- Home

- »

- Plastics, Polymers & Resins

- »

-

70 mm Plastic Closures Market Size, Industry Report, 2033GVR Report cover

![70 mm Plastic Closures Market Size, Share & Trends Report]()

70 mm Plastic Closures Market (2026 - 2033) Size, Share & Trends Analysis Report By Material (High-Density Polyethylene (HDPE), Polypropylene (PP)), By End Use (Food & Beverages, Pharmaceutical & Nutraceutical, Personal Care & Cosmetics, Homecare, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-843-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

70 mm Plastic Closures Market Summary

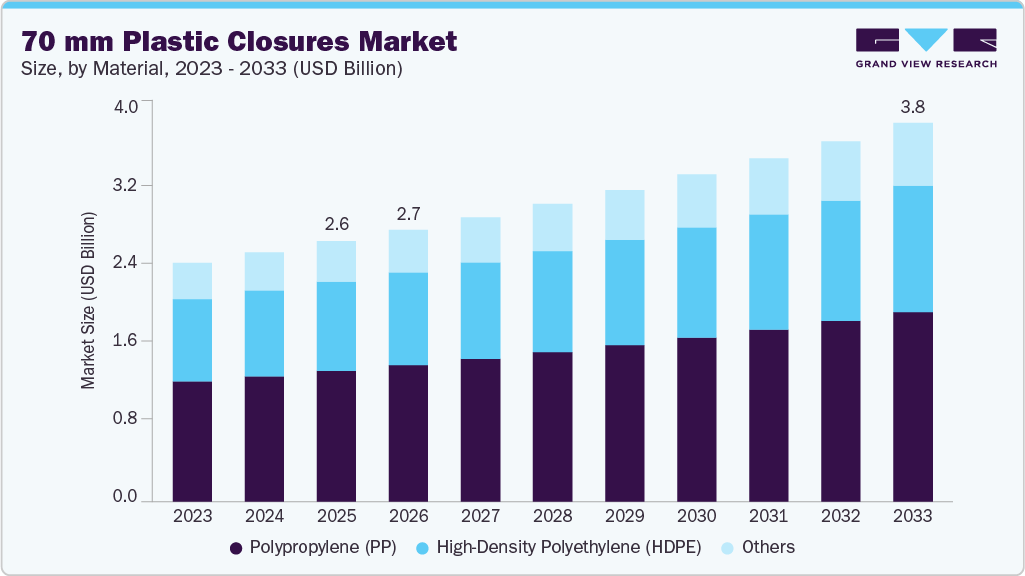

The global 70 mm plastic closures market size was estimated at USD 2.58 billion in 2025 and is projected to reach USD 3.75 billion by 2033, growing at a CAGR of 4.8% from 2026 to 2033. One of the primary factors driving the rising demand is the rapid growth of the global packaged goods industry, particularly in sectors such as food and beverage, dairy, and ready-to-drink products.

Key Market Trends & Insights

- Asia Pacific dominated the global 70 mm plastic closures market with the largest revenue share of 38.33% in 2025.

- The 70 mm plastic closures industry in the U.S is expected to grow at a substantial CAGR from 2026 to 2033.

- By material, the polypropylene (PP) segment led the market with the largest revenue share of 50.33% in 2025.

- By end use, the pharmaceutical & nutraceutical segment is expected to grow at the fastest CAGR of 5.4% from 2026 to 2033.

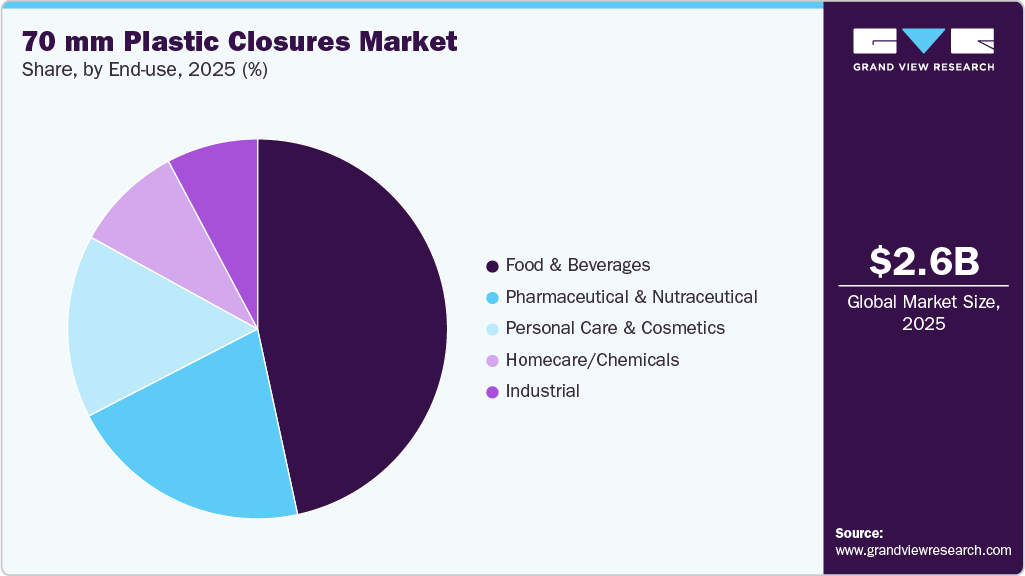

- By end use, the food & beverage segment led the market with the largest revenue share of 46.6% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.58 Billion

- 2033 Projected Market Size: USD 3.75 Billion

- CAGR (2026-2033): 4.8%

- Asia Pacific: Largest market in 2025

As global consumption increases, manufacturers require reliable and durable closures that ensure product safety, freshness, and shelf stability. Plastic closures are widely used because they offer strong seals and are compatible with standard bottle neck finishes used in many beverages and consumables. The expansion of consumption driven by urbanization, rising disposable incomes, and changing lifestyles has directly translated into increased orders for closures like the 70 mm category, which are common on larger bottles and containers.Packaging convenience has become a key differentiator, and 70 mm plastic closures offer easy opening, secure re-closure, and better grip, particularly for viscous or semi-solid products. Wider closures improve product accessibility, controlled dispensing, and consumer experience, especially for sauces, spreads, powders, and nutritional products. As brands redesign packaging to improve usability and reduce consumer frustration, wider plastic closures are increasingly selected over narrower or multi-component alternatives, supporting sustained demand growth.

The global expansion of processed food manufacturing and private-label brands has significantly contributed to closure demand. Private-label and regional brands often focus on cost-efficient, standardized packaging solutions, where 70 mm plastic closures provide an optimal balance of functionality, scalability, and price competitiveness. Their compatibility with high-speed filling lines and standard container finishes makes them particularly attractive for large-volume production, reinforcing their widespread adoption.

The rise of e-commerce and extended distribution networks has increased the need for robust, leak-resistant closures, especially for liquid and semi-liquid products. Larger-diameter plastic closures offer improved sealing performance and structural stability during handling, stacking, and transportation. As more products are shipped directly to consumers or across long distances, manufacturers favor closure designs that minimize spillage, returns, and customer complaints, contributing to higher demand for proven formats such as 70 mm closures.

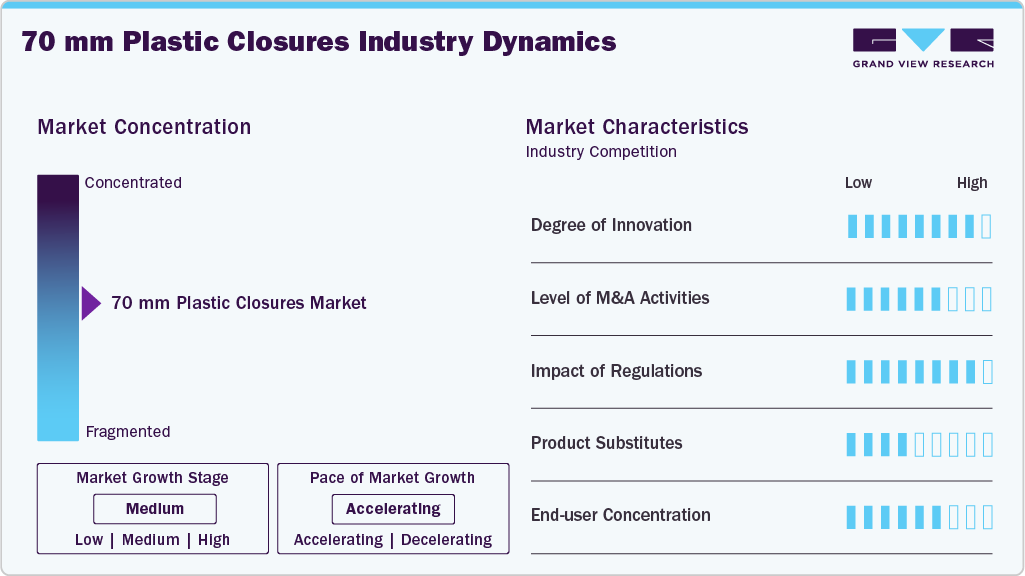

Market Concentration & Characteristics

The 70 mm plastic closures industry is characterized by high standardization combined with large-volume demand from wide-mouth container applications. This closure size is widely used across food, beverage, home care, and industrial packaging, where product accessibility, controlled dispensing, and reusability are critical. As a result, demand is closely linked to the performance of large-format packaging categories rather than niche or specialty formats. The market favors suppliers capable of producing consistent, high-quality closures at scale, as even minor dimensional deviations can impact sealing performance on standardized jar and bottle finishes.

Manufacturing in the 70 mm plastic closures industry is capital-intensive and efficiency-driven, relying heavily on high-cavitation injection molding systems and automated quality inspection. Given the larger diameter and higher resin usage compared to smaller closures, material optimization and light weighting play a significant role in cost control. Producers compete on cycle time reduction, mold efficiency, and resin management rather than purely on design innovation. Once approved by brand owners and filling lines, closure designs tend to remain stable for extended periods, creating a market structure with long product life cycles and relatively low design churn.

The market is also defined by strong integration with downstream filling operations and logistics requirements. Sealing reliability, torque consistency, and tamper-evidence integrity are critical performance parameters, particularly for products distributed through e-commerce or long supply chains. This integration creates high switching costs for end users, as changes in closure suppliers often require line trials, equipment recalibration, and regulatory revalidation. Consequently, the competitive landscape favors established manufacturers with proven technical capabilities, regional production footprints, and the ability to support customers throughout the packaging development and validation process.

The 70 mm plastic closures industry is increasingly influenced by packaging, food safety, and environmental regulations, particularly in food, beverage, and household product applications. Regulations related to food-contact safety, tamper-evidence, and traceability influence closure design, material selection, and testing requirements. At the same time, sustainability-focused policies-such as restrictions on virgin plastic usage, mandates for recyclability, and targets for recycled content-are prompting manufacturers to redesign closures through lightweighting and mono-material construction, rather than relying on size reduction. Because 70 mm closures are typically used on essential consumer and institutional products, regulatory pressure has not reduced demand. Still, it has instead raised compliance costs and technical entry barriers, favoring established suppliers with certified materials, in-house testing capabilities, and experience navigating multi-regional regulatory frameworks.

Material Insights

The polypropylene (PP) segment led the market with the largest revenue share of 50.33% in 2025. This is attributed to its balanced combination of mechanical strength, chemical resistance, and cost efficiency. PP closures are widely used for food & beverage containers (edible oils, sauces, dry foods), dairy tubs, nutraceutical jars, and industrial chemical packaging, where a 70 mm diameter is typically required for wide-mouth access and controlled dispensing. The material’s high stiffness-to-weight ratio allows manufacturers to produce lightweight yet durable continuous thread and snap-on closures without compromising seal integrity. Moreover, PP’s resistance to oils, acids, and alkaline substances makes it suitable for both consumable and non-consumable applications. Leading closure manufacturers, such as United Caps, MRP Solutions, and Erie Molded Packaging, extensively use PP for 70 mm caps due to its reliable performance on high-speed injection molding lines and its compatibility with tamper-evident bands and liner systems.

The high-density polyethylene (HDPE) represents a critical material segment, particularly for applications requiring high impact resistance, stress-crack resistance, and excellent moisture barrier properties. HDPE 70 mm closures are widely used in household chemicals, industrial liquids, agrochemicals, dairy products, and bulk food containers, where durability during transportation and repeated handling is essential. The material’s inherent toughness makes it well-suited for screw caps, snap-on lids, and tamper-evident closures used on wide-mouth containers. Compared to PP, HDPE offers superior flexibility and environmental stress crack resistance (ESCR), which is particularly valuable in closures exposed to surfactants, detergents, and aggressive formulations.

End Use Insights

The food &beverages segment led the market with the largest revenue share of 46.61% in 2025 and is expected to grow at the fastest CAGR of 4.7% over the forecast period. The food & beverages application segment, particularly jams, jellies & fruit preserves, pickles, sauces & condiments, spreads & pastes, and baby food, represents one of the largest and most stable demand centers. The 70 mm format is widely preferred for glass and rigid plastic jars used in these categories because it offers an optimal balance between wide-mouth accessibility, product visibility, and consumer convenience.

For instance, jam and fruit preserve manufacturers commonly use 70 mm continuous thread (CT) closures with plastisol or liner-based sealing systems to ensure hermetic sealing, extended shelf life, and protection against oxygen and moisture ingress. Similarly, pickles and sauces often require closures with strong torque retention and vacuum performance to withstand hot-fill or pasteurization processes, making PP-based 70 mm closures with liner compatibility a standard choice across mass-market and premium food brands.

The pharmaceutical & nutraceutical segment is forecasted to grow at a significant CAGR of 5.4% over the forecast period. This growth is supported by rising global demand for dietary supplements, preventive healthcare products, and over-the-counter formulations. Tablets, capsules, and soft gels are increasingly sold in bulk packaging formats, particularly in retail, e-commerce, and institutional supply channels, which drives demand for 70 mm closures with child-resistant and tamper-evident features. Medical powders and bulk pharmaceutical compounds require closures with high torque retention, chemical resistance, and strict adherence to regulatory standards, such as those established by the FDA, USP, and EU food and pharmaceutical contact regulations. Therefore, the segment is characterized by moderate volumes, high technical requirements, and strong emphasis on safety, reliability, and regulatory alignment within the 70 mm plastic closures industry.

Region Insights

The 70 mm plastic closures market in North America is positioned for steady growth, supported by strong demand from the food and beverage sector, particularly in packaged foods such as jams, jellies, sauces, condiments, spreads, pickles, and baby food. In the U.S. and Canada, the high penetration of branded and private-label packaged foods, combined with mature retail and e-commerce channels, continues to sustain volume demand for standardized closure sizes. Manufacturers benefit from long production runs and economies of scale, making 70 mm closures a preferred format for mass-market food applications. This trend is reinforced by ongoing product innovation from specialty and premium food brands, as seen in January 2025 when Stonewall Kitchen introduced more than 200 new products and collections, including classic salad dressings, cheese toppers, and Cherry Berry Quartet Jam, many of which typically rely on wide-mouth jars requiring reliable 70 mm closures for shelf appeal and functional performance.

U.S. 70 mm Plastic Closures Market Trends

The 70 mm plastic closures industry in the U.S is expected to grow at a substantial CAGR from 2026 to 2033. U.S. is widely adopted by food processors packaging jams, sauces, pickles, and bulk condiments in PET/PP jars sold through grocery and food service channels. These closures made from polypropylene (PP) provide reliable sealing and tamper-evidence for ambient and refrigerated foods, aligning with U.S. FDA food-contact requirements and retailer specifications. Beverage brands using larger-format kombucha, tea concentrates, syrup bases, or cold-brew coffee often pair 70 mm jars with high-seal liners to prevent leakage during transit. This highlights the segment’s reliance on screw closures for tamper-proof packaging.

Asia Pacific 70 mm Plastic Closures Market Trends

Asia Pacific dominated the global 70 mm plastic closures market with the largest revenue share of 38.33% in 2025. Asia Pacific is driving the regional segment of the 70 mm plastic closures industry due to sustained growth in packaged food, beverages, pharmaceuticals, and home care products across high-population economies such as China, India, Indonesia, and Vietnam. The region has a large base of condiment, sauce, edible oil, dairy, and nutraceutical manufacturers that predominantly use wide-mouth containers and jars requiring 70 mm closures for secure sealing and repeated usage. In India and China, the expansion of organized retail and private-label food brands has accelerated the shift from loose to packaged formats for products such as pickles, cooking pastes, health supplements, and protein powders, directly increasing demand for standardized closure sizes.

The 70 mm plastic closures market in Chinaaccounted for the largest market revenue share in Asia Pacific in 2025, driven by its unparalleled manufacturing scale and massive domestic consumption. As the world's largest producer of packaged food, beverages, and edible oils, China generates sustained demand for these large-format closures. Major domestic manufacturers, including Zijiang Enterprise, leverage advanced, cost-competitive production ecosystems to supply both local and regional markets. This established infrastructure positions China as the primary volume driver for the Asia-Pacific region, setting baseline standards for efficiency and price that shape the entire competitive landscape.

Europe 70 mm Plastic Closures Market Trends

The 70 mm plastic closures market in Europe is expanding rapidly, driven by a combination of stringent regulatory standards, strong sustainability mandates, and high-value end-use demand. The European Union’s packaging and waste regulations impose clear obligations on brand owners and packaging suppliers to enhance recyclability, reduce material usage, and increase the use of recycled content. These policies encourage the adoption of standardized, high-performance closure sizes such as 70 mm, particularly in food, beverage, and personal care packaging. As a result, manufacturers in Europe invest heavily in lightweight, mono-material polypropylene and polyethylene closures that meet food contact, safety, and environmental compliance requirements, supporting stable and long-term market growth.

The Germany 70 mm plastic closures market is anticipated to grow at a significant CAGR during the forecast period. Germany hosts a large base of food processors, beverage bottlers, and pharmaceutical companies that rely on wide-mouth jars and containers requiring 70 mm closures for applications such as solid oral dosage packaging, nutritional supplements, sauces, spreads, and cosmetic creams. German pharmaceutical manufacturers place a strong emphasis on tamper-evidence, child resistance, and consistent sealing performance to comply with EU GMP and safety regulations, which supports sustained demand for standardized 70 mm closures. This momentum is reinforced by ongoing product innovation among packaging suppliers.

Key 70 mm Plastic Closures Company Insights

The competitive landscape of the 70 mm plastic closures industry is moderately consolidated, with a mix of large multinational packaging companies and strong regional manufacturers. Competition is driven less by radical product differentiation and more by manufacturing efficiency, quality consistency, and customer reliability.

Large players benefit from integrated operations across closures, containers, and preforms, allowing them to offer bundled solutions and secure long-term supply contracts with major brand owners. Regional players compete by offering cost advantages, faster turnaround times, and localized customer support, particularly in emerging markets where demand for large-format packaging is expanding.

Key 70 mm Plastic Closures Companies:

The following are the leading companies in the 70 mm plastic closures market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- AptarGroup, Inc.

- Moulded Packaging Solutions Limited

- Closure Systems International

- Erie Molded Packaging

- ALPLA

- UNITED CAPS

- MRP Solutions

- Blackhawk Molding Co. Inc.

- Phoenix Closures, Inc.

- ITC Packaging

- Porter Bottle Company

- SKS Bottle & Packaging, Inc.

- Reliable Caps, LLC

Recent Development

-

In October 2025, UNITED CAPS is participating in ProPak Indonesia 2025 for the first time, marking a key step in expanding its footprint across Asia. The event takes place from November 19 to 22 at JIEXPO Kemayoran in Jakarta, where the company aims to showcase its closures and connect with regional partners. This move leverages UNITED CAPS' manufacturing plant in Kulim, Malaysia, to bring industry-leading solutions closer to the Asian market.

-

In July 2025, Amcor plc launched the Hector Child-Resistant Closure (CRC), a lightweight 7.25 g polypropylene closure designed for household chemicals such as bleaches and toilet cleaners. The solution reduces plastic use by up to 50% versus conventional 14 g closures, delivering savings of approximately 6.75 tonnes per one million units, while maintaining top recyclability ratings with HDPE and PET bottles and enabling compatibility with up to 100% post-consumer recycled (PCR) content.

70 mm Plastic Closures Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.69 billion

Revenue forecast in 2033

USD 3.75 billion

Growth rate

CAGR of 4.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, end use, region

States scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Amcor plc; AptarGroup, Inc.; ALPLA; Closure Systems International; UNITED CAPS; ITC Packaging; Phoenix Closures, Inc.; Erie Molded Packaging; Blackhawk Molding Co. Inc.; Moulded Packaging Solutions Limited; MRP Solutions; Porter Bottle Company; SKS Bottle & Packaging, Inc.; Reliable Caps, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 70 mm Plastic Closures Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global 70 mm plastic closures market report based on product, material, application, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

High-Density Polyethylene (HDPE)

-

Polypropylene (PP)

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Jams, Jellies & Fruit Preserves

-

Pickles, Sauces & Condiments

-

Spreads & Pastes (Peanut Butter, Nut Butters, Tahini)

-

Baby Food

-

Others

-

-

Pharmaceutical & Nutraceutical

-

Ointments, Creams & Topical Gels

-

Nutraceutical Powders & Granules

-

Tablets, Capsules & Soft Gels

-

Medical Powders & Bulk Compounds

-

Others

-

-

Personal Care & Cosmetics

-

Skin Care Creams & Body Butters

-

Hair Care Masks & Treatments

-

Balms, Waxes & Solid Cosmetics

-

Scrubs & Exfoliants

-

Others

-

-

Homecare / Chemicals

-

Cleaning Pastes & Gels

-

Adhesives, Sealants & Fillers (Consumer Grade)

-

Detergent & Chemical Powders (Jar-Pack)

-

Others

-

-

Industrial

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The 70 mm plastic closures market is expected to grow at a compound annual growth rate of 4.8% from 2026 to 2033 to reach around USD 3.75 billion by 2033.

b. The food & beverages segment recorded the largest market share of 46.61% in 2025 owing to the high preference for glass and rigid plastic jars used in food products because it offers an optimal balance between wide-mouth accessibility, product visibility, and consumer convenience.

b. The key players in the 70 mm plastic closures market include Amcor plc, AptarGroup, Inc., ALPLA, Closure Systems International, UNITED CAPS, ITC Packaging, Phoenix Closures, Inc., Erie Molded Packaging, Blackhawk Molding Co. Inc., Moulded Packaging Solutions Limited, MRP Solutions, Porter Bottle Company, SKS Bottle & Packaging, Inc., and Reliable Caps, LLC

b. One of the primary factors for rising demand is the rapid growth of the global packaged goods industry, especially in sectors like food and beverage, dairy, and ready-to-drink products

b. The 70 mm plastic closures market was estimated at around USD 2.58 billion in the year 2025 and is expected to reach around USD 2.69 billion in 2026.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.