- Home

- »

- Next Generation Technologies

- »

-

5G Devices Market Size And Share, Industry Report, 2030GVR Report cover

![5G Devices Market Size, Share, & Trends Report]()

5G Devices Market (2025 - 2030) Size, Share, & Trends Analysis Report By Form Factor (Phones, CPE, Modules, Hotspots, Switches & Routers, Laptop, Tablets), By Spectrum (Sub-6 GHz, MmWave), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-147-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2019 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

5G Devices Market Summary

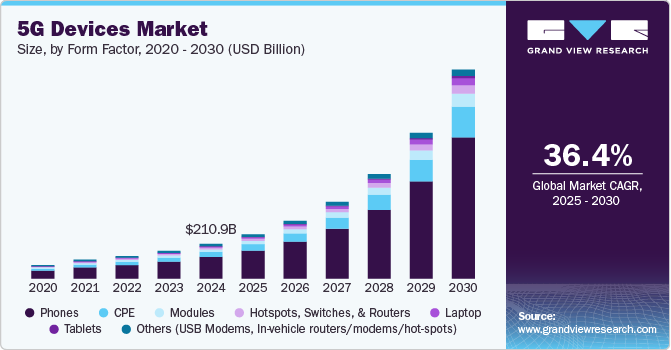

The global 5g devices market size was estimated at USD 210,920.5 million in 2024 and is projected to reach USD 1,269,201.4 million by 2030, growing at a CAGR of 36.4% from 2025 to 2030. One of the primary drivers propelling the market is the continuous expansion of 5G network infrastructure. Telecommunication companies and governments worldwide are investing heavily in rolling out 5G networks, increasing coverage and capacity.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, Brazil is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, phones accounted for a revenue of USD 169,919.5 million in 2024.

- Laptop is the most lucrative form factor segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 210,920.5 Million

- 2030 Projected Market Size: USD 1,269,201.4 Million

- CAGR (2025-2030): 36.4%

- Asia Pacific: Largest market in 2024

As these networks become more accessible, the demand for 5G devices such as smartphones, tablets, and IoT gadgets naturally rises. This expansion is enabling faster data speeds, lower latency, and greater connectivity, which appeals to both consumers and businesses.

Another significant driver of the market is the increasing consumer demand for high-speed connectivity. As people rely on their devices for an array of activities, from streaming high-definition content to online gaming, there is a growing need for quicker and more reliable connections. 5G technology caters to this demand by offering unparalleled data speeds and reduced lag, enhancing the overall user experience. This surge in consumer demand is pushing device manufacturers to produce more 5G-compatible products.

The substantial increase in the number of announced and commercially available 5G devices, as cataloged by GSA, is a strong driving force behind the growth of the market. The remarkable surge of 62% in announced 5G devices and a staggering 76% growth in 5G phones from the beginning of 2022 indicate the rapid pace of innovation within the industry. Consumers, as well as businesses and industries, are witnessing an expanding array of options in the market, catering to diverse needs and preferences. With over 1,650 commercially available 5G devices, reflecting a remarkable annual growth of more than 66%, this market transformation is extending the accessibility of 5G technology. This proliferation of 5G devices is translating into faster network adoption, improved connectivity, and enhanced user experiences, propelling the overall market forward.

The proliferation of the Internet of Things (IoT) and the advent of Industry 4.0 are also contributing to the growth of the market. These trends involve connecting various devices and sensors to the internet for data collection and automation. The low latency and high bandwidth of 5G networks are crucial for IoT and Industry 4.0 applications, as they enable real-time data transfer and decision-making. This is driving the development and adoption of 5G-compatible devices in sectors like manufacturing, healthcare, transportation, and smart cities.

One notable restraint in the 5G devices industry is the relatively higher cost associated with adopting this advanced technology. The deployment of 5G infrastructure and the production of compatible devices involve substantial investments. Consequently, this can drive up the cost of 5G devices, making them less affordable for some consumers or enterprises. To overcome this restraint, manufacturers and service providers need to focus on cost-effective solutions and foster competition in the market.

Form Factor Insights

The phones segment dominated the market in 2024 with the largest revenue share of 62.20%. Mobile phones have become an integral part of modern life, with millions of users globally. The transition to 5G not only promises faster and more reliable data speeds but also unlocks the potential for various applications, such as Augmented Reality (AR), Virtual Reality (VR), and the Internet of Things (IoT), which are best experienced on mobile devices. In addition, phone manufacturers have recognized the immense market potential and have been actively investing in 5G technology integration, thus further propelling the segment’s growth in the 5G devices market.

The laptop segment is anticipated to register significant growth over the forecast period. Laptops are essential tools for various professional and personal tasks, making them indispensable in modern life. The integration of 5G connectivity into laptops opens up new possibilities, enabling users to access high-speed internet on the go without the limitations of Wi-Fi hotspots. Laptops with 5G capabilities offer a compelling solution for remote work, as they provide reliable connectivity, ensuring professionals stay productive regardless of their location. The combination of 5G's low latency and high-speed internet access facilitates seamless video conferencing, cloud computing, and data-intensive tasks, further driving the appeal of 5G-enabled laptops.

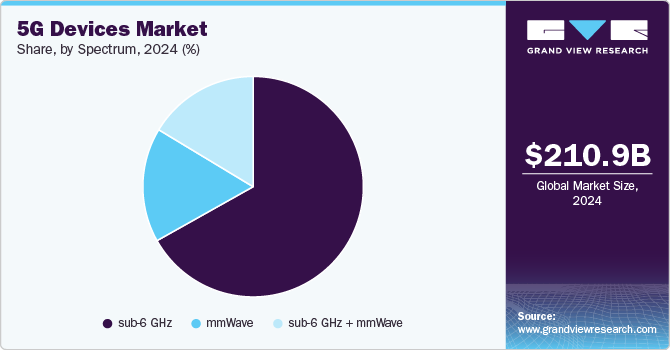

Spectrum Insights

The sub-6 GHz segment held the maximum market share in 2024. The sub-6 GHz frequencies offer a balanced mix of coverage and capacity. This means that devices operating in this frequency range can provide wide area coverage while also delivering impressive data speeds, making them suitable for both urban and rural areas. The sub-6 GHz 5G devices are also more widespread and accessible, as they are part of the initial phase of 5G deployments.

The mmWave segment is anticipated to register the fastest CAGR over the forecast period. Its emergence can be attributed to its unique capabilities and the growing demand for high-speed, low-latency connectivity. MmWave technology operates at extremely high frequencies, offering significantly faster data speeds compared to sub-6 GHz counterparts. As consumers and industries increasingly rely on bandwidth-intensive applications like AR, VR, and high-definition video streaming, mmWave's ability to deliver multi-gigabit data rates becomes a crucial selling point.

Regional Insights

The North America regional market is anticipated to emerge as the fastest-growing market from 2025 to 2030. North America, particularly the U.S., is home to some of the world's largest tech giants and innovators in the telecommunications industry. The region has been at the forefront of 5G network deployments, with extensive coverage and a strong focus on advancing the adoption of 5G technology. Moreover, North America boasts a tech-savvy consumer base that eagerly embraces the latest technological advancements. Growing demand for advanced technology, 5G network coverage, and investments in 5G networks are driving the regional market’s growth.

U.S. 5G Devices Market Trends

The growing demand for faster, more reliable internet connectivity, particularly as consumers and businesses increasingly rely on data-heavy applications such as streaming, gaming, and cloud computing. This is further supported by the expansion of 5G networks across urban and rural areas, ensuring broader coverage. Additionally, advancements in 5G technology, including improvements in speed, latency, and energy efficiency, have spurred the development of new devices, such as smartphones, IoT devices, and wearables, all of which require 5G connectivity to function optimally. The push for smart cities and connected ecosystems is also a significant driver, as 5G enables more efficient traffic management, health monitoring, and public safety systems.

Asia Pacific 5G Devices Market Trends

Asia Pacific 5G devices market dominated the 5G devices market in 2024. The region's vast population, particularly in countries like China and India, has fueled a tremendous demand for 5G devices. With growing urbanization and increasing smartphone adoption, consumers are eager to access the benefits of high-speed 5G networks. Furthermore, Asia Pacific hosts some of the world's largest manufacturers of 5G devices, including leading smartphone makers and network equipment providers. These local companies are well-positioned to deliver a wide range of 5G devices, catering to diverse consumer preferences and price points. In addition, Asian countries, including China and South Korea, were at the forefront of 5G network launches, which further propelled the region’s growth.

With the world’s one of the prominent 5G subscriber base, China is pioneering the adoption of 5G-enabled smartphones, IoT devices, and industrial applications. The government's strong commitment to digital transformation and smart city initiatives has spurred demand for devices that leverage 5G’s high-speed, low-latency capabilities. Additionally, the integration of 5G into sectors like manufacturing, healthcare, and transportation is fostering innovation and economic growth. As a hub for 5G device production and consumption, China continues to shape the global 5G landscape, driving connectivity and technological advancements.

Europe 5G Devices Market Trends

The increasing demand for advanced connectivity among consumers in the region drives growth of the 5G devices market in Europe. The demand is largely driven by activities such as high-definition video streaming, online gaming, and virtual reality applications, all of which are optimized with 5G technology. Companies are introducing affordable 5G devices to cater to the increasing demand. For instance, in September 2022, Deutsche Telekom launched the T Phone, a smartphone designed to provide users with an affordable and feature-rich 5G experience across nine European countries. The T Phone is equipped with a 6.52-inch IPS TFT display featuring a resolution of 720 x 1600 pixels and a refresh rate of 60 Hz, ensuring decent visual quality for everyday tasks. Such initiatives make 5G technology more accessible to a broader customer base and accelerate the adoption of 5G devices across the European market, thereby fueling the growth of the market.

UK 5G devices market is witnessing shift toward remote work and online education drives growth in the UK. Remote work became a prominent trend in the UK, with companies adopting hybrid or fully remote models to enhance flexibility and productivity. Employees working from home rely heavily on uninterrupted internet access for video conferencing, cloud-based collaboration tools, and data-intensive applications. 5G devices such as smartphones, laptops, and mobile hotspots provide faster speeds and lower latency compared to traditional broadband solutions, ensuring seamless virtual communication and workflow continuity. Businesses have also invested in 5G-enabled routers and dongles to equip their remote workforce with reliable connectivity, further boosting demand for such devices.

5G devices market in Germany is experiencing growth due to adoption of 5G in automotive applications. One of the key benefits of 5G in the automotive sector is its ability to enable seamless vehicle-to-everything communication. This technology allows vehicles to communicate with each other, with infrastructure, and with pedestrians, enhancing safety and efficiency on the roads. 5G’s ultra-low latency and high data transfer rates are critical for real-time decision-making in autonomous vehicles, requiring 5G-enabled modules, sensors, and onboard communication devices. The growing adoption of these devices by automakers in Germany is significantly contributing to the expansion of the 5G devices market.

Key 5G Devices Company Insights

Some of the key companies in the 5G devices market include ZTE Corporation, Xiaomi, Samsung, Sony Group Corporation, D-Link, Huawei, and others. The competitive landscape among device manufacturers in the market has ignited a flurry of innovation and fueled the continuous release of an array of advanced 5G devices. In the race to secure a strong market presence, companies are actively engaged in a relentless pursuit of excellence. This fervor for market share and customer loyalty is the driving force behind a relentless cycle of development and improvement in the 5G product domain.

-

Xiaomi is a technology company specializing in the design, development, and manufacturing of smartphones, smart home devices, and other consumer electronics. The company offers smartphones, smart TVs, fitness bands, air purifiers, and more. The company's offerings in the market include 5G smartphones, such as the Xiaomi MIX Flip, Xiaomi 14T Pro, and POCO C75, laptops, tablets and others. Xiaomi's products are available in over 100 countries and regions worldwide. In August 2024, the company earned a spot on the Fortune Global 500 list for the sixth consecutive year.

-

Samsung is a provider of technology and consumer electronics. The company operates across diverse sectors, including consumer electronics, information technology, mobile communications, and device solutions. Its extensive product portfolio encompasses smartphones, televisions, home appliances, semiconductors, and display panels. Samsung offers a range of 5G devices, including smartphones, tablets, laptops, and wearable technology. The company operates in over 76 countries and employs more than 260,000 people globally. In addition to consumer electronics, it also provides solutions across various sectors, such as healthcare, finance, and transportation.

Key 5G Devices Companies:

The following are the leading companies in the 5G devices market. These companies collectively hold the largest market share and dictate industry trends.

- ZTE Corporation

- Xiaomi

- Samsung

- Sony Group Corporation

- D-Link

- Huawei

- Nokia Corporation

- Fibocom Wireless, Inc.

- Inseego Corp

- Askey Computer Corp.

- HTC Corporation

Recent Developments

-

In September 2024, Samsung Electronics launched the Galaxy S24 FE, a flagship smartphone that combines advanced features with user-friendly performance. The device boasts a 6.7-inch Dynamic AMOLED 2X display with a resolution of 1080 x 2340 pixels and a smooth 120 Hz refresh rate, enhancing visual experiences for gaming and multimedia consumption. The Galaxy S24 FE is powered by the Exynos 2400e chipset, offering robust processing capabilities alongside 8GB of RAM and storage options of 128GB, 256GB, or 512GB. The smartphone aims to deliver an exceptional balance of performance and style to meet the needs of modern users.

-

In July 2023, Ericsson and Intel unveiled a strategic partnership aimed at harnessing Intel's cutting-edge 18A process and manufacturing technology to bolster Ericsson's forthcoming next-generation optimized 5G infrastructure. Within the framework of this collaboration, Intel is set to produce tailor-made 5G SoCs (system-on-chip) to empower Ericsson in crafting highly distinctive, top-tier products for the future landscape of 5G infrastructure. Beyond this, the collaboration extends to the optimization of 4th Gen Intel Xeon Scalable processors with Intel vRAN Boost for Ericsson's Cloud RAN solutions. The core goal is to empower communication service providers with amplified network capacity, heightened energy efficiency, and enhanced scalability and flexibility:

5G Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 269.20 billion

Revenue forecast in 2030

USD 1,269.20 billion

Growth rate

CAGR of 36.4% from 2025 to 2030

Base year of estimation

2024

Historical data

2019 - 2024

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Form factor, spectrum, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ZTE Corporation; Xiaomi; Samsung; Sony Group Corporation; D-Link; Huawei; Nokia Corporation; Fibocom Wireless, Inc.; HTC Corporation; Inseego Corp.; Askey Computer Corp.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 5G devices Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global 5G devices market report based on form factor, spectrum, and region.

-

Form Factor Outlook (Revenue, USD Billion, 2019 - 2030)

-

Phones

-

CPE

-

Modules

-

Hotspots, Switches, & Routers

-

Laptop

-

Tablets

-

Others

-

-

Spectrum Outlook (Revenue, USD Billion, 2019 - 2030)

-

sub-6 GHz

-

mmWave

-

sub-6 GHz + mmWave

-

-

Regional Outlook (Revenue, USD Billion, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G devices market size was estimated at USD 210.92 billion in 2024 and is expected to reach USD 269.20 billion in 2025.

b. The global 5G devices market is expected to grow at a compound annual growth rate of 36.4% from 2025 to 2030 to reach USD 1,269.20 billion by 2030.

b. The Asia Pacific segment dominated the market in 2024. The region's vast population, particularly in countries like China and India, has fuelled a tremendous demand for 5G devices. With growing urbanization and increasing smartphone adoption, consumers are eager to access the benefits of high-speed 5G networks, thus fuelling the demand for 5G devices in the market.

b. Some key players operating in the 5G devices market include ZTE Corporation, Xiaomi, Samsung, Sony Group Corporation, D-Link, Huawei, Nokia Corporation, Fibocom Wireless, Inc., MediaTek, Inc., and HTC Corporation.

b. The continuous expansion of 5G network infrastructure, the increasing consumer demand for high-speed connectivity, and proliferation of the Internet of Things (IoT) and the advent of Industry 4.0 are driving the 5G devices market’s growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.