- Home

- »

- Medical Devices

- »

-

3D Printed Surgical Models Market Size, Share Report, 2030GVR Report cover

![3D Printed Surgical Models Market Size, Share & Trends Report]()

3D Printed Surgical Models Market (2023 - 2030) Size, Share & Trends Analysis Report By Specialty (Cardiac Surgery, Neurosurgery, Orthopedic Surgery, Reconstructive Surgery, Transplant Surgery), By Technology, By Material, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-947-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

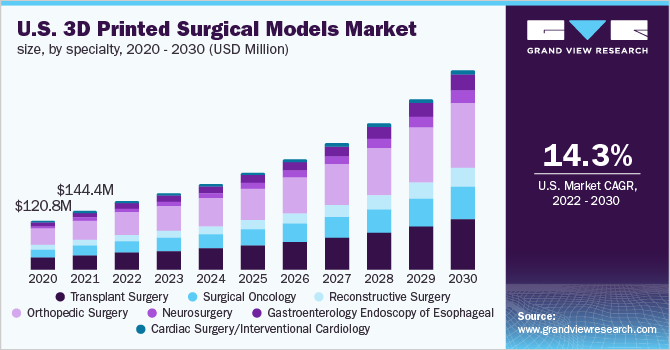

The global 3D printed surgical models market size was valued at USD 530.9 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 15.2% from 2023 to 2030. This surge can be attributed to the growing demand for technological advancements in surgical tools and techniques, personalized healthcare, and 3D printed materials. The 3D printing industry gained a lot of attention in 2020 as a result of its ability to meet urgent manufacturing needs and get around the limitations of conventional manufacturing during the COVID-19 pandemic. The elements driving the growth of 3D printed surgical models include the quickly expanding need for personalized healthcare solutions and the numerous surgical applications of 3D printing.

In recent years, 3D printing is being commonly used in the development of prototypes, anatomical models, surgical planning, prosthetics & assistive devices, patient-matched implants, tissue fabrications, and other medical products. This technology is anticipated to witness significant growth over the forecast period in terms of usage in existing applications as well as the development of new applications. 3D printing technology has the potential to significantly modify medical industry’s delivery and organization models across areas of clinical specialization.

Market Dynamics

Reimbursement for 3d Printing Services

Approval of reimbursement for 3D printed surgical models is anticipated to drive market growth over the forecast period. In July 2019, American Medical Association approved reimbursement codes for 3D printed anatomical models and customized surgical tools. These reimbursement codes are anticipated to increase the use and adoption of 3D printing in healthcare and clinical fields. The 0559T and 0561T codes are anticipated to result in the introduction of reimbursement for 3D printed anatomical models and tools by the U.S. Centers for Medicare and Medicaid and eventually by insurance companies, thus facilitating the market growth. In addition, the implementation of (as of July 2019) category III CPT code 0561T and its modifier 0562T, pertaining to 3D printed patient-specific surgical guides, is expected to represent a significant milestone within the Point-of-Care (POC) manufacturing community.

Increasing Use Of 3d-Printed Models In Healthcare Settings

3D printing enables the production of patient-specific anatomical and surgical models, which help surgeons and other surgical staff in effective decision-making, surgery simulation, and accurate surgery planning, thereby reducing the procedure time and resulting in fewer complications as well as better patient outcomes. These benefits of 3D printed surgical models are anticipated to impel market growth. For instance, Stratasys 3D printers support around 12 NHS (UK) hospitals, and Objet24 and Objet30 Pro 3D Printers enable surgeons to accurately assess intended implants before the surgery, resulting in reduced time for surgical procedures and subsequent reductions in operating room costs.

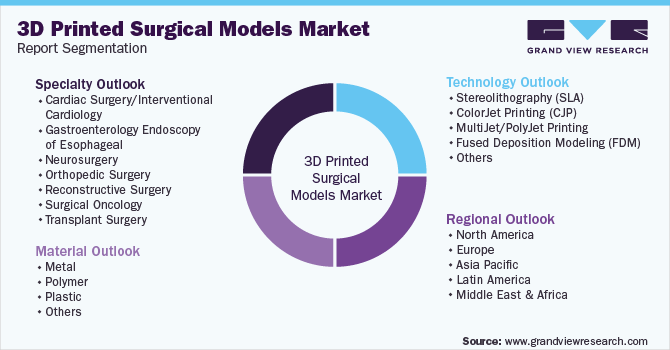

Speciality Insights

The 3D printed surgical models speciality segment is broadly categorized into cardiac surgery/interventional cardiology, gastroenterology endoscopy of esophageal, neurosurgery, orthopaedic surgery, reconstructive surgery, surgical oncology, and transplant surgery. The orthopaedic surgery segment dominated the global industry in 2021 and accounted for the largest share of more than 32.85% of the overall revenue. The main factors influencing the growth of orthopaedic surgery in the market are the growing ageing population and the increased prevalence & incidence of orthopaedic ailments.

According to the WHO, worldwide, approximately 1.71 billion people suffer from musculoskeletal diseases. Low back pain is the sole top cause of disability in 160 different nations, and musculoskeletal diseases are the main cause of disability globally. Over the forecast period, the neurosurgery segment is anticipated to grow rapidly. This is attributed to the technological advancements in 3D printing methods and materials, as well as the increasing prevalence of neurological diseases and the delicate architecture of the brain’s vasculature, which needs high degrees of precision in neurosurgery.

Technology Insights

On the basis of technologies, the global industry has been further segmented into Stereolithography (SLA), ColorJet Printing (CJP), multijet/polyjet printing, Fused Deposition Modeling (FDM), and others. The Fused Deposition Modeling (FDM) segment dominated the industry in 2021 and accounted for the largest share of 26.70% of the overall revenue. In 3D printing labs for medicine, FDM printers are very economical. FDM technology, which is a subset of the material extrusion technology class, is perfect for doctors who are interested in pursuing a career in 3D printing because it is quick, easy to use, office-friendly, and enables low-cost prototype creation.

In addition, the American Society of Mechanical Engineers reports states that in 2020, material extrusion technology will be one of the most widely used technologies for surgical planning, prosthetics, and assistive devices. Multijet/polyjet printing, Stereolithography (SLA), ColorJet Printing (CJP), Fused Deposition Modeling (FDM), and others are all included in the technology area. The other sector primarily consists of technologies for directed energy deposition, powder bed fusion, and associated technologies. The others category is expected to grow quickly as a result of the growing popularity of HP’s multijet fusion technology, which belongs to the powder bed fusion class of technologies.

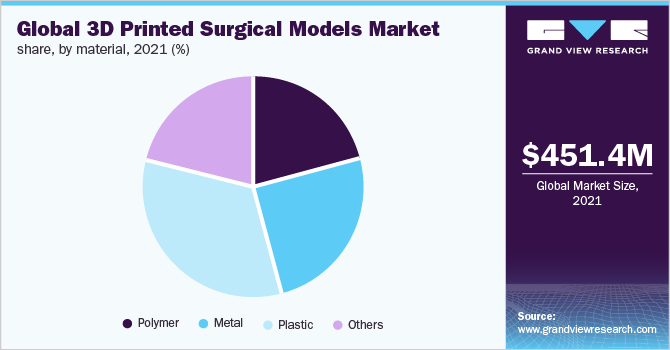

Material Insights

On the basis of materials, the global industry has been further segmented into metals, polymers, plastics, and other categories. The plastics material segment dominated the global industry in 2021 and accounted for the maximum share of more than 33.20% of the overall revenue. The segment is projected to expand further at the fastest growth rate maintaining its dominant position throughout the forecast period. The highest revenue share of plastics can be attributed to the availability of improved thermoplastics & biodegradable plastics, the relatively low cost of the material, reusability, and compatibility with a number of 3D printing technologies.

Plastics have been adopted in a significant and ever-expanding range of products due to their relatively low cost, ease of manufacture, versatility, and imperviousness to water. The polymers category is predicted to experience significant expansion over the forecast period due to the advent of desktop resin-based 3D printers and the versatility of these materials. The polymers segment is also estimated to expand at the second-fastest growth rate during the forecast period while the metals segment will account for the second-highest revenue share by 2030.

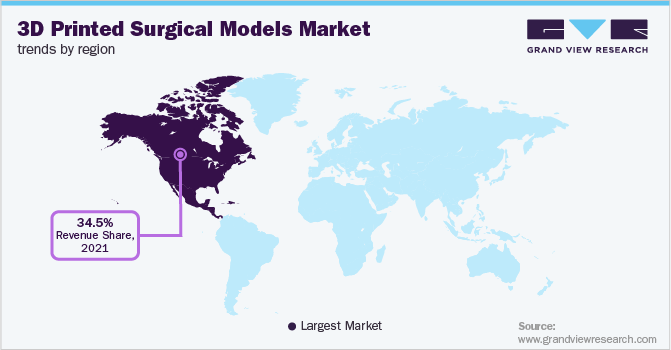

Regional Insights

On the basis of geographies, the global industry has been further segmented into North America, Asia Pacific, Europe, Middle East & Africa, and Latin America. North America dominated the global industry in 2022 and accounted for the largest share of more than 34.3% of the overall revenue. According to predictions, the local market will expand due to the growing senior population and the high frequency of illnesses associated with a sedentary lifestyle. The most advanced healthcare infrastructure, including clinics & hospitals, and extensive use of cutting-edge medical services & products like 3D printing will drive the region's growth.

A favorable reimbursement system and the presence of well-established competitors are also anticipated to boost the region’s industry share. Over the coming years, the industry is projected to expand significantly in the Asia Pacific. The need for 3D-printed surgical models is predicted to increase as a result of factors like rising per capita income levels, significant unmet medical requirements, technical improvements, and the economic development of emerging nations like China and India.

Key Companies & Market Share Insights

The presence of numerous domestic and foreign competitors reflects the intense competition in the market. In 2020, Stratasys Ltd., 3D Systems Inc., Materialise, and Formlabs were the major industry participants. The development of new products, mergers, acquisitions, partnerships, and collaborations are a few of the important strategic initiatives that industry participants have undertaken. For instance, Materialise expanded its 3D printing capabilities in the field of cardiology in 2021 by including new Left Atrium Appendage Occlusion (LAAO) procedure support technologies in the company’s Mimics Enlight cardiovascular planning software suite. In addition, in 2020, Fast Radius partnered with Axial3D to provide a new DICOM-to-print service for surgeons and hospitals across North America. Such strategic initiatives are anticipated to facilitate industry growth. Some of the prominent players in the global 3D printed surgical models market include:

-

Stratasys Ltd.

-

3D Systems, Inc.

-

Lazarus 3D, LLC

-

Osteo3D

-

Axial3D

-

Onkos Surgical

-

Formlabs

-

Materialise NV

-

3D LifePrints U.K. Ltd.

-

WhiteClouds Inc.

Recent Developments

-

In October 2022, PrinterPrezz, Inc., an industry leader in combining polymer and metal 3D printing, nanotechnologies, and surgical expertise to design and manufacture next-generation medical devices, signed a memorandum of understanding (MOU) to explore collaboration opportunities for the development of 3D printed medical implants in Singapore.

-

In November 2021, National University Hospital (NUH) with Johnson & Johnson Singapore, launched a 3D Printing Point-of-Care Collaboration. This effort is expected to significantly improve patient care capability as well as personalized healthcare.

-

In March 2021, Materialise NV expanded its 3D printing capabilities in the field of cardiology by including new Left Atrium Appendage Occlusion (LAAO) procedure support technologies in the company’s Mimics Enlight cardiovascular planning software suite.

-

In February 2021, Stratasys Ltd. announced the acquisition of UK-based RP Support Ltd., a provider of 3D printing post-processing solutions. The acquisition aimed at expanding Stratasys' product offerings and enhancing its customer support capabilities.

3D Printed Surgical Models Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 595.7 million

Revenue forecast in 2030

USD 1,605.6 million

Growth rate

CAGR of 15.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Specialty; technology; material; region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Stratasys Ltd.; 3D Systems Corporation; Materialise NV; Renishaw plc; EOS GmbH; Organovo Holdings Inc.; 3D LifePrints; Axial3D; Youbionic; Anatomiz3D Medtech Private Limited; Cyfuse Biomedical K.K.; RS Print; Replica 3DM; Osteo3d; BIO3d Technologies Pvt. Ltd.;

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Printed Surgical Models Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 3D printed surgical models market report on the basis of specialty, technology, material, and region:

-

Specialty Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac Surgery/Interventional Cardiology

-

Annuloplasty (mitral valve repair)

-

Repair Coronary Aneurysm

-

Replacement of Aortic Valve

-

Stent Insertion

-

Repair Congenital Heart Defects

-

-

Gastroenterology Endoscopy of Esophageal

-

Endoscopy of Esophageal lesion

-

Splenectomy

-

-

Neurosurgery

-

Repair Aneurysm

-

Transsphenoidal Excision of Pituitary Gland

-

Remove Brain Tumor

-

-

Orthopaedic Surgery

-

Repair Scoliosis

-

Repair Clavicle Fracture

-

Hip Repair

-

Repair Intervertebral Disc

-

Hip Replacement Revision

-

Repair Leg Fracture

-

Osteotomy

-

-

Reconstructive Surgery

-

Facial Reconstruction

-

Hand Reconstruction

-

Breast Reconstruction

-

Mastoidectomy

-

Cleft Palate Correction

-

-

Surgical oncology

-

Removal of Adrenal Tumor

-

Removal of Liver Tumor

-

Endoscopic Removal of Cardiac Lesion

-

Thoracic Removal of Lung Tumor

-

Removal of Renal Tumor

-

-

Transplant Surgery

-

Cardiac Surgery/ Interventional Cardiology

-

Heart Transplant

-

Liver Transplant

-

Lung Transplant

-

Kidney Transplant

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Stereolithography (SLA)

-

ColorJet Printing (CJP)

-

MultiJet/PolyJet Printing

-

Fused Deposition Modeling (FDM)

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal

-

Polymer

-

Plastic

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Some of the players operating in the 3D printed surgical models market include 3D Systems, Inc.; EnvisionTEC; Materialise N.V.; Stratasys Ltd.; and GPI Prototype.

b. Key factors that are driving the 3D printed surgical models market growth include growing demand for prototyping from the healthcare industry and intensive research and development activities.

b. The global 3D printed surgical models market size was estimated at USD 530.9 million in 2022 and is expected to reach USD 595.7 million in 2023.

b. The global 3D printed surgical models market is expected to grow at a compound annual growth rate of 15.2% from 2023 to 2030 to reach USD 1.60 billion by 2030

b. North America dominated the 3D printed surgical models market with a share of 34.3% in 2022. This is attributable to an increase in the geriatric population, high purchasing power, strong government support for quality healthcare, and supportive reimbursement policies in the U.S and Canada.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.