- Home

- »

- Plastics, Polymers & Resins

- »

-

Polytrimethylene Terephthalate Market Size Report, 2022-2030GVR Report cover

![Polytrimethylene Terephthalate Market Size, Share & Trends Report]()

Polytrimethylene Terephthalate Market (2022 - 2030) Size, Share & Trends Analysis Report By End-use (Automotive, Textiles), By Type (Petroleum, Bio-based), By Application (Film Materials, Fiber), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-970-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2019 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

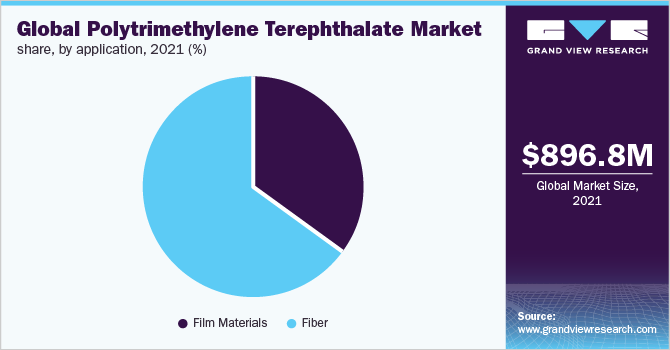

The global polytrimethylene terephthalate market size was valued at USD 896.8 million in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 5.4% over the forecast period. Polytrimethylene terephthalate (PTT) is majorly utilized in the textiles industry including stable fiber, film materials, and filament or textured yarns. It is majorly used in the industrial and residential carpet market along with engineering applications, such as automotive parts, mobile phone housings, and various other industrial and consumer products due to its good dimensional stability and finishing qualities.

Textiles comprising polylactic acid offer excellent drapability, breathability, and durability. PTT is a semi-crystalline polymer manufactured by polycondensation of trimethylene glycol with either dimethyl terephthalate or terephthalic acid. PTT-based products exhibit various superior characteristics including quick-drying, heat retention, resistance to stretching, wrinkle resistance, and high stiffness and tensile & flexural strength. These excellent characteristics have resulted in promoting demand from the textile and carpet industries. In addition, it possesses an enhanced surface and flows finish.

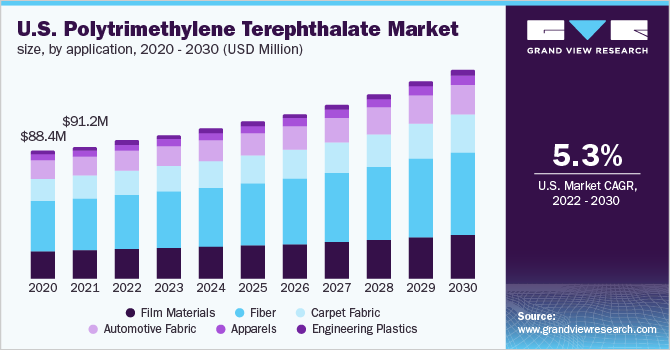

The U.S. is expected to dominate the industry over the forecast period owing to the increasing demand from the textile sector. Furthermore, PTT finds usage across various applications in automotive, medical, and many other end-use segments in the U.S. Rising demand for polytrimethylene terephthalate-based materials is anticipated to expand to the realm of various applications, such as film materials and fibers. The government initiatives and expenditure on the installment of manufacturing units for the production of PTT have created opportunities for investors in recent years, which are likely to boost production in the country. This, in turn, is projected to have a positive impact on product demand in the U.S.

Type Insights

On the basis of types, the global industry has been further categorized into bio-based and petroleum-based PTT. The bio-based PTT type segment dominated the overall industry and accounted for the maximum share of more than 76.90% of the global revenue in 2021. The segment is anticipated to expand further at the fastest growth rate retaining its dominant position in the global industry throughout the forecast period. Bio-based PTT exhibits higher elastic recovery, softness, and stretching & wrinkle resistance, making it suitable for use in the manufacturing of different film materials and fibers, such as carpet fabrics, automotive fabrics, apparel, and engineering plastics.

The growing awareness about the use of eco-friendly plastic-based products and strict environmental regulations, such as a ban on single-use plastics, have positively boosted the segment growth. Furthermore, petroleum-based PTT is expected to grow at a steady rate from 2022 to 2030 due to a rise in demand from various applications, such as medical, industrial area, commercial, and municipal fields as a result of its properties, such as profound stability and mechanical, thermal, & chemical resistance as well as dimensional stability.

End-use Insights

Textile emerged as the dominant end-use segment for polytrimethylene terephthalate market accounting for more than 28% market share owing to its properties including higher strength, enhanced elasticity, higher abrasion, and wrinkle resistance. Increasing investments in sports activities globally are augmenting the growth of the sports clothing and accessories market, which, in turn, is expected to drive the demand for PTT fibers. Various types of clothing, such as t-shirts and jackets, use fiber produced from PTT. Hence, PTT finds its suitability across the manufacturing of fibers and carpets and is anticipated to witness further growth during the forecast period.

Furthermore, the automotive industry is expected to grow at a steady pace over the forecast period, owing to the rising disposable income and increasing demand of the middle-class population. The growth of the automotive industry is anticipated to boost the growth of the PTT market owing to their uses in different automobile components and accessories such as automobile carpets, seating fabrics, side, roof, floor, and door panels, safety belts, tires, airbags, air filters, fuel filters, insulation materials, and various others. Moreover, stringent regulations imposed on the automotive industry related to pollution are driving the market.

As a result of these regulations, there is an increased demand for PTT products in the automotive and transportation industries. The growth in demand for personal hygiene products, such as toothbrushes and hand sanitizers, along with housewares, cosmetic goods, and convenience goods, is sharply increasing owing to the stockpiling and panic-purchasing by consumers. This shift in consumer buying behavior and structural change in the consumer goods industry is expected to augment the product demand over the forecast period.

Application Insights

The fibers segment emerged as the dominant application segment in 2021 and accounted for more than 64% share of the overall revenue. The segment is estimated to expand further at the fastest CAGR retaining its leading position throughout the forecast period. The growth can be credited to the high demand from various applications, such as carpet fabrics, automotive fabric, apparel, and engineering plastics. Fiber application caters properties, such as tenacity, flexibility, elasticity, uniformity, and others, which makes it suitable for various industries including textiles, automotive, and building & construction.

The film materials application is also estimated to witness a significant growth rate during the forecast period. The growth of this segment can be attributed to the increasing demand from industries including consumer goods, medical, and others, along with end-uses, such as microwave, semiconductor devices, light emitting diodes, wireless communications, rectifiers, transistors, telecommunications, and others due to their excellent physical, mechanical, thermal, electrical, and optical properties.

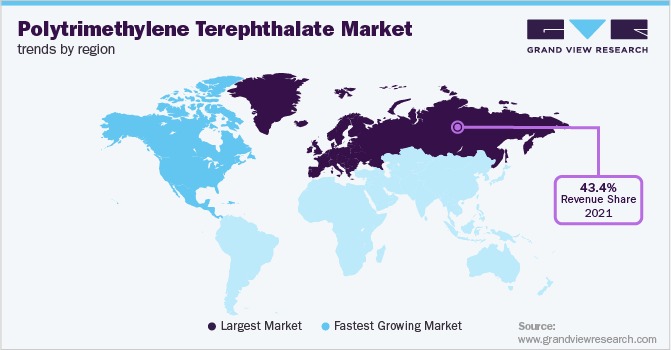

Regional Insights

Europe dominated the global industry in 2021 and accounted for the largest share of more than 43.40% owing to the growing textile industry in the region. Moreover, a rise in the number of manufacturers of carpets, apparel, food products, and other items is expected to drive the industry over the forecast period. The increasing technological advancement in the plastic industry to make it more environmentally friendly has fueled the industry growth in Europe. The U.K. holds the highest revenue share in the Europe region and is expected to record the fastest CAGRfrom 2022 to 2030. The increasing R&D activities and growing product utilization across applications, such as packaging, automotive, and building & construction industries, are some of the prominent factors driving the region’s growth.

North America is primarily driven by the rising product demand in the medical devices industry for the production of disposables and devices including catheters and surgical instruments. The product demand in various industries including textiles, automobile, building & construction, packaging, medical, and consumer goods is expected to boost the market growth in the region. China emerged as the leading plastic manufacturer in 2021 globally. The country is a major plastic producer with the presence of adequate number of plants and production capacities required to fulfill the local demand. The country manufactures a significant amount of PTT, which is used in various products, such as fibers, carpets, sheets, and films among others. Moreover, the developing automotive industry in the region results in a higher demand of automotive interior parts, such as fabrics, seat belts, dashboards, and others, which, in turn, boosts the PTT demand.

Key Companies & Market Share Insights

Companies are rapidly expanding their production capacities to consolidate their market position. Moreover, governmental support in various countries focused on environmental concerns as well as the growing textiles, automotive, and packaging industries will intensify the industry competition. For instance, in June 2022, Huafon Group, a Chinese manufacturer, has been named as the distributor of DuPont’s PTT business. The deal includes Sorona, which is a bio-based PTT fiber for different applications, such as carpets and fabrics. Some prominent players in the global polytrimethylene terephthalate market include:

-

DuPont

-

Huvis Corp.

-

GLORY

-

RTP Company

Polytrimethylene Terephthalate Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 930.4 million

Revenue forecast in 2030

USD 1.41 billion

Growth Rate

CAGR of 5.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2019 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; South Korea; Malaysia; Indonesia; Thailand; Brazil; Saudi Arabia

Key companies profiled

DuPont; Huvis Corp.; GLORY; RTP Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to the country, regional & segment scope report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polytrimethylene Terephthalate Market Segmentation

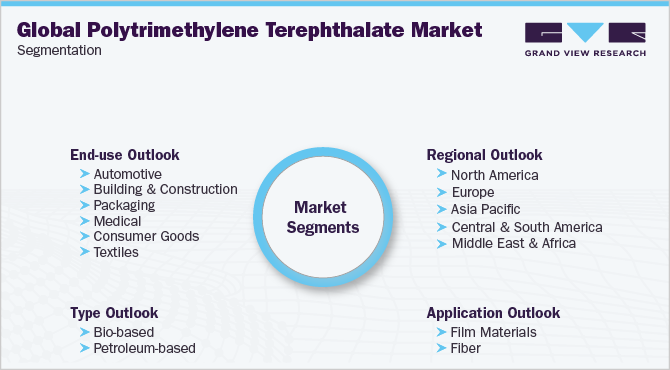

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented the global polytrimethylene terephthalate market report on the basis of type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2019 - 2030)

-

Bio-based

-

Petroleum-based

-

-

Application Outlook (Revenue, USD Million, 2019 - 2030)

-

Film Materials

-

Fiber

-

Carpet Fabric

-

Automotive Fabric

-

Apparels

-

Engineering Plastics

-

-

-

End-use Outlook (Revenue, USD Million, 2019 - 2030)

-

Automotive

-

Building & Construction

-

Packaging

-

Medical

-

Consumer Goods

-

Textiles

-

-

Regional Outlook (Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Indonesia

-

Thailand

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global polytrimethylene terephthalate market size was estimated at USD 896.8 million in 2021 and is expected to reach USD 930.4 million in 2022.

b. The global polytrimethylene terephthalate market is expected to grow at a compound annual growth rate of 5.4% from 2022 to 2030 to reach USD 1.41 billion by 2030.

b. Europe dominated the polytrimethylene terephthalate market with a share of 43.47% in 2021. Rising demand from the automotive industry is anticipated to boost the market growth across Europe during the forecast period.

b. Some of the key players operating in the polytrimethylene terephthalate market include DuPont, Huvis Group, GLOTY, and RTP Company.

b. Key factors driving the polytrimethylene terephthalate market growth include increasing demand from the textile industry, especially from carpet manufacturers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.