- Home

- »

- Sector Reports

- »

-

Material Handling Robots Industry Data Book, 2023-2030

Database Overview

Grand View Research’s material handling robots’ industry data book is a collection of market sizing information & forecasts, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

The following data points will be included in the final product offering in 3 reports and one sector report overview:

Material Handling Robots Industry Data Book Scope

Attribute

Details

Research Areas

- Automated Guided Vehicles Market

- Autonomous Mobile Robot Market

- Collaborative Robots Market

Number of Reports/Deliverables in the Bundle

- 3 Individual Reports-PDF

- 3 Individual Reports-Excel

- 1 Sector Report-PPT

- 1 Databook-Excel

Cumulative Country Coverage

28+ countries coverage

Cumulative Product Coverage

70+ Level 1 & 2 Products

Highlights of Datasets

- Vehicle Type Revenue, by Country

- Navigation Technology Revenue, by Country

- Application Revenue, by Country

- Component Revenue, by Country

- Vertical Revenue, by Country

- Battery Type Revenue, by Country

- Type Revenue, by Country

- Payload Capacity Revenue, by Country

- Competitive Analysis

Total number of Tables (Excel) in the bundle

370

Total number of figures in the bundle

50

Material Handling Robots Industry Data Book Coverage Snapshot

Markets Covered

Material Handling Robots Industry

USD 7.34 billion in 2021

17.4% CAGR (2022 - 2030)

Automated Guided Vehicles (AGV) Market Size

USD 3.81 billion in 2021

10.2% CAGR (2022 - 2030)

Autonomous Mobile Robot (AMR) Market Size

USD 2.52 billion in 2021

16.8% CAGR (2022 - 2030)

Collaborative Robots (cobots) Market Size

USD 1.01 billion in 2021

31.5% CAGR (2022 - 2030)

The global AGV, AMR, and cobots markets combine to account for USD 7.34 billion in revenue in 2021, which is expected to reach USD 31.07 billion by 2030, growing at a cumulative rate of 17.4% over the forecast period. The combination bundle is designed to provide a holistic view of these highly dynamic market spaces.

Automated Guided Vehicles Market Analysis & Forecast

The global automated guided vehicle market size was valued at USD 3.81 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.2% from 2022 to 2030. AGVs are widely utilized because of their numerous advantages, including lower labour costs, less product damage, higher production, and scale to support automation processes. These significant benefits motivate logistics and transportation companies to implement AGVs to increase their operations' effectiveness. As an illustration, AUDI AG announced in May 2021 that they employ AGVs at their manufacturing facilities to assist them in planning the production process by letting them know which component is out of stock and needs to be available. Additionally, it aids in transporting supplies in trolleys, which helps them retain safety.

Using automated guided vehicles (AGVs) to handle materials has become increasingly popular due to their effectiveness and dependability. These material handling techniques lessen physical harm to commodities while increasing operational effectiveness. Automated material handling is increasingly in demand due to the general requirement for high efficiency in the automotive, healthcare, e-commerce, and food and beverage sectors. Big data and machine learning have enabled industries to connect manufacturing, which has improved industry automation. Automating industrial facilities with AGVs can help them satisfy demands for increased material handling capacity and faster output.

Many businesses experienced losses due to a production gap brought on by statewide laws. As a result of the COVID-19 impact, the industrial industry saw a significant decline in earnings and income. The World Health Organization (WHO) has reported that the worst-affected nations by the COVID-19 outbreak include the United States, Spain, Italy, France, Germany, the United Kingdom, Russia, Turkey, Brazil, Iran, and China. The crisis hampered worldwide industries, and the international economy is now experiencing a downturn. There has been a significant decline in manufacturing activity due to business activities. SMEs were most negatively impacted by substantial layoffs, financial challenges, and attrition. However, the market is growing due to widespread vaccination in developed countries.

AGVs make it possible to provide raw materials just-in-time (JIT), computerize the control of received assembled parts, and track dispatched goods. AGVs and automation are quickly adopted by the automobile sectors, notably on their manufacturing floors. For instance, in March 2020, the SEAT factory in Martorell, Spain, transformed into a digital and intelligent factory, employing AGVs with 4G connectivity, SLAM navigation, and induction battery charging. AGVs deliver parts inside assembly workshops at Martorell and Barcelona, and eight AGVs deliver parts outside. Therefore, increased use of automated guided vehicles is anticipated throughout the forecast period due to the growing demand for automation in material handling across industries.

Autonomous Mobile Robot Market Analysis & Forecast

The global autonomous mobile robot market size was valued at USD 2.52 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 16.8% from 2022 to 2030. The growth can be attributed to several advantages, including their ability to stop product damage, lower labor costs, increase productivity, and automated procedures. AMR adoption is already paying off for incumbents in several industries and industrial verticals, including logistics, automotive, and food & drinks. AMR choose, move, and organize goods in production and distribution facilities without human assistance. With their vision cameras, onboard sensors, and facility map, AMRs can move raw materials and produced items within the facility with the help of Warehouse Execution Software (WES).

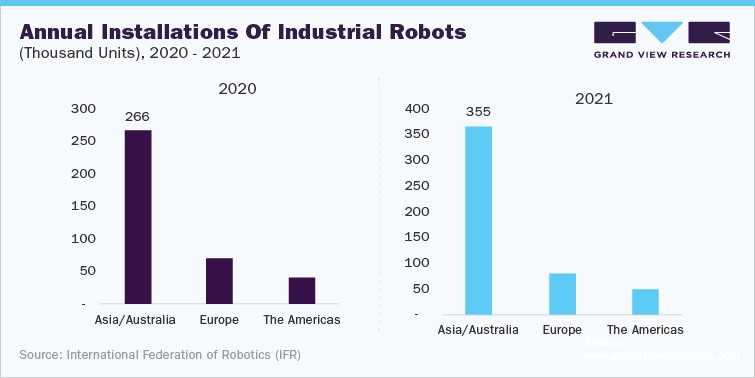

Country Ranking Analysis - Annual Installations of Industrial Robots, 2020

Country

Rank

China

1st

Japan

2nd

U.S.

3rd

South Korea

4th

Germany

5th

Italy

6th

Chinese Taipei

7th

France

8th

Singapore

9th

Spain

10th

Mexico

11th

India

12th

Thailand

13th

Canada

14th

U.K.

15th

The above table indicates the ranking analysis for the annual installations of industrial robots per country in the year 2020. Even though the Covid-19 pandemic severely impacted the Japanese economy, Japan is expected to be the second largest market after China. Industrial mobile robots programmed to complete tasks with little to no human contact are among the emerging technologies, including autonomous mobile robots. They can range from selecting vehicles with comprehensive data-collecting capabilities to robotic process automation due to their superior mobility, small size, diversified ability, and agility. Additionally, autonomous mobile robots have more advanced sensors and actuators than people do. These elements support the use of mobile autonomous robots across various industries, including transportation, medicine, agriculture, and others. For instance, Mobile Industrial Robots (MIR), one of the market leaders in autonomous mobile robots, reported a 55% rise in sales for Q1 2021 compared to the same period the previous year in April 2021. The MIR250, MIR's newest and most portable AMR, saw significant sales in Q1 and numerous orders from multinational businesses.

In addition to manufacturing, warehouses, hospitals, terminals, and cross-dock, autonomous mobile robots are employed in intra-logistics. They can function autonomously in changing environments thanks to their advanced technology and control software, as opposed to automated guided vehicle systems, where dispatching, routing, and scheduling decisions are made centrally for all automated guided vehicles (AGVs). AMRS can independently communicate with other resources, including machines and systems, enabling a decentralized approach to decision-making. Due to this, numerous firms deployed mobile, autonomous robots to boost facility production and efficiency. For instance, in January 2022, DHL Supply Chain and Boston Dynamics collaborated. As part of the multi-year deal, Stretch, the newest robot from Boston Dynamics created exclusively to automate the unloading process at distribution centres to increase productivity, will be installed in DHL facilities.

Collaborative Robots Market Analysis & Forecast

The global collaborative robots market size was valued at USD 1.01 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 31.5%, from 2022 to 2030. The adoption of cobots, by Small and Medium Enterprises, is one factor contributing to the expansion (of SMEs). Businesses are investing more and more in cobots to connect with people in a shared office and automate production procedures. Technological developments and the use of Machine Learning (ML) technologies and Artificial Intelligence (AI) in industrial robots have furthered the expansion. Additionally, the introduction of 5G technology is anticipated to encourage the use of cobots in the industrial industry. One notable example of such advances is the launch of an industrial grade 5G wireless network by the Nokia Corporation to satisfy Industry 4.0 standards. The 5G wireless solution's low-latency connectivity will improve manufacturing process productivity, quality, and efficiency.

As a crucial market in the APAC region, China was adversely affected by the COVID-19 pandemic in 2020. ABB and FANUC, two industry leaders with headquarters in APAC and Europe, respectively, have yet to experience a significant decline in sales in 2020. The COVID-19 epidemic hindered and slowed the adoption of collaborative robots in several essential industries, including metals and machining, electrical and electronics, and automotive. Additionally, a series of lockdowns has impacted all industries' supply chain ecosystems. A sharp reduction is also observed in the general manufacturing and automobile industries, where robotics solutions are essential.

Cobots offer a higher return on investment than other types of conventional industrial robots. In contrast, the cost of installing the extra hardware for regular industrial robots is higher than the cost of the robot itself. In addition, the cost of deploying collaborative robots' additional hardware is higher than the cost of this type of robot. As a result, standard industrial bots are more expensive overall than cobots, including any other hardware or components. Cobots, therefore, have a higher return on investment than conventional industrial robots because they need a controller, an indicator, and a vision system. Cobots are also becoming less expensive, more user-friendly, and more complex training tools. In addition to giving businesses more options, this will help all sizes and scales of sectors remain competitive as they use the most current sensors, plug-and-play gadgets, and automated robot programming using CAD data.

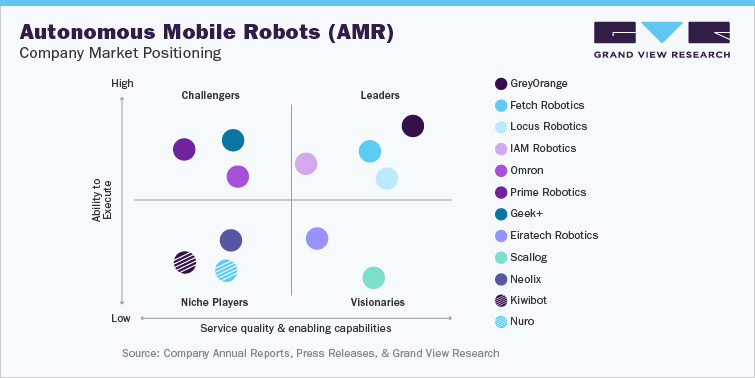

Competitive Insights

The key market players in the Material Handling Equipment markets, such as ABB, Bleum, Clearpath Robotics, GreyOrange, Inc., Harvest Automation, inVia Robotics, Boston Dynamics, IAM Robotics, Inc., KUKA AG, and Teradyne Inc., are continuously seeking various initiatives such as strategic alliances, mergers and acquisitions, and new development launches. These vendors bear expertise in the Material Handling Equipment industry and have strategic footprints across various parts of the world. Hence, these companies have successfully defended their position in the market.

This section in the final deliverables also highlights various strategic initiatives taken by the key companies in the recent past that strongly impact this market space. The market has witnessed several new product launches in recent years. For instance, In May 2022, ABB launched material-handling robots for electric vehicle battery production. With its improved speed, precision, and robust construction, the robot can increase productivity and performance with higher uptime. In October 2022, Vecna Robotics announced hardware upgrades and a significant software release for the AFL-class autonomous forklift it provides. By optimizing material transport between other machinery and equipment on warehouse and factory floors, the new capabilities expand the company's reach.

Key Drivers

-

Increasing Demand for Automation and Material Handling Equipment in Various Process

-

The emergence of artificial intelligence technology in autonomous mobile robots

-

Increased safety in high-risk workplace

-

High adoption of robots in manufacturing and warehouse logistics operations

-

Higher return on investment (RoI) and lower price of collaborative robots

-

Growing opportunities for robot installations in various industry verticals across the globe

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified