- Home

- »

- Sector Reports

- »

-

Neurodegenerative Disease Therapeutics Industry Data Book

Database Overview

Grand View Research’s neurodegenerative disease therapeutics industry data book is a collection of market sizing & forecasts insights, regulatory & technology framework, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses studies. Within the purview of the database, such information is systematically analyzed and provided in the form of summary presentations and detailed outlook reports on individual areas of research.The following data points will be included in the final product offering in two reports and one sector report overview.

Neurodegenerative Disease Therapeutics Industry Data Book Scope

Attributes

Details

Research Areas

- Parkinson’s Disease Treatment Market

- Alzheimer's Therapeutics Market

Details of the Product

- 2 Individual Reports - 2 PDFs

- 2 Individual Reports - Excel

- 1 Sector Report - PPT

- 1 Data book - Excel

Cumulative Country Coverage

25+ Countries

Cumulative Product Coverage

25+ Level 1 +Level 2

Highlights of Product

- Drug Class Revenue, by Country

- Distribution Channel Revenue, by County

- Competitive Landscape

- Regulatory Framwork, by County

- Pricing Analysis

Total number of tables (Excel) in the bundle

183+

Total number of figures in the bundle

160+

Neurodegenerative Disease Therapeutics Industry Data Book Coverage Snapshot

Markets Covered

Neurodegenerative Disease Therapeutics Industry

USD 8.33 billion in 2021

15.6% CAGR (2022-2030)

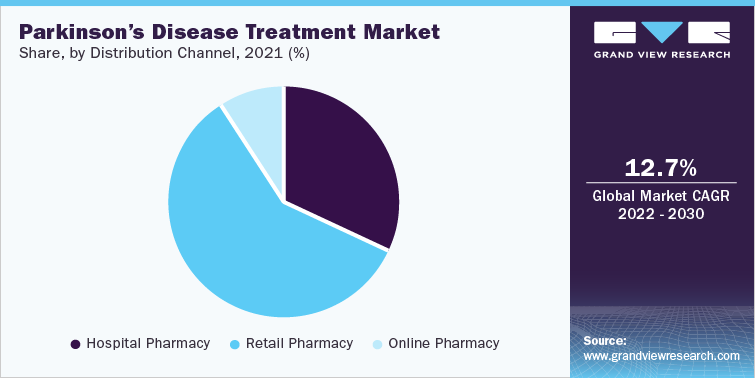

Parkinson’s Disease Treatment Market Size

USD 4.29 billion in 2021

12.7% CAGR (2022-2030)

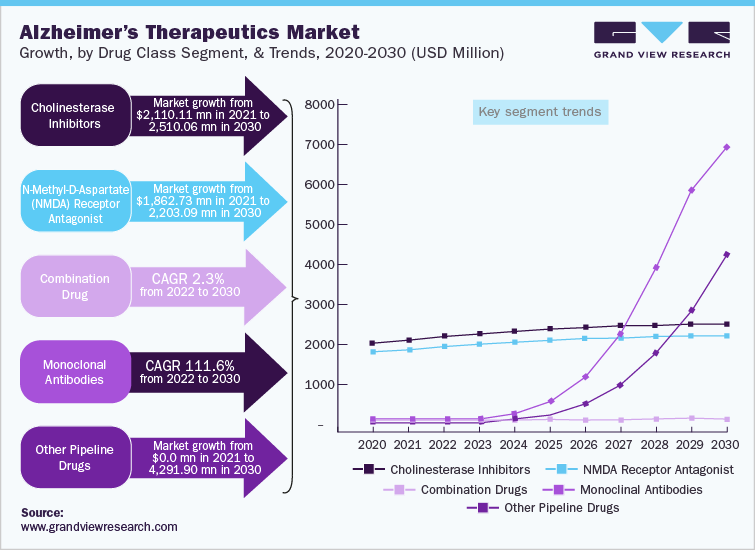

Alzheimer’s Therapeutics Market Size

USD 4.04 billion in 2021

18.3% CAGR (2022-2030)

The global neurodegenerative disease markets combine to account for USD 8.33 billion revenue in 2021, which is expected to reach USD 28.15 billion by 2030, growing at a cumulative rate of 15.6% over the forecast period. The combination bundle is designed to provide a holistic view of these highly dynamic market spaces.

Parkinson’s Disease Treatment Market Analysis & Forecast

The global Parkinson’s disease treatment market was valued at USD 4.29 billion in 2021 and is anticipated to witness growth at a rate of 12.7% over the forecast period. Parkinson’s disease is the most common neurodegenerative disease after Alzheimer’s disease. It is a progressive brain disorder that leads to stiffness, shaking, and difficulty in balance, walking and co-ordination. This is caused by the loss of nerve cells of the substantia nigra region of the brain, which are responsible for producing dopamine. There are five stages of Parkinson’s disorder and can affect an individual’s facial expressions, as well as hand & leg movements, which worsens with age. According to the Parkinson’s Foundation, around 60,000 people are diagnosed with Parkinson’s disease each year in the U.S. and over 930,000 people were living with Parkinson’s disease as of 2020.

The current management of Parkinson’s disease includes dopaminergic drugs such as levodopa, which forms the first-line treatment. Levodopa is also given in combination with carbidopa. Dopamine agonists (rotigotine [Neupro, given as a patch], pramipexole [Mirapex], ropinirole [Requip]) are also given as first-line treatment in some patients. MAO-B inhibitors (selegiline [Zelapar], safinamide [Xadago]), rasagiline [Azilect], and COMT inhibitors (Entacapone [Comtan], opicapone [Ongentys], Tolcapone [Tasmar, rarely prescribed due to liver side-effects]) are added as second-line therapy. However, the currently approved drugs are only effective in managing the motor symptoms of the disease. There is a clear unmet need for disease-modifying agents.

Upcoming therapies for Parkinson’s disease mostly include products that are novel delivery formulations of the currently approved products levodopa/carbidopa. For instance, AbbVie’s ABBV-951, which is a subcutaneous delivered LD/CD and IPX203 from Amneal Pharmaceuticals, which is an extended-release formulation of carbidopa-levodopa. In 2019, Acorda Therapeutics, Inc. also launched Inbrija, which is an inhaled form of Levodopa. Gene therapy is also being evaluated for Parkinson’s disease. For instance, in May 2022, Prevail Therapeutics received approval for its investigational new drug for PR001 candidate for Phase I/II clinical trials in patients with PD. Successful completion of the trial and their expected approvals are expected to boost market growth over the forecast period.

Carbidopa-levodopa dominated the drug class segment with a revenue share of more than 25.00% in 2021 attributed to the high prescription rate of these drugs. According to the U.S. Drug Use Statistics, 527,530 prescriptions were prescribed to 183,690 Parkinson’s patients in 2020 for Carbidopa-Levodopa. Levodopa and Carbidopa are a combination of medicines that treat PD symptoms. It is the highly used and most potent medication for PD as a second line of treatment and is primarily available in oral route of administration, such as in the form of controlled-release tablets, immediate-release tablets, extended-release capsules, and enteral suspension.

Alzheimer's Therapeutics Market Analysis & Forecast

The global Alzheimer’s therapeutics market was valued at USD 4.04 billion in 2021 and is anticipated to witness growth at a rate of 18.3% over the forecast period. The market is mostly saturated due to the availability of outdated symptom management therapies. However, pharmaceutical and biotechnology companies are engaged in the development of novel disease-modifying and preventive therapies, which may increase the competition in the market.

Companies are adopting strategies including mergers & acquisitions and strategic alliances to gain competitive advantage. For instance, in November 2021, Supernus Pharmaceuticals, Inc. completed the acquisition of Adamas Pharmaceuticals, Inc. to strengthen its portfolio with the addition of these products (Namzaric and Namenda XR). Moreover, the entry of new players is posing a threat to existing players, thereby maintaining industry rivalry at a higher level.

Key players are focusing on new therapies to prevent, slow the decline, defer, or improve the symptoms of Alzheimer’s disease. Globally, there are more than 200 drug candidates in the current Alzheimer’s disease treatment pipeline. Many drugs in development aim to interrupt the disease process by impacting the changes in the brain associated with Alzheimer’s disease. These changes offer potential targets for novel drugs to slow down the progression of Alzheimer’s disease.

Companies such as Biogen; AbbVie, Inc.; AC Immune SA; Novartis AG; TauRx Pharmaceutical Ltd., and Eli Lilly & Company are highly active in the development of novel therapies for the treatment of Alzheimer’s disease. Most of these companies have candidate drugs in Phase lll and Phase ll, which may be launched over the forecast period. The most promising drug candidate for Alzheimer’s treatment is F. Hoffmann-La Roche Ltd’s gantenerumab. It is an investigational drug developed by Novartis AG, which is under clinical trial phase III to treat patients suffering from early Alzheimer’s disease. Recently, in October 2021, U.S. FDA granted a breakthrough designation to gantenerumab developed by F. Hoffmann-La Roche Ltd. for the treatment of patients with Alzheimer’s disease. The expected launch of the product may contribute to market growth.

The cholinesterase inhibitors segment held the largest share in the Alzheimer’s therapeutics market in 2021 and it is expected to maintain its dominance throughout the forecast period. Cholinesterase inhibitors are mainly prescribed as first-line treatments to patients with mild to moderate Alzheimer’s disease. Cost-effectiveness and a high prescription rate of cholinesterase inhibitors are increasing their adoption. For instance, NICE recommended the use of cholinesterase inhibitors in mild to moderate Alzheimer’s cases, as a cost-effective treatment. Moreover, ongoing clinical studies to increase drug efficacy and decrease the adverse effects of cholinesterase inhibitors are also expected to contribute to market growth. However, adverse effects associated with cholinesterase inhibitors, such as gastrointestinal anomalies, are restraining market growth to a certain extent.

Competitive Landscape

Competitive rivalry in this market is likely to be high due to increasing number of mergers, acquisitions, and partnerships undertaken by major players globally. Many established and clinical-stage pharmaceutical companies are involved in the development of novel therapies & drugs to target people with unmet clinical needs. Furthermore, the companies are focusing on the development of strategic alliances and research collaborations with competitors. For instance, in January 2022, Mindset Pharma Inc. and McQuade Center for Strategic Research and Development, LLC entered into a partnership to promote the advancement of psychedelic medications.

Some of the key players in the neurodegenerative disease industry are Eisai Co., Ltd., AbbVie Inc. (Allergan Plc.), Merck & Co., Inc., Adamas Pharmaceuticals, Inc., Novartis AG,H. Lundbeck A/S, Cerevel Therapeutics, Biogen, Daiichi Sankyo Company, Limited, F. Hoffmann La Roche Ltd., TauRx Pharmaceuticals Ltd., Johnson & Johnson Services, Inc., AC Immune, Teva Pharmaceutical Industries Ltd., and GlaxoSmithKline plc. (GSK). Key players in the market adopt this strategy to strengthen their product portfolio and offer diverse, technologically advanced, & innovative products to patients. For instance, in August 2022, Knight Therapeutics, Inc. re-launching Exelon (Rivastigmine) developed by Novartis after receiving marketing authorization in Brazil. This launch is expected to boost the Alzheimer’s therapeutics market in Latin America.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified