- Home

- »

- Sector Reports

- »

-

Pet Supplements Industry Growth, Analysis Data Book, 2030

Database Overview

Grand View Research’s pet supplements industry data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & demographic framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research.

Pet Supplements Industry Data Book Scope

Attributes

Details

Areas of Research

- Skin & Coat Supplements Market

- Hip & Joint Supplements Market

- Digestive Health Supplements Market

Number of Reports/Presentations in the Bundle

1 Sector Outlook Report (PDF) + 3 Summary Presentations for Individual Areas of Research (PDF) + 1 Statistic eBook (Excel) + 3 Individual Databook (Excel)

Cumulative Coverage of Countries

15+ Countries

Cumulative Coverage of Products

15 + level 1,2,3 & 4 Products

Highlights of Datasets

- From Data, by Country

- Import/Export Data, by Country

- Pet Population Data, by Country

- Statistic e-Book

- Competitive Analysis

Pet Supplements Industry Data Book Coverage Snapshot

Markets Covered

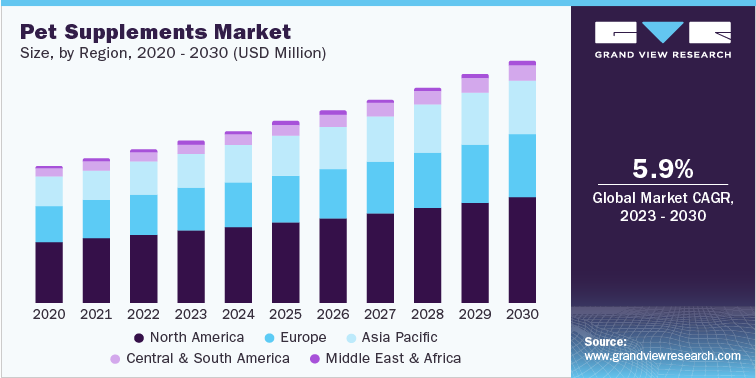

Pet Supplements Industry

USD 1,951.08 million in 2022

5.9% CAGR (2023-2030)

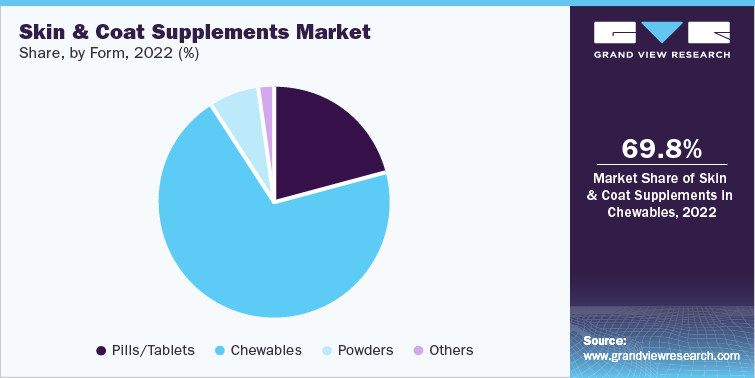

Skin & Coat Supplements Market Size

USD 193.54 million in 2022

6.5% CAGR (2023-2030)

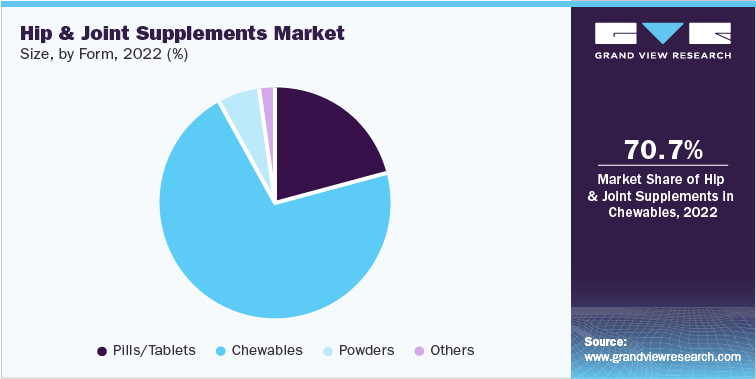

Hip & Joint Supplements Market Size

USD 1,182.18 million in 2022

5.8% CAGR (2023-2030)

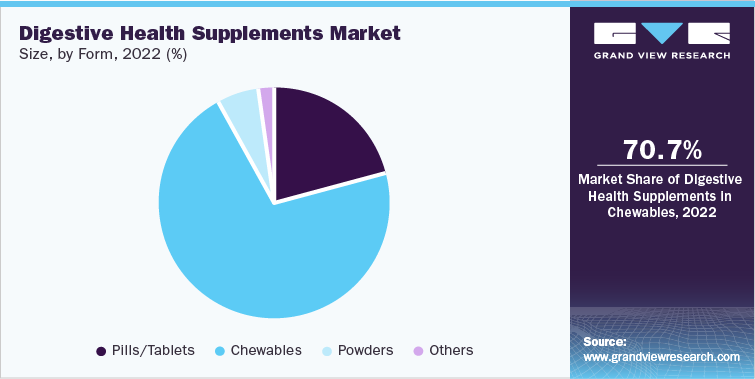

Digestive Health Supplements Market Size

USD 575.36 million in 2022

6.0% CAGR (2023-2030)

Pet Supplements Sector Outlook

Over the years, people have begun considering their pets as an integral part of their family and this has propelled the demand for natural, nutritious, and healthy food supplements essential for the overall growth and wellbeing of companion animals. Pet owners are willing to spend a lot of money to ensure the health of their pets, which has led to an increase in the health expenditure of pets.

According to Forbes, in 2022, approximately 66% of households in the U.S., which is equivalent to 86.9 million homes, had at least one pet. The most popular pet choice among Americans is dogs, with 65.1 million households owning them. Cats come next with 46.5 million households, followed by freshwater fish with 11.1 million households. In 2022, Americans spent a staggering USD 136.8 billion on their pets, showing a 10.68% increase from the previous year's spending of USD 123.6 billion.

Moreover, the increasing premiumization and differentiation of products are also driving the growth of the pet supplements market. The introduction of enhanced pet supplements by age, breed, and health problems is offering differentiation of products. This factor has also led to higher spending on pets by their owners. These consumer trends are propelling the demand for pet supplements across the globe.

Private label products have been a significant part of the market, attracting shoppers with their premium quality, lower prices, and better profit margins. This becomes even more appealing amid supply chain challenges, inflation, and rising product costs, which have led pet owners to look for more affordable options.

In the current economic climate, pet shoppers are more inclined towards competitively priced private label supplements, making them crucial for pet specialty retailers dealing with the challenges of e-commerce and mass premiumization. Various retailers have introduced new private label lines, capitalizing on the trend. However, this can be a challenge for smaller independent pet stores that lack the resources to develop their own store brand program.

Skin & Coat Supplements Market Analysis And Forecast

The condition of skin and coat in pets is influenced by various factors, including diet, season, and life stage. Changes in these factors often result in variations in the appearance and texture of the animal’s coat and skin. During colder seasons, most animals tend to grow a thicker coat to provide insulation and protect themselves from the cold. Conversely, as the weather warms up, animals often shed their heavy winter coat to adapt to the rising temperatures. Dogs and cats initially have soft and fuzzy hair, but as they grow older, their coat becomes coarser. Pregnant or nursing pets may also experience changes in coat condition or hair loss due to hormonal fluctuations.

Considering the influence of season, and life stage on the skin and coat condition of animals, there is a growing market for skin and coat supplements. These supplements can provide essential nutrients to support a healthy and vibrant coat throughout different seasons and stages of a dog's life. By addressing specific coat-related concerns and promoting overall skin health, these supplements can cater to the needs of dog owners who want to maintain the optimal appearance and condition of their pets' skin and coats.

Nowadays, chewable supplements are formulated with natural ingredients and avoid the use of artificial additives or fillers, aligning with the preferences of pet owners who prioritize the well-being of their pets. As the awareness of pet health and wellness continues to grow, the market for chewable pet supplements focused on skin and coat health is expected to expand further. Pet owners are increasingly recognizing the benefits of these supplements in maintaining vibrant and healthy skin and coats, making them a preferred product in the pet care industry.

Hip & Joint Supplements Market Analysis And Forecast

Excessive joint pains can lead to limping, stiffness, reluctance to do things, stress, and anxiety in pets, which can be more dangerous than any other health problem, as a result, companies are launching innovative products such as hemp oil supplements and cannabis-related products to counter these issues among pets. Moreover, dietary supplements such as glucosamine and chondroitin are given to pets to help protect the joints and prevent arthritis. Several dogs and cats are given supplements containing omega-3 fatty acids as these offer anti-inflammatory benefits. These factors are expected to drive the demand for supplements that address hip and joint issues.

Innovations in hip and joint supplements include advancements in ingredient combinations, dosage forms, and delivery methods. Manufacturers are incorporating a diverse range of ingredients known to support joint health, such as glucosamine, chondroitin, MSM (methylsulfonylmethane), omega-3 fatty acids, hyaluronic acid, and antioxidants. By combining these ingredients in unique ways, they create effective and comprehensive formulations that target joint support and mobility.

Additionally, manufacturers are considering the preferences and dietary restrictions of pets and their owners. They are developing chewable tablets, soft chews, liquids, powders, and other convenient dosage forms for hip and joint supplements that are palatable and easy to consume by pets. By introducing new and improved formulations, manufacturers are able to meet the demands of pet owners seeking effective and convenient solutions for maintaining their pets' joint health and mobility.

Digestive Health Supplements Market Analysis And Forecast

A major health problem faced by dogs and cats is the improper functioning of the digestive system. Often, pets fall sick due to various allergies, sudden changes in the diet, or infections; hence, customers are increasingly investing in supplements. Supplements that improve digestive health are commonly adopted by pet owners across the globe.

Market players are offering these supplements to cater to digestive issues among pets. For instance, in February 2021, the Boss Dog brand launched new raw frozen meal products for dogs, which include digestive supplements and health solutions for pets. The new complete frozen and balanced meals are available in BOSS PATTIES and BOSS NUGGS in chicken, beef, and fish offerings, and are infused with probiotics and essential vitamins and nutrients to deliver the support that dogs need.

The increasing prevalence of digestive issues in pets drives pet owners to seek products that can alleviate these problems and promote better digestive health. Digestive health supplements provide a proactive approach to addressing digestive issues by supporting the digestive system and promoting optimal gut health. Pet owners are increasingly recognizing the benefits of these supplements in maintaining and improving their pets' digestive well-being.

Competitive Insights

The global pet supplements market is characterized by the presence of some established multinational and regional companies, with leading manufacturers holding a significant share. Some of the key players in the market are Nestlé S.A.; Mars, Incorporated; Zoetis Inc.; Virbac; NOW Foods; Nutramax Laboratories, Inc.; and FoodScience Corporation.

Companies have been implementing various strategic initiatives such as expansions, strengthening of online presence, and launching new products to gain a competitive advantage over others. Moreover, companies are trying to increase their brand recognition through various forms of media, the internet, social networking sites, and collaborations with celebrities in their respective regions to reach the widest possible audience.

-

For instance, In May 2023, CULT Food Science Corp. introduced an exciting addition to their pet supplement range with the launch of Noochies! Sprinkles. This new line of premium pet supplements builds upon the success of their existing Noochies! products.

-

For instance, in April 2023, PetPlate, recently unveiled an innovative addition to their offerings with the introduction of PetPlate Park. By combining entertainment and pet care, PetPlate Park provides a dynamic platform for pet owners to engage with their furry companions and explore the benefits of PetPlate's new supplements.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified