- Home

- »

- Sector Reports

- »

-

Endoscopy Devices Industry Size & Analysis, Data Book, 2023

![Endoscopy Devices Industry Size & Analysis, Data Book, 2023]()

Endoscopy Devices Industry Data Book - Endoscopes, Endoscopy Visualization System, Endoscopy Visualization Component And Operative Devices Market Size, Share, Trends Analysis And Segment Forecasts, 2023 - 2030

- Published Date: Jun, 2023

- Report ID: sector-report-00170

- Format: Electronic (PDF)

- Number of Pages: 300

Database Overview

Grand View Research’s endoscopy devices industry data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research along with an endoscopy devices statistics e-book.

Endoscopy Devices Industry Data Book Scope

Attributes

Details

Areas of Research

- Endoscopes Market

- Endoscopy Visualization System Market

- Endoscopy Visualization Component Market

- Operative Devices Market

Number of Reports/Presentations in the bundle

- 4 Individual Reports - PDFs

- 4 Individual Reports - Excel

- 1 Data book - Excel

Cumulative Coverage of Countries

20+ Countries

Highlights of Datasets

- Type, Revenue, by Countries

- End-use, Revenue, by Countries

- Competitive Landscape

Total number of tables (Excel) in the bundle

300+

Total number of figures in the bundle

200+

Endoscopy Devices Data Book Coverage Snapshot

Market Covered

Endoscopy Devices Industry

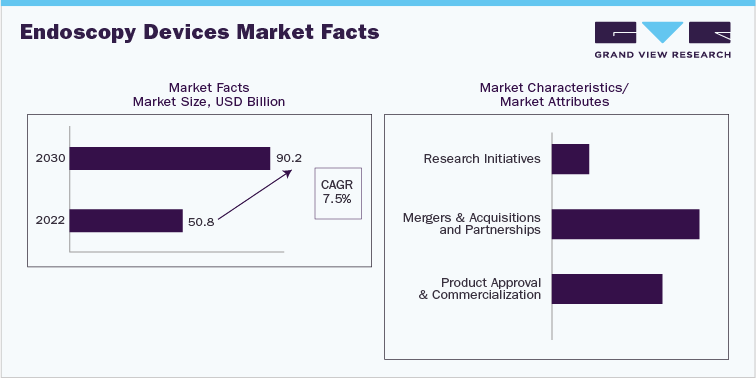

USD 50.8 billion in 2022

7.5% CAGR (2023-2030)

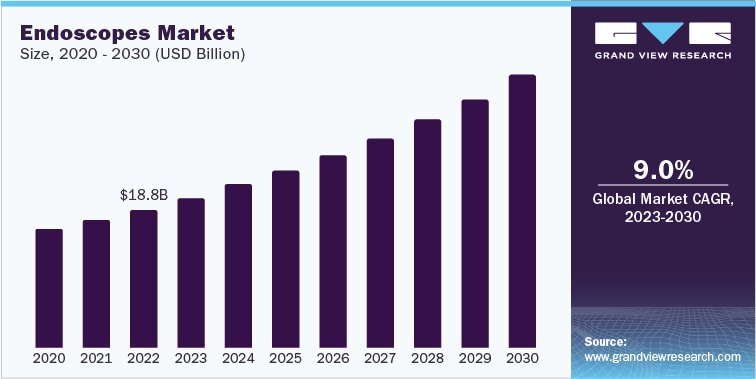

Endoscopes Market Size

USD 18.7 billion in 2022

9.0% CAGR (2023-2030)

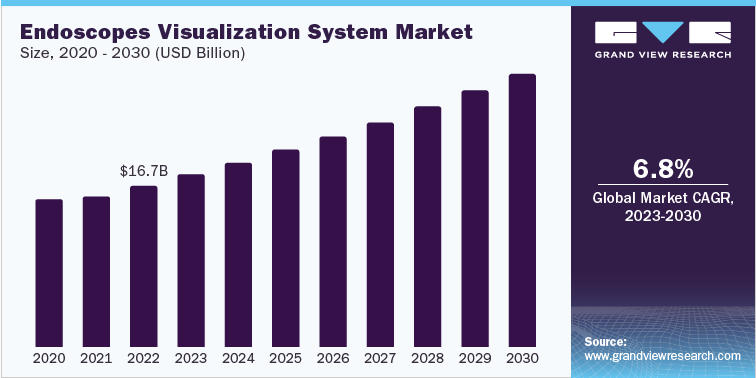

Endoscopes Visualization System Market Size

USD 16.7 billion in 2022

6.8% CAGR (2023-2030)

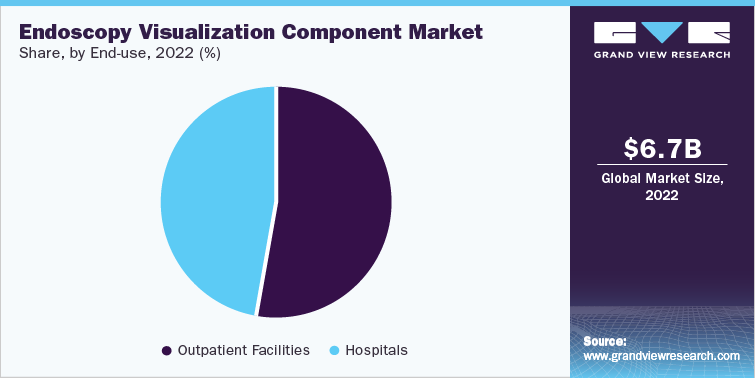

Endoscopy Visualization Component Market Size

USD 6.7 billion in 2022

7.0% CAGR (2023-2030)

Operative Devices Market Size

USD 8.6 billion in 2022

5.7% CAGR (2023-2030)

Endoscopy Devices Sector Outlook

The global endoscopy devices market was valued at USD 50.8 Billion in 2022 and is anticipated to grow at a CAGR of 7.5% over the forecast period. The market growth is attributed to the presence of cost-effective pre and post-procedures and increasing awareness regarding the minimal invasive properties of the devices. COVID-19 has impacted the market negatively as the number of endoscopic procedures reduced owing to the postponed and canceled elective and semi-urgent procedures. However, the increasing geriatric population, coupled with the rising burden of chronic diseases, is anticipated to drive the market. Furthermore, increasing the preference for disposable endoscopic equipment reduce the possibility of cross-contamination is anticipated to drive the market over the forecast period.

Key Market Participants

Olympus

Coroporation

Ethicon Endo-surgery,

FUJIFILM Holdings Corporation

Stryker

Boston Scientific Corporation

Karl Storz GmbH & Co.KG

Smith+Nephew

Richard Wolf GmbH

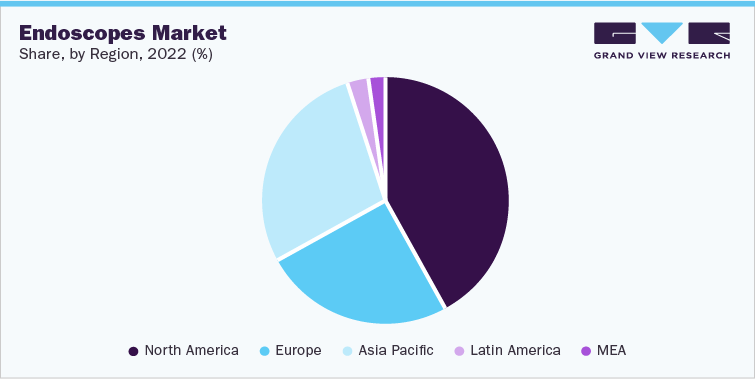

North America held the largest share of over 40% in 2022, owing to the presence of well-developed healthcare infrastructure and rising adoption of minimally invasive procedures. Additionally, the rising geriatric population coupled with the increasing prevalence of chronic diseases such as cancer, cardiovascular diseases, along with gastrointestinal disorders is driving the market. According to the Heart and Stroke Foundation of Canada, 100,000 people are diagnosed with heart failure every year, and currently, 750,000 people living in the region have suffered from heart failure.

Moreover, Asia Pacific is anticipated to show the fastest growth rate over the forecast period. The growth is attributed to the increasing incidences of functional gastrointestinal disorder patients coupled with increasing government support in the form of funding and initiatives for the development of healthcare infrastructure in the region.

Endoscopes Market Analysis And Forecast

The global endoscopy market was valued at USD 18.8 Billion in 2022 and is anticipated to grow at a CAGR of 9.0% over the forecast period. The growth is attributed to the rising incidence of chronic disorders and the growing awareness of early diagnosis of diseases using minimally invasive surgical methods. Furthermore, favorable reimbursement policies and increased FDA approvals for endoscopic devices are projected to drive market expansion in the coming years.

Endoscopic techniques have also been widely used to identify and treat functional gastrointestinal problems. Parts of the gastrointestinal tract, such as the stomach, esophagus, and intestines are vulnerable to functional gastrointestinal disorders. The rising prevalence of functional gastrointestinal illnesses such as Irritable Bowel Syndrome (IBS), functional constipation, and functional dyspepsia is also likely to drive endoscopic device use in the coming years. For instance, a multinational study published in the Gastroenterology Journal in 2021 found that approximately 40% of people from 33 nations have functional gastrointestinal issues.

Furthermore, obesity is a developing major health problem worldwide as a result of the increasing adoption of unhealthy lifestyles and diets. It is linked to a variety of gastrointestinal conditions, including esophageal adenocarcinoma, erosive esophagitis, gastroesophageal reflux disease, colorectal polyps, and cancer. Obesity is anticipated to rise significantly by 2030, according to a study conducted by the Organization for Economic Cooperation and Development (OECD). Obesity is anticipated to affect about 47%, 39%, and 35% of the population in the United States, Mexico, and England, respectively, by 2030.

Endoscopes Visualization System Market Analysis And Forecast

The global endoscopy visualization system market was valued at USD 16.7 Billion in 2022 and is anticipated to grow at a CAGR of 6.8% over the forecast period. The growth is attributed to the increasing prevalence of colorectal cancer, gastrointestinal disorders, pancreatic abnormalities, and urological, gynecological, and respiratory issues are likely to drive market expansion. Colorectal cancer is the third most prevalent cancer in males and the second most common disease in women, according to the World Cancer Research Fund. Furthermore, the WHO predicts that the number of new colon cancer cases will rise from 1.15 million in 2020 to 1.51 million by 2030.

Visualization systems that use sophisticated technology can provide improved image quality, making them extremely useful in the medical industry. Endoscopic operations have developed as a viable supplementary technique in a variety of medical disciplines, including general surgery, gastrointestinal surgery, urology, and others, in recent years. The Centers for Disease Control and Prevention estimates that around 494,000 hysterectomies are performed in the United States each year. Around 80.0% of procedures are performed laparoscopically or robotically. As a result of the shift toward minimally invasive surgeries and the rising prevalence of cancer, the market is expected to rise.

Endoscopic techniques have several advantages over open-invasive procedures. These operations are associated with shorter recovery times, shorter hospital stays, fewer complications, cheaper costs, and smaller incisions, all of which lead to superior clinical outcomes. As a result, the use of minimally invasive endoscopy is growing. A study published in Gastrointestinal Endoscopy, an official magazine of the American Society for Gastrointestinal Endoscopy, said that over 17.7 million endoscopic operations are conducted in the United States each year. This represents 5.6% of the U.S. population. As a result, a large increase in the number of minimally invasive endoscopic treatments, combined with the rising cancer expense burden, is expected to encourage the expansion of the market for endoscopy visualization systems.

Endoscopy Visualization Component Market Analysis And Forecast

The global endoscopy visualization component market was valued at USD 6.7 Billion in 2022 and is anticipated to grow at a CAGR of 7.0% over the forecast period. A significant increase in the number of endoscopic operations, as well as an increasing demand for minimally invasive treatments, are primary factors driving market growth. Endoscopy is becoming more popular due to its advantages over invasive procedures, significant cost savings, and favorable government reimbursement schemes. Furthermore, the increasing adoption of new diagnostic instruments has resulted in an increased demand for advanced visualization approaches. As a result, several manufacturers are emphasizing the introduction of components with enhanced visualization capabilities.

Moreover, the rising adoption of endoscopy display monitors with 4K resolution owing to the capability of providing clearer image quality when compared to full HD resolution is driving the market. However, when compared to 4K, full HD display monitors are more cost-effective and are easily available, which favors the demand for the FHD resolution segment.

Operative Devices Market Analysis And Forecast

The global operative devices market was valued at USD 8.6 Billion in 2022 and is anticipated to grow at a CAGR of 5.7% over the forecast period. The growth is attributed to the growing demand for endoscopic operative devices for diagnostic and therapeutic processes, combined with the rising prevalence of age-related diseases globally, which is driving the market expansion. These devices are crucial in identifying and treating disorders since they allow minimum intervention and a faster recovery time. Endoscopic operations are widely preferred for the treatment of gallstones, liver abscesses, pelvic abscesses, intestinal perforation, and endometriosis across the globe.

The increasing number of healthcare facilities, including cancer centers, endoscopy centers, hospitals, oncology specialized clinics, and diagnostic centers, is increasing demand for endoscopes and operating devices, which is anticipated to fuel the market growth over the forecast period. Additionally, healthcare infrastructure in both developed and developing nations continue to upgrade to meet the growing demand for diagnostic and therapeutic operations across the globe coupled with the advent of technologically advanced techniques for the diagnosis and management of digestive disorders, such as capsule endoscopy, is projected to propel the market growth.

Competitive Insights

Increasing demand for endoscopy devices is increasing competition in the market and, thus, forcing key players to introduce new products in the market. Additionally, it is projected that rising industry consolidation activities, such as acquisitions and mergers by the leading market participants, as well as expanding efforts in R&D of endoscopy device applications by key players, are also expected to boost the market share. For instance, in April 2021, Medtronic plc announced U.S. FDA de novo clearance for its intelligent endoscopy module, GI Genius, in the U.S. The module is capable of detecting colorectal polyps by using an AI-powered computer-aided detection system.

-

Olympus Corporation

-

Ethicon Endo-surgery, LLC.

-

FUJIFILM Holdings Corporation

-

Stryker Corporation

-

Boston Scientific Corporation

-

Karl Storz GmbH & Co. KG

-

Smith & Nephew Inc.

-

Richard Wolf GmbH

-

Medtronic Plc (Covidien)

-

PENTAX Medical

-

Machida Endoscope Co., Ltd

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified