- Home

- »

- Sector Reports

- »

-

Supply Chain Solutions Industry Trends Data Book, 2023-2030

Database Overview

Grand View Research’s supply chain solutions industry data book is a collection of market sizing information & forecasts, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

The supply chain solutions market is expected to grow owing to a rise in the volume of business data across industries and companies seeking logistics and supply chain technology-driven products. For instance, in November 2022, Corbus partnered with GIS International, a procurement service provider to provide their clients with supply chain management that is more effective and efficient. The firms' complementary supply chain and procurement services will be based on GIS' integrated supply chain and supplier relationships capabilities in Europe and Corbus' procurement and sourcing expertise in the U.S. and India.

The following data points will be included in the final product offering in 3 reports and one sector report overview:

Supply Chain Solutions Industry Data Book Scope

Attribute

Details

Research Areas

- Supply Chain Analytics Market

- Procurement as a Service Market

- Vendor Risk Management Market

Details of Product

- 5 Individual Reports - PDFs

- 5 Individual Reports - Excel

- 1 Data book - Excel

Cumulative Country Coverage

20+ Countries

Cumulative Product Coverage

25+ Level 1 & 2 Products

Highlights of Datasets

- Type Revenue, by Countries

- Deployment Revenue, by Countries

- Enterprise Size Revenue, by Countries

- End-user Revenue, by Countries

- Competitive Landscape

- Regulatory Guidelines, by Countries

- Reimbursement Structure, by Countries

Total Number of Tables (Excel) in the bundle

336

Total Number of Figures in the bundle

76

Supply Chain Solutions Industry Data Book Coverage Snapshot

Markets Covered

Supply Chain Solutions Industry

USD 20.45 billion in 2022

15.0% CAGR (2023-2030)

Supply Chain Analytics Market Size

USD 6.13 billion in 2022

17.8% CAGR (2023-2030)

Procurement as a Service Market Size

USD 6.15 billion in 2022

11.1% CAGR (2023-2030)

Vendor Risk Management Market Size

USD 8.18 billion in 2022

15.1% CAGR (2023-2030)

Supply Chain Analytics Market Analysis And Forecast

Increased demand for supply chain efficiency and the requirement for better operating procedures are anticipated to boost market growth. Due to the increasing volume and propensity for data-based decision-making, supply chain analytics solutions and services are being adopted across several verticals such as retail and manufacturing. Additionally, due to the ongoing COVID-19 pandemic and businesses' growing use of big data and analytics, demand for supply chain analytics solutions and services has increased significantly. The pandemic compelled companies to refocus their development and restructuring activities on maintaining business continuity by fostering resiliency and flexibility.

Long-term, improved supply chain visibility can assist firms in increasing sustainability, lowering inventory costs, and reducing product time-to-market. For instance, in September 2022, Accenture announced the acquisition of MacGregor Partners, a supply chain solutions provider. Accenture's supply chain network and fulfilment transformation capabilities supported by Blue Yonder technology are expanded due to the acquisition. The deal's financial details were not publicly disclosed. MacGregor joins Accenture's Intelligent Platform Services group and brings extensive knowledge in assisting businesses from several industries with implementing Warehouse Management Systems (WMS) and Transportation Management Systems (TMS).

In May 2022, Kinaxis announced a development in supply chain planning using advanced analytics with the launch of its new Planning. AI method. To deliver a highly accurate response as quickly as possible, AI is the only continuous planning solution that can automatically identify and combine the ideal mixture of criteria, optimization, and machine learning. Businesses are no longer required to control the trade-offs that result from selecting between several planning methods, such as speed or accuracy. A single problem may be tackled using numerous analytical strategies due to Planning. AI, also expands the types of supply chain issues that can be resolved and eliminates the requirement for tough data scientists and deep analytical specialists. This results in even more economic value.

Procurement as a Service Market Analysis And Forecast

With the expanding organizational reach, digitalization of procurement and sourcing processes is taking place. Due to rapid technological advancements, strategic sourcing of inventories and supply chain management is becoming easier. Procurement as-a-service involves technology, human resources, and human intelligence to manage parts of the organization’s procurement process. Traditional procurement processes are costlier, slower, and non-transparent. Modern procurement processes provide an end-to-end view of the entire supply chain process, reduce cost, and promote transparency. Thus, the rising technological advancements in the procurement process is expected to drive the market demand.

The sudden COVID-19 outbreak has impacted businesses and the supply chain drastically. The traditional procurement solution became ineffective during that time. There were major negative impacts of COVID-19, but there were also a few positive ones. The major shift in technological advancement and modernization in procurement operations helped companies streamline processes to boost efficiency & productivity within the organization. The reliable procurement service providers help in easier contracts and strategic sourcing that strengthens vendor relationships during the COVID-19 period.

As companies are continuously expanding their global reach, both large and small enterprises are involved in finding robust and strategic sourcing options. With the help of cloud-based technologies, Procurement solutions streamline the process and services, reduce the complexities, and promote simple and consistent business processes. Further, organizations are increasing their spending on technologically advanced procurement-as-a-service solutions, which is expected to support companies in reducing repetitive processes, discovering future improvement opportunities, and reducing cost through supplier management and strategic sourcing. These underlined factors are expected to drive the demand for procurement as-a-service market during the forecast period.

Vendor Risk Management Market Analysis And Forecast

Vendors and third parties play an important role in the business model. With the expanding footprints of industry players across the globe, many organizations have started approaching third-party vendors for outsourcing important activities and tasks. The rapidly changing rules and regulations across different geographies, organizational dependency on traditional systems for vendor risk management, and the need to continuously track, monitor, and assess vendor performance are some of the factors responsible for the rising demand of vendor risk management.

The COVID-19 pandemic has affected millions of companies, third-party vendors, and suppliers. The stringent lockdown and restrictions imposed by the government across the world has drastically disrupted the supply chain. Organizations have faced huge difficulties in managing vendors and suppliers. This recent event has underlined some of the major vendor-related vulnerabilities. In the business world, these actions have affected the major sum of the company’s revenue and its third-party vendors. An effective vendor risk management program can improve the organizational security position and reduce the harm of disruptive events like these.

Companies are adopting vendor risk management programs to ensure that the IT suppliers and service providers do now hamper or cause any risk to the business. Vendor risk management technology helps companies manage and monitor the risks and performances associated with third-party service providers. Vendor risk management helps companies identify risks, legal obligations, and tracking vendor performance. With the rising footprint of organizations across the world, companies are approaching third-party vendors to expand their productivity and reach, for which they need additional data security systems like cyber security, information security, third-party vendor security systems, etc. Firms are investing heavily in vendor risk management solutions to safeguard themselves from the risk of third-party and cyber threats. For Instance, on October 6, 2022, Prevalent, Inc., the leading-US-based software company, made a partnership with Halodata Group, a leading data security solutions distributor, to expand its global reach. Prevalent and Halodata will ensure access of the leading TPRM platform to commercial and government organizations and a trusted advisor to assist and navigate the ever-changing risks associated with vendor cybersecurity.

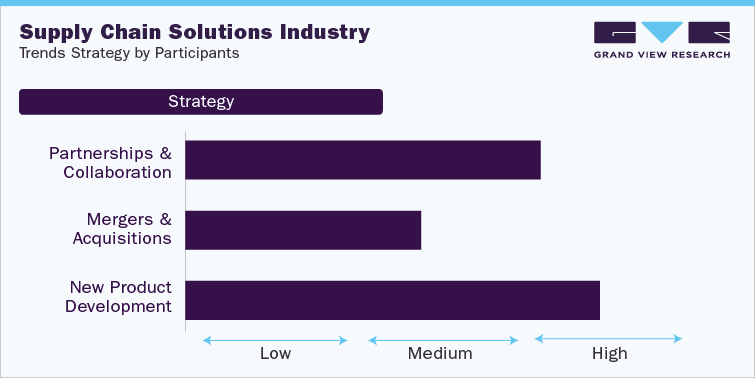

Competitive Landscape

The market is competitive with the presence of major players Genpact, Accenture, International Business Machines Corporation, HCL Technologies Ltd., WNS (Holdings) Ltd., Optive Security, Inc., Infor, Kinaxis, JDA Software Group, Inc., Aera Technology among others. The companies are adopting several growth strategies, such as partnerships, mergers & acquisitions, and product launches, to stay afloat in the competitive industry. For instance, in April 2022, Ernst & Young LLP announced an alliance with Aera Technology, an automation company to assist businesses in utilizing decision intelligence to expedite the transition of their supply chain. The EY-Aera alliance combines Aera's revolutionary cognitive technology with the EY organization's expertise in supply chain transformation. Aera's Decision Cloud is a digital platform that runs continuously in the cloud. It uses data crawling, artificial intelligence, and industry-specific models to execute difficult strategic and operational decisions to suggest actions, forecast results, and make decisions.

Strategy

Spearheads

Partnerships & Collaboration

Accenture; Genpact; Aera technology; Infor

Merger & Acquisitions

WNS (Holdings) Ltd.;Optive Security; HCL Technologies Ltd.

New Product Development

Kinaxiz; JDA Software Group, Inc.; International Business Machines Corporation

Product upgrades and new product developments are the key strategic growth employed to improve their market position. Genpact, Accenture, International Business Machines Corporation, HCL Technologies Ltd., WNS (Holdings) Ltd., Optive Security, Inc., Infor, Kinaxis, JDA Software Group, Inc., Aera Technology are some key vendors actively engaged in innovation and product upgrades. For instance, in June 2022, Infor announced a partnership with Everstream Analytics, a supply chain and risk analytics company to help businesses identify and navigate supply chain risks and disruptions more effectively. Through the collaboration, Infor will integrate the end-to-end supply chain risk monitoring and assessment data with its multi-enterprise business network platform, Infor Nexus. The Infor Nexus Command Center, an end-to-end supply management control tower, connects to carriers, logistics service providers, suppliers, and manufacturers to deliver intelligent, actionable insights. It gives organizations visibility to orders, shipments, and stockpiles throughout the supply chain.

Key Drivers

-

Need for business-driven and technology-driven solutions.

-

Increasing adoption of cloud supply management among SMEs.

-

Surge in need for improved supply chain visibility

-

Increase in demand for Transportation Management System (TMS) software.

-

Emerging digital and cognitive technologies

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified