- Home

- »

- Sector Reports

- »

-

Skin Diseases Treatment Industry Trends Data Book, 2023-2030

Database Overview

Grand View Research’s skin diseases treatment industry data book is a collection of market sizing & forecasts insights, regulatory & technology framework, pricing intelligence, competitive benchmarking analyses, and macro-environmental analyses studies. Within the purview of the database, such information is systematically analyzed and provided in the form of summary presentations and detailed outlook reports on individual areas of research. The following data points will be included in the final product offering in five reports and one sector report overview.

Skin Diseases Treatment Industry Data Book Scope

Attribute

Details

Research Areas

- Actinic Keratosis Treatment Market

- Atopic Dermatitis Market

- Alopecia Market

- Acne Drugs Market

Number of Reports/Deliverables in the Bundle

- 5 Individual Reports - 2 PDFs

- 5 Individual Reports - Excel

- 1 Sector Report - PPT

- 1 Data book - Excel

Cumulative Country Coverage

25+ Countries

Cumulative Product Coverage

25+ Level 1 + 2 Products

Highlights of Datasets

- Indication Revenue, by Country

- Route of Administration Revenue, by Country

- Type Revenue, by Country

- End Use Revenue, by Country

- Regulatory Framework, by Countries

- Value Chain Analysis

- Competitive Landscape

- Pricing Analysis

Total Number of Tables (Excel) in the bundle

183

Total Number of Figures in the bundle

160

Skin Diseases Treatment Industry Data Book Coverage Snapshot

Markets Covered

Skin Diseases Treatment Industry

USD 88.25 billion in 2022

4.3% CAGR (2022-2030)

Actinic Keratosis Treatment Market Size

USD 6.42 billion in 2022

4.20% CAGR (2023-2030)

Atopic Dermatitis Market Size

USD 14.19 billion in 2022

8.70% CAGR (2023-2030)

Alopecia Market Size

USD 8.19 billion in 2022

8.74% CAGR (2023-2030)

Acne Drugs Market Size USD 8.43 billion in 2022

4.74% CAGR (2023-2030)

The global skin diseases treatment industry combines to account for USD 88.25 billion in revenue in 2022, which is expected to reach USD 124.03 billion by 2030, growing at a cumulative rate of 4.3% over the forecast period. The combination bundle is designed to provide a holistic view of these highly dynamic market spaces.

Skin Diseases Treatment Industry Outlook

The global skin diseases treatment market was valued at USD 88.25 billion in 2022 and is anticipated to witness growth at a rate of 4.35% over the forecast period. The lucrative growth rate can be attributed to the growth in the adoption rate of pharmaceutical drugs for the treatment of dermatological conditions. The rise in awareness about the importance of facial aesthetics and increased use of high-cost biologics is significantly increasing the revenue generation ability of the market. The presence of over 3000 skin nail and hair conditions that require effective treatment makes the marketplace lucrative for pharmaceutical companies.

The presence of blockbuster drugs such as Humira, which is indicated for various dermatological conditions such as psoriatic arthritis, psoriasis, and hidradenitis suppurativa. Although there are over 10 biologics approved for the treatment of psoriasis but the demand for more effective therapies is still on the rise. The pipeline for dermatological disease has the presence of strong candidates such as beremagene geperpavec (B-VEC) and bimekizumab, which are anticipated to launch in 2023.

The rapidly evolving demand for more effective and faster treatment of dermatological conditions is driving the growth of the largest market segment of psoriasis. In December 2021, RINVOQ by AbbVie received and FDA approval for active psoriatic arthritis treatment. Within 4 years of launch products such as Otezla by Amgen are generating a revenue of over 1.9 billion. This demonstrates a lucrative market opportunity for novel drugs.

Topical drugs are a major form of treatment in the dermatology diseases segment. This can be attributed to the ease of use and high compliance rate associated with topical treatments. Furthermore, topical treatments can be used at the affected area which facilitates better treatment. This segment primarily includes corticosteroids and retinoid drugs.

Skin Diseases Treatment Industry - Key Market Players, 2022

-

Pfizer Inc.

-

AbbVie Inc.

-

Sun Pharmaceutical Industries Ltd.

-

GSK plc.

-

Amgen Inc.

-

Eli Lilly and Company

-

UCB

-

Novartis AG

-

Johnson & Johnson

-

Galderma S.A

-

AstraZeneca plc

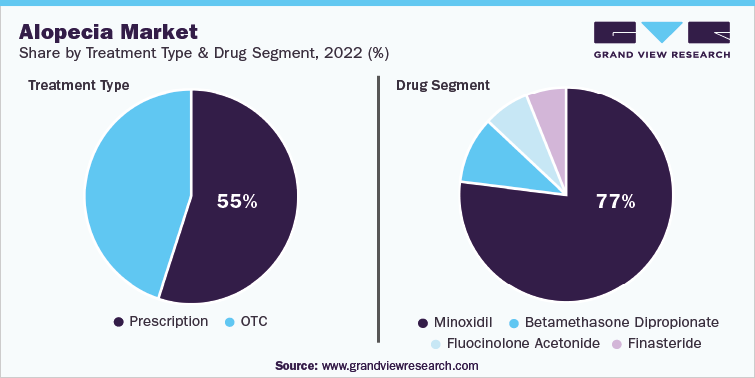

Alopecia Market Analysis & Forecast

The global alopecia market was valued at USD 8.19 billion in 2022 and is anticipated to witness growth at a rate of 8.74% over the forecast period. The significant growth rate can be attributed to the increased number of patients opting for dermatological drugs for the treatment of alopecia and the increasing interest of major pharmaceutical giants in the development and commercialization of novel drugs.

In June 2022, FDA approved baricitinib for the treatment of alopecia areata severe cases. Prior to the approval, the treatment was limited to the areas of hair loss, which limited the treatment scope. Smaller players such as Concert Pharmaceuticals are focusing only on developing treatments for alopecia with two successful phase III trials and the drug is projected to launch between 2023-2024. Unmet need and huge revenue generation opportunity is attracting players to the market.

The growing prevalence of alopecia is one of the crucial factors driving market growth. As per the American Hair Loss Association, it was stated that over 95% of hair loss in males is triggered by androgenetic alopecia. The occurrence of hair loss in men increases proportionately with age. Based on the report published by the International Society of Hair Restoration Surgery, it was estimated that nearly 40% of men encounter some degree of hair loss by 35 years of age, 65% at 60 years, 70% at 80 years, and 80% at the age of 85.

Alopecia Areata (AA) held the largest market share attributable to its high prevalence and increasing launch of new products in the segment. First-line treatment of the condition is majorly done using steroid injections, topical steroids, and minoxidil. As of 2022, there were over 700,000 alopecia areata patients in the U.S. The main objective of alopecia treatment is to block the immune system attack and promote the regrowth of hair.

The market for prescription medications for hair loss is expected to expand in the near future, driven by a strong product pipeline, growing disposable income, and rising adoption of unhealthy lifestyles, resulting in chronic diseases such as cancer, PCOS, and diabetes, which are associated with alopecia. Some of the commonly prescribed hair loss medications are corticosteroids, minoxidil, and finasteride. The potential pipeline candidates-Etrasimod by Arena Pharmaceuticals, Inc., SM04554 by Samumed, LLC., RCH-01 by RepliCel Life Sciences, and Pyrilutamide by Kintor Pharmaceutical Limited-are expected to be launched by the end of the forecast period. It is estimated that Americans spend over USD 3.5 billion per year to treat hair loss. Some of the prescribed medications and procedures for alopecia include finasteride, minoxidil, dutasteride, and anthralin.

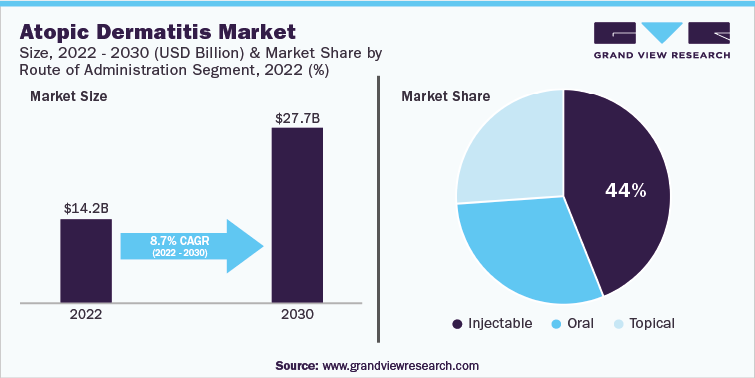

Atopic Dermatitis Market Analysis & Forecast

The global atopic dermatitis market was valued at USD 14.19 billion in 2022 and is anticipated to witness growth at a rate of 8.70% over the forecast period. Untapped opportunities, the growing prevalence of atopic dermatitis, rise in the adoption of biologics are anticipated to propel the market growth over the forecast period.

Continuous itching of the skin has heightened the adoption rate of topical ointments and creams. For instance, as per the National Eczema Association, 85.8% of people suffering from the condition report daily itching, which makes the adoption of fast-acting topical agents more likely when compared to oral drugs. Increased frequency of hand-washing has increased the appearance of dry and cracked skin in atopic dermatitis patients making them susceptible to infections. The increased number of hand eczema cases is creating an opportunity for the market players to develop ointments and creams with moisturizer bases to capture this untapped opportunity.

Topical corticosteroids are the first-line treatment for Atopic Dermatitis (AD). They work by mimicking natural hormones in the body and suppressing the immune system. Corticosteroids are available in various potencies and administered on the basis of the severity of the disease. The introduction of biologics has caused a paradigm shift in the therapeutic setting for AD. Biologics was the largest revenue-generating segment, which is attributed to increased penetration and high usage of the FDA-approved drug Dupilumab. The novel mechanism of target specificity provided the drug offers it a competitive edge in the market. Furthermore, the high price of this drug is likely to accelerate segment growth. However, the others segment is anticipated to witness the highest growth over the forecast years owing to the presence of JAK inhibitors in the pipeline.

The high cost of therapeutics is one of the key roadblocks in market growth. However, affordable healthcare measures are being incorporated across all major regions, impacting the pricing strategies of companies as well as reimbursement scenarios. Increased cost consciousness, especially in emerging countries, is anticipated to hinder premium-pricing opportunities for pipeline drugs, particularly biologics.

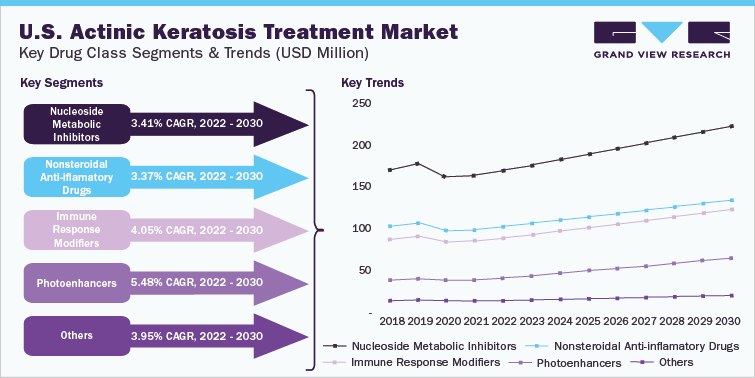

Actinic Keratosis Treatment Market Analysis & Forecast

The global actinic keratosis (AK) market was valued at USD 6.42 billion in 2022 and is anticipated to witness growth at a rate of 4.20% over the forecast period. Untapped opportunities, the growing prevalence of atopic dermatitis, and the rise in adoption of biologics are anticipated to propel the market growth over the forecast period.

Moreover, ongoing product approvals and a surge in product launches are other factors contributing to market growth. For instance, in February 2021, Almirall launched its topical AK treatment in the U.S. In addition, hospitals such as Mount Sinai, Metro East Dermatology, and Skin Cancer Center, among others, offer multiple treatment options for AK. For instance, Mount Sinai group of hospitals offers cryosurgery, topical therapy, chemical peels, and PDT for its management.

According to the American Academy of Dermatology Association, more than 40 million Americans develop AK each year and according to the NEWS Medical, the overall rate of AK in the U.S. is estimated to be about 26.5% in males and 10.2% in females. Thus, the prevalence of the disease is higher in men as compared to women. In addition, according to Skin Cancer Foundation, around 58 million Americans have one or more AK. This is the most common precancerous condition to occur on the skin damaged by UV rays. Solar keratosis is an alternative name for AK. If it is not treated in time, then it can develop into SCC, a common type of skin cancer, and it is estimated that around 5% to 10% of AK can develop into SCC.

Topical 5-Flourouracil (5-FU) is the gold standard against which all other topical therapies are measured. The antimetabolite 5-FU is cytotoxic. Fluorouracil is taken twice a day for 2 to 4 weeks and its cure rate is around 75%. Other applications of the drug are local irritation manifests as dryness, erythema, erosion, discomfort, or edema. 5-FU has been approved 50 years ago for the treatment of actinic keratosis and is used intensively owing to its ease of use, efficacy, & cost-effectiveness. The treatment with 5-fluorouracil is one of the most successful treatments for the elimination of actinic keratosis. It is intended to be used for both field-directed and lesion-directed actinic keratosis. 5-FU treatment is generally performed after cryotherapy or freezing with liquid nitrogen. Some of the key commercially available brands that are FDA approved for 5-FU include Carac, Efudex, Fluoroplex, and Tolak, among others. However, some side effects associated with the medication such as local inflammatory response and adverse skin reactions are somehow restraining the use of the medication.

Acne Drugs Market Analysis & Forecast

The global acne drugs market size was valued at USD 8.43 billion in 2022 and is anticipated to witness growth at a rate of 4.74% over the forecast period. The rising importance of aesthetics among the population, unhealthy lifestyle, and increased preference for pharmaceutical drugs over OTC cosmeceutical treatments is driving the market growth.

Acne impacts as many as 85% of the population aged 12-24 years and the number is as high as 50 million each year in the U.S. The global prevalence rate for acne is 9.4% which creates a high demand for acne-associated therapeutic products. The Pandemic hampered market growth for acne drugs attributable to limited access to dermatologists, thereby leading to a significant decline in the number of patients receiving prescription drugs. However, the number of patients increased post-pandemic with the rise in patient visits.

High demand for over-the-counter and topical treatments is significantly influencing the market growth with an increase in awareness regarding the usage of pharmaceutical products. The escalating number of competitors focusing on the launch of products in the segment is intensifying the competition. For instance, in March 2022, Galderma announced the launch of an acne vulgaris treatment topical cream. The prescription of a multi-step regimen is common for acne; however, this drug allows once-daily treatment, thus making its adoption easier.

New developments are underway in the market. This includes the development of vaccine-based acne treatment by companies such as Origimm Biotechnology GmbH which was acquired by Sanofi in December 2021. This demonstrates a keen interest of key players in the market. However, the wide presence of generics in the market is projected to slow down the adoption of novel treatments attributable to the cost-effective nature of generics.

Competitive Landscape

The presence of well-established companies in the skin diseases treatment market makes the entry of smaller players with newer products difficult. Companies are highly focused on R&D to develop and launch novel products that give them a competitive edge. Moreover, bigger players are aiming at acquiring smaller companies with upcoming promising products.

Some of the key players in the skin diseases treatment market include AbbVie Inc, Novartis AG, Leo Pharma A/S, Amgen Inc, Johnson & Johnson Services Inc., Eli Lilly and Company, UCB S.A., GALDERMA, GSK Plc, AstraZeneca, Pfizer Inc, Merck KGaA, Teva Pharmaceutical Industries Limited, and Sun Pharmaceutical Industries Limited.

To maintain their market share, large firms frequently engage in mergers, partnerships, acquisitions, and new product launches. For instance, in February 2021, Almirall, S.A. launched Klisyri for the treatment of actinic keratosis in the U.S. This product was approved by the U.S. FDA in December 2020. In July 2021, Sun Pharmaceuticals entered into an agreement with Cassiopea SpA to supply its acne treatment drug Winlevi in Canada and U.S. This would help the company strengthen its distribution network.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified