- Home

- »

- Consumer F&B

- »

-

100% Juice Market Size, Share And Trends Report, 2030GVR Report cover

![100% Juice Market Size, Share & Trends Report]()

100% Juice Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Fruits, Vegetables), By Category (Private Label, Branded), By Type, By Packaging, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-417-2

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

100% Juice Market Summary

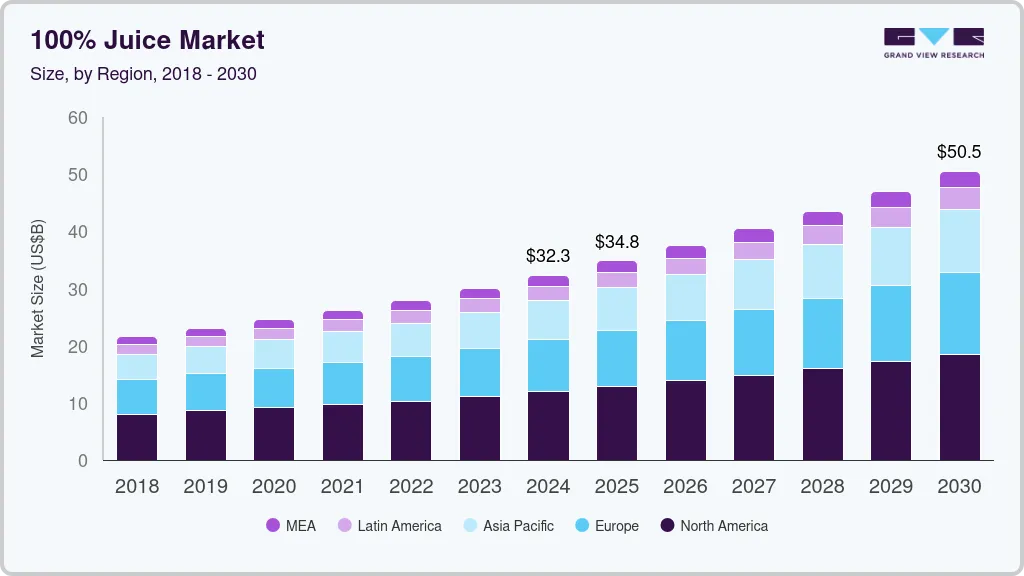

The global 100% juice market size was estimated at USD 29.99 billion in 2023 and is projected to reach USD 50.49 billion by 2030, growing at a CAGR of 7.7% from 2024 to 2030. The rise in health consciousness among consumers is a significant trend.

Key Market Trends & Insights

- The 100% juice market in North America captured a revenue share of over 36.97% in the market.

- The 100% juice market in the U.S. is projected to grow at a significant CAGR from 2024 to 2030.

- By product, the 100% fruit juice segment accounted for a share of 90.31% of the global revenue in 2023.

- By type, the Not from Concentrate (NFC) segment accounted for a share of 74.25% of the global revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 29.99 Billion

- 2030 Projected Market Size: USD 50.49 Billion

- CAGR (2024-2030): 7.7%

- North America: Largest market in 2023

Increasing awareness of the health benefits associated with consuming natural, nutrient-rich juices is boosting demand for the market. The rise of functional beverages, which offer additional health benefits, has led to a surge in demand for 100% packaged juice products enriched with vitamins, minerals, and probiotics. Consumers are increasingly looking for juices that boost immunity, enhance digestion, and provide energy.

With an increasing focus on sustainability, consumers are more inclined toward products that adopt environmentally friendly practices. Brands that emphasize sustainably sourced ingredients and eco-friendly packaging are witnessing greater consumer loyalty. Manufacturers are constantly experimenting with new flavor profiles and blends, moving beyond traditional orange and apple juices to exotic fruit combinations and blends that include superfoods. This innovation caters to a diverse palate and encourages trialing among consumers.

An increasing number of consumers are transitioning away from carbonated drinks and sugary beverages in favor of healthier, natural options. The perception of 100% packaged juice as a premium, healthful element of a balanced diet bolsters its appeal. Younger generations, who are highly health-conscious, are a driving force in the market. They prioritize clean-label products, which are perceived to be free from artificial ingredients.

Leading juice manufacturers are expanding their product lines to include functional juices, organic offerings, and blends featuring superfoods like turmeric or ginger. This diversification caters to evolving consumer preferences. Companies are increasingly positioning their products as organic, non-GMO, and free from artificial additives to cater to health-conscious consumers.

Globally, wellness centers have increasingly advocated for the adoption of healthier diets to enhance both physical and mental well-being. One of the emerging trends among consumers is detoxification, a practice aimed at cleansing the body, in which fruit juices play a crucial role. These juices not only aid in detoxification but also support weight loss. In response, juice manufacturers have begun launching products specifically designed to fit seamlessly into detox programs. For example, Pressed, a California-based company, introduced new detox juice offerings segmented into specific programs, such as the Cleanse 1 program and Cleanse 2 program, each featuring different juice products.

In addition, veganism has become a popular dietary trend, with widespread adoption globally. These juice products, which can easily be incorporated into a vegan diet, provide essential vitamins and minerals, driving their growing demand among consumers. To cater to this market segment, companies are launching such products in various flavors and innovative packaging to attract health-conscious consumers.

The 100% juice market is set for sustained growth, driven by innovations in product formulations, campaigns, and collaboration activities, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global market.

Product Insights

The 100% fruit juice segment accounted for a share of 90.31% of the global revenue in 2023. The 100% fruit juice is favored by consumers for its natural sweetness, derived entirely from fruits without added sugars or artificial sweeteners. This aligns with the growing preference for natural and healthier beverages. 100% packaged fruit juices are often marketed as part of a balanced diet, associated with various health benefits, including improved immune function, better digestion, and reduced risk of chronic diseases. This health association boosts their popularity. Many well-established juice brands have built their portfolios around 100% fruit juices, investing in extensive marketing campaigns that emphasize the purity, natural taste, and health benefits of their products. This has helped cement fruit juice's dominance in the market.

The 100% fruit & vegetable blend segment is expected to grow at a CAGR of 8.8% from 2024 to 2030. As consumers become more health-conscious, they are increasingly seeking beverages that offer a balanced nutritional profile. Blending fruits and vegetables creates juices that are lower in natural sugars while being rich in essential vitamins, minerals, and fiber. This combination appeals to consumers looking for healthier beverage options. The combination of fruits and vegetables offers a wider range of flavors and textures, appealing to consumers who are adventurous with their taste preferences. This diversity allows manufacturers to create unique blends that stand out in a crowded market, attracting consumers who seek variety in their diets.

Type Insights

The Not from Concentrate (NFC) segment accounted for a share of 74.25% of the global revenue in 2023. NFC juices are widely perceived by consumers as being of higher quality and closer to the natural taste of freshly squeezed juice. Unlike juice from concentrate, which undergoes multiple processing steps, including concentration and reconstitution, NFC juice retains more of the natural flavors and nutrients of the original fruit or vegetable. This perception of freshness and purity makes NFC juice more appealing to consumers who prioritize quality. Many established juice brands have built strong consumer loyalty around their NFC product lines. These brands often invest heavily in marketing and product innovation, reinforcing their market leadership and ensuring that NFC juices remain the preferred choice for a large segment of consumers.

The from concentrate segment is expected to grow at a CAGR of 8.0% from 2024 to 2030. Juices made from concentrate are generally more affordable than their "not from concentrate" counterparts. The concentration process reduces the volume and weight of the juice, making it cheaper to transport and store, which translates to lower costs for consumers. This affordability makes concentrate juices an attractive option, especially in price-sensitive markets and among budget-conscious consumers. The concentration process removes much of the water content, reducing the likelihood of spoilage and making these juices easier to store for extended periods.

Category Insights

The branded segment accounted for a share of 57.95% of the global revenue in 2023. Consumers often prefer well-known brands that they trust, particularly when it comes to products like 100% juice, which is associated with health and wellness. Established brands have built a reputation for quality, consistency, and safety, leading to strong consumer loyalty. This trust in branded products drives higher sales and market share. Major juice brands invest heavily in marketing and advertising campaigns that emphasize the purity, health benefits, and superior taste of their products. These efforts create strong brand recognition and reinforce the value proposition of branded juices, attracting a large consumer base.

The private label segment is expected to grow at a CAGR of 7.9% from 2024 to 2030. The perception of private-label products has significantly improved over the years. Many retailers have invested in enhancing the quality of their private label offerings, ensuring they meet or even exceed the standards of branded products. This shift has led to increased consumer trust and acceptance of private-label 100% juices. Retailers are increasingly promoting their private label products, giving them prominent shelf space and visibility. With the rise of supermarket chains and e-commerce platforms, private-label juices are becoming more widely available, making it easier for consumers to choose them over branded options.

Packaging Insights

The carton segment accounted for a share of 59.13% of the global revenue in 2023. Carton packaging is widely preferred by consumers for its convenience, ease of use, and portability. It is easy to store, pour, and reseal, making it an ideal choice for both home use and on-the-go consumption. This broad consumer appeal contributes to its dominant market share. They are less expensive to produce and transport compared to other packaging materials like glass. This cost efficiency allows juice producers to offer their products at competitive prices, which attracts more consumers and drives higher sales volumes.

The plastic segment is expected to grow at a CAGR of 8.0% from 2024 to 2030. Plastic bottles and containers are lightweight and durable, making them convenient for consumers to carry and handle. This portability is particularly appealing for on-the-go lifestyles, as plastic bottles are less likely to break compared to glass and are easier to transport in various settings. The lower production and transportation costs associated with plastic packaging make it an attractive option for manufacturers, which can lead to more competitive pricing for consumers.

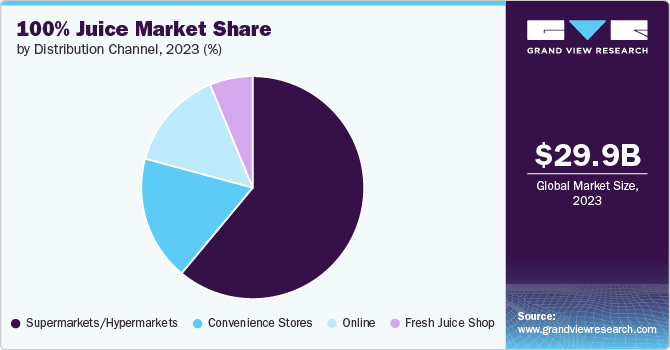

Distribution Channel Insights

The sales of 100% juice through supermarkets/hypermarkets accounted for a revenue share of 61.04% in 2023. These retail formats offer a one-stop shopping experience, where consumers can purchase all their grocery needs, including 100% juice, in a single trip. The convenience of picking up juice along with other household essentials boosts sales through these channels. Supermarkets and hypermarkets typically offer an extensive range of 100% juice products, including various brands, flavors, and packaging sizes. This vast selection attracts a broad customer base, allowing consumers to find exactly what they are looking for, which drives higher sales volumes.

The sales of 100% juice through online channels are expected to grow at a CAGR of 9.0% from 2024 to 2030. Juice manufacturers are increasingly investing in direct-to-consumer (D2C) online channels, bypassing traditional retail intermediaries. This approach allows brands to build stronger relationships with consumers, offer customized products, and collect valuable data on consumer preferences, all of which drive sales growth. Moreover, online platforms often utilize algorithms to provide personalized recommendations based on a consumer’s past purchases and preferences. This personalization encourages repeat purchases and increases the likelihood of trying new products, driving higher sales in the online segment.

Regional Insights

The 100% juice market in North America captured a revenue share of over 36.97% in the market. The market is evolving beyond traditional flavors such as orange, apple, and grape juice. Manufacturers are increasingly experimenting with exotic fruits, blends, and even functional additives like probiotics and vitamins to cater to the adventurous palate of modern consumers. This innovation not only attracts health-conscious individuals but also younger audiences who seek unique beverage experiences. Many juice brands have enhanced their online presence and optimized e-commerce channels, making it easier for consumers to access their favorite products.

U.S. 100% Juice Market Trends

The 100% juice market in the U.S. is projected to grow at a significant CAGR from 2024 to 2030.The market in the U.S. is experiencing robust growth, fueled by increasing consumer awareness of its health benefits, the rise of wellness trends, and a growing preference for natural and healthy beverages. The preference for clean-label products is rising, and 100% juice made from roasted barley grains without additives fits this trend perfectly.

Europe 100% Juice Market Trends

The 100% juice market in Europe is expected to grow at a CAGR of 7.8% from 2024 to 2030. European consumers are increasingly prioritizing health and wellness, leading to a strong preference for natural, clean-label products. 100% juice, with no added sugars, preservatives, or artificial ingredients, aligns well with this trend. Consumers are particularly interested in juices that offer health benefits, such as those high in vitamins, antioxidants, and other nutrients. Juice manufacturers are increasingly adopting recyclable, biodegradable, and reduced-plastic packaging options to meet consumer expectations and comply with stringent European Union regulations. Cartons made from renewable resources and glass bottles are gaining popularity.

Asia Pacific 100% Juice Market Trends

The 100% juice market in Asia Pacific is expected to witness a CAGR of 8.4% from 2024 to 2030. Consumers in Asia Pacific are increasingly focused on health and wellness, driving demand for 100% packaged juices that are natural and free from added sugars, preservatives, and artificial ingredients. The health benefits associated with consuming pure fruit juices, such as boosting immunity and providing essential nutrients, are key factors in this trend. As consumers become more aware of the potential health risks associated with pesticides and GMOs, there is a rising demand for organic 100% juices. This trend is particularly strong among urban populations in countries such as China, Japan, and Australia, where organic products are increasingly seen as premium and healthier options.

Key 100% Juice Company Insights

The market is characterized by competitive dynamics shaped by a combination of factors, including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Key manufacturers in the 100% packaged juice market utilize their expansive distribution networks and robust brand recognition to sustain a substantial market presence. They prioritize quality, innovation, and regional preferences, thereby reinforcing their leadership in international markets that embrace 100% packaged juice.

Key 100% Juice Companies:

The following are the leading companies in the 100% juice market. These companies collectively hold the largest market share and dictate industry trends.

- Del Monte Foods, Inc.

- Suntory Beverage & Food

- The Hain Celestial Group, Inc.

- Ocean Spray Cranberries, Inc.

- Welch Foods Inc.

- Juice Master Ltd.

- SUJA LIFE, LLC

- 7-ELEVEN, Inc.

- Greenhouse Juice Co.

- Pulp & Press Juice Co.

Recent Developments

-

In April 2024, Tropicana expanded its portfolio by introducing a new line called Tropicana Special Start, along with two additional flavors in its Tropicana Multivit Boost range. The new Tropicana Special Start line features three 100% pure pressed fruit juices: Pink Grapefruit, Sanguinello Blood Orange, and Pineapple. These fruits are sourced from regions chosen for their exceptional taste and color, such as the foothills of Mount Etna, where Tropicana's Sanguinello Blood Orange is harvested.

-

In January 2024, Revl Fruits debuted as a premium juice brand under the name 'Revl Fruits.' Their 100% juice lineup is crafted for enjoyment at any time, whether chilled or blended into your favorite beverages. The collection features four distinct flavors: Boldly Cran, Tart Cherry, Berry Wild, and Truly Tropical.

100% Juice Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 32.32 billion

Revenue forecast in 2030

USD 50.49 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, category, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Del Monte Foods, Inc.; Suntory Beverage & Food; The Hain Celestial Group, Inc.; Ocean Spray Cranberries, Inc.; Welch Foods Inc.; Juice Master Ltd.; SUJA LIFE, LLC; 7-ELEVEN, Inc.; Greenhouse Juice Co.; and Pulp & Press Juice Co.

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 100% Juice Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 100% juice market report based on product, type, category, packaging, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruits

-

Orange

-

Apple

-

Grape

-

Mixed Fruit

-

Others

-

-

Vegetables

-

Fruit & Vegetable Blend

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Not From Concentrate

-

From Concentrate

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Private Label

-

Branded

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Carton

-

Plastic

-

Glass

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Fresh Juice Shop

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 100% juice market size was estimated at USD 29.99 billion in 2023 and is expected to reach USD 32.32 billion in 2024.

b. The global 100% juice market is expected to grow at a compounded growth rate of 7.7% from 2024 to 2030 to reach USD 50.49 billion by 2030.

b. The fruits segment dominated the 100% juice market with a share of 90.31% in 2023. 100% fruit juices are often marketed as part of a balanced diet, associated with various health benefits, including improved immune function, better digestion, and reduced risk of chronic diseases.

b. Some key players operating in the 100% juice market include Del Monte Foods, Inc.; Suntory Beverage & Food; The Hain Celestial Group, Inc.; Ocean Spray Cranberries, Inc.; Welch Foods Inc.; and Juice Master Ltd

b. Key factors that are driving the market growth include the awareness of the health benefits associated with consuming natural, nutrient-rich juices is boosting demand. The rise of functional beverages, which offer additional health benefits, has led to a surge in demand for 100% juice products enriched with vitamins, minerals, and probiotics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.