- Home

- »

- Sector Reports

- »

-

Clinical Trial Recruitment Industry Data Book, 2023-2030

![Clinical Trial Recruitment Industry Data Book, 2023-2030]()

Clinical Trial Recruitment Industry Data Book - Clinical Trial Patient Recruitment, Site Management Organization and Support Services Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

- Published Date: Jan, 2023

- Report ID: sector-report-00117

- Format: Electronic (PDF)

- Number of Pages: 260

Database Overview

Grand View Research’s clinical trial recruitment industry data book is a collection of market sizing information & forecasts, legal authorizations, payout/reimbursement structure, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

The following data points will be included in the final product offering in 3 reports overview and 1 sector report:

Clinical Trial Recruitment Industry Data Book Scope

Attribute

Details

Service Areas

- Clinical Trial Patient Recruitment Market

- Clinical Trial Site Management Organization Market

- Clinical Trial Support Services Market

Details of the product

- 3 Individual Reports -PDFs

- 3 Individual Reports - Excel

- 1 Sector Report - PPT

- 1 Database - Excel

Country Coverage

23 Countries

Cumulative Service Coverage

10+ service offering analyzed at level 1

Highlights of Report

- Service revenue, by Countries

- Service revenue, by Phase

- Service revenue, by Service

- Service revenue, by Therapeutic Areas

- Competitive Landscape with understanding companies having horizontal integration

Total Number of Tables (Excel) in the bundle

299

Total Number of Figures in the bundle

195

Clinical Trial Recruitment Industry Data Book Coverage Snapshot

Markets Covered

Clinical Trial Recruitment Industry

USD 15.7 billion in 2021

6.1% CAGR (2022-2030)

Clinical Trial Patient Recruitment Market Size

USD 780 million in 2021

8.0% CAGR (2022-2030)

Clinical Trial Site Management Organization Market Size

USD 4,792.5 million in 2021

5.8% CAGR (2022-2030)

Clinical Trial Support Services Market Size

USD 10,124 million in 2022

6.1% CAGR (2022-2030)

Clinical Trial Patient Recruitment Market Analysis And Forecast

The global patient recruitment market generated over USD 780 million revenue in 2021 and is projected to expand at a CAGR of around 8.0% during the forecast period to reach USD 1.6 billion by 2030.

The patient recruitment market is one of the major aspects of ensuring the success of a clinical trial. On-time recruitment of patients and investigators is a challenge for organizations. Moreover, patient retention through engagement is another major factor that is often overlooked. Despite it being a key parameter for the success of the trial, financially, this not the most major aspect. The activity to recruit and retain individuals in clinical studies contributes for only 5-10% of the R&D budget.

During the pandemic, another course of clinical trial conduction was favored i.e., in-silico testing, which made use of predictive & simulation technology to help conduct trials. This has currently not gained much traction with the players, owing to the fact these present no factual proof to the safety profile of molecules, but may hinder the recruitment process in another decade.

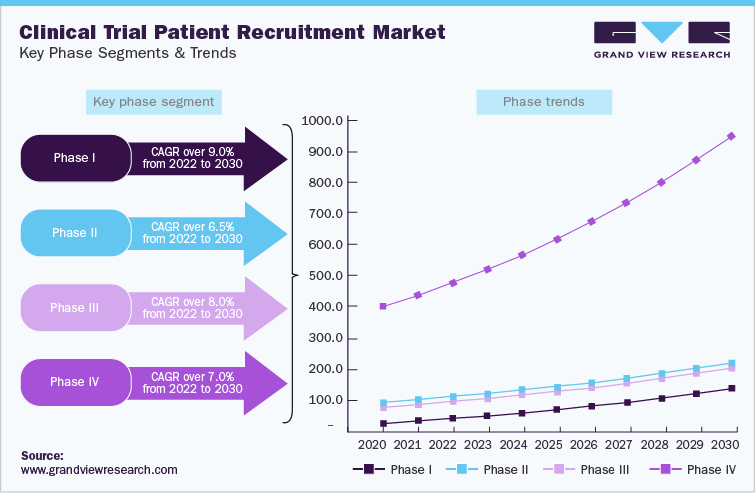

Based on phase, phase III dominated the market in 2021 with the share of 57.1%. The phase III clinical trials are the highly expensive due to the involvement of huge subjects. Failure rate in this phase is the highest as the sample size and study design requires complex dosing at an optimum level. Thus, the expensive nature of this phase increases its share in the market

Increasing number of therapeutics being studied for the management and cure of rare diseases is one of the major factors supporting the lucrative growth rate of phase I patient recruitment services. Moreover, the rate of patients being recruited in the initial phases is higher which tends to decrease across the other phases due to prolonged investigational trials leading to dropouts.

Despite the tendency of outsourcing, underdeveloped nations only host a small percentage of phase I trials. As a result of the aforementioned factors, as well as rising health care spending, an increasing number of Investigational New Drug (IND) applications is being filed for, and the trend of outsourcing the drug development process is likely to drive market growth.

Clinical Trial Site Management Organization Market Analysis And Forecast

Pharmaceutical organizations are progressively focusing on R&D activities to remain competitive & flexible in the world of healthcare expertise, gradually advancing technologies, & unbalanced economic environment. Companies are focusing on outsourcing tasks ranging from basic research to late-stage manufacturing, such as target validation, hit exploration & lead optimization, assay development safety, genetic engineering, and efficacy tests in animal models & clinical trials involving humans.

R&D activities provide companies a competitive edge. Hence, global leaders spend a large percentage of their revenue on R&D activities. For instance, Merck’s R&D cost was USD 13.6 billion in 2020, increasing by 37% from 2019. Similarly, Biogen’s R&D budget increased from USD 1.7 billion, or 75.0%, to nearly USD 4 billion in 2020

Year

Estimated Global R&D Spending (USD Billion)

2015

150.0

2016

160.0

2017

168.0

2018

179.0

2019

182.0

2020

189.0

2021

196.0

2022

~202.0

2023

~207.0

2024

~213.0

Site management involves investment of millions of dollars every year. For instance, as per an article published by the Florence HC, the cost of clinical trials is projected to be anywhere between USD 44 million and USD 115 million. Site monitoring accounts for 9% to 14 % and site retention accounts for 9% to 16%. Thus, site management accounts for around 29% to 59% of the entire cost of a trial. If put into calculation with the aforementioned table, by 2024 the site management revenue would be anywhere between USD 60-125 Billion making it a lucrative business opportunity for SMOs.

The amount of money that drug companies devote to R&D is determined by the amount of revenue they expect to earn from a new drug, policies that influence the supply of and demand for drugs, and the expected cost of developing that drug. From 2010 to 2019, the number of new drugs approved for commercialization has increased by 60% compared to the previous years, with the peak being 59 new drugs approved in 2018. Hence, such factors have strongly supported the increase in R&D expenditure of medical device and pharmaceutical companies, which is also expected to fuel growth of support services market. The table below shows the % of revenue allocated by companies towards R&D activities:

Top R&D Spenders

% Revenue allocated towards R&D

Incyte

83.10%

Regeneron Pharmaceuticals

32.19%

Biogen

29.68%

Vertex Pharmaceuticals

29.49%

UCB

29.00%

Merck

28.25%

Clinical Trial Support Services Market Analysis And Forecast

Outsourcing to researchers not only benefits sponsors in terms of productivity and time but also in terms of cost. Various strategic and market leaders have calculated and estimated cost saving of about USD 3 million to USD 7 million on average in outsourcing to offshore facilities. An additional benefit of USD 90-100 million may be estimated if the product is a market mover and has the fastest time to market. In terms of offshore outsourcing, sponsors gain a dual benefit of reduced cost and better profiling of the drug molecule in different races, thereby driving the market growth.

