- Home

- »

- Sector Reports

- »

-

Eyewear Industry Trends & Overview Data Book, 2023-2030

Database Overview

Grand View Research’s eyewear sector data book is a collection of market sizing information & forecasts, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

The following data points will be included in the final product offering in 3 reports and one sector report overview:

Eyewear Industry Data Book Scope

Attribute

Details

Research Areas

- Traditional Eyewear Market

- Contact Lenses Market

- Smart Glasses Market

Number of Reports/Deliverables in the Bundle

- 3 Individual Reports-PDF

- 3 Individual Reports-Excel

- 1 Sector Report-PPT

- 1 Databook-Excel

Cumulative Country Coverage

25+ countries coverage

Cumulative Product Coverage

70+ Level 1 & 2 Products

Highlights of Datasets

- Distributional Channel Revenue, by Country

- Distributional Channel Volume, by Country

- Competitive Analysis

Total number of Tables (Excel) in the Bundle

200+

Total Number of Figures in the Bundle

50

Eyewear Industry Data Book Coverage Snapshot

Markets Covered

Eyewear Industry

USD 171.1 billion in 2022

8.7% CAGR (2023-2030)

Traditional Eyewear Market Size

USD 152.8 billion in 2022

8.4% CAGR (2023-2030)

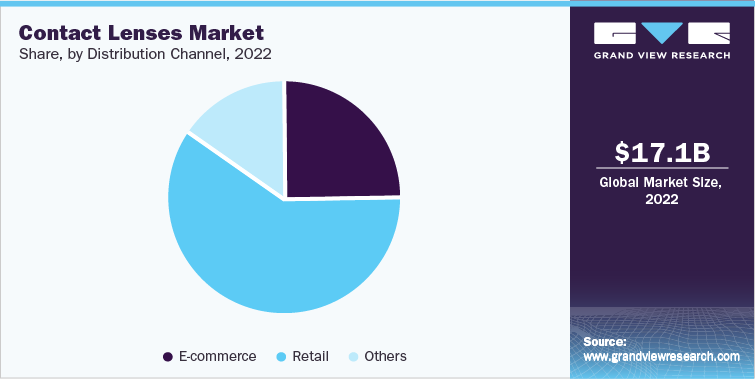

Contact Lenses Market Size

USD 17.1 billion in 2022

8.9% CAGR (2023-2030)

Smart Glasses Market Size

USD 1.2 billion in 2022

27.1% CAGR (2023-2030)

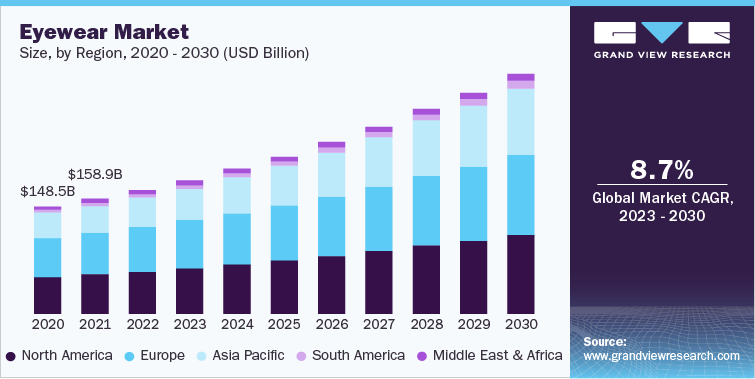

Eyewear Sector Outlook

The global traditional eyewear, contact lenses, and smart glasses markets cumulatively accounted for USD 171.1 billion in revenue in 2022, which is expected to reach USD 332.0 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.7% over the forecast period. The eyewear industry has witnessed significant growth over the years, driven by several key factors. For instance, the increasing prevalence of vision-related issues such as astigmatism, myopia, hyperopia, and presbyopia have significantly contributed to the expansion of the eyewear market. As more individuals require corrective lenses or vision aids, the demand for prescription glasses, contact lenses, and specialized eyewear has surged.

Advancements in technology are playing a pivotal role in the expansion of the eyewear sector. The development of lightweight and durable materials, such as titanium and carbon fiber, has led to the production of more comfortable and stylish eyewear. Innovative lens technologies, such as anti-glare coatings, blue-light filters, and photochromic lenses, have gained significant popularity, catering to the evolving needs and preferences of consumers. Besides, the increasing awareness of the harmful effects of UV radiation on the eyes has propelled the demand for sun-protected eyewear. With growing concerns about eye protection and the desire to prevent conditions like cataracts and macular degeneration, consumers are increasingly investing in high-quality sunglasses that offer effective UV protection.

Additionally, the widespread adoption of e-commerce and online retail platforms has revolutionized the eyewear industry. Online retailers offer a wide range of eyewear options, allowing consumers to conveniently browse and purchase products from the comfort of their homes. Virtual try-on technologies and home try-on services have further enhanced the online shopping experience, facilitating increased sales and market expansion.

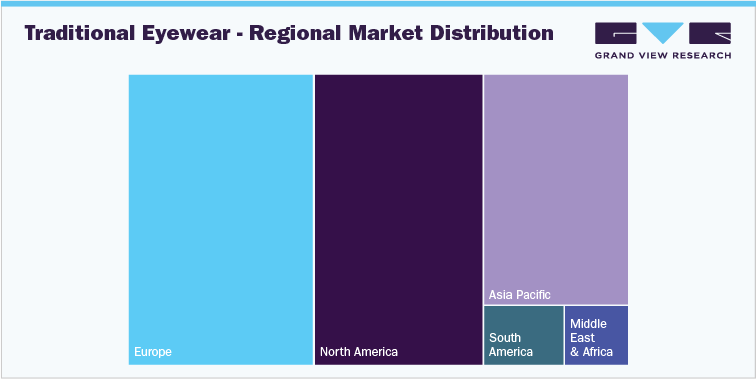

Traditional Eyewear Market Analysis & Forecast

The traditional eyewear market globally was estimated at USD 152.8 billion in 2022 and is likely to grow at a CAGR of 8.4% from 2023 to 2030. The global eyewear industry is experiencing significant growth due to rising demands for corrective and prescription-based spectacles, especially among the geriatric population. Multiple factors, such as the increasing awareness of eye health, a rise in visual impairments, and a growing aging population, have all contributed to the market's revenue growth. In addition, changing lifestyle patterns and adopting luxurious accessories among millennials are other factors driving the eyewear market revenue growth. Encouraged by the burgeoning demand, eyewear manufacturers are actively expanding their consumer base by introducing new designs and patterns that swiftly respond to ongoing fashion trends and appeal to enthusiasts. For instance, in June 2022, CooperVision commenced expanding and renovating its manufacturing and distribution facilities in New York to meet the rising demand from eye care professionals and wearers for its contact lenses. Additionally, in January 2023, Harley-Davidson motor company and Marcolin renewed the licensing agreement for the designing, manufacturing, and global distribution of eyewear frames and sunglasses branded by Harley-Davidson motor company.

The eyewear sector has seen significant technological advancements in recent years, bringing innovative changes. The adoption of 3D printing has transformed the industry, enabling it to meet the evolving needs of consumers. 3D printing enables eyewear manufacturers to create custom-made glasses that perfectly fit the wearer's face. This technology has also reduced the manufacturing time and costs associated with producing traditional eyewear products. Moreover, the flexibility of 3D printing allows for more customization in frame design, which is attractive to consumers seeking unique and personalized eyewear. For instance, in March 2022, a Belgian eyewear company, Odette Lunettes, collaborated with Materialise and former cycling world champion, Tom Boonen, to launch a new eyewear collection developed using biobased 3D printing technology.

During the COVID-19 pandemic, the e-commerce distribution channel continued to be strong due to global store closures, but this situation had an extended impact on physical retail. The eyewear providers witnessed changes in consumer purchasing behavior due to retail store closures. Eyewear sales through e-commerce saw an upsurge due to changes in customer buying preferences. As various geographies were under lockdown, the retail store footfalls declined drastically, and customers were refraining from going out. Global brands adapted to the changing buying patterns of buyers. For instance, Warby Parker continued to operate their e-commerce distribution channel and provided a virtual try-on tool in the Warby Parker application, which provided an easy shopping experience to the buyers. The company also offered virtual vision consultations in select states as the retail stores were closed.

Eyewear giant Essilor temporarily closed all its industrial locations in France & some parts of the World during the COVID-19 pandemic. However, e-commerce activities grew in full swing. Furthermore, eyewear providers offered free shipping and returns for all domestic orders to maintain the financials and attract a larger customer base, thereby promoting eyewear sales through e-commerce channels. The companies have also started offering buyers a try-on feature, where the buyers can try the eyewear and customize the selected pair further.

The global eyewear market experienced significant growth in recent years, especially in the emerging countries of Asia-Pacific, such as India and China. This is attributed to the higher population relying on eyewear for vision correction in China, India, and Japan. According to the Ministry of Health and the Ministry of Education, China has a large myopia rate of 33%, particularly among young consumers. More than 400 million individuals in China are myopic and require corrective eyewear. In 2022, China witnessed a substantial increase in myopia, with up to 90% of the young population being affected compared to 10% to 20% around 60 years ago. The regional eyewear sector is also experiencing a rapid transition regarding changing customer buying patterns, customer choices, a shift towards the chain of organized retail outlets from local optical stores, and an influx of foreign optical brands. In addition, the rising income levels, increase in population, after-sales services, and growing penetration of the retail distribution network are some of the key driving factors for the growth of the eyewear industry in India.

Contact Lenses Market Analysis & Forecast

The contact lenses market’s growth is driven by the upsurge in the usage of innovative materials for manufacturing contact lenses and the growing tendency of youngsters to enhance their aesthetic appearance. For instance, there is a considerable prevalence of contact lens usage by female university students in Saudi Arabia, particularly for cosmetic purposes. In addition, the rising aging population is expected to drive the demand for contact lenses over the forecast period. Moreover, a corrective lens is preferably used to correct refractive errors and compensate for visual deficiencies such as myopia, hyperopia, presbyopia, and astigmatism. For instance, in January 2022, Alcon launched DAILIES TOTAL1 for astigmatism. It is the first water gradient contact lens for astigmatism patients. The product launch extends the company’s range of premium, daily disposable lenses designed for astigmatic patients. Thus, a rise in visual disorders is expected to drive the market over the forecast period.

In December 2022, Bausch + Lomb Corporation announced that Biotrue Hydration Contact Lens Rehydrating drops, a preservative-free multi-dose rehydrating drop for use with soft gas permeable contact lenses, has gained 510(k) approval from the US Food and Drug Administration. Biotrue Hydration Boost Contact Lens drops are inspired by the biology of the eye, and it contains a combination of components influenced by the Tear Film and Ocular Surface Society's DEWS II study, including hyaluronan, a moisturizer found naturally in the eye, and other nature-inspired chemicals. It also mimics the pH of healthy tears for added comfort. The availability of Biotrue Hydration Boost for Contacts is expected to assist patients in reducing contact lens-related dryness. For instance, around 33 percent of contact lens users in the U.S. suffer from contact lens dryness.

The prevalence of ocular diseases, such as dry eye syndrome, glaucoma, and cataracts is on the rise, which is expected to boost the demand for daily disposable lenses. Daily disposable lenses are designed to be worn once and then discarded, which may help to reduce the risk of eye infections and other complications associated with long-term use of contact lenses. The rising awareness regarding the benefits of daily disposable lenses and the increasing focus of enterprises on developing and launching new products with greater comfort and ease to use is initiating the shift toward disposable lenses among the general population. The development of innovative goods and the introduction of awareness campaigns by numerous contact lens manufacturers are additional activities that are expected to enhance the sales of daily disposable lenses. For instance, in September 2022, CooperVision announced the launch of MyDay Energys daily disposable lenses to cater to the growing demand for a digital lifestyle.

The soft lens or silicone hydrogel segment has a wide range of applications and is one of the prominent contributors to the growth of the market for contact lenses. Soft contact lenses provide flexibility, breathability, and comfort over other contact lenses and have a huge customer base. Manufacturers such as Carl Zeiss; Essilor International; Menicon Co. Ltd.; and Alcon Laboratories, Inc. are trying to develop innovative technologies for fabricating unique soft contact lens materials that are highly flexible, breathable, and infection-free. Most lens producers promote silicone hydrogel soft lenses as they hold a unique quality to increase oxygen transmission to the eyes. Approximately three-fourths of contact lens users prefer silicone hydrogel soft contact lenses, owing to their unique property that helps improve the health of the eyes. For instance, in June 2022, Bausch + Lomb announced the launch of Revive, customizable soft contact lenses in the U.S. These soft lenses are available in multifocal, multifocal toric, and spherical options and are developed for patients with different vision impairments.

Smart Glasses Market Analysis & Forecast

The global smart glasses market was estimated at USD 1.2 billion in 2022 and is likely to grow at a CAGR of 27.1% from 2023 to 2030. The market is expected to grow rapidly in the coming years owing to the increasing demand for wearable technology and the growing adoption of smart glasses in industries such as healthcare, education, and manufacturing. Smart glasses offer workers in these industries real-time information and instructions, which can improve efficiency and safety. Advancements in technology, such as voice and gesture recognition, improved battery life, and better display resolutions, are making smart glasses more appealing to consumers. Moreover, the rising investments in research and development to improve the functionality of smart glasses drive innovation in the market, leading to improved performance and increasing engagement of players in mergers, acquisitions, and new product launches. For instance, in December 2022, Meta acquired Luxexcel Group B.V., a 3D-printed ophthalmic and smart lens provider, to build augmented reality smart glasses.

The smart glasses market is witnessing several technological trends shaping the industry's future. Artificial Intelligence (AI) and Machine Learning (ML) are used to improve the accuracy of smart glasses and provide users with more personalized experiences. The prevalence of AR and VR technology is also driven by consumer demand for more immersive and interactive experiences in gaming, entertainment, and sports. The growing hype for smart glasses has led technology providers and lens manufacturers to develop their versions of eyewear. The Chinese start-up Rokid Corporation Ltd. launched an AR glass, Rokid Glass, equipped with Wi-Fi and Bluetooth, enabling the wearers to interact with their surroundings. The glasses feature optical corrective lenses, which can provide additional benefits to users with vision imbalances. The glass features a voice recognition system, face recognition, and object recognition capabilities. Vuzix Blade is another example of AR smart glass that works with Amazon’s Alexa AI service, featuring voice control, touchpad gesture, head motion tracking, and haptic vibration alert. The design of the Vuzix Blasé is similar to sunglasses and is lightweight, enabling people to wear them at work or leisure. This is anticipated to provide opportunities for smart glasses manufacturers to innovate their product offerings with the changing time.

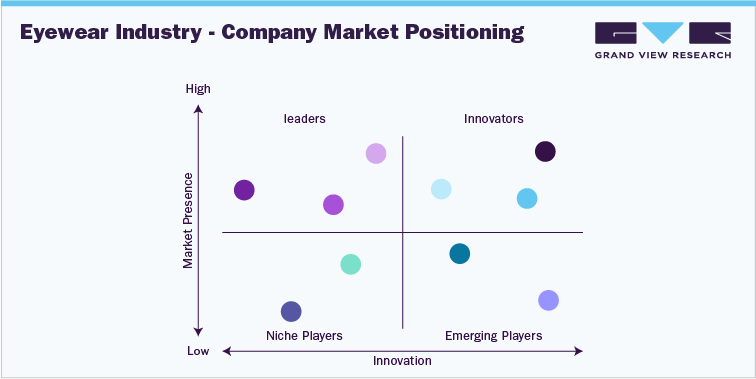

Competitive Insights

The key players in the eyewear industry, such as Bausch & Lomb Incorporated; Carl Zeiss AG; NetEase, Inc.; Johnson & Johnson Vision Care, Inc.; CooperVision; EssilorLuxottica; Alcon Vision LLC; Microsoft Corporation; Google LLC; and Amazon Inc. continuously seek various initiatives including mergers and acquisitions, strategic alliances, and new product launches. These vendors have significant eyewear industry expertise and a global strategic presence. This, in turn, has enabled these companies to defend their position in the market successfully.

For instance, In November 2022, Alcon announced the completion of its purchase of Aerie Pharmaceuticals, a clinical-stage pharmaceutical business dedicated to the research, development, and commercialization of treatments for the treatment of glaucoma and other eye illnesses. This deal strengthens Alcon's position as a major player in the ophthalmic pharmaceutical industry due to its expanding commercial product range and research and development program. The deal complements Alcon's development into the ophthalmic pharmaceutical arena, including acquisitions of exclusive U.S. commercialization rights for Simbrinza from Novartis in April 2021, Eysuvis, and Inveltys from Kala Pharmaceuticals, Inc. in May 2022. Alcon plans to incorporate Aerie into its operations completely, and the company used debt to fund the deal for a total purchase consideration of roughly $930 million.

Market Participants

-

Google LLC

-

Amzon Inc.

-

Microsoft Corportaion

-

Lenovo

-

Sony Corportaion

-

Johnson & Johnson Vision Care, Inc.

-

EssilorLuxottica

-

Carl Aeiss AG

-

CooperVision

-

Hoya Corportaion

Several market players operating in the eyewear industry have launched several new products recently. For instance, in September 2022, Ambrane India Pvt Ltd. announced the launch of Ambrane Glares, smart glasses that include an open ear speaker system, Bluetooth V5.1, and more features. Furthermore, the product is certified with UV400 UV certification. In September 2022, Johnson & Johnson Vision Care, Inc launched ACUVUE OASYS MAX 1-DAY contact lenses and ACUVUE OASYS MAX 1-Day MULTIFOCAL contact lenses for presbyopia. The new lenses have been designed to combine the OptiBlue light filter and TearStable Technology to support digitally intense lifestyles.

Key Drivers

-

Growing number of ophthalmic disorders

-

Awareness regarding eye examinations

-

Perception of eyewear as a fashion accessory

-

Growing Plano sunglasses market

-

Rapid innovations and rise in advanced technology

-

Lucrative demand for smart glasses in the healthcare sector

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified