- Home

- »

- Sector Reports

- »

-

Enzymes Industry Share & Analysis Data Book, (2023-2030)

Database Overview

Grand View Research’s enzymes industry data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with a statistics e-book.

Enzymes Industry Data Book Scope

Attributes

Details

Areas of Research

- Industrial Enzymes Market

- Specialty Enzymes Market

Number of Reports/Presentations Covered in the Bundle

1 Sectoral Outlook Report + 2 Summary Presentations for Individual Areas of Research + 1 Statistic ebook

Cumulative Coverage of Countries

50+ Countries

Cumulative Coverage of Application

13 Application Categories

Highlights of Datasets

- Trade Data, by Country

- Demand/Consumption, by Country

- Industrial Enzymes

- Specialty Enzymes

- Statistics e-book

- Competitive Analysis

Enzymes Industry Data Book Coverage Snapshot

Market Covered

Enzymes Industry

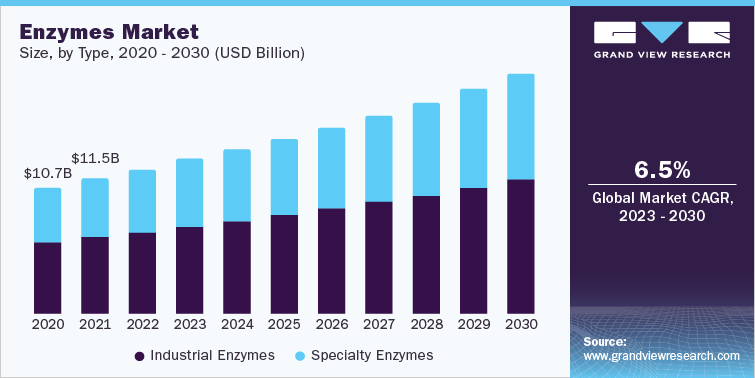

USD 12.28 billion in 2022

6.5% CAGR (2023-2030)

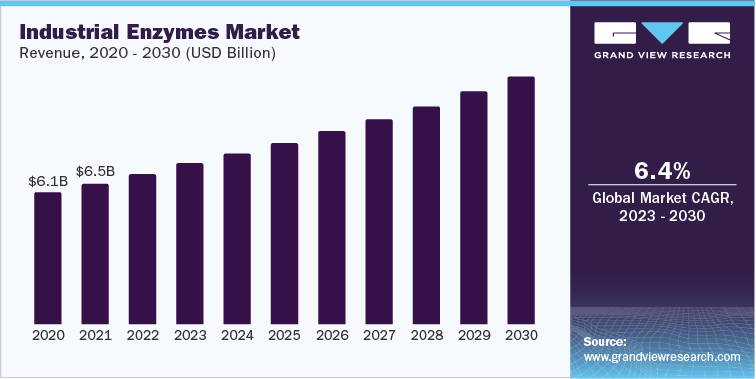

Industrial Enzymes Market Size

USD 6.96 billion in 2022

6.4% CAGR (2023-2030)

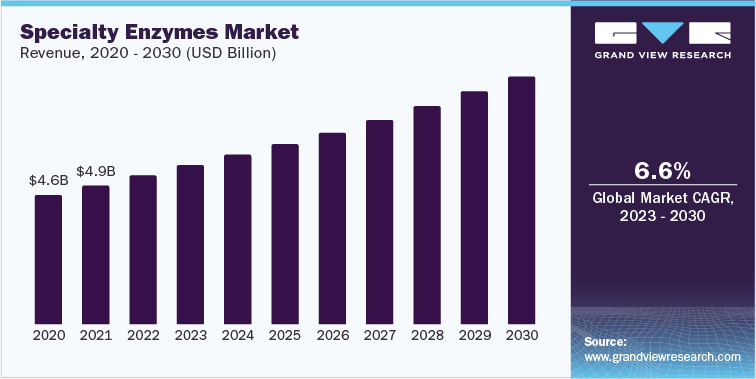

Specialty Enzymes Market Size

USD 5.32 billion in 2022

6.6% CAGR (2023-2030)

Enzymes Sector Outlook

The economic value generated by the enzymes industry was estimated at approximately USD 12.28 billion in 2022. This economic output is an amalgamation of basic enzyme categories namely, industrial enzymes and specialty enzymes.

The global market is anticipated to expand at a notable CAGR over the forecast period due to the growing demand for specialty enzymes in several applications including research, pharmaceutical, diagnostics, and biotechnology. Industrial enzymes are expected to witness significant growth due to their increasing demand from animal feed and nutraceutical industries. Rising consumer awareness about health has resulted in the growing consumption of functional food products, which is expected to trigger product demand in the coming years.

Microorganisms as a key source of enzymes are growing at a fast pace, which can be attributed to the low production cost and easy availability of raw materials to enzyme manufacturers. End-use industries are extensively using enzymes sourced from microorganisms as these enzymes can be used to manufacture several products and their scope is not restricted. This is beneficial for the product portfolio of enzyme manufacturers.

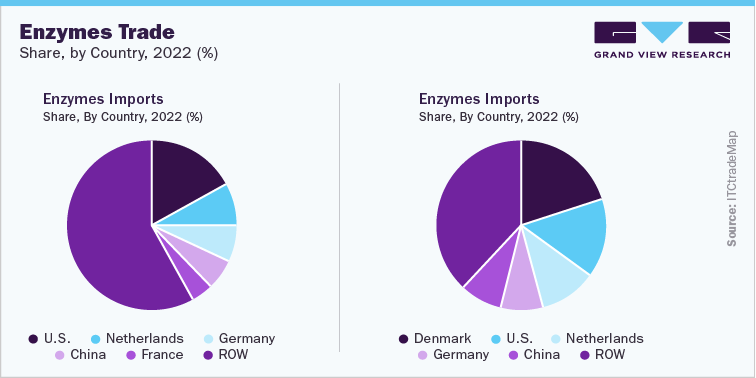

The U.S. is expected to dominate the North America market due to the high demand for enzymes from the food & beverage sector, increasing consumer awareness about health, and growing consumer preference for functional foods. The enzymes market in the U.S. is anticipated to witness notable growth on account of the extensive growth of the pharmaceutical and nutraceutical sectors in the country. The Asia Pacific enzymes market, led by India, China, South Korea, and Japan, is expected to observe significant growth due to the expansion of detergent and pharmaceutical sectors in the region.

Key players in the global enzymes market include BASF SE, DSM, Novus International, ABF Ingredients, Chr. Hansen Holding A/S, DuPont Danisco, Lesaffre, and Adisseo. The enzymes market is highly influenced by dominated supply from Novozymes AG, DuPont Danisco, and DSM. The industrial enzymes segment is categorized by investment-intensive and long enzyme development cycles by key enzyme manufacturers. The market has observed a rise in the demand for superior-quality specialty enzymes. As a result, raw material suppliers and manufacturers have significant opportunities to provide uniform and high-quality enzymes through a reviewed supply chain.

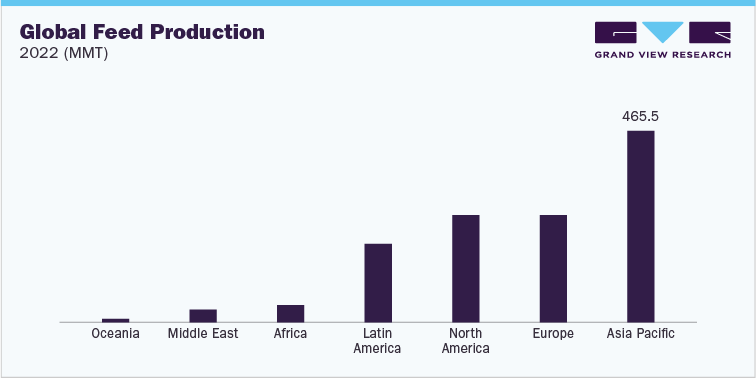

The above-mentioned figure depicts the global feed production in 2022 in terms of Million Metric Tons. As depicted, Asia Pacific accounted for the highest feed production amounting to 465.5 MMT in 2022. The Asia Pacific region is expected to be a prominent market for enzymes over the forecast period on account of growing meat production, particularly in China. Rising awareness among consumers regarding the prevalence of livestock diseases has led to the adoption of improved animal nutrition practices, which is anticipated to play a key role in driving the demand for enzymes over the coming years. Other factors contributing to the market growth include growing detergents demand in end-use applications, the expanding pharmaceutical industry in China and India, and increasing biodiesel production in Malaysia and Indonesia.

The European Commission’s inclination toward reducing greenhouse emissions and promoting the production of biofuels is expected to have a positive impact on the growth of the enzymes market over the forecast period. Russia is expected to witness a significant increase in meat production due to the improving economic conditions. Enzymes are extensively used in meat processing to improve the tenderness of the meat. Europe is also a prominent consumer of meat products and is anticipated to positively influence product demand.

North America is a prominent market for enzymes due to the strong presence of various end-use companies in the food & beverage, pharmaceuticals, laundry detergent, and personal care & cosmetics industries along with high scope for research & development activities in major countries of the region. The U.S. government has adopted several initiatives to promote the production of biodiesel, cellulosic biofuels, and advanced biofuels. The government established Renewable Fuel Standards (RFS1 and RFS 2) program in 2005, which focuses on reducing greenhouse emissions and promoting the use of alternative fuels. These government initiatives coupled with the growing production of biofuels in the U.S. are expected to propel the growth of the enzymes market over the forecast period.

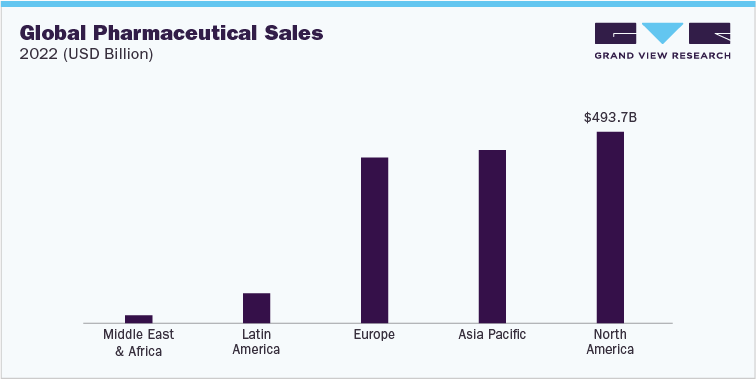

Cysteine proteinases, streptokinase, asparaginase, deoxyribonuclease, glucocerebrosidase, urokinase, pegademase, and hyaluronidase are the prominently used enzymes in the pharmaceutical sector. Enzymes are used in pharmaceutical applications due to their two important attributes; firstly, enzymes regularly bind and mark their targets with greater specificity and affinity and secondly, they are catalytic and transform numerous target particles into preferred products.

Favorable government policies to support the pharmaceutical sector coupled with growing investment by private companies across emerging countries, especially India are expected to drive the pharmaceutical industry, which, in turn, is projected to boost the consumption of enzymes in the coming years. The growth of the global pharmaceutical industry is attributed to rapid expansion by major companies such as Johnson & Johnson Services Inc., Novartis AG, F.Hoffmann-La Roche Ltd, Pfizer Inc., Sanofi, Merck KGaA, GlaxoSmithKline plc, AstraZeneca, and Bayer AG, which is also expected to positively influence the enzymes market over the forecast period.

Industrial Enzymes Market Analysis And Forecast

Industrial enzymes accounted for a share of nearly 56% of the industry in 2022. The demand for industrial enzymes is increasing across a range of industries including food and beverages, biofuels, pharmaceuticals, textiles, animal feed, and detergent manufacturing. Enzymes are used in these industries for processes such as food processing, fermentation, waste management, and bioconversion, driving the market’s growth.

There is a growing awareness among consumers regarding the environmental impact of traditional chemical processes. Industrial enzymes offer more sustainable alternatives by reducing energy consumption, waste generation, and the use of harsh chemicals. As a result, there is an increasing demand for enzyme-based products and processes which is predicted to drive the market growth.

Specialty Enzymes Market Analysis And Forecast

Specialty enzymes accounted for a share of over 43% in the industry in 2022. Specialty enzymes find extensive applications in the healthcare and pharmaceutical sectors. They are used in diagnostics, drug development, biotechnology research, and treatments. The growing prevalence of diseases, advancements in drug discovery and development, and the need for personalized medicine are driving the demand for specialty enzymes in these industries.

Specialty enzymes play a crucial role in drug discovery and development processes. They are used for target identification and validation, high-throughput screening, lead optimization, and structure-based drug design. Specialty enzymes such as proteases, kinases, polymerases, and ligases are employed in various assays and experiments to study the interaction of drugs with their targets.

They are also employed in biocatalysis and biotransformation processes in the pharmaceutical industry. They enable selective chemical transformations and the synthesis of complex molecules, including chiral compounds and intermediates for drug synthesis. Enzymes such as oxidases, reductases, and hydrolases are utilized to carry out specific reactions efficiently and with high selectivity.

Competitive Insights

In recent years, the market for enzymes has grown significantly due to their increasing consumption in numerous end-use applications such as food & beverages, diagnostics, paper & pulp, nutraceuticals, detergents, animal feed, pharmaceutical, research, and biotechnology. The majority of market participants have focused their research & development efforts on the development of innovative enzyme products in bulk for their use in multiple applications.

As a result, the market has witnessed several joint ventures and acquisitions. For instance, in April 2021, BASF SE decided to collaborate with Sandoz GmbH, a subsidiary of Novartis AG to invest initsKundl/Schaftenau Campus in Austria. This move will lead to an increase in the production capacity and biotechnology and enzyme product lines of BASF SE.

Companies, such as Novus International and Adisseo, have a limited product portfolio as they majorly concentrate on manufacturing enzymes for the animal feed industry. The market is anticipated to witness a high growth rate on account of the rapidly growing animal feed market and increasing consumption of enzymes in the formulation of animal feed, especially for poultry and swine. However, key market players have the challenging task of bringing down production costs and improving the quality of products.

Company Financial Performance, for Enzyme Business Portfolio, 2022 (USD Billion)

Company

Contact Details

Revenue

BASF SE

5th Floor, 'A' wing,

Sun Magnetica LIC Service Road,

Louiswadi, Thane (W) 400 604, India

Tel: +91-22-4170 3200

Nutrition & Care: 8.8 Billion

Associated British Foods Plc

Weston Centre

10 Grosvenor Street

London, W1K 4QY

Tel: +44 20 7399 6500

Ingredients: 2.0 Billion

Advanced Enzyme Technologies

Carl-Bosch-Str. 38,

67056 Ludwigshafen,

Germany

Tel: +49 621 60-0

64.6 Million

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified