- Home

- »

- Renewable Chemicals

- »

-

1,3 Propanediol Market Size, Share & Trends Report, 2030GVR Report cover

![1,3 Propanediol Market Size, Share & Trends Report]()

1,3 Propanediol Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Conventional, Bio-based), By Application (Polytrimethylene Terapthalate, Polyurethane), By Region, And Segment Forecasts

- Report ID: 978-1-68038-385-0

- Number of Report Pages: 81

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

1,3 Propanediol Market Summary

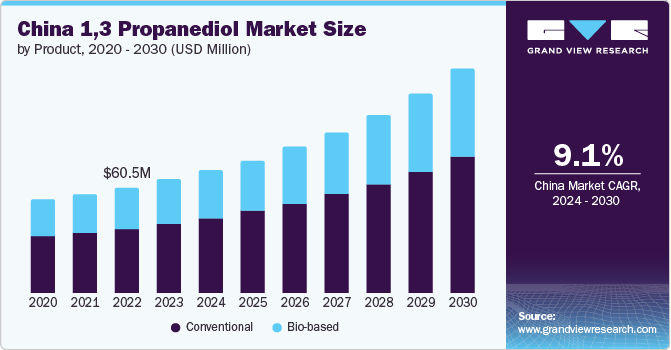

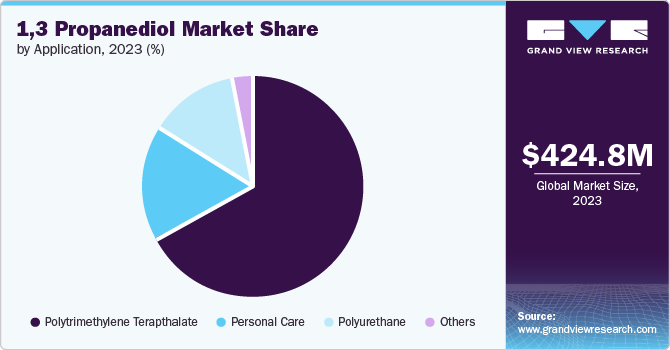

The global 1,3 propanediol market size was estimated at USD 424.8 million in 2023 and is projected to reach USD 799.7 million by 2030, growing at a CAGR of 9.8% from 2024 to 2030. The demand for the product can be attributed to the rising adoption of polytrimethylene terephthalate from various end-use industries, such as personal care, cosmetics, and cleaning products.

Key Market Trends & Insights

- Asia Pacific led the global 1,3 propanediol market with the largest revenue share in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030.

- By product, the bio-based segment led the market, with a revenue share of 55.9% in 2023.

- By application, the polytrimethylene terephthalate (PTT) segment led the market, with a revenue share of 67.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 424.8 Million

- 2030 Projected Market Size: USD 799.7 Million

- CAGR (2024-2030): 9.8%

- Asia Pacific: Largest market in 2023

The market is expected to be driven by shifting consumer preference toward bio-based products. It is anticipated that the increasing consumer acceptability for bio-based products across a range of end-use sectors would further bolster market expansion.

Changing customer preferences toward bio-based products are expected to drive the global 1,3-propanediol market. The growing acceptance of bio-based products across diverse end-use industries is presumed to complement the market growth further. Companies are focusing on increasing the renewable content in their products for various reasons. The need to reduce carbon emissions and create more sustainable products has increased the demand for bio-based products.

The primary raw materials used in the production of 1,3 propanediol are glycerol, glucose, and crude glycerin from vegetable oils or recycled oil. It is also produced from petrochemicals-based glycols such as glycerin, propylene glycol, and butylene glycol. Fermentation, chemical conversion, bioconversion, catalytic processes, a two-step process, and the Degussa-DuPont route are some of the processes utilized in the production of 1,3 propanediol.

Life Cycle Assessment (LCA) is applied to biobased 1,3-propanediol (PDO) production. The cradle-to-factory gate system includes growing corn, corn milling, converting cornstarch to glucose, and fermentative production of PDO using a genetically modified biocatalyst. The LCA is a preliminary biobased process design and is used to identify system improvement targets and benchmark life-cycle environmental performance. The analysis indicates that approximately 70% of nonrenewable energy produces PDO from glucose. The most significant part of this is used in purifying PDO. Biobased PDO is predicted to have significantly lower cradle-to-factory gate nonrenewable energy and climate change potential than PDO derived from ethylene oxide. PDO converted to polytrimethylene terephthalate (PTT) is expected to outperform Nylon 6 in these categories and have lower NO x emissions.

The increasing demand for eco-friendly and sustainable materials, technological advancements in biobased PDO production, and expanding applications beyond textiles and cosmetics into industries such as automotive and packaging are significant opportunities for the market.

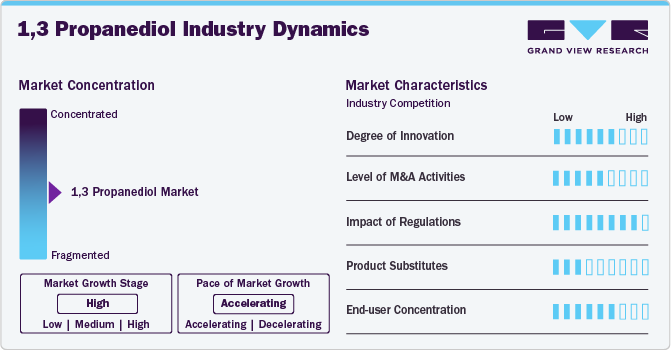

Market Concentration & Characteristics

The 1,3 propanediol market is fragmented with the presence of many manufacturers. 1,3 propanediol comes in various products, such as conventional, and Bio-based.

Manufacturers must adopt the right sales channel to ensure their products are distributed effectively to end consumers. To ensure a smooth supply of goods, manufacturers must establish a good working relationship with their distributing partners. Selection of an ideal sales channel is essential for secure distribution of the product to end-user.

Leading market players, such as DuPont, Shell Chemicals LP, and Tokyo Chemical Industry Co., Ltd., have a vast distribution network owing to their global presence and are integrated throughout the value chain. Some of the key distributors of 1,3 PDO include Wego Chemical Group, Connect Chemicals, ATAMAN KiMYA, Parchem- fine & specialty chemicals, Gantrade Corporation, Otto Chemie Pvt. Ltd etc.

A few small and domestic players rely on third-party distributors to provide their products to customers. Online distribution channels are preferred by both large and small players in this market. The online supply of 1,3-propanediol is facilitated through online platforms, such as TCI America, Amazon, Brenntag India, IndiaMart, and Merck KGaA.

Product Insights

The bio-based segment dominated the market in 2023 and accounted for a revenue share of 55.9%. The production from biomass imparts distinct characteristics, making it an attractive option for eco-conscious industries. It reduces reliance on finite fossil resources and mitigates environmental impact by lowering greenhouse gas emissions and reducing dependency on petrochemical feedstocks.

Conventional 1,3 propanediol (PDO) represents a fundamental segment of chemical compounds. Its structure is defined by a linear propane backbone comprising three carbon atoms sequentially bonded together. Two hydroxyl groups (-OH) are strategically positioned along this backbone, specifically at the first and third carbon positions. Hydroxyl groups confer a diol characteristic to the molecule, playing a pivotal role in its functionality and versatility across numerous industrial applications.

Application Insights

The polytrimethylene terephthalate (PTT) segment dominated the global market in 2023 and accounted for a revenue share of 67.5%. This is attributable to the product’s exceptional characteristics, such as resilience, stain resistance, and environmental sustainability. PTT is used as a crucial polymer in the formulation of various composites, adhesives, laminates, and moldings.

Polyurethane benefits significantly from incorporating 1,3-propanediol in its synthesis, as this versatile polymer is used in many applications. This bio-based compound, derived from renewable resources, enhances the sustainability and performance of polyurethanes, making it suitable for various application segments. One of the polyurethanes' most significant application segments (incorporating 1,3 PDO) is foams, which include flexible and rigid types. In flexible foams, 1,3 PDO improves comfort and resilience, making it ideal for mattresses, furniture, and automotive seating. Rigid foams enhance insulation properties, crucial for energy-efficient buildings and refrigeration applications.

Regional Insights

North America market is expected to grow on account of the presence of various personal care and cosmetic companies such as Maybelline New York, Procter & Gamble, Colgate-Palmolive Company, Avon, Unilever, and Johnson & Johnson Private Limited.

U.S. 1,3 Propanediol Market Trends

The U.S. market has experienced significant demand from the personal care industry as it effectively replaces glycol and butylene as a more environmentally and skin-friendly alternative. The personal care industry is constantly booming in the domestic market.

Asia Pacific 1,3 Propanediol Market Trends

The demand for bioplastics is evident in every major region, especially in the Asia Pacific owing to favorable government policies and regulations aimed at encouraging the use of bio-based products.

The 1,3 propanediol market in China has been witnessing steady growth over the past few years owing to the country's expanding personal care products industry. The increase in raw materials prices used for developing biobased and conventional 1,3 propanediol resulted in the moderate-to-slow market growth in China during 2023.

Europe 1,3 Propanediol Market Trends

The market is anticipated to be driven by the growth in the personal care industry. Several developments in Europe reflect the promising growth for the 1,3 propanediol market. In addition, the region also has well-established construction and furniture industries owing to the need for aesthetic products and the presence of regional manufacturers. According to the European Commission, the region's economy highly depends on its construction industry.

The Germany 1,3 propanediol market is witnessing significant growth due to the overall market of 1,3 propanediol receiving a significant boost. Several investments in the personal care industry reflected the strong growth and performance of the market.

Central & South America 1,3 Propanediol Market Trends

The Central & South America market accounted for a low revenue and volume share relative to the global market. This situation will likely remain the same over the forecast period, owing to the consolidated nature of the global market and the availability of traditional substitutes of 1,3 propanediol.

The Brazil 1,3 propanediol market is anticipated to receive a boost from the domestic personal care industry. It is the largest market in the region and the fourth-largest cosmetics market globally. The personal care market witnessed strong growth, with most of its revenue derived from exports to neighboring countries in the region.

Middle East & Africa 1,3 Propanediol Market Trends

Middle East and Africa are promising regions for the demand for 1,3-propanol. According to the Organic, Natural & Clean Beauty MENA Market Report 2023, published by the Middle East Organic and Natural Products Expo, which took place in Dubai, UAE, from 12th to 14th December 2023, the region presents significant opportunities for companies to cater to the growing demand for organic and specialty products in personal care.

The 1,3 propanediol market in South Africa is anticipated to grow due to the presence of domestic manufacturers of cosmetics and personal care products. Companies such as Lelive and Suki Naturals have consciously focused their marketing efforts on catering to differing skin types and tones in the country and differentiating themselves from global brands.

Key 1,3 Propanediol Company Insights

Some of the key players operating in the market include DuPont, Shell Chemicals LP among others.

-

Dupont is a chemical company that produces polymers, high-performance fibers and foams, aramid papers, non-woven structures, water purification technologies, and protective garments. The company has subsidiaries in about 50 countries worldwide and manufacturing operations in about 24 countries. It has 150 research and development facilities in China, Brazil, India, Germany, and Switzerland.

-

Shell Chemicals is the petrochemicals arm of Shell plc. It consists of nearly 70 companies engaged in the production of chemicals, supplying the parent company, and selling to the external market. The company is a pioneer in 1,3 PDO production and was responsible for developing 1,3 PDO two decades ago. It also produces alpha olefins, detergent alcohols, alcohol ethoxylates, plasticizer alcohols, ethylene oxide, and ethylene glycols. It operates in over 70 countries and caters to the energy and petrochemical industries. Its business is divided into the following segments: Integrated Gas, Upstream, Chemicals & Products, Renewables & Energy Solutions, and Marketing.

Shenghong Group Holdings, Zhangjiagang Glory Biomaterial Co., Ltd. and Zouping Mingxing Chemical Co., Ltd., among others, are some of the emerging market participants in the 1,3 propanediol market.

-

Zhangjiagang Glory Biomaterial Co., Ltd. (earlier called Zhangjiagang Huamei Biomaterial Co., Ltd.) is a manufacturer of 1,3 PDO that was initially established for a biobased PDO program between Glory Chemical and Softbank China Venture Capital. The former had partnered with DuPont until 2012, after which the contract expired. The company produces PDO from glycerol used in cosmetics, humectants, solvents, and APIs. Its annual production capacity for 1,3 PDO and 2,3 BDO is 65,000 tons, and its products are ISO 9001:2000 certified.

-

Shenghong Group Holdings is a manufacturer of chemical fibers and polymers. The company produces microfibers, differentiated functional fibers, and other fiber products. It has three industrial bases: Suzhou, Lianyungang, and Suqian. The company acquired the Global Recycled Standard (GRS) certification license and promoted its green competitiveness and sustainability mission in the international market. The "green design platform for bio-based PTT fiber" developed by the company was then exported for use in various end-user markets. It mainly caters to the domestic market, with exports to other APAC countries and MEA.

Key 1,3 Propanediol Companies:

The following are the leading companies in the 1,3 propanediol market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont

- Metabolic Biopolymer

- Zhangjiagang Glory Biomaterial Co., Ltd.

- Zouping Mingxing Chemical Co., Ltd.

- Shell Chemicals LP

- Tokyo Chemical Industry Co., Ltd.

- Shenghong Group Holdings

- Primient

- Haihang Industry

Recent Developments

-

In April 2023, Ningbo Juhua Chemical & Science Co., Ltd. awarded a contract to Technip Energies for a 1,3 PDO plant with an annual capacity of 72 kilo tons in Ningbo, Zhejiang, China. This is part of the company’s initiative to expand its petrochemical new material business.

-

In January 2024, Germany-based chemical manufacturer Nordmann acquired Italy-based SD Chemicals S.r.l., a distributor of raw materials catering to the cosmetics industry catering to skin care, hair care, and makeup applications. This acquisition will enable Nordmann to expand its presence and enhance customer reach.

1,3 Propanediol Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 455.7 million

Revenue forecast in 2030

USD 799.7 million

Growth Rate

CAGR of 9.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

DuPont; Metabolic Biopolymer; Zhangjiagang Glory Biomaterial Co., Ltd.; Zouping Mingxing Chemical Co., Ltd.; Shell Chemicals LP; Tokyo Chemical Industry Co., Ltd.; Shenghong Group Holdings; Primient; Haihang Industry.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 1,3 Propanediol Market Report Segmentation

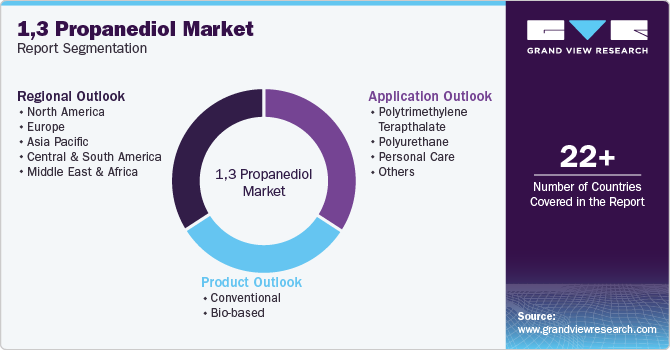

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 1,3 propanediol market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Conventional

-

Bio-based

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Polytrimethylene Terapthalate

-

Polyurethane

-

Personal Care

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 1,3 propanediol market size was estimated at USD 424.8 million in 2023 and is expected to reach USD 455.7 million in 2024.

b. The global 1,3 propanediol market is expected to grow at a compound annual growth rate of 9.8% from 2024 to 2030 to reach USD 799.7 million by 2030.

b. Asia-Pacific dominated the 1,3 propanediol market with a share of 35.7% in 2023. This is attributable to the growing demand for bio-based alternatives and growing bio-diesel production.

b. Some key players operating in the 1,3 propanediol market include DuPont, Metabolic Biopolymer, Zhangjiagang Glory Biomaterial Co., Ltd., Shell Chemicals LP, Tokyo Chemical Industry Co., Ltd., Shenghong Group Holdings, Primient, Haihang Industry and Zouping Mingxing Chemical Co., Ltd.

b. Key factors that are driving the market growth include growing demand for polyesters such as polytrimethylene terephthalate (PTT) and increasing polyurethane penetration across various end-use industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.