In the past 5 years, the number of mergers & acquisitions has significantly increased between pharmaceutical & medical device companies and CROs. Several large mergers were witnessed from 2016 to 2021. For instance, in 2016, Quintiles and IMS Health (now IQVIA) announced their merger at USD 8.8 billion, while in 2017, PAREXEL was bought out by Pamplona Capital and INC Research merged with InVentiv (now Syneos). Moreover, the trend of large transactions has been increasing since 2021 as Thermo Fisher announced the acquisition of pharmaceutical services giant PPD, and ICON plc announced the acquisition of PRA Health Sciences. Consolidation has been witnessed with regard to analytical technologies and software solutions used in biopharmaceutical and pharmaceutical companies’ services space.

Year

Total number of M&A deals between CROs & CDMOs

2016

24

2017

25

2018

23

2019

21

2020

25

Below are listed some of the most recent M&A activities

-

In June 2020, Sygnature Discovery acquired Alderley Oncology, which added expertise in its preclinical oncology research.

-

In December 2021, Cerba HealthCare, announced an agreement to acquire Viroclinics-DDL, a global immunology and virology based CRO, from Summit Partners. Viroclinics-DDL offers a wide range of virology-based services in the field of clinical trials, assay development, clinical diagnostics, and clinical trial logistics, enabling development of antiviral drugs, vaccines, & other therapies.

-

In November 2021, Emmes, a CRO, launched its new center, Orphan Reach, as a unique ‘rare CRO.’ This new rare disease center will include Emmes’ reputation in public health research across the biopharmaceutical industry and public sector.

Competitive Landscape

This micro market analyses different stakeholders of the value chain, and cumulatively the 3 studies will include players such as Antidote; Clara Health; Clariness; BBK Worldwide; Worldwide Clinical Trials; Clinical Site Services (CCSi); IQVIA; PPD Inc; Veristat; Elligo Health Research. These are major players in the patient recruitment and retention services. Other players would be Charles River Laboratories Inc.; Eurofins Scientific SE; IQVIA; Syneos Health Inc.; The Pharmaceutical Product Development LLC; Icon PLC; WuXi AppTec; LabCorp; Alcura; Parexel International, Clinedge; WCG; ClinChoice; Access Clinical Research; FOMAT Medical Research INC.; SGS; KV Clinical; SMO-Pharmina; Xylem Clinical Research; Aurum Clinical Research

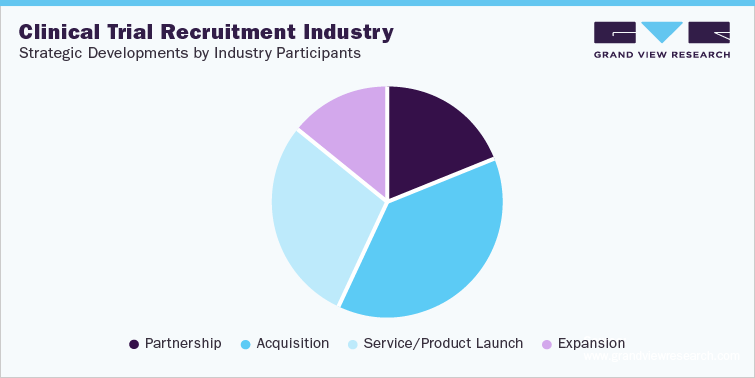

This section in the final deliverables also highlights various initiatives taken by the key companies in the recent past that strongly impacts this market space. The below figure represents the various strategic developments initiated by these market participants:

Key Drivers

-

High R&D Spending by Pharmaceutical & Biotechnology Companies

-

Increasing rate of clinical trials outsourcing by pharmaceutical and biopharmaceutical companies

-

Development of ever evolving clinical trials across the globe

-

Amends in existing regulations to promote higher scrutiny in economically booming industries.

-

Technological advancements in supply chain management

-

Evolvement of healthcare IT towards digital patient recruitment software, databases, etc.

-

Rising number of companies offering niche services within this umbrella

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified