- Home

- »

- Next Generation Technologies

- »

-

3D Secure Payment Authentication Market Size Report, 2030GVR Report cover

![3D Secure Payment Authentication Market Size, Share & Trends Report]()

3D Secure Payment Authentication Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Merchant Plug-in, Access Control Server), By Application (Merchants & Payment Gateway, Banks), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-011-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Secure Payment Authentication Market Summary

The global 3D secure payment authentication market size was estimated at USD 1.10 billion in 2022 and is projected to reach USD 2.76 billion by 2030, growing at a CAGR of 12.7% from 2023 to 2030. Increasing Card-Not-Present (CNP) frauds across the world and growing online & e-commerce shopping among consumers are major drivers behind the growth of the global market.

Key Market Trends & Insights

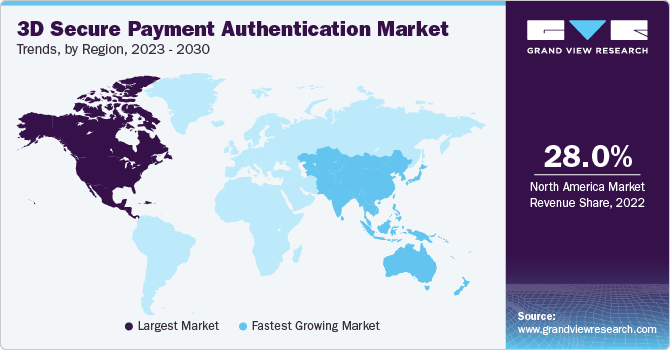

- North America dominated the 3D secure payment authentication market with a share of more than 28.80% in 2022.

- Asia Pacific is expected to witness the fastest growth over the forecast period.

- By component, the merchant plug-in segment dominated the market in 2022 and accounted for a share of more than 39.0% of the global revenue.

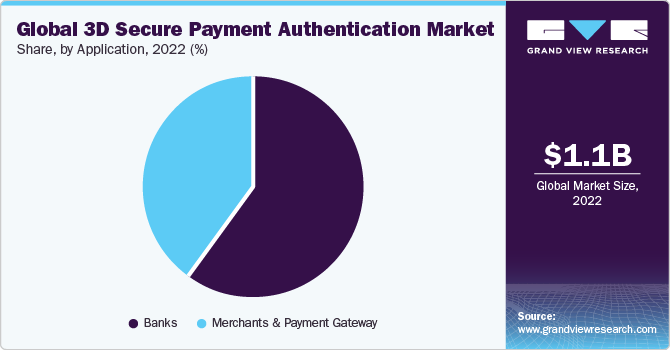

- By application, the banks segment reported a maximum revenue share of over 59.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 1.10 Billion

- 2030 Projected Market Size: USD 2.76 Billion

- CAGR (2023-2030): 12.7%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

In addition, advancements in 3D secure (3DS) payment authentication technology to enhance customer experience are further propelling the market growth. Robust authentication solutions are becoming of paramount importance as cyber threats are evolving and getting more sophisticated. Technological advancements have led to a highly competitive market as the population is getting attracted to digital technologies.

In the rapidly evolving landscape of the market, the integration of advanced technologies, such as Machine Learning (ML) and Artificial Intelligence (AI), has emerged as a key trend. These advanced technologies strengthen the security of online transactions by continuously assessing and examining user behavior and transaction data in real time. 3D secure solutions combined with AI and ML systems adapt to evolving fraud tactics, promptly identifying irregularities and potential security risks.

The global market is further experiencing growth due to the advancement of biometric authentication techniques, such as fingerprint recognition, facial recognition, and iris scanning. These biometric methods enhance the security of online transactions by confirming distinctive physical characteristics, simultaneously enhancing both security measures and user convenience. This has a substantial impact on the security environment and user interactions. Thus, the rapid adoption of biometric authentication technology in 3D secure payment authentication solutions is driving the growth of the market.

The major restraining factor associated with 3D secure payment authentication is its implementation costs. Merchants can anticipate transaction-related fees when utilizing 3D secure payment authentication. However, as the market for 3D secure payment authentication continues to evolve, finding cost-effective and scalable solutions would be crucial to overcoming the high initial installation costs, thereby fostering wider adoption of 3D secure payment solutions across various industries and industry verticals.

Component Insights

The merchant plug-in segment dominated the market in 2022 and accounted for a share of more than 39.0% of the global revenue. Merchant plug-in is one of the most important elements that perform 3D secure payment authentication and verification of credit and debit cards, thereby expected to grow over the forecast period. For instance, GPayments Pty Ltd. offers a 3D secure merchant plug-in under its ActiveMerchant offering. Similarly, Total System Services LLC also provides Payment Gateway & Merchant Plug-In as a solution to acquirers.

The access control server segment is anticipated to witness significant growth over the forecast period. The growth of this segment can be projected due to factors, such as the increase in the need for identity verification while processing digital transactions owing to the rise in identity fraud. Furthermore, the access control server software module adds an extra level of security to credit card transactions by enabling cardholders to validate their identity using a personally determined password. The solution is offered by several market players, including AsiaPay Technology, Worldline, and GPayments Pty Ltd., among others.

Application Insights

The banks segment reported a maximum revenue share of over 59.0% in 2022. The segment’s growth can be attributed to the increasing digitalization across the banking industry. In September 2022, Bankrate, LLC, mentioned that around 65.3% of the U.S. population uses digital banking services. Thus, the higher the use of digital banking and online card transactions, the greater the need for fraud prevention in the banking sector. Furthermore, 3D secure payment authentication enables banks to view customers’ transaction history and behavioral history and provides information about the users’ devices. Thus, these aforementioned factors are expected to fuel the segment’s growth over the forecast period.

The merchants & payment gateway segment is anticipated to witness significant growth over the forecast period. The increasing popularity of 3D secure payment authentication across the globe is anticipated to drive the segment’s growth over the forecast period. Furthermore, the development of 3D secure technology by upgrading it to 3D secure 2.0 has resulted in decreasing cart abandonment rates. Thus, such advancements and acceptance of 3D secure for fraud prevention are anticipated to drive the growth of the segment.

Regional Insights

North America dominated the market in 2022 and accounted for a share of over 28.0% of the global revenue. The growth of the regional market can be attributed to the rise in CNP frauds across North America. Merchants across the U.S. and Canada are increasingly adopting 3D secure payment authentication to prevent CNP frauds across the region. For instance, in 2021, the Federal Trade Commission (FTC) received approximately 390,000 reports associated with credit card fraud, thereby making it one of the prevalent forms of fraud in the U.S. Furthermore, the dominance of the market players offering 3DS solutions across the region is also a major factor responsible for the growth of the market in North America.

Asia Pacific is expected to witness the fastest growth over the forecast period. The growing population and increasing use of online shopping platforms are expected to fuel the growth of the regional market. As more consumers shop online, there is a greater need for secure payment authentication methods to prevent fraud, which has propelled the adoption of 3D payment authentication solutions. Furthermore, prominent market players, such as Visa Inc., have issued guidelines for rolling out EMV 3DS for the Asia Pacific region.

Key Companies & Market Share Insights

The market players are continuously working towards new product development and up-gradation of their existing product portfolio. For instance, in June 2023, GPayments Pty Ltd. announced the launch of ActiveAccess Service, an access control server designed particularly for the card issuing industry. ActiveAccess Service is a Software-as-a-Service (SaaS) solution that revolutionizes fraud prevention, enabling card issuers with enhanced efficiency, flexibility, and security.

In addition, these players are focused on strategies, such as partnerships and collaborations, which further contribute to the market’s growth. For instance, in January 2023, Bluefin Payment Systems LLC announced its partnership with Visa Inc. for network tokenization. Integration with Visa Inc.’s token technology is expected to enable network tokenization via Bluefin Payment Systems LLC’s PayConex payment gateway and ShieldConex data security platform.

Key 3D Secure Payment Authentication Companies:

- GPayments Pty Ltd.

- Broadcom Inc.

- Mastercard Incorporated

- RSA Security LLC

- Modirum

- Visa Inc.

- Bluefin Payment Systems LLC

- DECTA Limited

- American Express Company

- JCB Co., Ltd

3D Secure Payment Authentication Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.20 billion

Revenue forecast in 2030

USD 2.76 billion

Growth rate

CAGR of 12.7% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Component, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; China; India; Japan; Singapore; Australia; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

GPayments Pty Ltd.; Broadcom Inc.; Mastercard Inc.; RSA Security LLC; Modirum; Visa Inc.; Bluefin Payment Systems LLC; DECTA Ltd.; American Express Company; JCB Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Secure Payment Authentication Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global 3D secure payment authentication market report based on component, application, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Access Control Server

-

Merchant Plug-in

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Banks

-

Merchants & Payment Gateway

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Singapore

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 3D secure payment authentication market size was estimated at USD 1.10 billion in 2022 and is expected to reach USD 1.20 billion in 2023.

b. The global 3D secure payment authentication market is expected to grow at a compound annual growth rate of 12.7% from 2023 to 2030 to reach USD 2.76 billion by 2030.

b. North America dominated the 3D secure payment authentication market with a share of more than 28.80% in 2022. Merchants across the U.S. and Canada are increasingly adopting 3D secure payment authentication to prevent card-not-present (CNP) frauds across the region.

b. Some key players operating in the 3D Secure Payment authentication market include GPayments Pty Ltd., Broadcom Inc., Mastercard Incorporated, RSA Security LLC, Modirum, Visa Inc., Bluefin Payment Systems LLC, DECTA Limited, American Express Company, JCB Co., Ltd.

b. Key factors that are driving the market growth include increasing card-not-present (CNP) frauds across the globe and growing e-commerce & online shopping trends among consumers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.