assist in guiding urology, colorectal, and pelvic floor surgeries. This advanced system aims to provide healthcare professionals with enhanced visualization and navigation capabilities, enabling more precise and effective surgical procedures in these specialized fields.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified