- Home

- »

- Medical Devices

- »

-

3D Printed Wearables Market Size And Share Report, 2030GVR Report cover

![3D Printed Wearables Market Size, Share & Trends Report]()

3D Printed Wearables Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Prosthetics, Orthopedic Implants), By End-use (Hospital, Pharma & Biotech Companies), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-166-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Printed Wearables Market Size & Trends

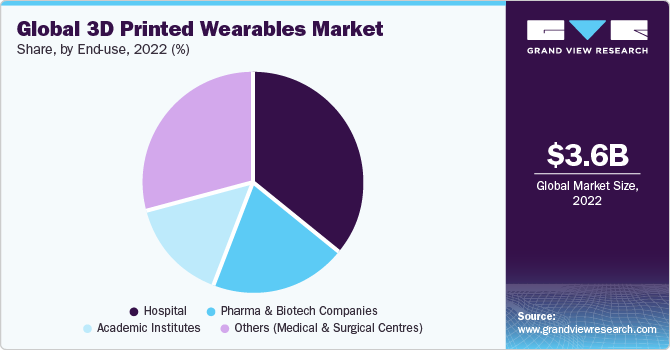

The global 3D printed wearables market size was valued at USD 3.59 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.0 % from 2023 to 2030. 3D printing technology comprises the creation of medical devices and other products layer by layer. This market is expected to increase as a result of industry participants concentrating more on the production of wearable 3D-printed products and the increasing preference of customers for highly customized goods. Sales of freshly developed 3D printed wearables are likely to increase soon since they are expected to overcome the drawbacks of conventional products.

The major factor influencing the 3D printed wearables industry is the increasing demand for uniquely designed products. With the help of 3D printing, companies can customize a device as per customers' requirements. Additionally, the factors driving the market are the increasing emphasis on healthcare by consumer technology companies and the general public. For instance, with the help of 3D printing technology, sports manufacturers have produced shoe soles that increase diabetics' sensory perception. Diabetic patients can walk more comfortably, and the shoes can also be customized as per patient needs.

In June 2020, Rejoint, an Italian manufacturer of medical implants, joined forces with Arcam, a GE Additives company. Due to this collaboration, Rejoint is using the EBM technology from GE Additive to produce knee implants additively. The tibia plate and femur condyles, among other specialized components for knee replacement surgery, are made by Rejoint using the artificial intelligence-enhanced Arcam EBM Q10plus technology.

In contrast to conventional products, 3D printed wearables can record data such as the total number of steps an individual has taken each day and their heart rate. Current technology research focuses heavily on sensors, flexible materials, and their bendable and pliable capacity. These characteristics make wearables ideal, especially for smartwatches and small discrete sensors. Omron Healthcare announced the HCR-6900T Series (HeartGuide), a wearable blood pressure monitor, in December 2019. It measures blood pressure on the wrist and is the size of a wristwatch.

One of the most promising applications of additive manufacturing, also known as 3D printing, is the production of complex and customized medical components and parts, including tissues, organs, orthopedic and cranial implants, and dental prosthetics. Additive manufacturing is considered to be the next manufacturing industrial revolution. Medtronic's Adaptix interbody system using Titan nanoLOCK surface technologies was launched in October 2020. The system's structure is a unique combination of surface textures across macro, micro, and nanoscales. This system provides Nano surface technology backed by science that enables effective navigation inside a dependable design with expanded features to fulfill the general requirements of fusion outcomes for surgeons.

The COVID-19 pandemic has significantly affected the transportation and logistics of the raw materials of 3D printed wearable products. The global supply chain was disrupted during the first half of 2020 due to the lockdown and COVID-19 restrictions in various regions. As a result, market players have witnessed a decrease in the sale of 3D printed products. The FDA took flexible approaches to ensure the availability and resolve the critical supply chain shortage of 3D products such as 3D printed PPE suits for healthcare workers. By the end of the third quarter of 2020, the sale of 3D printed products started increasing as the need and demand for the products increased with increased awareness of the product among consumers.

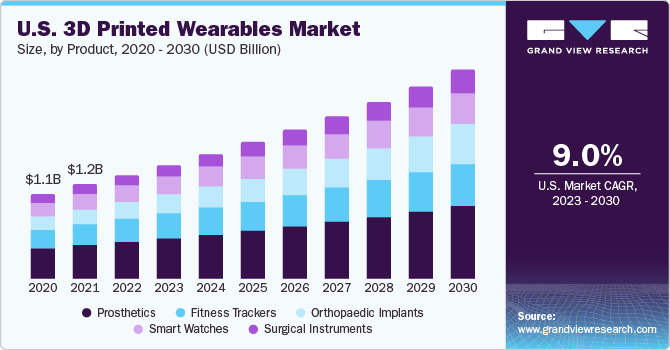

Product Type Insights

On the basis of product, the market is segmented into prosthetics, orthopedic implants, surgical instruments, smartwatches, and fitness trackers. The prosthetics segment accounted for the largest revenue share of around 35% in 2022. The large share of this segment is attributed to the rising prevalence of chronic diseases and the increasing demand for prosthetics implants in developing countries. An increasing number of amputation cases globally and a rise in limb amputation due to cardiovascular disease are other factors likely to fuel segment growth during the forecast period.

A US-based firm called LIMBER Prosthetics & Orthotics makes prosthetic limbs that are reasonably priced. The process used by the startup scans amputee limbs and creates custom prostheses from them. Its manufacturing process includes imaging, modeling, simulation, testing, digital design, and 3D printing to dramatically lower production costs. Along with offering lower prices, the firm also caters to the demands of each user to better help amputees and people with disabilities.

The orthopedic implants segment is expected to register a growth rate of 10.1% over the forecast period as these implants provide advantages such as extra comfort, efficiency, relative abundance, and long shelf life. In 2019, it was estimated that over 6,00,000 implants had been produced with 3D printing. Increasing awareness regarding this technologically advanced product is likely to expand the market. The growing usage of connectivity technologies such as microprocessor controllers, Bluetooth, and myoelectric technology has increased demand for such devices.

Amber Implants, A Dutch firm, creates treatments for vertebral compression fractures (VCFs) and burst fractures. Its VCFix Spinal System includes preparation, implantation, and an optional supplemental fixation kit, a vertebral body augmentation system with a 3D-printed perforated framework. As a more natural healing procedure, the system promotes bone ingrowth. The technique also avoids injecting cement into the bone to maintain bone fractures and eliminate the risks. With Amber Implant's solution, medical experts can improve the results of patients with spinal fractures.

End-use Insights

The hospitals segment accounted for the largest revenue share of over 35% in 2022 due to the expeditiously increasing patient admissions, growing cases of chronic disorders, and rising investment in the research and development of 3D printed wearable devices. The requirement of these devices is in large quantities in each room of the hospital, such as nurse’s station, operation theater, emergency room, outpatient clinics, and in the hospital’s ambulatory services. According to a report by Statista, in comparison to just three hospitals in 2010, 113 hospitals in 2019 had centralized 3D facilities for point-of-care manufacturing. During the COVID-19 epidemic, when certain hospitals relied on technology for a quick rollout of personal protective equipment and medical gadgets, the market for 3D printing in the healthcare industry grew significantly.

The pharma and biotech companies segment is estimated to register the fastest CAGR of 8.9% over the forecast period, as 3D printing offers many benefits to both clinical practice and the pharma and biotech industry, such as decreased overall cost and expedited development time for manufacturing drugs. Wireless 3D printed devices are likely to help in maintaining patient records more systematically. Increasing focus on 3D printed wearables and growing R&D spending are major factors responsible for the growth of this segment.

Regional Insights

North America dominated the market and accounted for a revenue share of around 40% in 2022 and is also estimated to register the fastest CAGR of 8.8% over the forecast period. This can be linked to a quickening pace in the creation of wearable 3D-printed technologies to fulfill the nation's growing need for effective healthcare, strong research and development, and the promotion of novel treatments. The most advanced, sophisticated, and high-end 3D printed wearable and medical gadgets are also produced in North America. This is anticipated to push the market for wearable 3D-printed products to expand.

Rapid technological advancements and growing demand for 3D-printed wearable devices are factors expected to drive the market in the region. Moreover, several medical device manufacturing companies are concentrating on the market due to the booming healthcare industry in the region. Increasing investments in 3D printing and rising R&D spending are also impacting the growth of the market in the region. For instance, developed by a US-based startup, Atomica Scanner is implant planning software that offers guided digital workflows for precise and predictable implant treatments. Digital patient scans take the place of traditional dental impressions. Using Atomica's software suite, dental professionals can then plan, develop, and 3D print surgical guides for precise and accurate implant procedures. Additionally, the platform offers simulation programs for braces and smile designs that increase patient engagement by displaying the anticipated results of the proposed course of action.

Key Companies & Market Share Insights

Key companies are engaging in partnerships, mergers, and acquisitions, aiming to strengthen their product portfolio, expand their manufacturing capacities, and provide competitive differentiation. For instance, Stratasys Ltd. announced the acquisition of Origin in January 2021. The primary factor in the company's growth is the purchase. The acquisition enhances the company's software-centric additive manufacturing solution, which provides printing technology based on digital light processing. Some prominent players in the global 3D printed wearables market include:

Key 3D Printed Wearables Companies:

- 3D Systems, Inc

- ENVISIONTEC US LLC

- Stratasys

- GENERAL ELECTRIC

- CYFUSE BIOMEDICAL K.K.

- Koninklijke Philips N.V.

- Zephyr Technologies & Solutions Pvt. Ltd

- OMRON Corporation

- Everist Health, Inc.

- BioTelemetry

3D Printed Wearables Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.90 billion

Revenue forecast in 2030

USD 6.67 billion

Growth rate

CAGR of 8.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

3D Systems, Inc; ENVISIONTEC US LLC; Stratasys; GENERAL ELECTRIC; CYFUSE BIOMEDICAL K.K.; Koninklijke Philips N.V.; Zephyr Technologies & Solutions Pvt. Ltd; OMRON Corporation; Everist Health, Inc.; BioTelemetry

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Printed Wearables Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 3D printed wearablesmarket report based on product type, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Prosthetics

-

Orthopaedic Implants

-

Surgical Instruments

-

Smart Watches

-

Fitness Trackers

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Pharma and Biotech companies

-

Academic Institutes

-

Others (Medical And Surgical Centres)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global 3D printed wearables market size was estimated at USD 3.59 billion in 2022 and is expected to reach USD 3.90 billion in 2023.

b. The global 3D printed wearables market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 6.67 billion by 2030.

b. North America dominated the 3D printed wearables market with a share of 40.8% in 2022. This is attributable to rising healthcare awareness coupled with wearable medical devices and constant research and development initiatives.

b. Some key players operating in the 3D printed wearables market include 3D Systems Corporation, EnvisionTEC, Stratasys Ltd., Arcam AB, Cyfuse Biomedical, Koninklijke Philips N.V., Zephyr Technology Corporation, Omron Corporation, Everist Health, LifeWatch AG.

b. Key factors driving the 3D printed wearables market growth include rising demand for wearable medical devices, increasing investment in R&D, and the rising incidence of cardiac disease.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.