- Home

- »

- Next Generation Technologies

- »

-

Payment Gateway Market Size, Share & Growth Report, 2030GVR Report cover

![Payment Gateway Market Size, Share & Trends Report]()

Payment Gateway Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Hosted, Non-hosted), By Enterprise Size (Large Enterprise, Small & Medium Enterprises), By End Use (BFSI, Retail & E-commerce), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-511-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Payment Gateway Market Summary

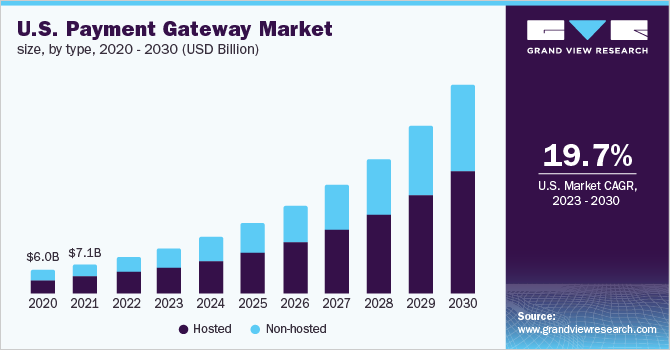

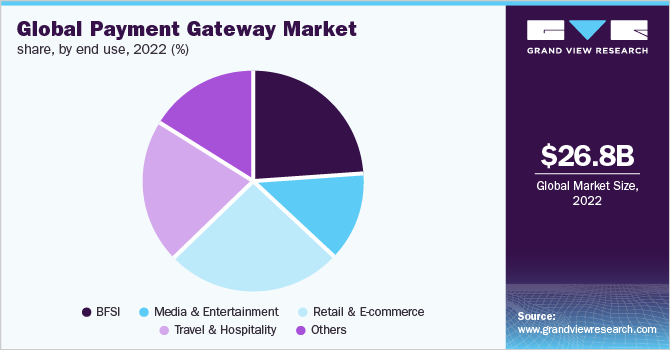

The global payment gateway market size was estimated at USD 26.79 billion in 2022 and is projected to reach USD 132.24 billion by 2030, growing at a CAGR of 22.2% from 2023 to 2030. The market growth can be attributed to the increasing demand for mobile-based payments across the globe.

Key Market Trends & Insights

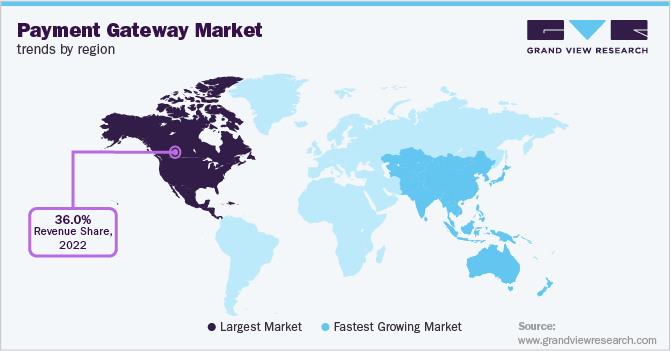

- North America dominated the market in 2022 and accounted for more than 36.0% share of the global revenue.

- By type, the hosted segment dominated the market in 2022 and accounted for more than 57.0% share of the global revenue.

- By enterprise size, the large enterprise segment dominated the market in 2022 and accounted for more than 56.0% share of the global revenue.

- By end use, the retail and e-commerce segment dominated the market in 2022 and accounted for more than 26.0% share of the global revenue.

Market Size & Forecast

- 2022 Market Size: USD 26.79 Billion

- 2030 Projected Market Size: USD 132.24 Billion

- CAGR (2023-2030): 22.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Rising e-commerce sales and growing internet penetration globally are other significant factors that are anticipated to contribute to the growth of the market for payment gateway. Additionally, the shift in merchant and consumer preference to digital channels for enabling online money transfers is projected to propel the growth of the market in the forthcoming years.

Companies are increasingly seeking payment gateways that provide secure internet transactions and help prevent credit or debit card scams and other fraudulent activities. Reliable payment gateways encrypt sensitive information such as bank account details and debit or credit numbers to ensure that the information is transferred securely from the customer to the issuing bank. Moreover, they eliminate the need for consumers to deal with the hassles of shopping from physical stores and waiting in long queues. Consumers can efficiently complete the entire transaction online, enjoying a seamless shopping experience.

Technological advancements and the rapid rate of internet penetration globally have enabled financial service providers to offer novel digital services to customers. The rising popularity of mobile-based apps for making money transfers also propels internet banking demand. Governments globally are making efforts to promote internet services across rural areas. The British government in 2020 has invested USD 5.9 billion in the country's rural areas to provide fast broadband services. 95% of the country's rural areas were expected to receive 4G coverage in the coming years owing to the USD 606.3 million investments made by the government in 2020 in the shared rural mobile phone network project.

E-commerce companies are partnering with payment service providers to offer a digital payments infrastructure to merchants and customers. Merchants manage a large volume of transactions, which has encouraged the integration of gateway systems into their sales channels. For instance, in July 2021, PayU, a payment gateway service provider, announced its partnership with WooCommerce, a customizable e-commerce platform, to enable WooCommerce merchants with digital payment infrastructure and end-to-end digitalization of business processes. This partnership is expected to offer merchants contactless payment solutions to scale the profitability and growth, exclusive pricing on transactions, and no hidden charges.

Numerous banks across the globe are also making efforts to enter into partnerships with payment gateway service providers to offer real-time payment facilities to consumers and merchants. For instance, in November 2021, Yes Bank announced its collaboration with Amazon Pay and Amazon Web Services (AWS) to provide a real-time payment system through the Unified Payment Interface (UPI) transaction facility. Through this collaboration, UPI facilitates inter-bank person-to-merchants and peer-to-peer network transactions through the Yes Bank digital payment platform.

COVID-19 Impact Analysis

The COVID-19 pandemic has positively impacted market growth. This can be attributed to the growing consumer preference for e-commerce, digital payments, quick payments, and cash displacement trend. The e-commerce space has grown significantly during the pandemic as there has been a 13%-20% increase in the number of customers preferring to make purchases online. Moreover, the dependency of individuals on mobile and internet services has increased during the pandemic as it connects them with payment gateways and other online platforms.

Type Insights

The hosted segment dominated the market in 2022 and accounted for more than 57.0% share of the global revenue. The demand for hosted payment gateways is increasing among merchants due to factors such as easy payment setup systems and reduced merchant liability. These factors ensure that third-party payment service providers handle the entire transaction process and provide enhanced security and data protection. Hosted payment gateways also allow merchants to reduce fraudulent activities and focus on their core offerings. Moreover, hosted gateways comply with the Payment Card Industry Data Security Standard (PCI DSS), which makes them a safer option for payment processing.

The non-hosted segment is expected to witness significant growth over the forecast period. Various merchants across the globe prefer a non-hosted payment gateway for their website as they can retain control over the whole checkout process, including the layout and design process while providing a seamless shopping experience to the customers. Using APIs, merchants enable customers to enter their debit or credit card information directly on the checkout page and process the payments. Moreover, non-hosted gateways can be integrated with online payment solutions using APIs with any device, thereby creating growth opportunities for the segment over the forecast period.

Enterprise Size Insights

The large enterprise segment dominated the market in 2022 and accounted for more than 56.0% share of the global revenue. Large enterprises tend to have higher customer visits on their website and hence need to deploy effective solutions for their customers during the checkout process. Payment gateway solutions can ensure a convenient checkout process for customers by supporting various digital payment methods, including net banking and credit or debit cards. Additionally, these enterprises require a highly secure and safe mode of transaction, which is facilitated by payment gateways. Reliable payment gateways use industry-standard encryption and protect sensitive customer and merchant data.

The small and medium enterprises segment is anticipated to register the highest growth over the forecast period. Small & medium enterprises are turning to payment gateways for faster payment processing and offering increased convenience to customers. Several small and medium enterprises are restructuring their revenue strategies and businesses by adopting a more digital approach. This is expected to spur the growth prospects of the segment in the near future.

End-use Insights

The retail and e-commerce segment dominated the market in 2022 and accounted for more than 26.0% share of the global revenue. The segment growth can be attributed to the rising number of online transactions in retail and e-commerce businesses across the globe. According to Oberlo, a drop-shipping solutions company, the retail industry is expected to grow at an average annual rate of 3.58% from 2018 to 2022. Furthermore, the increasing demand for online retailing across the globe is anticipated to fuel market growth over the forecast period.

The BFSI segment is expected to witness significant growth over the forecast period. The BFSI sector is widely adopting payment gateway systems as they provide an end-to-end ecosystem for financial services. Financial companies are challenged with complex cash flows where cash is collected from numerous sources and routed to various accounts. Gateway systems help financial companies easily manage money movement from a single dashboard.

Regional Insights

North America dominated the market in 2022 and accounted for more than 36.0% share of the global revenue. The growth can be attributed to technological advancements and the application of payment gateways in flourishing end-use segments such as retail and e-commerce. The presence of prominent players such as Square, PayPal Holdings Inc., Mastercard, BluePay, and Amazon Payments Inc. is also driving the market growth in the region. According to Oberlo, sales in the U.S. retail sector would grow at 2.3% in 2021 and further rise to 4.1% in 2022.

Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period. The growth can be attributed to several initiatives undertaken by governments to improve the online payment infrastructure in Asia Pacific countries. For instance, in India, the Reserve Bank of India (RBI) has regulated gateways such as Bharat Bill Pay, Paytm, and Mobikwik to enable effective digital payments. The Chinese government is focusing on improving internet access in rural areas, thereby creating growth opportunities for the market.

Key Companies & Market Share Insights

Vendors in the market are focusing on acquisitions and extending their product and service portfolios in untapped industries. For instance, in October 2020, Stripe, a financial service company, announced the acquisition of Paystack, an online payment processing company. Paystack operates in Nigeria and has plans to expand across South Africa. Paystack works independently and has embedded the services of Stripe with its offerings. Through this initiative, Stripe has expanded its presence in Africa.

Security concerns related to online payments are encouraging service providers to adopt advanced technologies and solutions to curb fraudulent activities. New product developments and collaborations are some of the key strategies adopted by players to gain a competitive edge in the market. For instance, in May 2021, Stripe announced its partnership with GrabPay, a provider of payment solutions to businesses, allowing businesses in Malaysia and Singapore to offer consumers a more convenient and rewarding online payment method through GrabPay’s e-wallet. Under the partnership, GrabPay worked with Stripe Checkout and API Integration to allow merchants to support payments in both Malaysian Ringgit and Singapore Dollar Currencies. Some of the prominent players operating in the global payment gateway market are:

-

Adyen

-

Amazon Payments Inc.

-

Authorize.Net

-

Bitpay, Inc.

-

Braintree

-

PayPal Holdings, Inc.

-

PayU Group

-

Stripe

-

Verifone Holdings, Inc.

-

Wepay, Inc.

Payment Gateway Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 32.52 billion

Revenue forecast in 2030

USD 132.24 billion

Growth rate

CAGR of 22.2% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

Adyen; Amazon Payments Inc.; Authorize.Net; Bitpay; Inc.; Braintree; PayPal Holdings, Inc.; PayU Group; Stripe; Verifone Holdings, Inc.; Wepay, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

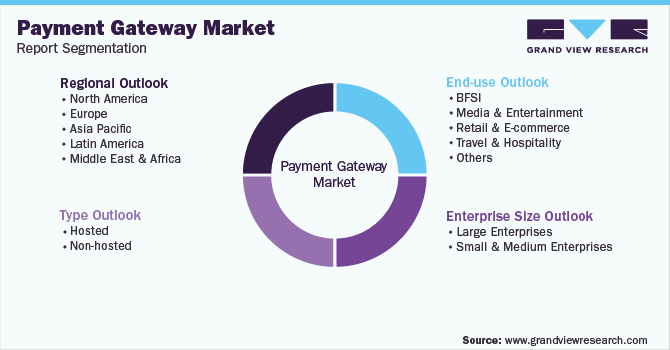

Segments Covered in the ReportThe report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global payment gateway market report based on type, enterprise size, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hosted

-

Non-hosted

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Media & Entertainment

-

Retail & E-commerce

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global payment gateway market size was estimated at USD 22.09 billion in 2021 and is expected to reach USD 26.79 billion in 2022.

b. The global payment gateway market is expected to grow at a compound annual growth rate of 22.1% from 2022 to 2030 and is expected to reach USD 132.24 billion by 2030.

b. The hosted segment led the payment gateway market and accounted for more than 57.0% share of the global revenue in 2021.

b. Some key players operating in the payment gateway market include Adyen, Amazon Payments Inc., PayPal Holdings, Inc., Authorize.Net, Stripe, PayU Group, Bitpay, Inc., Braintree, Wepay, Inc., and others.

b. Key factors that are driving the payment gateway market growth include increasing internet penetration and changing the preference of customers for online transactions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.