- Home

- »

- Sector Reports

- »

-

Crop Protection Chemicals Industry Trends, Data Book, 2030

![Crop Protection Chemicals Industry Data Book - Herbicides, Fungicides, Insecticides, Biopesticides and Other Crop Protection Chemicals Market Size, Share, Trends Report]()

Crop Protection Chemicals Industry Data Book - Herbicides, Fungicides, Insecticides, Biopesticides and Other Crop Protection Chemicals Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

- Published Date: Oct, 2023

- Report ID: sector-report-00226

- Format: Electronic (PDF)

- Number of Pages: 350

Database Overview

Grand View Research’s crop protection chemicals sector database is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with a statistics e-book.

Crop Protection Chemicals Industry Data Book Scope

Attribute

Details

Areas of Research

- Herbicides Market

- Fungicides Market

- Insecticides Market

- Biopesticides Market

- Other Crop Protection Chemicals Market

Number of Reports/Presentations Covered in the buddle

1 Sector Outlook Report + 4 Summary Presentations for Individual Areas of Research + 1 Statistic eBook

Cumulative Coverage of Countries

50+ Countries

Cumulative Coverage of Products

05 Application Categories

Cumulative Coverage of Application

04 Application Categories

Highlights of Datasets

- Trade Data, by Country

- Demand/Consumption Data, by Country

- Herbicides

- Fungicides

- Insecticides

- Biopesticides

- Other Crop Protection Chemicals

- Competitive Landscape

Crop Protection Chemicals Industry Data Book Coverage Snapshot

Markets Covered

Crop Protection Chemicals Industry

2,828.7 kilotons in 2022

3.7% CAGR (2023-2030)

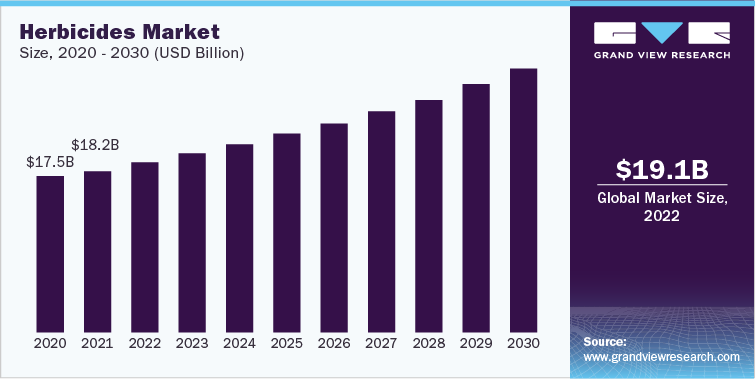

Herbicides Market

1,249.5 kilotons in 2022

3.7% CAGR (2023-2030)

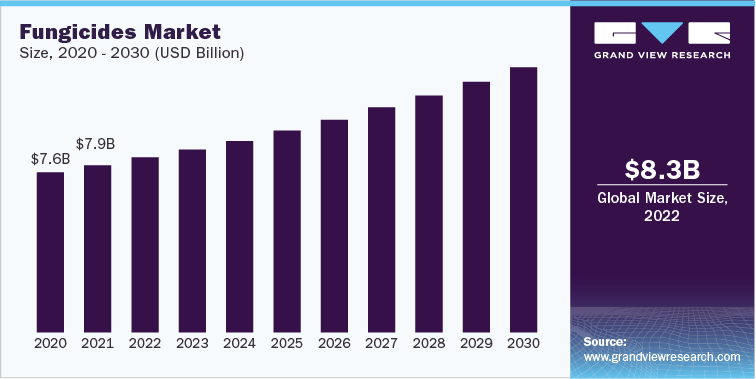

Fungicides Market

538.9 kilotons in 2021

3.5% CAGR (2022-2030)

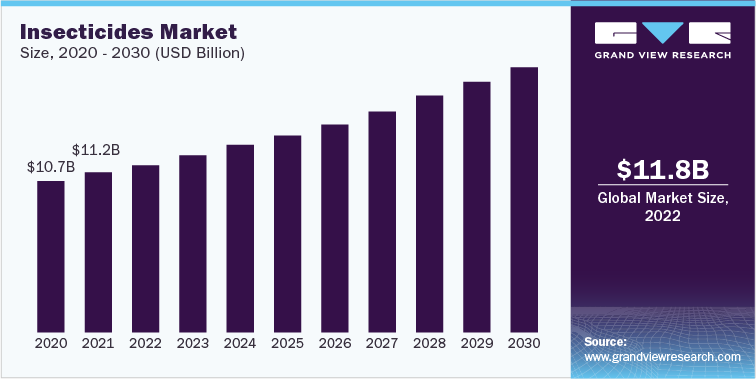

Insecticides Market

766.1 kilotons in 2022

4.0% CAGR (2023-2030)

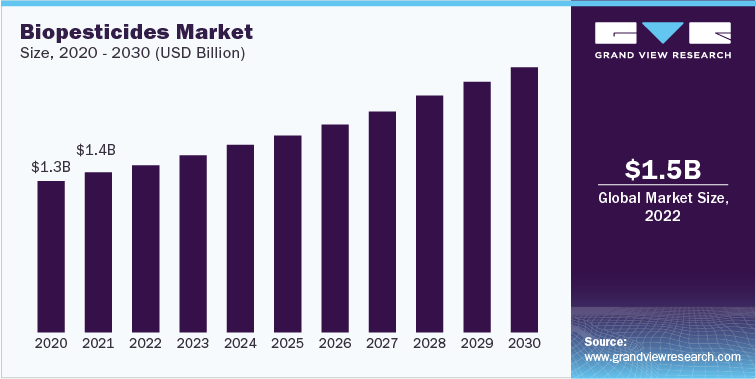

Biopesticides Market

95.7 kilotons in 2022

4.8% CAGR (2023-2030)

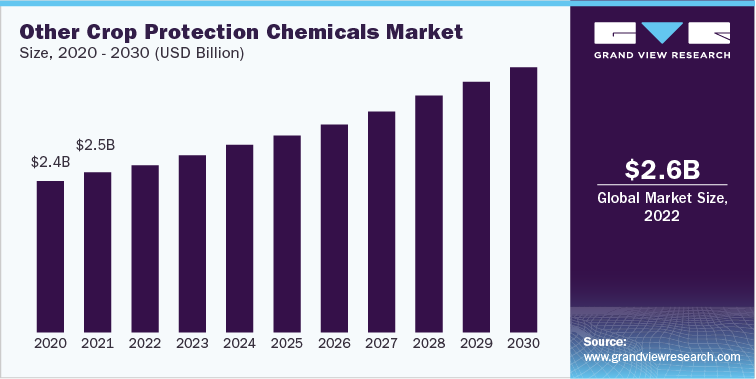

Other Crop Protection Chemicals Market

178.5 kilotons in 2022

3.1% CAGR (2023-2030)

Crop Protection Chemicals Sector Outlook

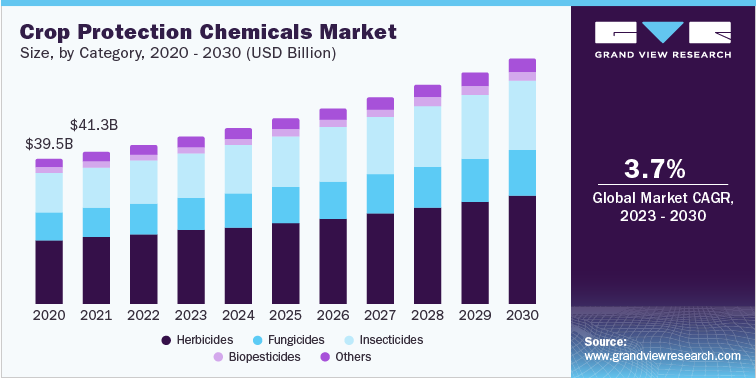

The economic value generated by the crop protection chemicals industry was estimated at approximately USD 43.24 billion in 2022. This economic output is an amalgamation of basic crop protection chemicals categories namely, herbicides, fungicides, insecticides, biopesticides, and others.

The crop protection market is growing at a staggering pace owing to the rising importance of crop protection for healthy yields. Agricultural fields tend to attract insects and pests, which stay over crops for a long time and deteriorate the crop quality. This can result in massive crop failure. Therefore, farmers resort to crop protection chemicals and related technologies. However, it is also essential for farmers to learn what quantity of crop protection chemicals is enough to avoid spoiling the crops.

The escalating demand for food, driven by a growing global population is set to stimulate the expansion of the crop protection chemicals market during the projected period. As indicated by the Economic Survey, the agricultural and allied industry demonstrated considerable resilience to the challenges of COVID-19, posting growth rates of 3.6% in 2020-21 and 3.9% in 2021-22 in India. In the U.S., the agricultural sector played a pivotal role, contributing 5.0% to the nation's total GDP, primarily due to the heightened food demand within the country, as reported by the U.S. Department of Agriculture. This dynamic is poised to further drive the worldwide demand in the crop protection chemicals market during the forecast period.

Crop protection chemicals are utilized for a variety of crops including cereal & grains, oilseeds & pulses, fruits & vegetables, and others. Crop protection chemicals not only protect crops from insects but also impart nutritional ingredients to them for maximum crop yield. The demand for crop protection chemicals is likely to skyrocket on the account of rising consumption of food across the globe. Population explosion is the key driving factor behind the growing consumption of food. Asia Pacific is a major contributor to the global population. According to the United Nations Population Fund, the region alone accounted for approximately 60% of the world’s population with 4.3 billion people in 2021.

The growing global need for crop protection chemicals, driven by their heightened usage in diverse agricultural contexts, is placing manufacturers and suppliers under pressure to increase their production and distribution of these chemicals. The increasing global consumption of food has prompted farmers to improve their crop yields, subsequently bolstering the worldwide demand for crop protection chemicals. Stable demand and supply conditions for these chemicals are projected in countries like China, India, the U.S., and France. However, some countries, primarily in Africa, continue to grapple with significant crop losses due to restricted access to crop protection chemicals and advanced agricultural technologies.

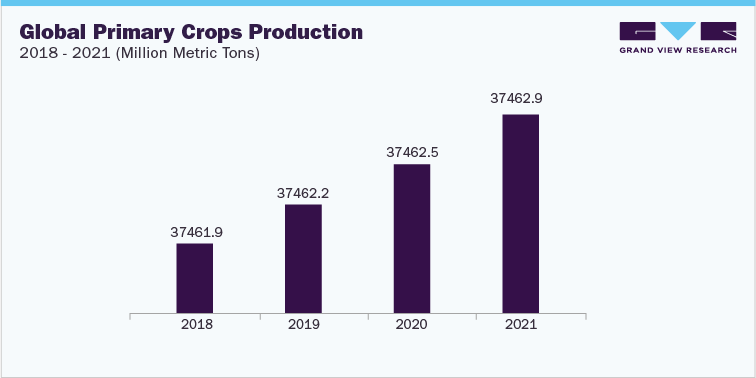

The figure above depicts the global production of primary crops from 2018 to 2021 in terms of Million Metric Tons. According to the World Bank, the agricultural land in North America expanded from 4,627,040 square km in 2015 to 4,635,537 square km in 2020, while the average cereal productivity reached 1.44 t ha-1 in 2018. The U.S. Department of Agriculture reported that grain production in North America increased from 437,578 thousand metric tons in 2018/2019 to 454,922 thousand metric tons in 2021/2022.

As per the Organization for Economic Co-operation and Development (OECD) and Food and Agricultural Organization (FAO), Asia Pacific holds the title of the largest producer of agricultural goods. The region is anticipated to contribute 53% of global agricultural production by 2030. However, despite this, arable land in the Asia Pacific is dwindling while the demand for food is surging due to population growth. Consequently, farmers are turning to crop protection products and fertilizers to enhance crop yields. In China, the National Bureau of Statistics (NBS) reported a record-high grain output of 686.53 million tons in 2022, marking a 0.5% increase from 2021.

Central & South America emerges as a significant global exporter of food and agricultural commodities, boasting a considerable amount of untapped agricultural land. Dominated by crops such as corn, soybeans, pineapples, sugarcane, and coffee, this region's varied topography, rich biodiversity, and wide latitudinal range result in a complex array of farming systems. Consequently, the demand for crop protection chemicals in Central & South America is driven by this diverse agricultural landscape. Argentina particularly shines in highbush blueberry production, with Buenos Aires and Tucuman accounting for over 50% of local yields. The susceptibility of highbush blueberries to fungal spoilage due to low pH and high water levels prompts the common use of fungicides in blueberry fields, fostering the crop protection chemicals market in Argentina.

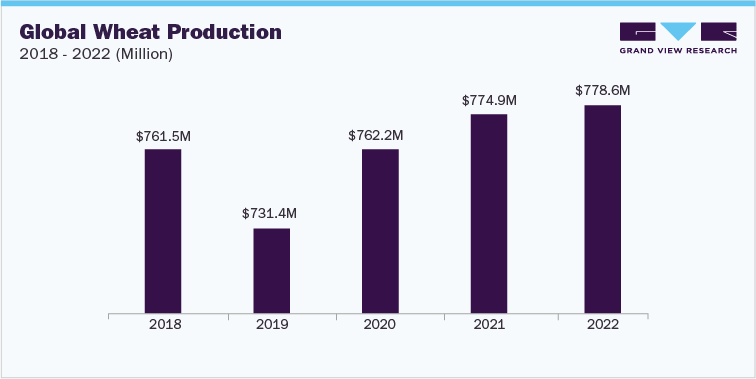

Wheat crops are susceptible to various pests, insects, and diseases that can significantly impact yields. Crop protection chemicals play a vital role in managing these threats and ensuring a healthy and productive harvest. Crop protection chemicals aid in maintaining the quality of harvested wheat by preventing damage caused by pests and diseases. This ensures that the harvested grain meets the required standards for consumption and processing. The growing production of wheat across the globe is anticipated to fuel the demand for crop protection chemicals market over the forecast period.

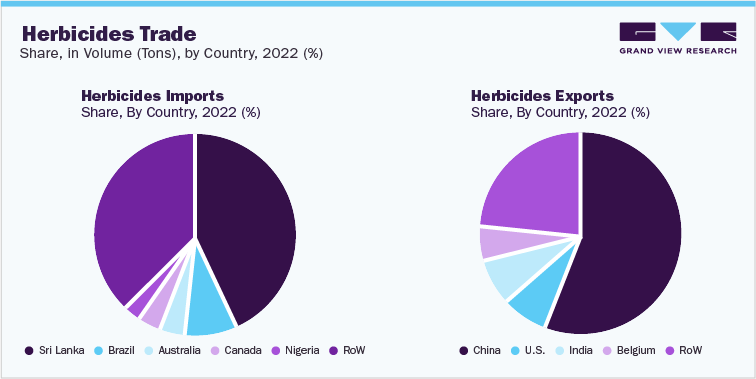

Herbicides Market Analysis And Forecast

Herbicides accounted for a share of 44.2% of the industry in 2022. Herbicides are one of the most widely used pesticides in agricultural applications. They serve the purpose of eradicating a diverse range of undesirable weeds. According to the Food and Agriculture Organization, the global consumption of herbicides reached around 2 million tons in 2019, which was double the quantity of insecticides used on a global scale during the same year. These herbicides are primarily employed during the autumn vegetation phase to enhance agricultural practices.

Glyphosate is applied to the leaves of plants, which eliminates grass as well as broadleaf plants. Glyphosate is among the most commonly used herbicides in the U.S. The sodium salt which consists of glyphosate is effective in monitoring plant growth and stimulating the growth of specific crops. It is widely used in agriculture, forestry, orchards, gardens, and lawns. Some specific products, that contain glyphosate, can even monitor aquatic plants.

Fungicides Market Analysis And Forecast

Fungicides accounted for a share of 19.1% of the industry in 2022. Fungicides eliminate the growth of fungi as well as their spores. They are used to regulate the growth of fungi that erode the plants and vegetation, which include rust, mildew, and blight. They are also used to monitor mold. Sulfur-based fungicide helps control the spread of diseases on vegetables and fruits and control rust and ornamentals from leaf spots, powdery mildew, and other diseases. It is also used as a dust or spray up to the day of harvest. In addition, it is not that toxic to animals and plants, when compared to other fungicides.

PCNB is a commonly used fungicide to suppress the growth of fungi in various vegetation. For instance, cotton, rice, and seed grains. In addition to that, it is commonly used to eliminate slime in industrial water. PCNB is used as a soil fungicide in lawns as well as in ornamental vegetation. Moreover, it is also used in the seed treatment of crops and vegetables.

Insecticides Market Analysis And Forecast

Insecticides accounted for a share of 27.2% of the industry in 2022. According to the Federation of Indian Chambers of Commerce and Industry (FICCI), insecticides hold the largest share of the India agrochemicals market. This can be attributed to the increasing demand for the product for various crops such as paddy (rice crop), cotton, vegetables, and fruits. They are effective in averting early germination pest attacks in several crops.

Chlorpyrifos is a commonly known organophosphate insecticide. It is developed with white or colorless crystals and eliminates insect pests on a variety of crops such as corn, cotton, wheat, and other vegetation. Moreover, the usage of Chlorpyrifos (organophosphate) has consistently increased due to its effective use as an insecticide in agriculture and animal care applications. Chlorpyrifos is also effective in commercial applications, such as golf courses and playgrounds, for eliminating mosquitoes and other insects. This is likely to have a positive impact on the market in the coming years.

Biopesticides Market Analysis And Forecast

Biopesticides accounted for a share of 3.4% of the industry in 2022. The Environmental Protection Agency (EPA) of the United States encourages the creation and application of biopesticides. To simplify the registration of biopesticides, the Biopesticides and Pollution Prevention Division was established under the Pesticide Programs. Additionally, research, development, and commercialization of biopesticides and biofertilizers have been supported in India by a number of government organizations, including the Department of Biotechnology (DBT), the Ministry of Science and Technology, and the Ministry of Agriculture and Farmers Welfare. By offering subsidies for new bio-fertilizer/biopesticide units, the Indian government is actively promoting organic farming.

Biopesticides are inherently less toxic when compared to commonly used pesticides. Furthermore, they primarily impact the target pest and its closely related organisms. Unlike traditional pesticides, which also harm organisms such as birds, insects, and mammals, biopesticides pose fewer risks to the environment.

Other Crop Protection Chemicals Market Analysis And Forecast

Other crop protection chemicals accounted for a share of 6.1% of the industry in 2022. This segment includes weedicides, rodenticides, and bactericides. These chemicals are essential for protecting the crops from attacks by bacteria, weeds, and rodents. For instance, as per the studies weeds and bacteria can reduce the productivity of crops by 33% thus, making it essential to use bactericides and weedicides to minimize crop loss.

Competitive Insights

Crop protection chemical production involves the ultrasonic production method, which is an extensive step-by-step method that includes dispersion, emulsification, dissolving, and homogenization of active ingredients. The manufacturing process of pesticides, herbicides, fungicides, and other crop protection chemicals as well as other active substances requires reliable dispersing, milling, dissolving, and emulsification of active ingredients of the final product. Power ultrasound offers properties like reliable mixing, ingredients homogenizing, and blending by cavitation-generated shear forces. The ultrasonic manufacturing method presents a wide range of advantages such as a reliable production process, high-quality product, batch and inline processing, easy and safe operations, eco-friendly operations, and more.

Most companies are focusing on improving their regional presence by entering into strategic partnerships and collaborations. For instance, in March 2021, BASF SE and AGBIOME collaborated on a new biological fungicide for Europe, Middle East & Africa. Additionally, the market players are focusing on increasing investments along with product development to improve performance of the crop protection products.

Company Financial Performance, for Crop Protection Business Portfolio, 2022 (USD Billion)

Company

Contact Details

Revenue

Bayer AG

Building W 11

51368 Leverkusen, Germany

Tel: +49 (0)21 4301

Crop Science: 5.21 Billion

BASF SE

Carl-Bosch-Strasse 38,

Ludwigshafen, Rhineland-

Palatinate, Germany

Tel: 49-621-600

Agricultural Solutions: 11.11 Billion

FMC Corporation

Rue Entre-deux-Villes 10 1814

La Tour-de-Peilz Switzerland

Tel: +41 21 924 51 11

5.80 Billion

Corteva

9330 Zionsville Road

Indianapolis, IN 46268, U.S.

Tel: +1 (833) 267-8382

Crop Protection: 8.48 Billion

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified