- Home

- »

- Sector Reports

- »

-

Industrial Gases Industry Revenue Data Book, 2023-2030

Database Overview

Grand View Research’s industrial gases sector data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with a statistics e-book.

Industrial Gases Industry Data Book Scope

Attribute

Details

Areas of Research

- Oxygen Industrial Gases Market

- Nitrogen Industrial Gases Market

- Hydrogen Industrial Gases Market

- CO2 Industrial Gases Market

- Acetylene Industrial Gases Market

- Argon Industrial Gases Market

- Others Industrial Gases Market

Number of Reports/Presentations Covered in the buddle

1 Sector Outlook Report + 7 Summary Presentations for Individual Areas of Research + 1 Statistic Book

Cumulative Coverage of Countries

50+ Countries

Cumulative Coverage of Products

6 Product Categories

Highlights of Datasets

- Production Data, by Country

- Trade Data, by Country

- Demand/Consumption, by Country

- Statistic e-book

- Competitive Analysis

Industrial Gases Industry Data Book Coverage Snapshot

Markets Covered

Industrial Gases Industry

1,600,924.6 million SCF in 2022

6.1% CAGR (2023-2030)

Oxygen Industrial Gases Market

644,075.3 million SCF in 2022

6.3% CAGR (2023-2030)

Nitrogen Industrial Gases Market

436,775.5 million SCF in 2022

6.8% CAGR (2023-2030)

Hydrogen Industrial Gases Market

251,958.6 million SCF in 2022

6.0% CAGR (2023-2030)

CO2 Industrial Gases Market

71,185.4 million SCF in 2022

5.1% CAGR (2023-2030)

Acetylene Industrial Gases Market

29,322.4 million SCF in 2022

4.1% CAGR (2023-2030)

Argon Industrial Gases Market

117,330.4 million SCF in 2022

4.4% CAGR (2023-2030)

Others Industrial Gases Market

48,830.9 million SCF in 2022

5.5% CAGR (2023-2030)

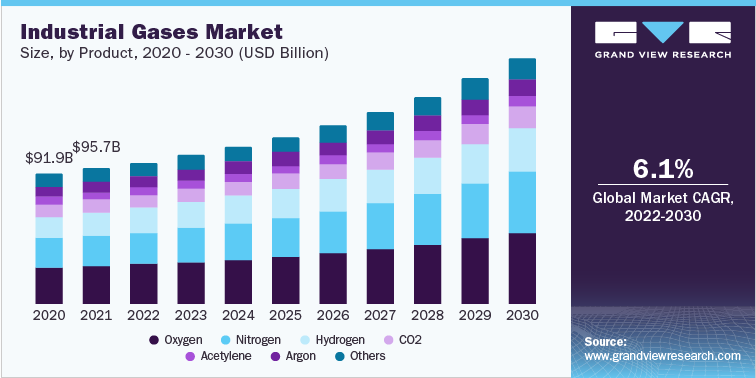

The economic value generated by the industrial gas market was estimated at approximately USD 99.9 billion in 2022. This economic output is an amalgamation of industrial gas products including nitrogen, hydrogen, carbon dioxide, oxygen, argon, and acetylene.

Global industrial gases market’s growth is driven by increasing consumption of industrial gases in a wide range of end-use industries such as steel, cement, water treatment, automotive, food & beverages, plastics and rubbers, medical, and others. Increasing industrialization in the growing economies of the world is expected to the driving force behind the growing consumption of industrial gases.

Several initiatives have taken place for the development of the market in 2021 and 2022, which is anticipated to further escalate the growth in the forthcoming years. For instance, in October 2022, American oil & gas giant Air Liquide has announced to build three industrial gas production plants to serve large semiconductor manufacturers across the globe. For this, Air Liquide entered into a joint venture with Far Eastern Group and is estimated to invest over USD 530 million in this development strategy, according to Francois Abrial, member of Air Liquide executive committee of Asia Pacific. This is a triggering factor for the growth of industrial gases market.

The Asia Pacific industrial gas market is anticipated to account a substantial growth owing to the rapid industrialization in countries like India and China. For instance, in October 2022, Air Water India Private Limited revealed its plan to construct a new plant to produce a wide range of liquefied gases that comprises liquefied argon, liquefied nitrogen, and liquefied oxygen with a production capacity of 200N ㎥/h, 1,600N ㎥/h, and 5,100N ㎥/h respectively. The officials of the company further stated that they are expecting to commence the construction by October 2023, and operations will start in the year 2024.

Industrial gases are widely utilized in the manufacturing industry and play a key part in a range of manufacturing application. Argon is widely utilized in applications such as glass manufacturing and welding and casting, and automotive. Acetylene presents wide application in welding, automotive, and portable light manufacturing. Similarly, carbon dioxide is utilized in welding, fire suppression, and electronic product manufacturing. The growing application of industrial gases across a wide variety of industries is likely to propel the market growth over the forthcoming years.

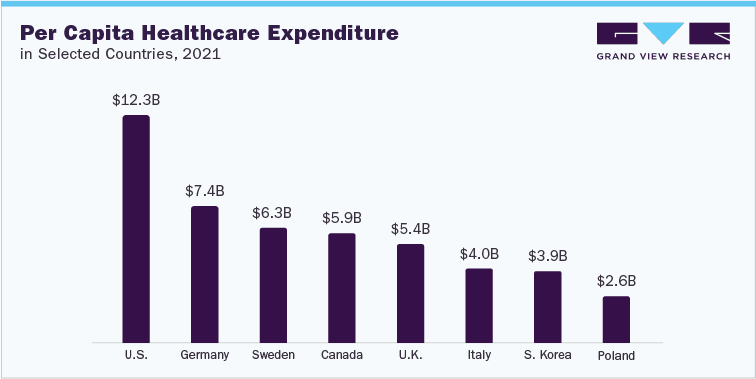

Healthcare sector is a key consumer of industrial gases, especially oxygen. The outbreak of Covid-19 has spurred the demand for oxygen cylinders owing to the massive health crisis during the pandemic. The majority of casualties were reported to be caused by low oxygen availability. India was one of the adversely affected countries and became an epicenter of COVID-19 in 2021. This factor drove India to stock up on its oxygen supplies and gear up for any upcoming oxygen emergency. The central government of India has funded for 1,222 pressure swing adsorption (PSA) plant, which is estimated to produce 1,750 metric tons of oxygen on a daily basis. In addition, in 2021, Saudi Arabia shipped 80 metric tons of liquid oxygen to India to fight coronavirus.

Industrial gases are heavily utilized in the food & beverages industry for application such as packing, freezing, chilling, and grinding. Nitrogen is used for food packaging to preserve the integrity, freshness, and quality of packaged food. The growing population and rapid increase in urbanization have accelerated the demand for packaged food, owing to its easy accessibility. The working class population heavily depends on packaged food owing to no cooking efforts involved in it. Growing consumption of packaged food & beverages is anticipated to fuel the demand for industrial gases over the projected years.

The market is highly scrutinized by government agencies owing to its negative effects on humans, animals, and the environment. There are a large number of industrial gases including carbon monoxide, carbon dioxide, hydrogen fluoride, and others, which are toxic in nature and can have an adverse effect on humans and the environment. Inhaling such gases may lead to chronic illness, fatigue, nausea, eye irritation, and others. Exposure to these gases can also lead to death in extreme cases. Therefore, the concerned government bodies in different countries have imposed several laws and regulations regarding the manufacturing, distribution, and usage of industrial gases.

Regulatory Body/Agency

Impact on the Industrial Gases Market

Bureau of Land Management (BLM) Oil and Gas page

BLM regulates federal onshore lands. Their website on the government's oil and gas program contains lease sale information, forms, statistics, and enforcement guidelines.

Bureau of Ocean Energy Management (BOEM)

Formally the Minerals Management Service along with BSEE, BOEM is responsible for providing leases for exploring federal offshore lands. It is divided into four regions: Alaska, the Atlantic, the Gulf of Mexico, and the Pacific. Its official website contains regulations, governing statutes, and GIS data.

Bureau of Safety and Environmental Enforcement (BSEE)

Formally the Minerals Management Service along with BOEM, BSEE is responsible for enforcing safety and environmental regulations of offshore oil and gas resources. In addition to their safety bulletin, their website has a data center, planning and preparedness information, and incident statistics.

Environmental Protection Agency (EPA)

The EPA is responsible for the regulation of the emission of industrial gases.

Federal Energy Regulatory Commission (FERC)

Federal Energy Regulatory Commission regulates pipeline rates to encourage maximum use and regulates interstate transportation practices of oil and gas companies.

Pipeline and Hazardous Materials Safety Administration (PHMSA)

PHMSA assesses the safety and performance of pipelines. Their website includes data on incidents, information on regulations and permits, and research on pipeline safety. The office is organizationally a part of the Department of Transportation

U.S. Department of Energy

The Department of Energy manages the United States' nuclear infrastructure and administers the country's energy policy. The Department of Energy also funds scientific research in the field. It is the parent agency of the Energy Information Agency and the Office of Fossil Energy

Industrial Emissions Directive (IED)

The framework aims to accompany the green and circular transformation of the industry over the long term, with significant health and environmental benefits

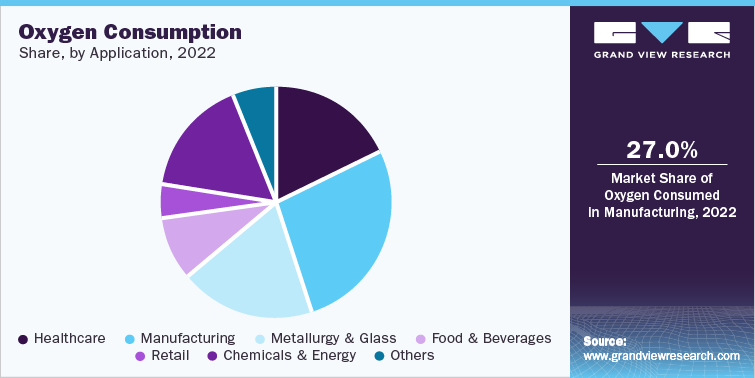

Oxygen Market Analysis And Forecast

Oxygen is the second largest component of the atmosphere, comprising around 21% volume. Although oxygen is utilized by living beings on Earth, it has applications across different end-use industries. Oxygen is usually available in the gaseous form, but for storage and transportation purposes, it is generally liquefied for ease of handling. Oxygen finds application in various end-use industries including automotive & transportation equipment, aerospace & aircraft, chemicals, glass, healthcare, energy, metal production, pulp & paper, refining, water & wastewater treatment, pharmaceutical & biotechnology, and welding & metal fabrication. Oxygen finds wide application in the metal industries in combination with acetylene and other fuel gases for scarfing, metal cutting, hardening, welding cleaning, and melting. Oxygen or oxygen-enriched air is extensively used in the iron and steel manufacturing process.

Manufacturing application accounted for the largest market share in 2022 and is projected to grow at second highest CAGR during the forecast period. The demand for oxygen in the manufacturing industry is projected to witness substantial growth in the developing economies owing to the growing manufacturing industry such as electronics, transportation, food, and chemicals in India, China, Brazil, and South Korea. The growing demand for advanced industrial gas- in the electronic industry, is expected to further propel the growth of this segment. Oxygen is used on a large scale in the electronic industry. The growing electronic industry is expected to drive the demand for oxygen. Moreover, owing to the recent outbreak of the pandemic, people around the world are practicing new ways of studying, working, and communicating through videoconferencing and other technologies. This recent trend is expected to have a lasting impact on semiconductor demand and open new possibilities for existing products and services thus driving the demand.

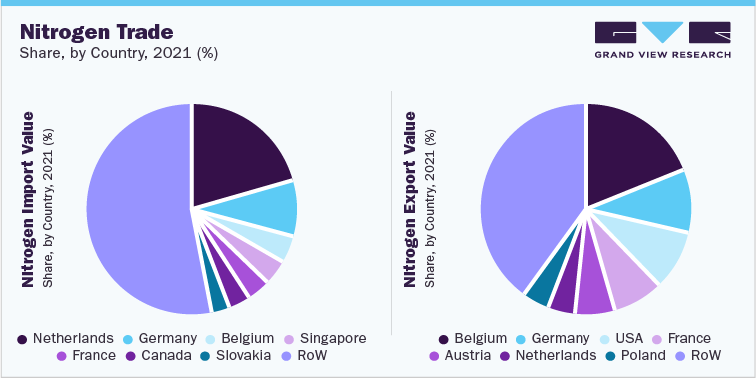

Nitrogen Market Analysis And Forecast

Nitrogen is a highly demanded industrial gas owing to its rising consumption in applications like food & beverages, light bulb manufacturing, fire suppression system, steel manufacturing, aircraft fuel system, chemical manufacturing, and others. The growing automotive and chemicals industry in the developing economies of the world is fueling the demand for nitrogen. In January 2023, Atlas Copco Industrial Assembly Solutions announced that it has installed a nitrogen generation system with the intention to serve the global automotive industry.

Plastic manufacturers are highly dependent on nitrogen supplies due to their high usage in the manufacturing process. Plastic manufacturers mainly use nitrogen in gas-assisted injection molding projects. The gas-assisted process is widely used in the production of large plastic parts. According to the Plastic Industry Association, plastic production in the U.S. reportedly increased by 5.7% in February 2022 as compared to February 2021.

In addition, the total plastic and rubber shipment was reported USD 22.1 billion in the year 2022 in the U.S. Growing demand for plastics is majorly driven by rising consumption of consumer goods, electronic products, motor vehicles, and a range of other products. Growing consumption of plastics and rubber from end-use industries such as consumer goods, automotive, and others is expected to bolster the demand for nitrogen over the foreseeable future.

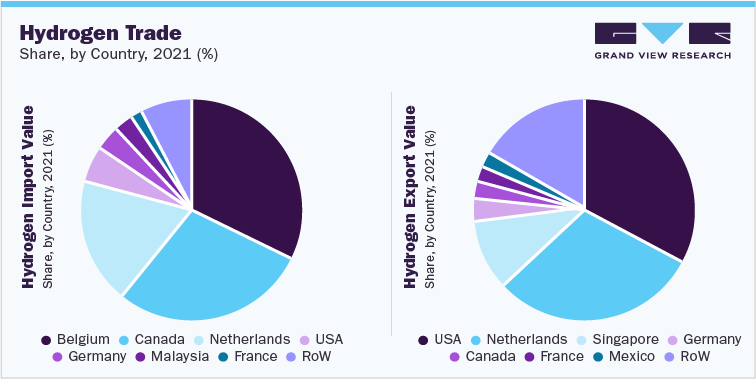

Hydrogen Market Analysis And Forecast

Hydrogen gas is mainly utilized for welding purposes in industrial operations. Hydrogen helps enhance stability in plasma welding and cutting activities in various welding processes. Hydrogen can also be mixed with argon to provide a gas shield to protect the welded metal from corrosion and contamination. In addition, hydrogen plays a key role in metal fabrication to secure metal products from oxidation during heat treatment. Another major application of hydrogen is in glass manufacturing. Hydrogen is used in combination with other gases to secure glass from oxidation during glass production.

Growing welding processes in fabrication industry is expected to escalate the demand for hydrogen gas. The welding process primarily involves tungsten inert gas welding, metal inert gas welding, and brazing. The growing usage of metal in the automotive industry has spurred its demand over the past few years. In addition, the growing aerospace industry has propelled the usage of metal in aircraft production. The demand for automobiles is likely to skyrocket owing to the growing usage of automatic and electric vehicles. Rising individual disposable income coupled with a huge range of options in passenger cars at low prices has fueled the demand for vehicles across the globe. The rising purchase of automobiles is anticipated to fuel the demand for metal products, in turn, will positively influence the hydrogen gas market.

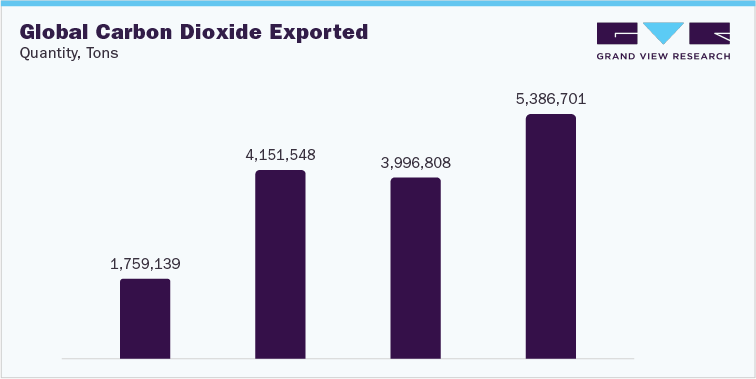

Carbon Dioxide Market Analysis And Forecast

Carbon dioxide is pivotal to the welding process of metal in metal fabrication plants. Carbon dioxide is utilized as a shield to help produce high welding rates in metal inert gas and metal arc welding processes. Welders often prefer carbon dioxide in their welding operations owing to its low prices and deep weld penetration, even through thick metals. Furthermore, carbon dioxide is a prominent fire suppressor due to its properties of displacing oxygen in the environment, which helps suppress the spread of fire. Carbon dioxide presents a low risk of water damage and requires very little clean-up.

The growing usage of metal in the automotive and aerospace industry is anticipated to drive demand for carbon dioxide over the projected years. The demand for automobiles surged during the period of Covid-19 owing to safety concerns regarding public transport. Shut down of public transport due to prolonged lockdown during the year 2020-21, compelled people to consider purchasing passenger cars for commuting purposes, and that also provided safety from Covid-19 infection. This factor triggered the demand for automobiles in countries like China, India, and the U.S. This factor is likely to bolster the demand for metal welding, as a result, will positively impact the carbon dioxide market over the forthcoming years.

Growing risk of fire in public places such as theaters, offices, big halls, and others has fueled the demand for fire suppressors. Rapid construction of residential and official buildings in urban as well as rural areas is fueling the demand for fire suppressors across the globe. Carbon dioxide is a prominent suppressor of oxygen, which prevents fire from spreading. Growing safety concerns from fire in public places are anticipated to drive demand for carbon dioxide over many years to come.

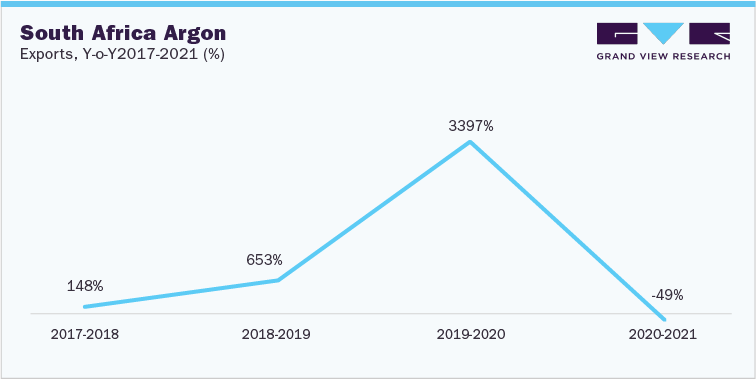

Argon Market Analysis And Forecast

Argon gas is extensively used in automotive assembly plants to weld seats, suspensions, axles, and exhaust system. Argon gas presents high application in welding and casting. Argon is categorized as a nonreactive gas, which makes it an ideal shield gas. In addition, argon is heavily utilized for glass manufacturing owing to its application in filling thermal holes in windowpanes. The rising usage of glass in a range of industries such as consumer goods, electronics, construction, and others has been driving demand for argon gas during the past many years. In addition, the growing usage of personal vehicles for commuting and traveling purposes is expected to further elevate the demand for argon gas over the future years.

Growing personal vehicle purchase on the account of rising population coupled with growing individual disposable income in growing economies such as China, India, Brazil, U.S. and others is anticipated to positively impact argon gas market over the forthcoming years. National Association of Motor Vehicle Manufacturers in Brazil stated that the country’s automotive industry produced 152,666 units of vehicles in January 2023, which was an increase of around 5.0% from January 2022. The production included 125,060 passenger cars, 22,775 commercial vehicles, 4,049 trucks, and 782 buses. In addition, U.S.-based J.D. Power and LMC Automotive revealed that 1,013,700 units of passenger cars were estimated to be sold through retail business by the end of the year 2022 in the U.S. This factor is likely to propel the demand for argon over the projected years.

Acetylene Market Analysis And Forecast

Acetylene gas plays a key role in welding and cutting processes. The acetylene welding process is widely known as cutting coal or cutting oxy-fuel. Acetylene is highly used for cutting and welding metal materials that require temperature of up to 3,500° C. Acetylene is highly flammable gas that is extensively used for cutting torches in metal welding processes. Oxy-fuel cutting is an effective method for soldering metal rods to base metal and melting steel and iron. Furthermore, acetylene is used as a carbon source for carburizing processes by the automotive industry. The growing automotive industry driven by the rapid increase in urbanization has spurred the usage of acetylene gas. Acetylene is also used for the manufacturing of portable lights. The rising power cut issue, predominantly in rural areas, is likely to escalate the demand for portable lights, in turn, will excel the consumption of acetylene over the forthcoming years.

Competitive Insights

The global industrial gas market is highly competitive due to presence of a large number of well small scale and large-scale manufacturers and suppliers of industrial gases. The small-scale companies majorly focus on stable pricing, regular supply, and product quality to serve the best to its clients. Whereas the large-scale companies regularly invest time and money on research and development activities for innovation and new product development related to industrial gases. Large-scale companies also focus on building a strong supply chain for the seamless distribution of industrial gases to their customers.

Global as well as regional players are striving to strengthen their sales channels to maintain a stable supply of industrial gas products to its consumers. The growing usage of industrial gases from a wide range of industries is also creating a competitive environment for industrial gas producers. Large players cater to the maximum share of the industrial gas market, while small players are also focusing on innovation and better product and service quality to capture a greater market share.

Company

Production Capacities

Air Liquide

Low Carbon Hydrogen (Becancour, Quebec -8.2 tonnes/day

Oxygen (Uttar Pradesh, Northern India) - 350 tonnes/day

Linde Plc

Liquid Oxygen, Nitrogen And Argon (Delaware Valley) - 1,200 tons/day

INOX-Air Products Inc.

Industrial Gases - 7900 metric tons/day, including 6,000 Tons of Oxygen and 1,900 Tons of Nitrogen (Hazira, Gujarat, India)

Messer Group GmbH

Oxygen, Nitrogen, And Argon - 2,400 tons per day (Vila-Seca, Spain)

SOL Group

CO2 Recovery - 65,000 tonnes of product per year (Wanze, Belgium)

Matheson Tri-Gas

Hydrogen - 285 tonnes/day Numaligarh, Assam

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified