- Home

- »

- Next Generation Technologies

- »

-

5G Enterprise Market Size & Share, Industry Report, 2030GVR Report cover

![5G Enterprise Market Size, Share & Trends Report]()

5G Enterprise Market (2025 - 2030) Size, Share & Trends Analysis Report By Network Type (Hybrid Networks, Private Networks), By Infrastructure, By Spectrum, By Frequency Band, By Organization Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-586-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

5G Enterprise Market Summary

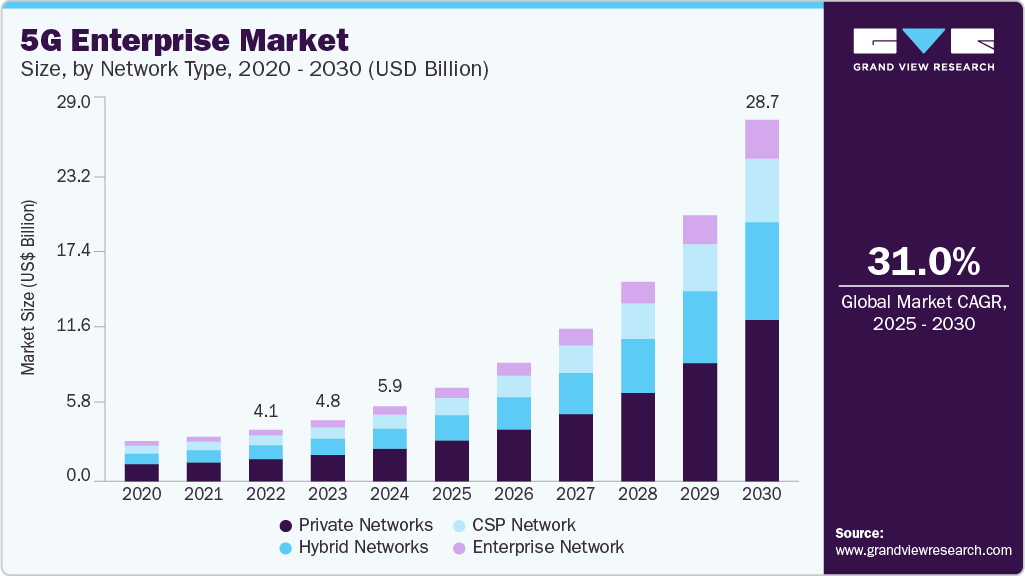

The global 5G enterprise market size was estimated at USD 5.96 billion in 2024 and is projected to reach USD 28.73 billion by 2030, growing at a CAGR of 31.0% from 2025 to 2030. Governments are positioning 5G as the foundation of next-generation economic competitiveness, investing heavily to enable enterprise-led digital transformation.

Key Market Trends & Insights

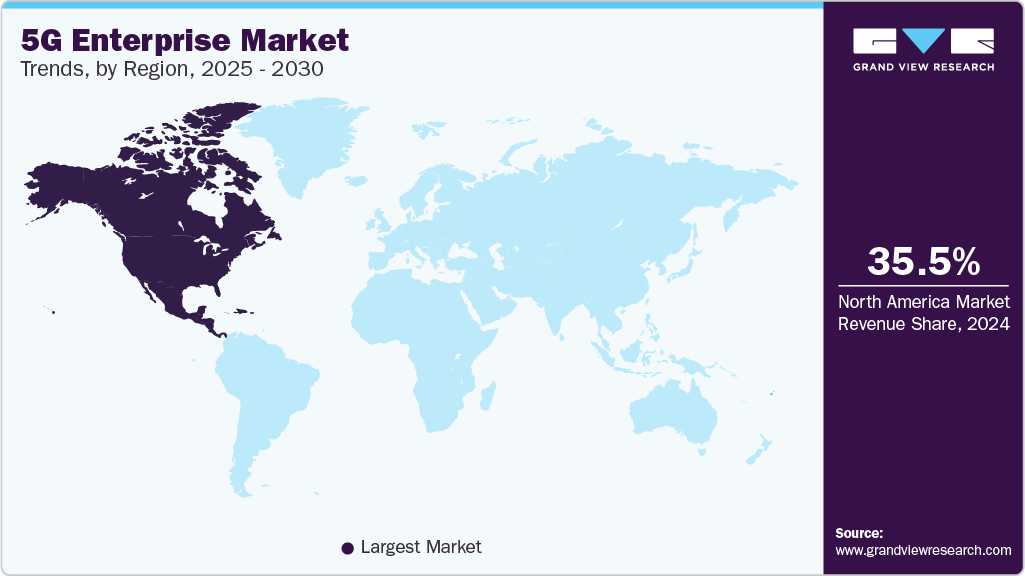

- North America 5G enterprise market accounted for a 35.5% share of the overall market in 2024.

- The 5G enterprise industry in the U.S. held a dominant position in 2024.

- In terms of network type segment, the private networks segment accounted for the largest share of 43.5% in 2024.

- In terms of infrastructure segment, the core network segment held the largest market share in 2024.

- In terms of organization size segment, the large enterprises segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 5.96 Billion

- 2030 Projected Market Size: USD 28.73 Billion

- CAGR (2025-2030): 31.0%

- North America: Largest market in 2024

These national strategies are creating an ecosystem that empowers businesses to integrate ultra-reliable low-latency communications (URLLC) and massive machine-type communications (mMTC) into their operations. For instance, Singapore’s government, through the Research, Innovation and Enterprise 2025 (RIE2025) plan, allocated USD 18.1 billion (SGD 25 billion) to support transformative technologies such as 5G. As a result, the nation now boasts over 95% standalone 5G coverage, positioning it as a leading testbed for enterprise innovation across healthcare, logistics, and urban infrastructure.These national strategies are creating an ecosystem that empowers businesses to integrate ultra-reliable low-latency communications (URLLC) and massive machine-type communications (mMTC) into their operations. For instance, Singapore’s government, through the Research, Innovation and Enterprise 2025 (RIE2025) plan, allocated USD 18.1 billion (SGD 25 billion) to support transformative technologies such as 5G. As a result, the nation now boasts over 95% standalone 5G coverage, positioning it as a leading testbed for enterprise innovation across healthcare, logistics, and urban infrastructure.

In the U.S., the Federal Communications Commission (FCC) has aggressively promoted 5G expansion through spectrum auctions and funding mechanisms. The 3.45 GHz and 2.5 GHz bands were released to enable large-scale enterprise use, while the Infrastructure Investment and Jobs Act (IIJA) allocated USD 65 billion to broadband infrastructure, supporting 5G deployments in rural and industrial corridors.

Efficient spectrum management and agile regulatory frameworks have become essential enablers of 5G enterprise solutions. With growing demand from sectors such as manufacturing, agriculture, and logistics, governments are optimizing spectrum allocation to enhance enterprise-grade network performance. In the UK, Ofcom auctioned the 3.4 GHz and 2.3 GHz bands, allowing mobile network operators like EE, Vodafone, and Three to deliver expansive 5G coverage across over 66 cities, supporting enterprise applications such as remote asset management and smart infrastructure. The FCC in the U.S. took a similar step in 2021 by auctioning 100 MHz of mid-band spectrum in the 3.45-3.55 GHz band and initiating planning for mmWave auctions in the 42 GHz band. These releases are specifically geared toward enterprise deployments like private networks, advanced robotics, and precision agriculture, where dedicated and uncongested bandwidth is vital. Flexible licensing schemes and shared access models are also being introduced to support private 5G networks, a model increasingly favored by large enterprises for low-latency, secure, on-premise communications.

Governments are fostering innovation in the 5G enterprise industry through collaborative public-private partnerships (PPPs). These alliances bridge the gap between emerging technology and real-world enterprise deployment by facilitating experimentation, co-development, and ecosystem growth. In Singapore, the Infocomm Media Development Authority (IMDA) has allocated USD 21.7 million (SGD 30 million) to fund 5G Living Labs in verticals such as maritime logistics, healthcare, and smart estates. These testbeds have accelerated the deployment of enterprise-grade 5G applications such as autonomous vehicles, remote diagnostics, and intelligent building systems. Meanwhile, Germany’s 2022 Digital Strategy emphasizes cross-border collaboration with U.S. and European tech firms in emerging areas like quantum computing and AI over 5G infrastructure. By co-funding R&D and pilot projects, the German government aims to strengthen its digital sovereignty while enabling enterprises to benefit from cutting-edge network-enabled solutions. These partnerships have proven to be vital for de-risking large-scale enterprise investments while simultaneously shaping global technology standards and market readiness.

As enterprises rely more on 5G for mission-critical applications, ensuring network security and data sovereignty has become a strategic necessity. National governments are tightening cybersecurity frameworks and mandating domestic control over digital infrastructure to protect economic and security interests. In China, the 14th Five-Year Plan for the Digital Economy outlines mandatory requirements for deploying "secure and controllable" digital infrastructure. It prioritizes domestic R&D in AI, blockchain, and encryption technologies, especially for sectors like finance, energy, and telecommunications that are adopting 5G-enabled systems. Germany’s International Digital Strategy, published by the Federal Ministry for Economic Affairs and Climate Action, calls for cross-border cooperation on cybersecurity standards while emphasizing data sovereignty for critical infrastructure. Enterprises must adhere to strict data localization laws and adopt network slicing technologies to separate and secure different classes of enterprise data traffic. These cybersecurity frameworks are now integral to enterprise 5G adoption strategies, especially in sectors that handle sensitive operational or customer data, such as healthcare, utilities, and public services.

Network Type Insights

The private networks segment accounted for the largest share of 43.5% in 2024. Private 5G networks are witnessing rapid adoption across manufacturing, mining, and defense due to their ability to deliver dedicated bandwidth, enhanced security, and real-time reliability. These networks support closed-loop automation, autonomous vehicle coordination, and machine vision. With the rising availability of licensed and shared spectrum options, even mid-sized firms are piloting private networks to enhance operational efficiency. The ecosystem is further enriched by vendor-neutral platforms, accelerating enterprise-specific deployment.

The hybrid segment is expected to grow at a significant CAGR during the forecast period. Hybrid networks are evolving as a pragmatic choice for enterprises seeking flexibility between operational control and cost-efficiency. By integrating private 5G for latency-sensitive tasks and public 5G for broader coverage, businesses in sectors like healthcare and logistics can dynamically route data based on sensitivity and bandwidth requirements. This model supports remote workforce management, asset tracking, and cloud-based operations without the capital intensity of a full private deployment. The trend is especially strong among multinational corporations managing geographically dispersed operations with varying regulatory constraints.

Infrastructure Insights

The core network segment held the largest market share in 2024. The transformation of the 5G core into a cloud-native, service-based architecture is central to enabling enterprise agility. This segment is being driven by demand for features like ultra-reliable low-latency communication (URLLC), network slicing, and mobile edge computing (MEC). Enterprises are integrating 5G core with orchestration tools to optimize traffic flow and QoS (Quality of Service) for applications such as remote surgery, robotic automation, and real-time video analytics. As 5G Standalone (SA) deployments increase, enterprises are prioritizing core integration to unlock full 5G potential.

The NFV segment is projected to grow at the fastest CAGR over the forecast period. NFV is redefining the way enterprises deploy network functions, moving away from proprietary hardware toward software-defined flexibility. In 5G, NFV enables slicing for different use cases, such as separating mission-critical industrial traffic from general enterprise communications. Enterprises leveraging NFV are reducing OPEX and achieving faster rollouts of services like edge analytics and AI-driven maintenance. Additionally, NFV simplifies multi-site management, which is vital for retail chains, smart campuses, and logistics providers operating across regions.

Spectrum Insights

The licensed segment dominated the market in 2024. Enterprises with mission-critical requirements, such as airports, energy utilities, and smart ports, prefer licensed spectrum for guaranteed performance and reduced interference. Operators are leasing spectrum slices to enterprises under managed services models, ensuring SLAs (service level agreements) for uptime and throughput. Governments in regions like Germany and Japan have allocated licensed spectrum bands specifically for enterprise use, further accelerating uptake. This trend is setting the stage for industrial-grade private networks with tightly controlled latency and availability.

The unlicensed/shared segment is projected to grow at the fastest CAGR over the forecast period. Shared spectrum, like CBRS in the U.S. and the UK’s shared access band, is democratizing access to 5G for SMEs and community-level deployments. Startups, universities, and hospitals are deploying localized networks using shared spectrum for IoT, remote monitoring, and connected mobility. These networks are often deployed using plug-and-play small cells with cloud-based management platforms. The lower cost and regulatory burden are making shared spectrum a critical enabler of 5G proliferation in the mid-market and public sectors.

Frequency Band Insights

The sub-6GHz segment dominated the market in 2024, due to its superior coverage and adequate bandwidth for most industrial use cases. It is well-suited for campuses, logistics hubs, and semi-urban areas where penetration and range are prioritized. Enterprise applications such as mobile workforce connectivity, IoT integration, and real-time telemetry are being rolled out at scale using Sub-6GHz. Its balanced performance is making it the "default choice" for enterprises beginning their 5G journey.

The mmWave segment is projected to grow at the fastest CAGR over the forecast period. mmWave is emerging as the high-performance option in enterprise 5G, particularly in high-density, high-throughput environments. Use cases such as AR/VR-enabled training, 4K/8K video surveillance, digital twins, and factory robotics benefit from mmWave's ultra-high speed and low latency. Despite challenges in propagation and indoor penetration, its application in indoor environments like smart factories and stadiums is gaining ground. Innovations in beamforming and repeaters are improving deployment economics, especially in developed markets.

Organization Size Insights

The large enterprises segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period. Large enterprises are leading 5G adoption with full-scale integration across supply chains, manufacturing lines, and customer service operations. These organizations are investing in private networks and customized spectrum solutions, often in partnership with telecom operators and cloud service providers. Their focus is on hyperautomation, real-time analytics, and enhanced cybersecurity. Use cases include connected assembly lines, AI-assisted maintenance, and autonomous logistics, all powered by dedicated 5G architecture.

The Small & Medium Enterprises (SMEs) segment is projected to grow at the fastest CAGR over the forecast period. SMEs are embracing 5G through managed services, hybrid networks, and shared spectrum solutions. They are focused on enhancing productivity and customer engagement through affordable 5G tools like mobile POS, smart inventory systems, and video-based security. The availability of cloud-native, modular 5G packages allows SMEs to scale incrementally without large capital investments. This democratization of 5G technology is enabling digital transformation even in traditionally underserved business segments.

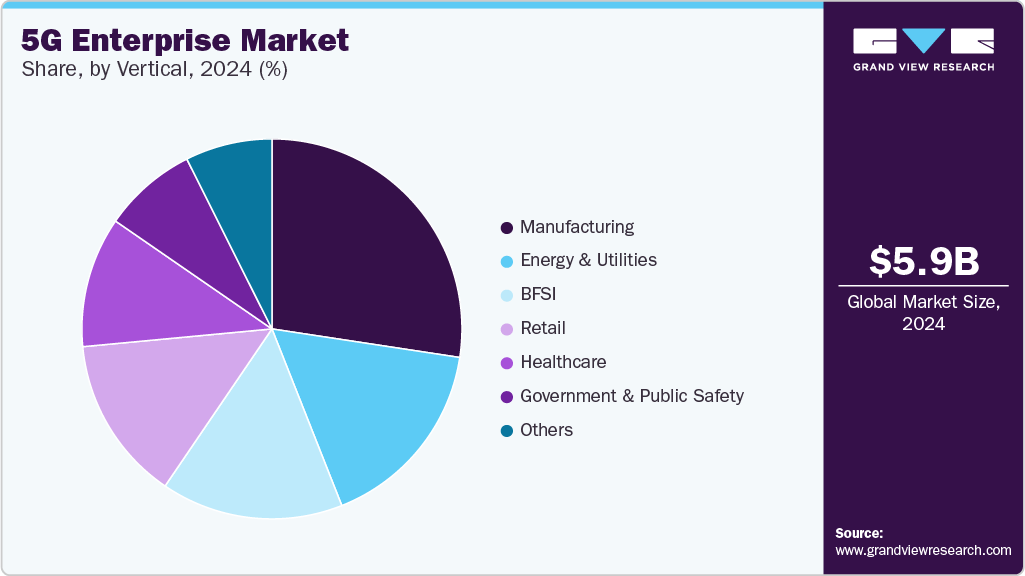

Vertical Insights

The manufacturing segment held the largest market share in 2024. Manufacturing is the cornerstone of enterprise 5G growth. Smart factories powered by 5G are enabling real-time machine coordination, predictive maintenance, and human-robot collaboration. From automotive assembly to food processing, manufacturers are leveraging private 5G networks for continuous monitoring and data-driven decision-making. The use of digital twins and augmented diagnostics is expanding rapidly, with 5G offering the backbone for ultra-responsive, autonomous manufacturing ecosystems.

The BFSI segment is expected to grow at a significant CAGR during the forecast period. The BFSI sector is integrating 5G to enhance customer experience, transaction security, and operational efficiency. Branchless banking, real-time fraud detection, and immersive financial advisory (via AR/VR) are gaining ground. 5G enables seamless connectivity across mobile apps, ATMs, and data centers. Moreover, the sector’s focus on edge-based processing for high-speed transactions and secure data transfer makes it a critical early adopter of enterprise-grade 5G services.

Regional Insights

North America 5G enterprise market accounted for a 35.5% share of the overall market in 2024. North America continues to set the pace in the global 5G enterprise market, driven primarily by early deployment, a mature telecom infrastructure, and strong public-private collaboration. The U.S., in particular, is seeing aggressive investments in private 5G networks across manufacturing, healthcare, and logistics sectors. Tech giants and telecom carriers are partnering with cloud providers to offer enterprise-grade 5G services with edge computing integration.

U.S. 5G Enterprise Industry Trends

The 5G enterprise industry in the U.S. held a dominant position in 2024. The U.S. leads in mid-band spectrum availability, with 1,130.5 MHz repurposed for 5G, including 280 MHz in the C-band and 150 MHz in CBRS. The NTIA’s efforts, supported by legislative acts like the MOBILE NOW Act, ensure enterprises have access to spectrum for advanced applications. The FCC and NTIA are driving 5G deployment through spectrum auctions and initiatives like the 5G Challenge Event, which promotes innovation in 5G subsystems.

Europe 5G Enterprise Industry Trends

The 5G enterprise industry in Europe was identified as a lucrative region in 2024. Europe's 5G enterprise growth is shaped by regulatory uniformity and industrial digitalization initiatives such as Germany’s "Industry 4.0". While adoption across the continent is uneven, countries like Germany and France are emerging as leaders in private 5G deployments for smart factories, energy management, and automated warehousing. However, bureaucratic red tape and spectrum allocation delays in some countries have hindered the market’s full momentum. Still, EU-backed digital transformation funds are expected to accelerate enterprise 5G rollouts, particularly in Eastern and Southern Europe, over the next two years.

Europe is balancing regional cohesion with a focus on national sovereignty, as evidenced by Germany’s emphasis on Industry 4.0. The German government is integrating private 5G networks in key manufacturing hubs such as Stuttgart, enabling real-time synchronization of robotic systems. The 2023 International Digital Strategy aims to foster AI integration into logistics, with companies like Siemens using 5G to enhance manufacturing efficiency. Fraunhofer Institute is also working on 5G-enabled digital twins for predictive maintenance in renewable energy sectors like offshore wind farms.

The UK has been quick to roll out 5G, with EE launching across 71 cities by 2020. Ofcom’s spectrum reallocation from the Ministry of Defence, including the 2.3 GHz band, enabled the O2 network to enhance its capacity for smart city applications, such as agricultural drones, through the 5G RuralDorset initiative. Additionally, Bristol’s autonomous vehicle trials are showing the way collaboration between governments and enterprises can drive industry-wide adoption.

Asia Pacific 5G Enterprise Industry Trends

The 5G enterprise market in Asia-Pacific is growing as a hub for enterprise 5G adoption, with China, South Korea, and Japan at the forefront. China, bolstered by aggressive state policy and investment, is deploying large-scale private 5G networks in steel, ports, and smart cities. South Korea's innovation-led economy is embracing 5G in automotive, healthcare, and robotics, while Japan is leveraging 5G in public safety, agriculture, and enterprise IoT. Southeast Asian countries, including Singapore and Thailand, are piloting enterprise 5G networks, particularly in urban and logistics corridors, though high costs remain a barrier for SMEs.

China 5G enterprise market’s “5G Plus” strategy has deployed over 2.3 million 5G base stations in 2023, supporting innovative applications like AI-driven factory automation and remote surgery. The Chinese government has mandated state-owned enterprises to incorporate 5G into their operations, which has led to an increased demand for Huawei’s enterprise solutions. Projects like Shenzhen’s smart port, which uses 5G to automate cargo handling, exemplify the country’s push for 5G in critical industries.

The 5G enterprise market in Japan is growing as the country’s Ministry of Economy, Trade, and Industry (METI) has focused on addressing rural-urban disparities in 5G access, particularly through telemedicine projects in Hokkaido and IoT-based disaster response systems in Fukushima. Through the Open Innovation initiative, Japan is also fostering 5G-enabled robotics advancements. For instance, SoftBank’s autonomous delivery robots in Tokyo are demonstrating the potential for 5G to enable new business models in urban environments.

Key 5G Enterprise Companies Insights

Key players operating in the 5G enterprise market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key 5G Enterprise Companies:

The following are the leading companies in the 5G enterprise market. These companies collectively hold the largest market share and dictate industry trends.

- Telefonaktiebolaget LM Ericsson

- Nokia

- Huawei Technologies Co., Ltd.

- Qualcomm Technologies, Inc.

- Samsung

- Cisco Systems, Inc.

- ZTE Corporation

- Hewlett Packard Enterprise Development LP

- Intel Corporation

- Microsoft

Recent Developments

-

In February 2025, Telefonaktiebolaget LM Ericsson partnered with Jaguar Land Rover (JLR) to deploy its Private 5G network at JLR’s Solihull plant, replacing traditional wired systems with wireless connectivity for AI-driven quality control and IoT sensors. This reduced production line reconfiguration times from weeks to seconds, enhancing agility in manufacturing Range Rover vehicles. The network supports real-time data transmission for automated guided vehicles (AGVs) and predictive maintenance tools, marking a milestone in Industry 4.0 adoption.

-

In April 2025, Cisco Systems, Inc. agreement with Vodafone Idea (Vi) in India to deploy MPLS transport solutions to upgrade 4G/5G backhaul networks, improving data traffic management and reducing latency by 30%. This upgrade supports Vi’s rollout of 5G services in Delhi and Mumbai, enabling high-quality streaming and enterprise cloud applications.

5G Enterprise Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.43 billion

Revenue forecast in 2030

USD 28.73 billion

Growth rate

CAGR of 31.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Network type, infrastructure, spectrum, frequency band, organization size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Telefonaktiebolaget LM Ericsson; Nokia; Huawei Technologies Co., Ltd.; Qualcomm Technologies, Inc.; Samsung; Cisco Systems, Inc.; ZTE Corporation; Hewlett Packard Enterprise Development LP; Intel Corporation; Microsoft

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 5G Enterprise Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 5G enterprise market report based on network type, infrastructure, spectrum, frequency band, organization size, vertical, and region:

-

Network Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hybrid Networks

-

Private Networks

-

Enterprise Network

-

CSP Network

-

-

Infrastructure Outlook (Revenue, USD Billion, 2018 - 2030)

-

Access Equipment

-

Small Cells

-

NFV

-

Core Network

-

SDN

-

E-RAN Equipment (Service Node)

-

-

Spectrum Outlook (Revenue, USD Billion, 2018 - 2030)

-

Licensed

-

Unlicensed/Shared

-

-

Frequency Band Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sub-6GHz

-

mmWave

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Manufacturing

-

Energy & utilities

-

Retail

-

Healthcare

-

Government and public safety

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G enterprise market size was estimated at USD 5.96 billion in 2024 and is expected to reach USD 7.43 billion in 2025.

b. The global 5G enterprise market size is expected to grow at a significant CAGR of 31.0% to reach USD 28.73 billion in 2030.

b. North America held the largest market share of 35.5% in 2024. This is due to the early deployment, a mature telecom infrastructure, and strong public-private collaboration.

b. Some of the players in the 5G enterprise market include Telefonaktiebolaget LM Ericsson, Nokia, Huawei Technologies Co., Ltd., Qualcomm Technologies, Inc., Samsung, Cisco Systems, Inc., ZTE Corporation, Hewlett Packard Enterprise Development LP, Intel Corporation, and Microsoft.

b. The key driving trend in the 5G enterprise market is the rising demand for ultra-reliable, low-latency connectivity to support mission-critical applications, automation, and real-time data processing across industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.