- Home

- »

- Sector Reports

- »

-

Cryptocurrency Industry Research Data Book, 2022-2030

![Cryptocurrency Industry Research Data Book, 2022-2030]()

Cryptocurrency Industry Data Book - Cryptocurrency Mining Hardware & Exchange Platform, Crypto Wallet, Cryptocurrency Payment Apps and Crypto ATM Market Size, Share, Trends Analysis, And Segment Forecasts, 2022 - 2030

- Published Date: Jan, 2023

- Report ID: sector-report-001011

- Format: Electronic (PDF)

- Number of Pages: 180

Database Overview

Grand View Research’s cryptocurrency industry data book is a collection of market sizing information & forecasts, regulatory data, reimbursement structure, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

The following data points will be included in the final product offering in 5 reports and one sector report overview:

Cryptocurrency Industry Data Book Scope

Attribute

Details

Research Areas

- Cryptocurrency Mining Hardware Market

- Cryptocurrency Exchange Platform Market

- Crypto Wallet Market

- Cryptocurrency Payment Apps Market

- Crypto ATM Market

Details of the Product

- 5 Individual Reports - PDFs

- 5 Individual Reports - Excel

- 1 Data Book - Excel

Cumulative Country Coverage

20+ Countries

Cumulation Product Coverage

25+ Level 1 & 2 Products

Highlights of Datasets

Product Revenue, by Countries

Application Revenue, by Countries

End Use Revenue, by Countries

Competitive Landscape

Regulatory Guidelines, by Country

Reimbursement Structure, by CountriesTotal Number of Tables (Excel) in the bundle

420+

Total Number of Figures in the bundle

180+

Cryptocurrency Industry Data Book Coverage Snapshot

Markets Covered

Cryptocurrency Industry

USD 40.09 billion in 2021

26.8% CAGR (2022 to 2030)

Cryptocurrency Mining Hardware Market Size

USD 2.32 billion in 2021

9.3% CAGR (2022 to 2030)

Cryptocurrency Exchange Platform Market Size

USD 30.18 billion in 2021

27.8% CAGR (2022 to 2030)

Crypto Wallet Market Size

USD 6.97 billion in 2021

24.4% CAGR (2022 to 2030)

Cryptocurrency Payment Apps Market Size

USD 545.4 million in 2021

16.6% CAGR (2022 to 2030)

Crypto ATM Market Size

USD 75.0 million in 2021

61.7% CAGR (2022 to 2030)

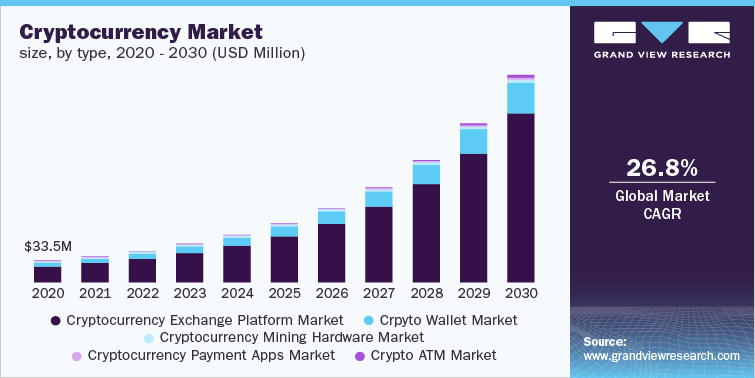

The global cryptocurrency market generated over USD 40.09 billion in 2021 and is expected to grow at a CAGR of 26.8% over the forecast period. The cryptocurrency is segmented in various end uses such as trading, government, gaming, banking, healthcare, retail & e-commerce, and others. Cryptocurrency uses distributed ledger technology such as blockchain to validate transactions. The increasing adoption of distributed ledger technology is anticipated to propel the market growth during the forecast period. Moreover, increasing usage of cryptocurrencies for cross-border remittances is expected to fuel market expansion due to the reduction in consumer fees and exchange charges.

One of the key elements influencing the growth of digital currency is the rising need for better transparency and operational efficiency in digital payments systems, increase in data security, and integration of blockchain technology. Additionally, the growing adoption of digital currency by major corporations such as MasterCard Inc. and Tesla Inc. is anticipated to boost industry expansion. Binance, Bit fury Group Limited, Ripple, and Intel Corporation are some of the key players spearheading the growth of these applications.

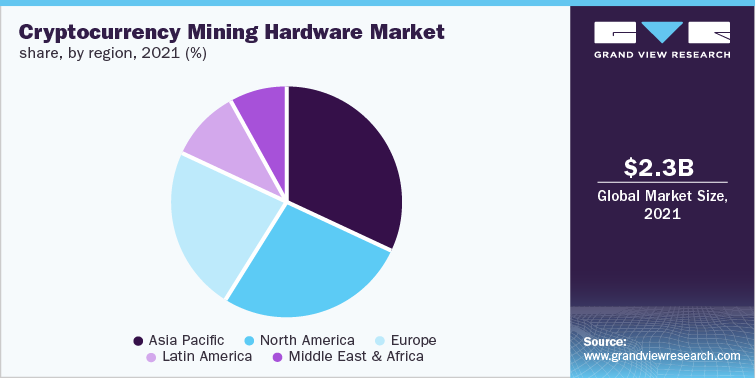

Cryptocurrency Mining Hardware Market Analysis & Forecast

The cryptocurrency mining hardware market was valued at USD 2.32 billion in 2021 and is expected to reach USD 5.03 billion by 2030 at a CAGR of 9.3% from 2022 to 2030. The growth of the market is anticipated to several companies across the globe are also focusing on collaborative initiatives for the development of advanced mining solutions to provide a better customer experience. For instance, in March 2021, DMG Blockchain Solutions Inc. announced its collaboration with Argo Blockchain to launch the Terra Pool, an integrated Bitcoin mining pool powered by sustainable energy. This launch helped DMG Blockchain Solutions Inc. to shift its customer interest towards sustainable technology solutions and differentiate its offering in the market.

This market is segmented based on type, coin, and application. Based on type it is divided into Central Processing Unit, Graphics Processing Unit, Application-Specific, Integrated Circuit, and Field Programmable Gate Array. The application-specific integrated circuit held a highest share in 2021 and are anticipated to grow at the significant CAGR over the forecast period. An Application-Specific Integrated Circuit (ASIC) is an electronic circuit designed for the sole purpose of mining cryptocurrencies. It is designed to mine cryptocurrencies such as Bitcoin, Litecoin, Ethereum, Zcash, and a few other crypto assets.

The coin segment is classified into Bitcoin, Ethereum, Monero, and Others. The Bitcoin segment dominated the coin segment in the market in terms of revenue share in 2021 due to factors such as various companies across the globe are making efforts to enter into a strategic partnership with financial services companies to develop and form the carbon-neutral Bitcoin mining facility by using renewable energy sources. The Ethereum segment is expected to witness the significant growth over the forecast period owing to efforts from numerous companies across the globe to launch the Ethereum and Altcoins mining business via a strategic partnership with pool mining companies.

The application segment includes enterprise and personal. The personal subsegment dominated the application segment owing to the factors such as advancements in technologies to reduce power consumption while increasing the hash rates encourage several individuals to opt for crypto mining hardware solutions. Asia Pacific dominated the cryptocurrency mining hardware market in 2021 due to factors such as growing presence and concentration of prominent cryptocurrency mining hardware providers, including Canaan Inc., BitMain Technologies Holding Company, and Ebang International Holdings Inc. However, North America is expected to witness the significant growth over the forecast period owing to key factors such as increasing investments in developing technologically advanced solutions for cryptocurrency mining systems, including better hash rates and improved power efficiency.

Cryptocurrency Exchange Platform Market Analysis & Forecast

The global cryptocurrency exchange platform market was valued at USD 30.18 billion in 2021 and is anticipated to witness growth at a rate of 27.8% over the forecast period. The rise of cryptocurrency as a decentralized asset class has attracted investments by private venture companies in the market. For instance, the U.S. market witnessed investments worth USD 6.1 billion in 2021 across 106 deals. The growth is further supported by the increased demand for cryptocurrency as an alternative form of tender across emerging economies, such as Argentina, Zimbabwe, and Iran, plagued with devalued currencies.

This market is segmented based on cryptocurrency type, and end use. Based on cryptocurrency type it is divided into Bitcoin, Ethereum, Cardano, Solana, and Others. The Ethereum held a significant share in 2021 and are anticipated to grow at the second-fastest growth rate over the forecast period. Ethereum’s popularity is growing in parallel with the emergence of digital assets, such as NFTs and Decentralized Finance (DeFi) projects. Furthermore, the growth of the Ethereum market can be attributed to the significant increase in traffic on the Ethereum network owing to the influx of new projects running on it. Ethereum was the first cryptocurrency to utilize smart contracts for algorithm-based financial transactions.

Crypto Exchange Fee Comparison

Trading Fees

Maker

Taker

Bibox

0.075%

0.15%

Binance.us

0.1%

0.1%

Binance.com

0.1%

0.1%

Bitfinex

0.1%

0.2%

Based on end-use the market is divided into commercial and personal. Commercial is further divided into banks, fintech companies, credit unions, and others. The commercial subsegment dominated the end-use segment owing growing adopting of cryptocurrencies by businesses to attract young customers, gain broader access to capital compared to traditional sources, and better transparency in tracking the trail of financial transactions offered by digital currencies compared to cash. The commercial use spans operational, investment, and transactional activities. The personal end-use segment is expected to witness high growth attributed to the rising demand for cryptocurrency exchange platforms from individuals is expected to stem mainly from trading activities. Crypto exchange platforms enable users to deposit a local currency and use it for purchasing and trading cryptocurrencies.

North America dominated the global industry in 2021 and accounted for the maximum share of the overall revenue. The dominance of region is attributed to the presence of several prominent players in the region, such as Kraken, Gemini, and others. However, the Asia Pacific is expected to register the highest CAGR over the forecast period. The growing strategic collaborations and partnered ventures by key players contribute to the region’s growth. For instance, TaoTao, a crypto exchange platform, and Z Corporation, Inc., an investment company, entered into a strategic collaboration with Binance Holding Ltd. in January 2020. The partnership was aimed at providing trading services for consumers across Japan.

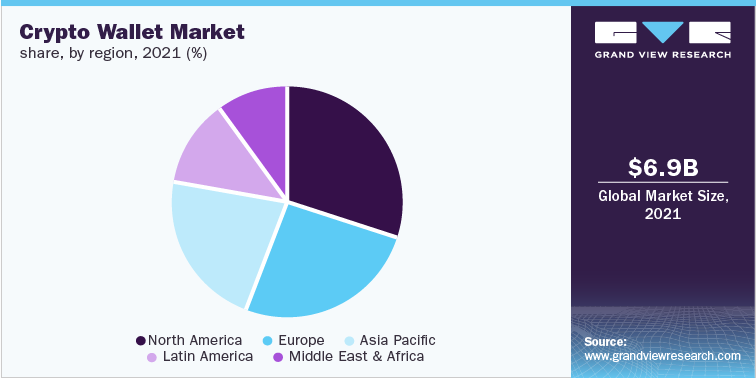

Crypto Wallet Market Analysis & Forecast

The global crypto wallet market was valued to be USD 6.97 billion in 2021 and is anticipated to witness growth at a rate of 24.4% over the forecast period. The robust security provided by the crypto wallets is expected to impel the demand for crypto wallets, thereby driving the future market growth. Furthermore, crypto wallets allow sending, receiving, and spending of cryptocurrencies such as Ethereum and Bitcoin.

The global crypto wallet market is segmented based on wallet type, operating system, application, and end-user. Based on crypto wallet type it is divided into hot wallets and cold wallets. The hot wallets segment dominated the market in 2021 owing to ease in accessing hot wallets as it can be downloaded on desktops, smartphones, or other devices. Cold wallets segment is expected to register significant growth during the forecast period. The high security offered by cold wallets owing to no link with the internet is expected to drive the segments growth. Cold wallets are considered a safer or more secure option for storing cryptocurrency.

The operating system segment is divided into Android, iOS, and others. The android segment dominated the market in 2021 owing to the increasing use of cryptocurrency coupled with growing smartphone penetration. However, the iOS segment is expected to register significant growth during the forecast period. The growth of this segment is attributed to the ability of iOS crypto wallets to offer a robust and reliable way of storing cryptocurrencies.

Based on application the crypto wallet market is divided into peer-to-peer payments, trading, remittance, and others. The trading segment dominated the market in 2021 owing to the crypto wallets being primarily used for cryptocurrency trading. The remittance segment is expected to register the highest growth during the forecast period due to the factors such as increasing adoption of cryptocurrency as a medium to send money overseas by consumers across the globe.

North America dominated the crypto wallet market in 2021. North America houses several key players in the market, including Coin base Global, Inc., Bit Go, and Bit Pay, among others. Additionally, the region is known for being an early adopter of technology. The Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period. The Asia Pacific is expected to play a vital role and be crucial in blockchain innovation. The region’s large population, including financially aware and technologically inclined, is driving the innovation in crypto wallets in the area.

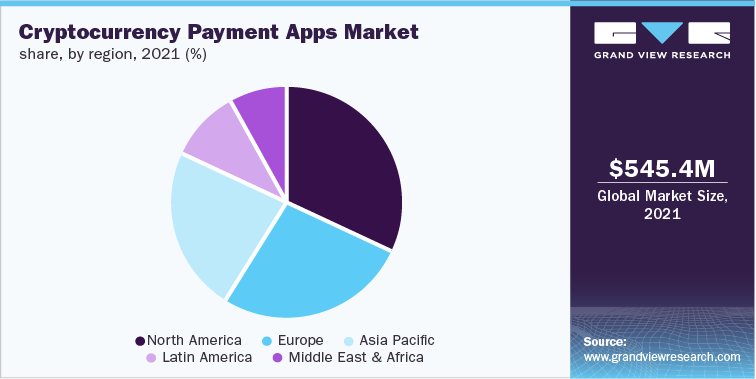

Cryptocurrency Payment Apps Market Analysis & Forecast

The global cryptocurrency payment apps market size was valued at USD 545.4 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 16.6% from 2022 to 2030. The approval and legalization of the purchase, sale, and trade of cryptocurrencies in various developed countries has contributed to the growth of the market. Additionally, the legalization of cryptocurrency has sparked interest among digital payment application providers, resulting in the launch of new applications that support cryptocurrency payment methods. The market is segmented into cryptocurrency type, payment type, operating system, and end user.

Based on cryptocurrency type, the market is segmented into Bitcoin, Ethereum, Litecoin, DAI, Ripple, and Others. The Bitcoin segment dominated the market in 2021. The dominance is attributable to bitcoin being the pioneer of the industry. Furthermore, the dominance can be attribute to several large enterprises, including Microsoft and Whole Foods, that accept bitcoin to make the purchases. However, the Ethereum segment is expected to grow at the significant rate during the forecast period. Several businesses, including Overstock, Shopify, and Gipsybee, among others, accept payment in Ethereum. For instance, egifter, allows its users to purchase gifts of more than 300 brands using Ethereum. Moreover, the rise in the decentralized finance (Defi) and NFT market is also expected to drive the Ethereum market over the forecast period.

The following table lists companies that use crypto-based payments:

List of companies accepting crypto payments

Company

Analysis

Microsoft

The company has accepted bitcoin for its online Xbox store since 2014. However, the company had temporarily paused the use of bitcoin due to its volatility but has now again started accepting it for Xbox store credits

Overstock

It is a U.S.-based internet retailer focused on selling furniture. The company accepts multiple kinds of cryptocurrencies

Home Depot

It is a large hardware store chain located in the U.S. The company accepts bitcoin-based payments through Flexa’s checkout system installed in its stores

Food Industry

KFC Canada

The company accepts bitcoin for its services

Pex Pepper

The company offers hot spicy sausages for bitcoins

Just Eat

The French company started accepting bitcoin for the orders placed on its websites

Quiznos

The company started accepting bitcoin for its sandwiches via a partnership with Bakkt, a crypto payment solution provider

Sports Team

Dallas Mavericks

People visiting Dallas Mavericks stadium can buy products as well as tickets using bitcoin

Miami Dolphins

The professional American football team allows people to purchase tickets and food using bitcoin and litecoin

The payment type segment is classified into in-store payment and online payment. The in-store payment subsegment dominated the payment type segment in this market in terms of revenue share in 2021. The dominance of the in-store payment subsegment is due to factors such as increasing adoption of cryptocurrency payments across the stores is driving the segment's growth. Furthermore, cryptocurrency payment providers are increasingly launching new POS systems that support cryptocurrency payments at brick-and-mortar stores. The online payment segment is expected to register the fastest growth during the forecast period. One of the major reasons for the segment’s growth is rapid advancements in technological innovations such as digitization and faster payment processing.

Based on operating system, the market is segmented into Android, iOS, and others. The android segment dominated the market in 2021. The dominance is emphasized by the easy availability and affordability of android-based smartphones. However, the iOS segment is expected to witness significant growth during the forecast period. The major factor of growth is that Apple launched its new Apple Pay feature named Tap to Pay in February 2022, allowing millions of retailers throughout the U.S. to utilize their iPhones to collect payments easily, quickly, and securely by tapping their phones.

Based on end users, the market is segmented into individuals and businesses. In 2021, business segment dominated the market due to the larger size of the cryptocurrency transactions made using cryptocurrency payment apps. However, the individual segment is expected to grow at the significant rate during the forecast period. The social media campaigns to promote the utilization of cryptocurrencies as an investment alternative is propelling the growth of the individual segment.

Crypto ATM Market Analysis & Forecast

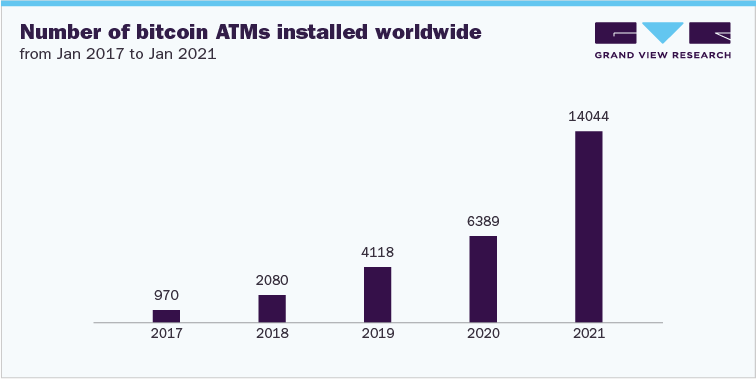

The global crypto ATM market size was valued at USD 75.0 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 61.7% from 2022 to 2030. The growth of the market can be attributed to the growing demand for crypto ATMs from cryptocurrency users worldwide. Cryptocurrency users are preferring crypto ATMs because they offer easier trading options, do not involve any online wallets, and do not require setting up an account and dealing with lengthy public keys. The growing number of startups focusing on providing cryptocurrencies and the growing use of cryptocurrencies, particularly among youngsters, are also emerging as some of the major factors opening new opportunities for the growth of the market.

The crypto ATM market is segmented into type, offering, coin type, and application. The type segment is further divided into one way and two way crypto ATMs. The one-way segment dominated the market in 2021. One-way crypto ATMs enable the users to convert cash to cryptocurrency. It offers various benefits to the users, such as remote monitoring and management, remote software up-gradation, and others, which is expected to drive the growth of the segment. However, the two-way segment is anticipated to witness the fastest growth over the forecast period. The increasing installation of bidirectional two-way ATMs in malls is expected to drive the growth of the segment. For instance, in August 2021, BR Malls, a mall chain in Brazil, announced its partnership with Coin Cloud, a manufacturer of bitcoin ATMs to install 15 ATMs in four Brazilian cities. The ATMs provided by Coin Cloud are bidirectional, which enables the customers to buy and sell cryptocurrencies.

Based on offering crypto ATM market is divided into hardware and software. The hardware segment dominated the market in 2021. The hardware used by crypto ATM manufacturers includes a head unit cage, cash dispenser, door switches, extension box, cashbox, cash recycler, among others. The cash recycler delivers highly compact and reliable cash handling solutions for crypto ATMs. Thereby, enhancing user experience and profitability of the operator, owing to which demand for improved cash recycler is high among the manufacturers. However, the software segment is expected to register the fastest growth over the forecast period. The crypto ATM software enables the companies to comply with consumer protection standards, including the Payment Application Data Security Standard, the Payment Card Industry Data Security Standard, and other payment application protection standards.

Based on coin type the crypto ATM market is divided into Bitcoin, Dogecoin, Ethereum, Litecoin, and others. The bitcoin segment accounted for the highest revenue share in 2021. The growing installations of bitcoin ATMs worldwide is one of the major factors driving the growth of the market. According to the statistics provided by Coin ATM Radar, a platform dedicated to tracking the number of cryptocurrency ATMs across the globe, there were around 14,000 bitcoin ATMs installed worldwide at the start of 2021. The number further increased to about 34,000 at the end of 2021, showing an increase of about 20,000 bitcoin ATMs within 12 months. However, the Litecoin segment is anticipated to register significant growth over the forecast period. Litecoin is in demand as it is faster at handling payments as compared to bitcoin. Various companies thereby make efforts to provide litecoin payment options at ATM terminals. For instance, in February 2020, Litecoin Foundation, a non-profit organization, partnered with MeconCash to combine litecoin into M.Pay platform. This thereby allows litecoin to be withdrawn to Korean Won at over 13,000 ATMs in South Korea. These new services allow litecoin holders to have quick access to cash as well as the ability to send remittances to Korea from overseas.

The application segment is classified into commercial spaces, restaurants & other hospitality spaces, transportation hubs, standalone units, and others. The restaurants and other hospitality spaces segment accounted for the highest market share of the global revenue in 2021. Several restaurants have started offering cryptocurrency as a payment option. Benefits, such as higher reliability, rapid transactions, and lower transaction fees, associated with bitcoin are particularly encouraging restaurants to opt for bitcoin as a payment method. Several hotels, such as the D Vegas Casino Hotel, and The Dolder Grand, among others, have also installed bitcoin ATMs as part of their efforts to offer diversified payment options to their customers. The commercial spaces segment is anticipated to witness the fastest CAGR over the forecast period. The installation of crypto ATMs across commercial places, such as malls, and banks, among others, is gradually gaining traction. Several malls are striking partnerships with crypto ATM providers to install crypto ATMs and allow their customers to buy and sell bitcoins conveniently.

Competitive Landscape

The key players in the market have developed novel concepts & ideas, upgraded the current set of products, and enhanced their profitability to sustain the intense competition in the market. The market players have adopted new product development as their key developmental strategy to cater to the increasing demands of end users. Additionally, they have obtained approvals to launch their products across various countries. For instance, in May 2022, Robin Hood, a financial service company, announced the launch of a new independent Web 3.0 cryptocurrency wallet that will cover clients' transaction costs on the blockchain network without keeping control of their assets. This launch will make it easy for the users to hold their keys and experience all the open financial system's opportunities. Furthermore, several fintech companies are investing aggressively in the market recognizing the potential of cryptocurrencies. In July 2022, PicPay, a fintech company based in Brazil, announced the launch of a cryptocurrency exchange platform to provide its customers access to Ether, Bitcoin, and Paxos’ USDP stablecoin. Additionally, in June 2022, Kwik Trip operating as Kwik Star in Iowa and Illinois announced that it is installing bitcoin ATMs at over 800 locations in Iowa and the Midwest. This installation of ATM is made possible by the U.S.-based bitcoin ATM network named Coinsource.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified