- Home

- »

- Sector Reports

- »

-

In Vitro Diagnostics & IVD Quality Control Industry Data Book

Database Overview

Grand View Research’s In Vitro Diagnostics and IVD quality control industry data book is a collection of market sizing & forecasts insights, regulatory & technology framework, pricing intelligence, volumetric analyses, competitive benchmarking analyses, macro-environmental analyses studies. Within the purview of the database, such information is systematically analyzed and provided in the form of summary presentations and detailed outlook reports on individual areas of research. The following data points will be included in the final product offering in two reports and one sector report overview.

In Vitro Diagnostics & IVD Quality Control Industry Data Book Scope

Attributes

Details

Research Areas

- In Vitro Diagnostics (IVD) Market

- IVD Quality Control Market

Number of Reports/Deliverables in the Bundle

- 2 Individual Reports - PDF

- 2 Individual Reports - Excel

- 1 Sector Report – PPT

- 1 Data Book - Excel

Cumulative Country Coverage

50+ Countries

Cumulative Product Coverage

25+ Level 1 & 2 Products

Highlights of Datasets

- Product Revenue, by Country

- Technology Revenue, by Country

- Application Revenue, by Country

- End-use Revenue, by Country

- Volumetric Analysis, by Instruments and Consumables

- Regulatory Framework, by Country

- Competitive Analysis

- Pricing Analysis

Total Number of Tables (Excel) in the bundle

325

Total Number of Figures in the bundle

160

In Vitro Diagnostics & IVD Quality Control Industry Data Book Coverage Snapshot

Markets Covered

In Vitro Diagnostics & IVD Quality Control Industry

USD 112.79 Billion in 2021

0.2% CAGR (2022-2030)

In Vitro Diagnostics Market Size

USD 111.67 Billion in 2021

0.2% CAGR (2022-2030)

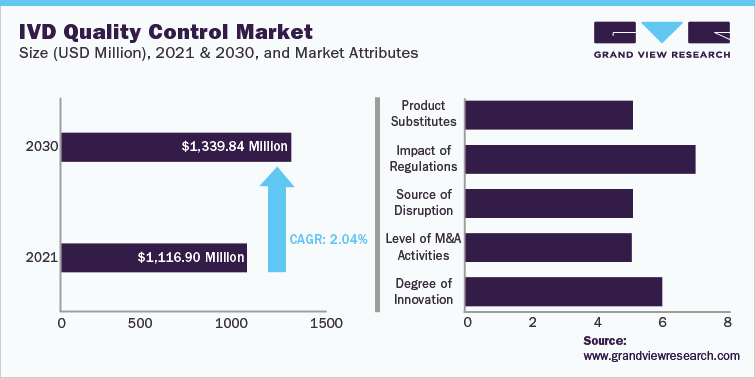

IVD Quality Control Market Size

USD 1.12 Billion in 2021

2.0% CAGR (2022-2030)

The global In Vitro Diagnostics (IVD) and IVD quality control markets combine to account for USD 112.79 billion in revenue in 2021, which is expected to reach USD 114.73 billion by 2030, growing at a cumulative rate of 0.2% over the forecast period. The combination bundle is designed to provide a holistic view of these highly dynamic market spaces.

In Vitro Diagnostics Market Analysis & Forecast

IVD renders accurate & effective results and has indispensable applications in the field of disease diagnosis. Eventually, quality control services have become requisite in accredited medical or clinical laboratories. In vitro diagnostics shows significant potential for growth driven by an aging global population that requires accurate diagnosis, increased demand for targeted cancer therapies supported by Companion Diagnostic (CDx) devices, and rising demand for infectious diseases diagnostics due to frequent viral/bacterial outbreaks such as COVID-19.

In addition, NGS-based genetic prenatal tests are becoming more common, and adoption of these tests is rising due to their low false-positive rates. Hence, FDA recently issued guidance to improve oversight of test quality, accuracy, safety, and medical benefit. Key players such as Illumina, Inc. have NGS-based prenatal screening tests that allow detection of common abnormalities like Down syndrome. Furthermore, the number of people suffering from congenital heart disease is increasing, requiring medical professionals to develop IVD tools for accurate diagnoses. According to CDC, congenital heart defects are the most common birth defects in the U.S., affecting approximately 1% of births every year.

The use and demand of Point-of-Care (PoC) tests and devices are rising owing to increased demand for rapid identification of diseases in close proximity to patients to facilitate faster decision-making. This trend is pushing manufacturers to launch small, transportable, fast, and easy-to-use instruments, making use of these instruments easier in non-laboratory settings. For instance, in July 2021, QuantuMDx announced the launch Q-POC system, which offers rapid PoC molecular diagnostics advantageous for settings, such as ICUs, clinics, and birthing centers.

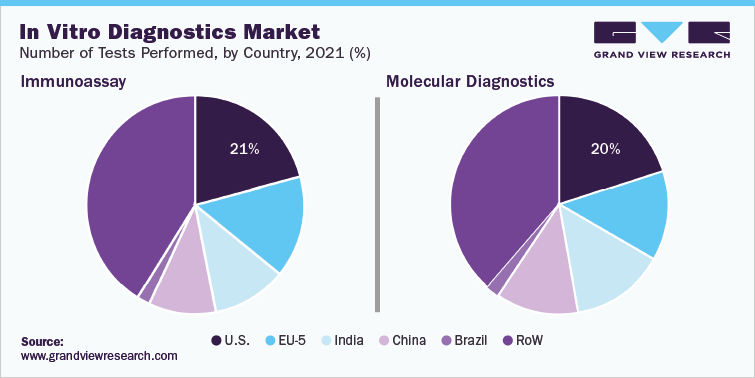

In IVD market, Molecular diagnostics technology held the largest market share over 35% in 2021, which can be attributed to the increasing adoption of high-throughput PCR technology to detect coronavirus. In April 2020, Mobidiag Ltd. received EUA for Amplidiag COVID-19 for application in clinical laboratories in Finland. EUA of the product is underway in France, Sweden, and the UK. This rapid molecular diagnostic test is designed to be used on Amplidiag Easy platform, which helps detect SARS-CoV-2 from the nasopharyngeal swabs, using automated DNA extraction and PCR technology.

Hospitals are considered the largest segment of this market in 2021 with a revenue share of more than 37% owing to the increasing collaboration of diagnostic centers with hospitals and its larger number of patient admissions. Most of the IVD devices are purchased by hospitals and are used in significant volumes. In 2022, there are over 6,093 hospitals in the U.S. that require constant aid from IVD for critical decision-making, as IVD tests provide faster and more accurate results. Companies are donating devices to hospitals to support and help them in providing quality care in the battle against the coronavirus epidemic. For instance, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. donated IVD devices with other medical devices, worth USD 3.14 million to Tongji Hospital and Union Hospital in China.

In Vitro Diagnostics Quality Control Market Analysis & Forecast

In IVD quality control, immunochemistry led the global market in 2021 and accounted for a revenue share of more than 35.00%. Key applications of the immunochemistry include detection of infectious microorganisms, such as viruses, bacteria, and fungi, by detecting the presence of their toxins and coat antigens.

IVD Quality Control Market - Key Participants

Bio-Rad Laboratories, Inc.

Abbott

Siemens Healthcare AG

Sysmex Corporation

Sero AS

Thermo Fisher Scientific, Inc.

Danaher

F. Hoffman-La Roche, Ltd.

Randox Laboratories

Ortho Clinical Diagnostics, Inc.

Quest Diagnostics

SeraCare Life Sciences, Inc.

Diagnostics laboratories are in demand owing to the increasing prevalence of diseases such as infectious diseases, cardiovascular conditions, and diabetes. To meet the industry demand, many private and public laboratories are undergoing accreditation procedures, which is creating a surge for IVD quality control measures. As of May 2022, the quality standards of 330,000 laboratories in the U.S. are regulated under the Clinical Laboratory Improvement Amendments (CLIA) by the CMS, making quality management crucial.

Regional Insights

North America dominated the in vitro diagnostics and quality control market with a share of over 40.00% in 2021 owing to the increasing number of products launches due to Emergency Use Authorization (EUA) for various COVID-19 diagnostic tests, presence of the U.S. FDA, and many accredited diagnostic laboratories coupled with strong QC regulation systems. In October 2021, Abbott received EUA from the U.S. FDA for AdviseDx SARS-CoV-2 IgM (Immunoglobulin M) lab-based serology test, which is compatible with ARCHITECT and Alinity platforms.

Asia Pacific is expected to grow at the fastest CAGR of 1.5% over the forecast period. Some of the factors attributed to its high growth are the presence of stabilizing economies, supportive government policies, rapid urbanization, a rapidly growing middle-class population across the region, and joint collaborations of research agencies. However, In Japan, Sysmex Corporation is taking initiatives to develop companion diagnostic drugs & new testing technologies for analyzing genes, proteins, disease-derived cells, and other elements in body fluids.

Competitive Landscape

F. Hoffmann-La Roche Ltd., Siemens Healthcare GmbH, and Abbott Laboratories were some of the other major competitive players in 2021. Siemens Healthcare GmbH offered its services in 17 countries, with 48 production facilities. Furthermore, acquisitions and partnerships can increase the market share held by these companies. For instance, in October 2019, Siemens Healthineers GmbH announced a 10-year strategic partnership with Dallah Health Company for providing access to the latest technologies, such as computer tomography, angiography, magnetic resonance imaging, and ultrasound equipment. Additionally, these players are large and established and hence can innovate to sustain a competitive edge. This in turn offers the leading players to capitalize on consolidation opportunities in the market.

Also, market participants are updating their range of testing options for qPCR instruments by undertaking R&D initiatives for the development of kits that target emerging diseases or by entering into agreements with other kit manufacturing companies. This includes the introduction of cobas HPV test assay in cobas 4800 by Roche Diagnostics and BD (Methicillin-resistant Staphylococcus aureus) MRSA ACP assay by Becton, Dickinson, and Company, which run on SmartCycler developed by Cepheid. The IVD market operates through different sales channels: pharmacies, satellite laboratories, hospitals, and e-commerce. Some of the key distributors of the global in vitro diagnostics market:

- Una Health Ltd.

- Diachel Diagnostics S.A.

- BHR Diagnostics Pvt. Ltd.

- MD Doctors Direct GmbH

- Axon Lab AG

- Rafer, S.L.

- CTK Biotech, Inc.

- Diagnostic BioSystems

- Scientific Equipment Company

- Stat Services Inc.

Key Drivers

- Growing number of accredited clinical laboratories

- Introduction of platforms that have gained CLIA waivers

- Rising demand for external quality assessment programs

- Rising use of third-party quality controls across the world to verify the reliability and accuracy of diagnostics tests

- Increasing demand for companion diagnostics tests to improve the targeted therapies.

- Increasing Adoption of POCT in Emerging Countries

- Growing trend of automation and modernization of hospitals and laboratories in emerging countries

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified