- Home

- »

- Sector Reports

- »

-

Enterprise Mobility Management Industry Data Book, 2030

![Enterprise Mobility Management Industry Data Book - Mobile Device Management, Mobile Identity Management, Mobile Content Management and Mobile Application Management Market Size, Share, Trends Report]()

Enterprise Mobility Management Industry Data Book - Mobile Device Management, Mobile Identity Management, Mobile Content Management and Mobile Application Management Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

- Published Date: Jul, 2023

- Report ID: sector-report-00186

- Format: Electronic (PDF)

- Number of Pages: 350

Database Overview

Grand View Research’s enterprise mobility management industry database is a collection of market sizing information & forecasts, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

The following data points will be included in the final product offering in 4 reports and one sector report overview:

Enterprise Mobility Management Industry Data Book Scope

Attribute

Details

Research Areas

- Mobile Device Management Market

- Mobile Identity Management Market

- Mobile Content Management Market

- Mobile Application Management Market

Details of Product

- 4 Individual Reports - PDFs

- 4 Individual Reports - Excel

- 1 Sector Report - PPT

- 1 Data Book - Excel

Cumulative Country Coverage

40+ Countries

Highlights of Datasets

- Solution Revenue, by Countries

- Deployment Revenue, by Countries

- Enterprise Size Revenue, by Countries

- Vertical Revenue, by Countries

- Competitive Landscape

Number of Tables (Excel) in the bundle

~350

Enterprise Mobility Management Industry Data Book Coverage Snapshot

Markets Covered

Enterprise Mobility Management Industry

USD 12.01 billion in 2022

24.4% CAGR (2023-2030)

Mobile Device Management Market Size

USD 5.02 billion in 2022

24.2% CAGR (2023-2030)

Mobile Identity Management Market Size

USD 2.60 billion in 2022

26.6% CAGR (2023-2030)

Mobile Content Management Market Size

USD 2.50 billion in 2022

22.2% CAGR (2023-2030)

Mobile Application Management Market Size

USD 2.0 billion in 2022

24.2% CAGR (2023-2030)

Enterprise Mobility Management Sector Outlook

The global enterprise mobility management market size was evaluated at USD 12.01 billion in 2022 and is expected to grow at a CAGR of 24.4% from 2023 to 2030. Enterprise mobility management (EMM) products are witnessing growing demand across the globe owing to a significant increase in mobile devices, and shifting various end-user companies’ focus on protecting their digital infrastructure is propelling market growth. Further, advancements in cloud-based EMM solutions are creating a positive outlook for the market. The rising adoption of Bring Your Own Device (BYOD) policies and the rising mobile workforce by various enterprises to enhance employees' productivity are expected to drive market growth in the forecast period.

Moreover, enterprise mobility management enables businesses to enhance their workplace efficiency and productivity, control operational costs, and reduce device downtime. The solution benefits the IT administration to remotely distribute applications across end-users, making the data accessible to them easily. In addition to the benefits, the solution offers advanced privacy capabilities, including remote data encryption and wiping to secure business information.

The growing focus of governments across countries, such as the UK, India, Canada, Brazil, and Saudi Arabia, to apply stringent regulations and laws on safeguarding personal and private information is further anticipated to boost the enterprise mobility management market growth. The aim to fund multiple research projects supporting cybersecurity product development to enhance digital infrastructure data security is fueling the demand in the market.

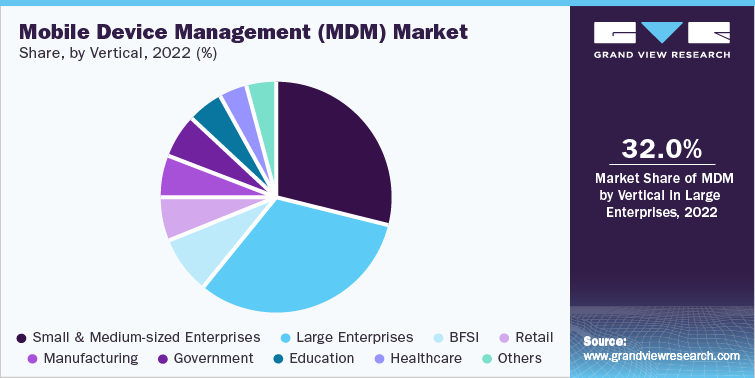

Mobile Device Management (MDM) Market Analysis and Forecast

The global mobile device management (MDM) market size was evaluated at USD 5.02 billion in 2022 and is expected to grow at a CAGR of 24.2% from 2023 to 2030. The usage of mobile devices has grown even more important due to the pandemic, which has forced many employees to work remotely. MDM solutions have become crucial for businesses to secure and control these devices and allow staff to work remotely without compromising security. One of the key factors influencing the market is the rising concern for data security. Data security is becoming a bigger issue as mobile devices proliferate since they might be lost, stolen, or hacked, possibly exposing valuable corporate data. By offering security features like device encryption, password protection, remote wiping, and the capacity to track and control devices, MDM solutions can aid in resolving these issues.

Employees are free to use their devices for work under the BYOD and CYOD rules, or they can select the gadgets of their choice from a list of options. MDM programs are evolving to manage and separate personal and business data on these devices in a secure manner. Robust MDM solutions that can manage and secure various linked devices are now necessary due to the development of IoT devices. These devices, which need thorough management and monitoring, include wearables, sensors, and other smart devices.

MDM solutions are adding tougher data protection features in response to the growing concerns around data privacy. Ensuring private data is managed safely on mobile devices involves encryption, data separation, and respect for privacy laws. The popularity of cloud-based MDM systems is growing as a result of their scalability, flexibility, and implementation simplicity. Organizations can manage their mobile devices more easily because of cloud-based solutions' centralized management, remote device monitoring, and quicker updates.

Mobile Identity Management (MIM) Market Analysis and Forecast

The global mobile identity management (MIM) market size was evaluated at USD 2.60 billion in 2022 and is expected to grow at a CAGR of 26.6% from 2023 to 2030. Managing and protecting user identities on mobile devices is the focus of the field of mobile identity management (MIM). Mobile identity management increasingly uses biometric authentication techniques, including iris scanning, facial recognition, and fingerprint recognition. These techniques replace conventional passwords or PINs with simple and safe ways to authenticate users on mobile devices.

As businesses search for cloud-based solutions to manage and authenticate user identities across numerous applications and devices, Identity as a Service (IDaaS) is growing in popularity. To offer centralized identity management, single sign-on (SSO) capabilities, and seamless user experiences across various mobile applications, MIM systems are integrating IDaaS.

MIM solutions are focusing on giving customers control over their data in response to growing privacy concerns. This includes tools like consent management, which lets users control and approve access to their data on mobile devices. To improve security and user experience, MIM solutions are merging with the biometric sensors found on mobile devices. This connection allows many mobile applications to seamlessly use biometric authentication, increasing ease and lowering reliance on separate hardware tokens.

Blockchain technology is being investigated for mobile identity management due to its decentralized and tamper-proof features. Blockchain-based MIM solutions can offer a transparent and safe identity verification procedure, lowering the possibility of identity fraud and promoting trustworthy interactions between mobile users. Users can access numerous mobile applications using Mobile Single Sign-On (SSO) without re-entering their login information. Mobile SSO features are included in MIM solutions to simplify user authentication and enhance the usability of mobile apps.

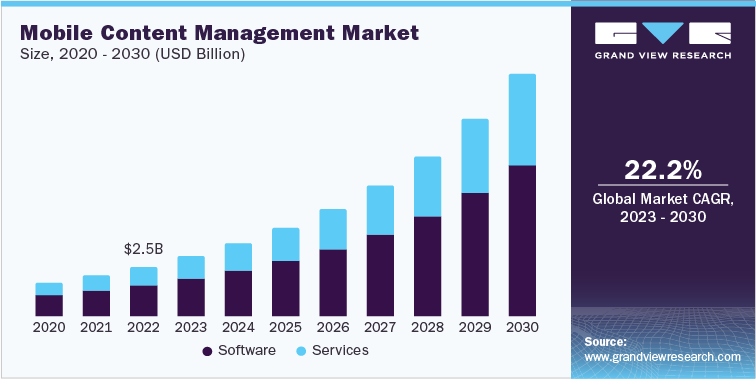

Mobile Content Management (MCM) Market Analysis and Forecast

The global mobile content management (MCM) market size was evaluated at USD 2.50 billion in 2022 and is expected to grow at a CAGR of 22.2% from 2023 to 2030. The management, distribution, and security of content on mobile devices within organizations are all a part of mobile content management (MCM). Because of their flexibility, accessibility, and simplicity of setup, cloud-based MCM systems are becoming more popular. These solutions provide seamless device synchronization, centralized content storage, and productive mobile user collaboration.

MCM solutions put a lot of effort into making it easier for mobile users to collaborate and share material. MCM platforms include functions like real-time editing, version control, and secure content sharing to facilitate seamless teamwork and boost productivity on mobile devices. MCM solutions on mobile devices are now offering strong document management capabilities. This contains tools for creating, editing, annotating, and securely storing documents. Access control, document integrity, and effective information retrieval are all features of MCM platforms.

MCM systems are implementing cutting-edge security measures in response to the growing demand for data protection. Protecting sensitive content on mobile devices includes encryption, data loss prevention, digital rights management, and access controls. MCM platforms also use Secure containerization techniques to separate business information from personal data. Enterprise Mobility Management (CRM), enterprise resource planning (ERP), and content management systems (CMS) are just a few of the business systems that MCM solutions are interacting with. This integration enhances workflow productivity and offers a consistent user experience by enabling easy access to enterprise information and data on mobile devices.

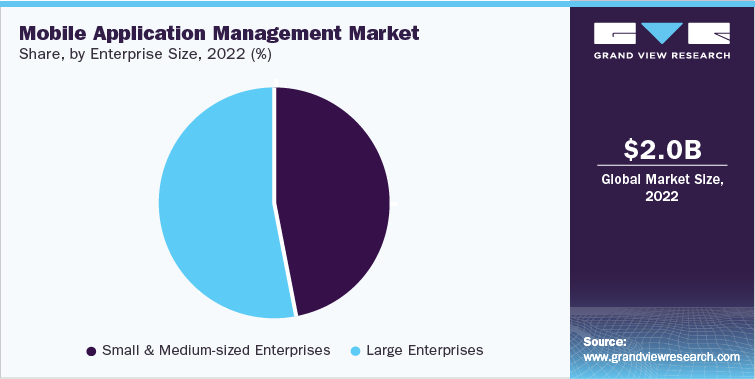

Mobile Application Management (MAM) Market Analysis and Forecast

The global mobile application management (MAM) market size was evaluated at USD 2.0 billion in 2022 and is expected to grow at a CAGR of 24.2% from 2023 to 2030. The management and deployment of mobile applications within organizations is a function of mobile application management (MAM). App containerization, where apps are contained within secure containers on mobile devices, is a major development in MAM. This strategy makes it possible to separate personal information from business information, guaranteeing that business apps and data are secure even on employee-owned devices.

Businesses are creating enterprise app stores and app catalogs as a centralized platform for organizing and distributing mobile apps within the company. These app stores allow IT managers to manage software versions, deliver updates, and guarantee security and licensing guidelines are followed. Analytics capabilities are being incorporated into MAM solutions to learn more about how apps are used, adopted, and performed. Organizations may monitor user behavior, pinpoint areas for improvement, and enhance app experiences with the help of mobile app analytics.

MAM systems can configure app settings, preferences, and functionalities according to user roles or organizational needs. As a result, businesses may customize app experiences and expedite app deployments for various user groups. Performance monitoring capabilities are incorporated into MAM solutions to track app performance indicators like response time, crashes, and resource usage. To provide verticals with the best possible app experiences, these capabilities help discover and fix performance issues. MAM solutions are aligned with privacy laws and data protection practices for the secure processing of user data within mobile apps. This offers users transparency and control over their personal information by incorporating features like data encryption, consent management, and user privacy controls.

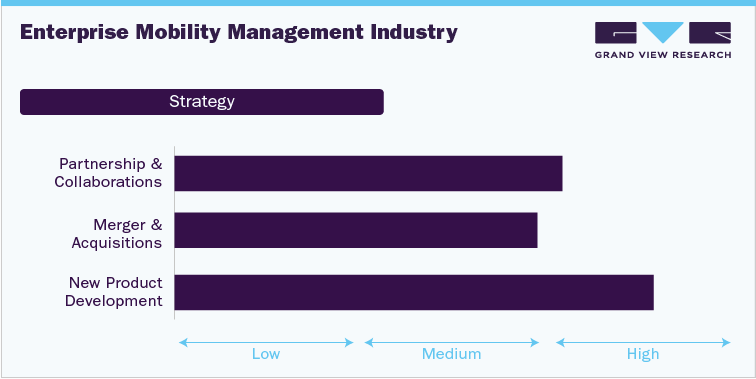

Competitive Landscape

The market is competitive with the presence of major Cisco Systems; SAP SE; Broadcom, Inc.; Vmware, Inc.; Ivanti; Sophos; and Blackberry, among others. These companies maintain an exhaustive product portfolio and are employed to maintain a competitive edge in the market, their product offerings, the applications segment they served, the sophistication of their technology, their strategy to differentiate their products, and their industry impact. The key strategies include strategic collaborations, partnerships, and agreements; new product development; capability expansion; mergers & acquisitions; and research & development initiatives. In February 2022, IBM Corporation announced a multi-million-dollar investment to expand its capabilities and resources in cyber security and prepare organizations for dealing with the growing threat of cyberattacks across Asia Pacific.

Strategy

Spearheads

Partnerships & Collaborations

Vmware,Inc., IBM Corporation, Broadcom, Inc., Cisco System, Inc.

Merger & Acquisitions

IBM Corporation, Cisco System, Inc., Microsoft Corporation

New Product Development

Google, Cisco System Microsoft Corporation

Product innovations and new product development are the primary strategic growth tactics to strengthen their market position. Google, Cisco Systems, and Microsoft Corporation are some key vendors actively engaged in innovation and product upgrades. For instance, in August 2021, Google launched its most recent Google Identity Services APIs, which include multiple identity services under one software development kit (SDK). The SDK uses secure tokens apart from passwords to sign the user into partners’ apps and websites.

Key Drivers

-

Growing adoption of cloud-based solutions

-

Growing dependence on mobile devices and applications for streamlining workflows

-

Growing advancement in security solutions

-

Increasing Bring Your Device (BYOD) trends and remote working across organizations.

-

Growing government focus and investments in data privacy regulations.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified