- Home

- »

- Paints, Coatings & Printing Inks

- »

-

72 Inch Paint Protection Film Market Size, Share Report 2030GVR Report cover

![72 Inch Paint Protection Film Market Size, Share & Trends Report]()

72 Inch Paint Protection Film Market Size, Share & Trends Analysis Report By Application (Automotive & Transportation, Electrical & Electronics, Aerospace & Defense), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-679-0

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Report Overview

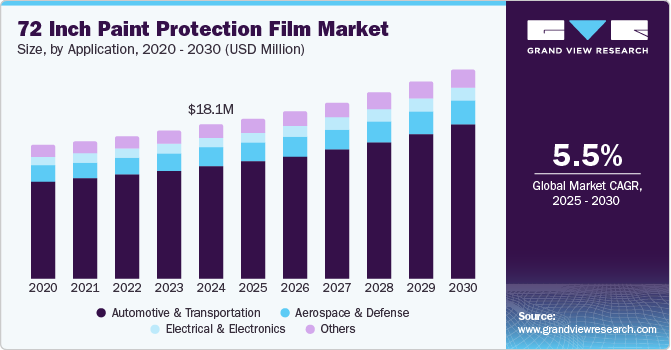

The global 72 inch paint protection film market size was valued at USD 18.1 million in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2030. The increasing awareness of vehicle maintenance and the desire for aesthetic enhancement among consumers has spurred demand for high-quality paint protection solutions. Additionally, the rise in the automotive aftermarket, coupled with the trend toward customization, is encouraging car owners to invest in protective films to preserve their vehicles' appearance and resale value.

The 72-inch paint protection film market is shaped by various regulations and standards to ensure product safety and environmental compliance. For instance, the Environmental Protection Agency (EPA) enforces regulations on volatile organic compounds (VOCs) in coatings and films, mandating that manufacturers adhere to specific emission limits. Additionally, the Federal Trade Commission (FTC) requires accurate labeling and marketing practices to prevent misleading claims about the durability and performance of paint protection films. Compliance with the ASTM International standards for product quality and performance is also essential, as these guidelines help establish reliability benchmarks in the market. Furthermore, local regulations regarding waste disposal and recycling of used films can influence manufacturing practices and end-of-life management strategies.

Application Insights

The automotive & transportation segment accounted for the largest share of 73.0% in 2024 due to the increasing consumer demand for long-lasting vehicle aesthetics. With rising awareness about the benefits of paint protection films, such as preserving the car's finish, reducing the impact of road debris, and maintaining resale value, more vehicle owners are investing in these protective solutions. Additionally, the growing trend of car customization and the popularity of luxury and premium vehicles fuel the demand for high-quality paint protection films. The advent of electric vehicles (EVs), which are often marketed with an emphasis on sustainability and long-term value, has further contributed to this segment's growth. Automakers are also incorporating these films during the manufacturing process to enhance the durability of their products.

The aerospace & defense segment is expected to grow at a CAGR of 5.1% during the forecast period, driven by the need to protect these high-value assets from harsh environmental conditions, UV radiation, and physical damage. In the aerospace sector, the films are used to maintain the aesthetic appeal of commercial aircraft, which is crucial for brand image and customer satisfaction. For defense applications, the films offer an additional layer of durability and protection for military vehicles and equipment operating in rugged terrains. The focus on operational efficiency and lifecycle cost management in these industries also drives the adoption of paint protection films, as they help reduce maintenance costs and extend the lifespan of assets. These trends indicate a robust market outlook for paint protection films across diverse application segments.

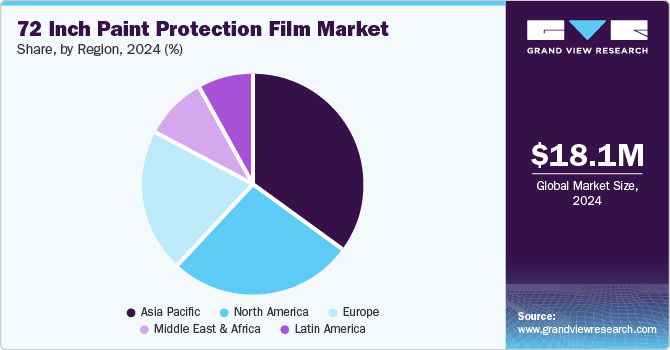

Regional Insights

North America accounted for a significant share of the global 72-inch paint protection film market in 2024. The rise in vehicle customization and aesthetic enhancements has led to a greater focus on protecting paint surfaces, particularly among luxury car owners. Additionally, the influence of automotive aftermarket trends, including DIY installations, has spurred the demand for paint protection films. This region benefits from advanced distribution networks and a high level of technological innovation, further enhancing market growth.

U.S. 72 Inch Paint Protection Film Market Trends

The U.S. dominated the North American 72-inch paint protection film market in 2024, owing to the high number of vehicle sales, a well-established automotive aftermarket, and a strong consumer preference for premium vehicle care products. The U.S. market benefits from technological advancements in film materials, which enhance the performance and appeal of paint protection films. Furthermore, the growing trend of electric vehicles (EVs) and the increasing customization of vehicles drive the demand for high-quality paint protection solutions in the country.

Europe 72 Inch Paint Protection Film Market Trends

The 72-inch paint protection film market in Europe is anticipated to grow at a CAGR of 4.9% during the forecast period. This growth is fueled by the increasing popularity of high-end vehicles and consumer awareness regarding paint protection benefits. The European automotive market, known for its premium car manufacturers, has created a significant demand for protective films that cater to high-performance vehicles. Additionally, Europe is home to several luxury vehicle manufacturers, which boosts the demand for high-quality paint protection films tailored to premium vehicles.

Asia Pacific 72 Inch Paint Protection Film Market Trends

The Asia Pacific 72-inch paint protection film market held the largest share 36.6% in 2024, driven by rapid urbanization and a booming automotive industry. As disposable incomes rise, consumers increasingly invest in vehicle aesthetics and protection, especially in countries with a strong car culture. The region's growing interest in luxury vehicles has fueled demand for high-quality paint protection solutions.

China held a substantial revenue share of the Asia Pacific market in 2024, fueled by growth fueled by a large consumer base, increasing vehicle ownership, and a strong emphasis on vehicle maintenance and care. Chinese consumers are increasingly aware of the benefits of paint protection films, leading to higher adoption rates. The government's focus on promoting electric vehicles and the associated infrastructure further boosts the demand for paint protection solutions. Additionally, China's robust automotive manufacturing sector and the presence of leading vehicle brands contribute to the market's expansion.

Key 72 Inch Paint Protection Film Company Insights

Some of the key companies in the 72-inch paint protection film market include 3M, Eastman Chemical Company, Schweitzer-Mauduit International, Inc., Avery Dennison, and others.

-

3M leverages its extensive expertise in material science to develop high-performance films that offer superior protection and durability. Its products are widely used in the automotive and transportation sectors, where they help preserve vehicle aesthetics and extend paint life.

-

XPEL Inc. is a prominent player in the 72-inch paint protection film market, renowned for its self-healing films that protect vehicles from scratches, chips, and UV damage. The company offers a range of customizable solutions for automotive applications.

Key 72 Inch Paint Protection Film Companies:

The following are the leading companies in the 72 inch paint protection film market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Eastman Chemical Company

- Schweitzer-Mauduit International, Inc.

- Avery Dennison

- XPEL Inc.

- RENOLIT SE

- Saint-Gobain S.A.

Recent Developments

-

In October 2024, XPEL Inc. acquired Uniprotect Ventures LLP, its longtime distributor in India. This strategic acquisition aligns with XPEL's ongoing expansion efforts in one of the world's most dynamic automotive markets. By bringing Uniprotect Ventures into the XPEL family, the company aims to strengthen its market position further and capitalize on India's growing demand for premium automotive protection solutions.

-

In August 2024, HOHOFILM invested significantly in modernizing its manufacturing facilities. This upgrade incorporates state-of-the-art equipment and processes. This follows the successful introduction of our 72-inch-wide PPF product in the previous year.

72 Inch Paint Protection Film Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.8 million

Revenue forecast in 2030

USD 24.5 million

Growth rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million, volume in square meters and CAGR from 2025 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Germany, UK, France, China, Japan, India, South Korea, Australia, Malaysia, Indonesia, Thailand

Key companies profiled

3M, Eastman Chemical Company, Schweitzer-Mauduit International, Inc., Avery Dennison, XPEL Inc., RENOLIT SE, Saint-Gobain S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 72 Inch Paint Protection Film Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 72 inch paint protection film market report based on application, and region:

-

Application Outlook (Revenue, USD Million, Volume, Square Meters; 2018 - 2030)

-

Automotive & Transportation

-

Electrical & Electronics

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume, Square Meters; 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Malaysia

-

Indonesia

-

Thailand

-

-

Latin America

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."