- Home

- »

- Sector Reports

- »

-

White Spirits Industry Analysis & Overview Data Book, 2030

Database Overview

Grand View Research’s white spirits industry data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research.

White Spirits Industry Data Book Scope

Attributes

Details

Areas of Research

- Vodka Market

- Rum Market

- Gin Market

Number of Reports/Presentations in the Bundle

1 Sector Outlook Report (PDF) + 3 Summary Presentations for Individual Areas of Research (PDF) + 1 Statistic eBook (Excel) + 3 Individual Databook (Excel)

Cumulative Coverage of Countries

15+ Countries

Cumulative Coverage of Products

15 + level 1 & 2 Products

Highlights of Datasets

- Type Data, by Country

- Import/Export Data, by Country

- Demand/Consumption Data , by Country

- Statistic e-Book

- Competitive Analysis

White Spirits Industry Data Book Coverage Snapshot

Markets Covered

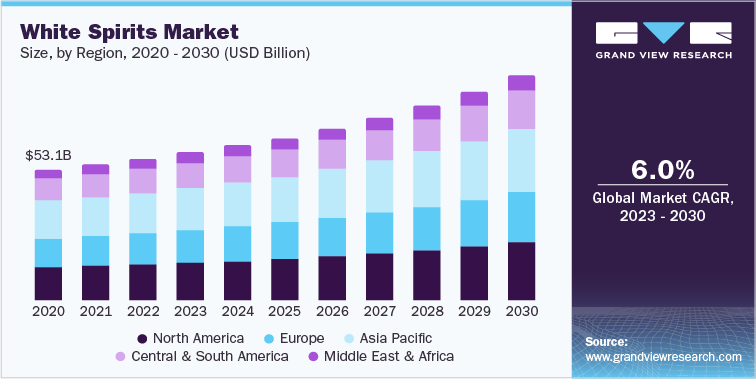

White Spirits Industry

USD 57.37 billion in 2022

6.0% CAGR (2023-2030)

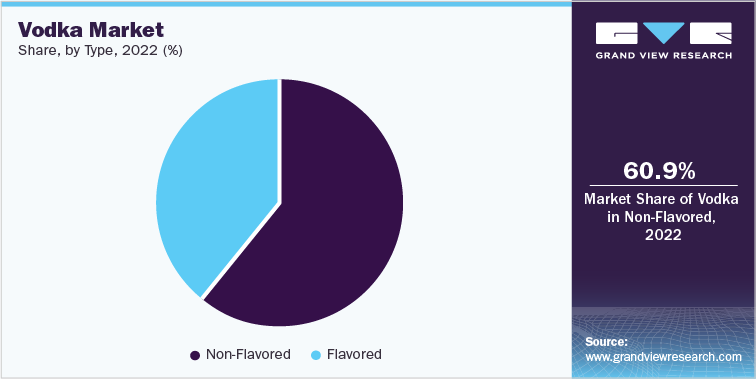

Vodka Market Size

USD 35.94 billion in 2022

6.2% CAGR (2023-2030)

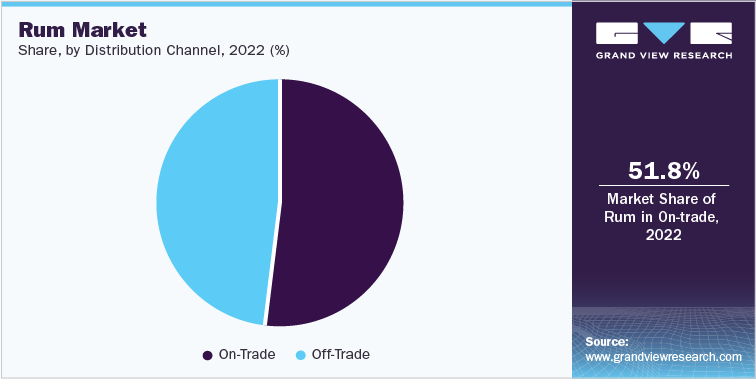

Rum Market Size

USD 7.94 billion in 2022

5.3% CAGR (2023-2030)

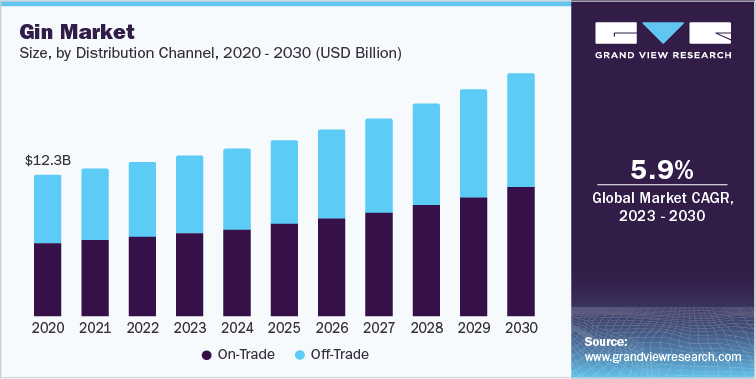

Gin Market Size

USD 13.49 billion in 2022

5.9% CAGR (2023-2030)

White Spirits Sector Outlook

Increasing urbanization in emerging countries such as China and India as well as new product launches in the category are the key growth driving factors in the market. Moreover, rising social acceptance of alcohol consumption has spurred the consumption of spirits in a social environment.

Consumer inclination toward premiumization has facilitated producers with increased margins and revenue growth. The shift toward premium products is supported by the increasing popularity of cocktail culture besides effective marketing efforts by companies.

Prominent players focus on innovative ingredients. For instance, in November 2022, Radico Khaitan launched the Jaisalmer Gold Gin, the second gin in their Jaisalmer range. This gin is crafted in the Himalayas and infused with a blend of 18 botanicals, with 14 of them thoughtfully sourced from various regions of India. It has an alcohol by volume (ABV) of 43% and is available for purchase at select retailers, offering a 500ml bottle for £39.

Rapid urbanization, growing population, and rising per capita income of consumers are the key factors driving the market’s growth in the Asia Pacific region. North America and Europe emerged as the major regional markets due to the shift in consumer preferences from beer and ciders to spirits. High consumption of alcohol in countries is expected to boost market growth in the Middle East and Africa.

Vodka Market Analysis And Forecast

The rising demand for vodka can be attributed to the growing consumption of premium vodka-based cocktails in developed economies such as the U.S. and Germany. The growing demand for vodka flavors such as cranberry, lime, and raspberry is augmenting growth. Moreover, offline trading of alcoholic beverages is further anticipated to boost market growth over the forecast period. The growing acceptance of grain-based vodkas with a delicious fruity taste is the major factor driving market growth.

Furthermore, there has been a noticeable increase in the demand for natural and authentic flavors. This surge can be attributed to the influential role of social media and blogging sites, which act as catalysts for the growth of the global vodka market. Nowadays, consumers actively engage on various social networking platforms and possess a heightened awareness regarding an array of flavored vodkas and cocktails. A prime example is Tito’s Vodka, whose online presence portrays it as "handcrafted vodka. Moreover, numerous blog posts explore diverse categories of vodka brands including flavored and organic variations.

Procuring citrus cocktails at an affordable price presents an upcoming opportunity in the market; however, consumers' preference for non-alcoholic beverages acts as a barrier to its growth. At present, key players are concentrating their efforts on launching fruit-based vodka flavors containing minimal alcohol content. Thus, significant market expansion is expected within the review period. To propel this development further and cater to consumer demands. Major companies are investing heavily in sourcing top-notch ingredients like blueberries and ruby red grapefruits. Moreover, heightened demand for organic infusions across various regions is stimulating industry expansion while premium brands prioritize introducing delectably flavored vodkas with a delightful crispness.

Rum Market Analysis And Forecast

The global industry is on the verge of a significant surge in response to the escalating demand for exceptional and superior products. Specifically, millennials are displaying a profound interest in genuine and distinctive alcoholic beverages, which is expected to make a substantial contribution to the exponential sales growth. Among the diverse range of spirits available, rum occupies a prominent position as one of the most widely consumed alcoholic beverages. The steady rise in per capita income, observed in both developed and developing economies, plays an important role in fueling the global demand for premium spirits like rum.

The on-trade market encompasses the sale of alcoholic beverages for consumption on premises including bars, restaurants, and hotels. White rum is not as frequently found in the on-trade market due to its common use in cocktails with other ingredients like juices, sodas, and liqueurs. Certain bars and restaurants do provide it as a standalone drink or as a part of their distinctive cocktails.

Gin Market Analysis And Forecast

The gin market is witnessing tremendous change as many distilleries are emerging in different parts of the world. This shift can be attributed to a big increment in the drinking habit of young adults and millennials who highly prefer the alcoholic drink−gin. While there are manifold choices within the alcoholic beverage industry, like beer, wine, and spirits, gin has captured significant focus, especially in foreign markets. Interesting trends within the gin beverages market include enthusiastic exploration of innovative and varied drink options. Therefore, demand for gin cocktails is rising.

The growth of the gin market can be attributed to several key factors that have contributed to the increasing popularity of gin. One such factor is the rising demand for gin cocktails, which have become a favored choice among consumers. Additionally, there is a noticeable increase in the preference for premium spirits, driving the expansion of the gin market. This trend of "premiumization" is particularly appealing to younger consumers who possess more refined palates and actively seek out unique and high-quality alcoholic beverages.

Moreover, consumers are becoming more conscious of their health and are increasingly aware of the potential benefits associated with consuming gin. This growing awareness has played a role in boosting market growth as gin is perceived to have certain health advantages.

To cater to evolving consumer preferences, the alcoholic beverage industry has embraced the use of natural ingredients. By incorporating natural flavors, these beverages are enhanced both in terms of functionality and overall appeal. This emphasis on natural flavors has gained significant popularity within the industry, as it preserves the authentic taste and rustic charm of gin. Consequently, gin has become a favored choice for creating high-quality drinks, prominently featured on on-trade counters.

Competitive Insights

The manufacturers aim to achieve optimum business growth and a strong market position through the implementation of various strategies such as acquisitions, new product launches, collaborations, and strengthening of distribution networks in the global as well as regional markets. White spirits material manufacturers aim to intensify their market positions by widening their customer base. Thus, multinational players are aiming to achieve business growth in the regional market through mergers, acquisitions, and other strategic initiatives.

-

In March 2023, Bacardi Rum launched a new premium spiced aged rum called Bacardi Caribbean Spiced. Made with coconut, pineapple, vanilla, and cinnamon, it was inspired by the blender's Caribbean upbringing. The rum combines heavy and light-aged rum bases, coconut blossom sugar, pineapple, and coconut water. It is filtered and blended with cinnamon and vanilla.

-

In April 2023, Desi Daru Vodka, a new vodka brand, recently launched in the market. The brand aims to tap into the growing demand for premium spirits among consumers in India. Desi Daru Vodka is produced using a unique combination of traditional Indian ingredients and modern distillation techniques, creating a distinctive flavor profile. The brand positions itself as a premium offering, targeting consumers who appreciate high-quality and locally inspired spirits. The launch of Desi Daru Vodka is a response to the increasing popularity of vodka in India, where consumers are exploring new and innovative options in the alcoholic beverage market.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified