- Home

- »

- Electronic Devices

- »

-

3D Projector Market Size, Share And Growth Report, 2030GVR Report cover

![3D Projector Market Size, Share & Trends Report]()

3D Projector Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (DLP, LCD, LCoS), By Brightness, By Light Source (Laser, LED, Lamps), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-979-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Projector Market Size & Trends

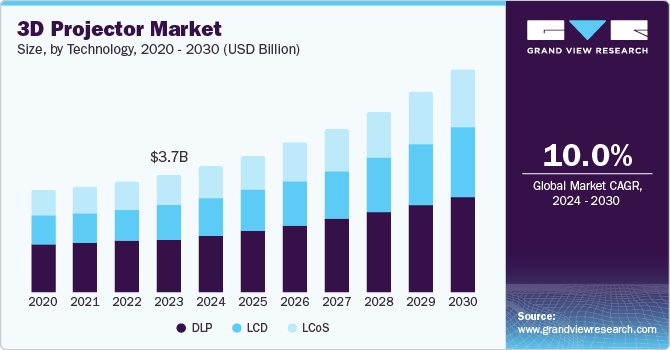

The global 3D projector market size was valued at USD 3.72 billion in 2023 and is projected to grow at a CAGR of 10.0% from 2024 to 2030. A 3D projector maps three-dimensional images and videos on a two-dimensional (2D) surface like a screen. Objects generated from a 3D projector give a sense of depth to the viewer, which leads to an enhanced viewing experience. The entertainment sector has witnessed a surge in the incorporation of 3D content to increase audience appeal. Prominent production houses in the film and television industries globally are coming up with high-quality 3D movies and shows. Additionally, innovative applications of 3D projectors in education, corporate, and healthcare sectors are expected to propel market growth.

Technological advancements in 3D projectors over the past few years have led to better product offerings from manufacturers with higher contrast ratios, sharper images, improved color production, and enhanced viewing experiences for audiences. The adoption of laser light sources has helped improve image quality, lifespan, and energy efficiency compared to traditional lamp-based projectors. Additionally, connected technologies such as cloud computing, IoT, and AI are being integrated into 3D projectors, presenting several avenues for innovative applications of this technology and optimal user experiences.

3D projectors are being utilized increasingly in corporate and educational sectors. For instance, the technology can be used to create interactive learning experiences that improve student engagement and concept clarity regarding complex subjects such as science, engineering, architecture, and visualization. On the other hand, the increased popularity of 3D games in the gaming community has led to a surge in demand for 3D projectors that feature higher picture quality and faster refresh rates.

Technology Insights

Digital Light Processing (DLP) technology accounted for the highest market revenue share of 45.8% in 2023. DLP utilizes color wheel, millions of micromirrors, and lenses to produce a much sharper picture than other conventional technologies. The micromirror array precisely controls light reflection, resulting in minimal pixelation and the production of a distinct, high-contrast picture. Additionally, DLP technology can be adapted according to various resolutions, making it suitable for a wide range of applications, ranging from movie theaters to business presentations.

Meanwhile, LCD technology is expected to register the highest CAGR during the forecast period. Compared to DLP projectors, LCD projectors are known for displaying better picture quality due to vivid color and sharper image production at a lower price. LCD projectors excel in color accuracy, making them well-suited for applications such as photography presentations or where consistent brand color representation is crucial. Additionally, LCD projectors consume lower power compared to their DLP counterparts. It translates to lower operating costs and reduced heat generation, leading to quieter operations.

Brightness Insights

The 2,000-3,999 lumens segment dominated the 3D projector market, accounting for a revenue share in 2023. 3D projectors in this segment offer a good balance between brightness and usability. They deliver high-quality images in moderately lit environments, making them suitable for a wide range of applications, such as business presentations in conference rooms, educational settings such as classrooms and training rooms, and even home entertainment settings. Additionally, this segment presents a more cost-effective solution compared to higher-lumen projectors. This affordability factor is crucial for businesses and educational institutions that require multiple projectors or prioritize value within their budgets.

The 4,000-9,999 lumen segment is expected to advance at a significant growth rate during the forecast period. 3D projectors in this brightness range offer superior image quality over longer distances than lower-lumen models. This makes them ideal for applications such as significant venue events, auditoriums, and conference rooms where a captivating and detailed presentation is crucial. Advancements in projector technology, such as improved lamp efficiency and laser light sources, are contributing to developing more compact and cost-effective projectors, leading to segment growth.

Light Source Insights

The lamps-based segment accounted for the highest market revenue share in 2023. Lamp-based 3D projectors represent a more mature technology than newer options such as laser and LED. It leads to a wider availability of lamp-based projectors, established supply chains, and potentially lower upfront costs for consumers and businesses. Lamp-based 3D projectors are more cost-effective than other types, making them an attractive choice for consumers with tight budgets. These factors make such projectors popular among consumers, leading to substantial segment demand.

The laser-based segment is expected to register the fastest CAGR during the forecast period. Laser projectors offer superior brightness, maintaining this consistency throughout their lifespan. This is a significant advantage over traditional lamp-based projectors, which experience a decline in brightness throughout their usage. Additionally, lasers deliver exceptional color accuracy and stability, providing a more vibrant and realistic 3D viewing experience. The maintenance costs associated with laser-based 3D projectors are lower than those of their lamp-based counterparts. This longer life span is a major factor for the growing adoption of this segment.

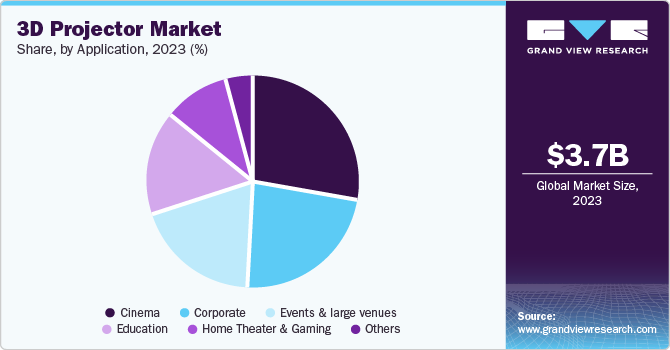

Application Insights

The cinema segment dominated the market in 2023. 3D technology offers a differentiated and immersive movie-watching experience that traditional 2D screens cannot replicate. This enhanced experience attracts audiences willing to pay premium prices for 3D movie tickets, driving revenue for filmmakers and theaters. Moreover, advancements in 3D projection technology, such as improved brightness, resolution, and 3D effect quality, incentivize cinemas to upgrade their existing equipment. This ongoing technology update cycle contributes to market growth in this application segment.

On the other hand, the corporate sector is expected to register a notable growth rate during the forecast period. The 3D projection technology allows businesses to present complex data and information in a more impactful and immersive manner. It leads to deeper audience engagement, better comprehension, improved communication, and informed decision-making within organizations. Additionally, an increasing trend of adopting a collaborative work environment has necessitated a better transition of ideas within teams, which can be achieved using 3D projection technology.

Regional Insights

Asia Pacific 3D projector market accounted for the highest market revenue share of 30.2% in 2023. This region is experiencing a significant rise in demand for consumer electronics products. Such widespread technology acceptance has helped in creating a fertile ground for the 3D projectors market. Furthermore, rising income levels, rapid urbanization, and the prevalence of the young population lead to increased expenditure on everyday leisure activities such as playing video games and watching movies. 3D projectors offer a better alternative to existing sources of entertainment, leading to their heightened demand in regional economies.

India 3D Projector Market Trends

India has been experiencing significant economic growth for two decades. A large population is shifting to urban areas for higher earning possibilities. The availability of high disposable income has led to increased spending on entertainment. India's thriving film industry and rich cinema culture offer several options for people to enjoy their leisure time during weekends. Furthermore, a rising trend of online gaming presents promising growth prospects for manufacturers of 3D projectors as they offer a superior quality immersive gaming experience than conventional 2D flat screens.

North America 3D Projector Market Trends

North America 3D projector market has been identified as a particularly lucrative region. The population in this region enjoys recreational activities such as online gaming. 3D projectors offer a much better experience, creating an augmented experience for gaming enthusiasts. Additionally, businesses in North America are increasingly seeking advanced presentation solutions to create a more impactful experience for clients and stakeholders. 3D projectors offer a unique way to present data and concepts, leading to higher adoption rates in this segment.

U.S. 3D Projector Market Trends

The U.S. is well-known for its rich and innovative filmmaking industry in the form of Hollywood. Filmmakers develop world-class cinema content every year, establishing global standards for producers worldwide. The sector requires advanced and innovative technology solutions to offer best-in-class experience to audiences. This endeavor for exceptional and high-quality film production results in theater owners deploying 3D projectors that utilize the latest technologies in their theaters. It helps maintain a steady demand for 3D projectors in the country.

Europe 3D Projector Market Trends

Europe accounted for the second-highest market revenue share in 2023. European consumers have traditionally been highly receptive to innovative technologies. Several multinational companies have headquarters in this region, which is expected to boost the demand for 3D projectors. While the region has a comparatively modest geographical spread and population, a high-earning population accounts for strong market growth prospects.

The number of 3D cinema screens in the UK is over 2,000. The population in this economy enjoys watching cinema from several genres during holidays and weekends. A distinct experience offered by 3D cinemas attracts a larger audience, increasing theater owners' profits. It has led to a heightened demand for 3D projectors in the UK. Additionally, incorporating this technology in the educational sector leads to an enhanced learning experience, and educational institutions are expected to drive the demand for 3D projectors from 2024 to 2030.

Key 3D Projector Company Insights

Some key companies involved in the 3D projector market include Seiko Epson Corporation, ViewSonic Corporation, and Panasonic Corporation.

-

Seiko Epson Corporation is a Japanese electronics company renowned worldwide for its projectors and printers. The company offers a variety of 3D projectors for businesses and home-based entertainment. Projectors offered a range in brightness from 2600 lumens to 3700 lumens, addressing a range of requirements and purposes. Additionally, products with different resolutions, such as Full HD, XGA, WXGA, and 4K-UHD, can be chosen as per customer needs.

-

ViewSonic Corporation is an American multinational electronics company specializing in digital display products such as projectors, interactive whiteboards, and LCDs. ViewSonic offers various projectors for different applications, such as business, education, and home entertainment. The brightness provided by projectors ranges from <2,999 lumens to >6000 lumens and resolution from WVGA to 4K-UHD.

Key 3D Projector Companies:

The following are the leading companies in the 3D projector market. These companies collectively hold the largest market share and dictate industry trends.

- Acer Inc.

- Barco

- Delta Electronics, Inc.

- Hitachi Digital Media Group

- Sharp NEC Display Solutions

- Optoma Corporation

- Panasonic Corporation

- Seiko Epson Corporation

- Sony Corporation

- ViewSonic Corporation

Recent Developments

-

In July 2024, Barco launched a global marketing campaign called "Laser by Barco" to showcase its technological expertise in laser projectors and educate consumers regarding the world-class cinema viewing experience offered by Barco products. The campaign is expected to attract potential consumers to buy Barco's laser projector range.

-

In February 2024, Sharp Corporation of Australia announced the integration of its product portfolios with NEC Display Solutions. This strategic collaboration is expected to augment and leverage the expertise of both companies toward developing world-class product offerings and services to consumers in the display technology segment.

3D Projector Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.99 billion

Revenue Forecast in 2030

USD 7.08 billion

Growth rate

CAGR of 10.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Technology, brightness, light source, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; China; Japan; India; Brazil

Key companies profiled

Acer Inc.; Barco; Delta Electronics, Inc.; Hitachi Digital Media Group; Sharp NEC Display Solutions; Optoma Corporation; Panasonic Corporation; Seiko Epson Corporation; Sony Corporation; ViewSonic Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Projector Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 3D projector market report based on technology, brightness, light source, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

DLP

-

LCD

-

LCoS

-

-

Brightness Outlook (Revenue, USD Million, 2018 - 2030)

-

<2,000

-

2,000-3,999

-

4,000-9,999

-

>10,000

-

-

Light source Outlook (Revenue, USD Million, 2018 - 2030)

-

Laser

-

LED

-

Lamps

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cinema

-

Education

-

Corporate

-

Home Theater and Gaming

-

Events & large venues

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Russia

-

-

Asia Pacific

-

Japan

-

India

-

China

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global 3D projector market size was estimated at USD 3.15 billion in 2019 and is expected to reach USD 3.24 billion in 2020.

b. The global 3D projector market is expected to grow at a compounded annual growth rate of 5.4% from 2019 to 2025 to reach USD 4.34 billion by 2025.

b. Asia Pacific dominated the 3D projector market with a share of 22.1% in 2019. This is attributable to flourishing film industry and growing inclination of the Chinese audience towards 3D movies.

b. Some key players operating in the 3D projector market include Optoma Corporation, Acer Inc., Seiko Epson Corporation, Barco, Delta Electronics, Inc., Hitachi Digital Media Group, NEC Display Solutions, Panasonic Corporation, Sony Corporation, and ViewSonic Corporation.

b. Key factors that are driving the market growth include increasing number of 3D cinema screens worldwide, digitization in the education sector, and increased use of 3D projectors in the gaming industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.