- Home

- »

- Medical Devices

- »

-

AAV Contract Development & Manufacturing Organizations Market, 2033GVR Report cover

![AAV Contract Development And Manufacturing Organizations Market Size, Share & Trends Report]()

AAV Contract Development And Manufacturing Organizations Market (2025 - 2033 ) Size, Share & Trends Analysis Report By Workflow (Upstream Processing, Downstream Processing), By Culture, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-026-9

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AAV Contract Development And Manufacturing Organizations Market Summary

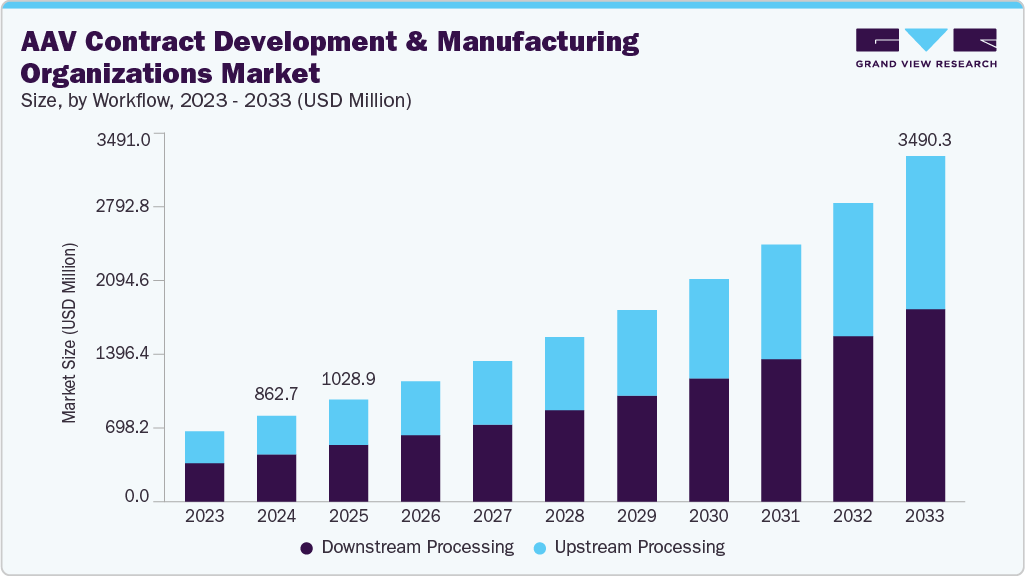

The global AAV contract development and manufacturing organizations market size was estimated at USD 862.7 million in 2024 and is projected to reach USD 3,490.3 million by 2033, growing at a CAGR of 16.5% from 2025 to 2033. The market is driven due to the rising demand for adeno-associated virus (AAV) vectors in gene therapy applications, particularly in the treatment of rare genetic disorders, ophthalmic conditions, and neurological diseases.

Key Market Trends & Insights

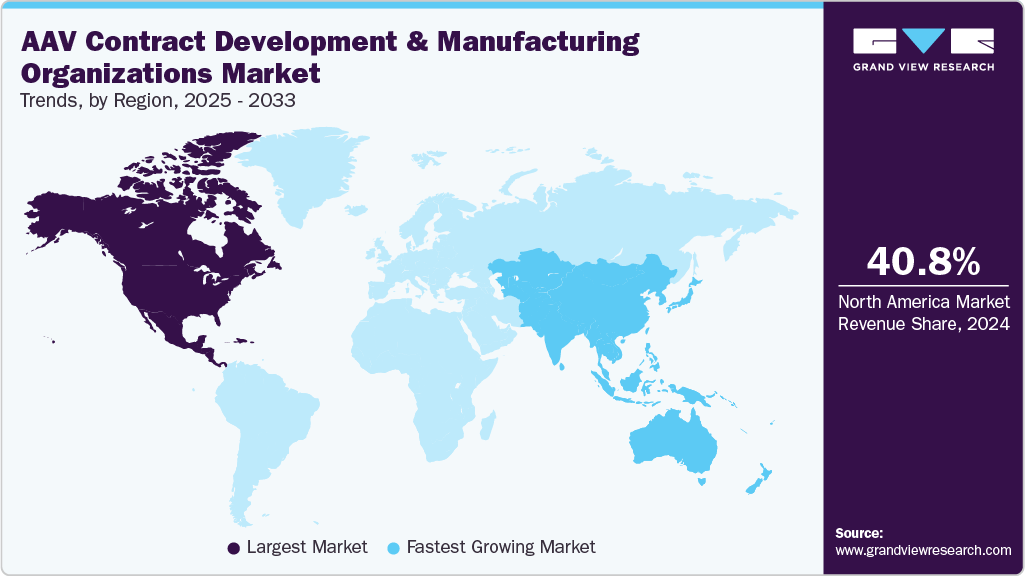

- North America AAV contract development and manufacturing organizations industry held the largest share of 40.8% in 2024 globally.

- By workflow, the down-streaming segment led the market with the largest revenue share of 54.9% in 2024.

- By culture, the adherent culture segment led the market with the largest revenue share in 2024.

- By application, the cell & gene therapy development segment held the largest market share in 2024.

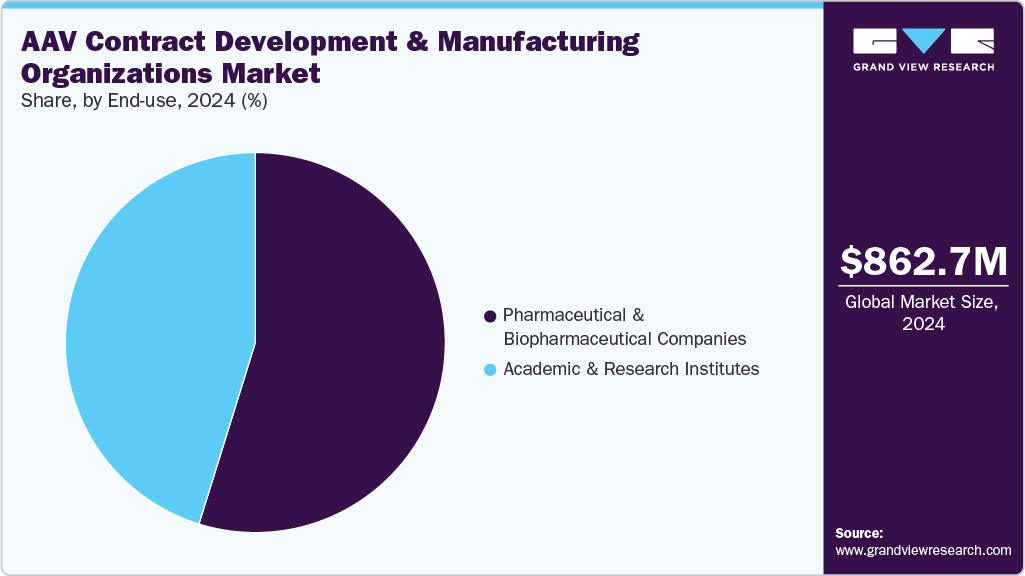

- By end use, the pharmaceutical and biopharmaceutical companies segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 862.7 Million

- 2033 Projected Market Size: USD 3,490.3 Million

- CAGR (2025-2033): 16.5%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

Increasing approvals of AAV-based therapies by regulatory bodies have further accelerated the need for specialized manufacturing capacity. The market is primarily driven by thesurge in R&D investments in cell and gene therapy pipelines and is also fueling the reliance on AAV CDMOs. Small and mid-sized biotech firms often lack in-house vector development capabilities, making outsourcing a cost-effective and efficient solution. Leading CDMOs are expanding their capabilities by building advanced viral vector manufacturing facilities, integrating automated platforms, and offering end-to-end services including process development, GMP manufacturing, and regulatory support. This expansion of service portfolios is creating strong growth opportunities for the market.

Furthermore, strategic partnerships and capacity expansions by key players such as Lonza, Catalent, Thermo Fisher Scientific, and Samsung Biologics are enhancing market competitiveness. The growing prevalence of genetic and rare diseases, coupled with an increasing number of clinical trials evaluating AAV-based therapies, is further driving outsourcing demand. These dynamics position AAV CDMOs as a critical backbone of the gene therapy ecosystem, ensuring a timely supply of high-quality viral vectors for both clinical and commercial use.

Opportunity Analysis

The AAV CDMO market presents strong opportunities driven by the rising gene therapy pipeline, particularly for rare diseases and neurological conditions, which is creating sustained demand for scalable viral vector manufacturing. Many small and mid-sized biotech firms lack in-house expertise, pushing them to outsource to CDMOs that offer cost-effective and integrated end-to-end solutions. Expanding regulatory approvals for AAV-based therapies are further encouraging early partnerships with manufacturers, while gaps in global capacity provide room for CDMOs to scale. Opportunities also lie in next-generation AAV development, such as capsid engineering and high-yield production systems, alongside regional growth in Asia-Pacific and Europe, where investments in gene therapy infrastructure are accelerating. Collectively, these factors position CDMOs to benefit from both short-term outsourcing needs and long-term commercial-scale manufacturing demand.

Technological Advancements

The technology landscape of AAV contract development and manufacturing organizations (CDMOs) is shaped by innovations across upstream and downstream platforms aimed at improving scalability, efficiency, and product quality. On the upstream side, HEK293 transient transfection systems remain widely used for flexibility, while Sf9/baculovirus systems support higher volumetric productivity for large-scale production. Emerging approaches, such as stable producer cell lines and helper-free systems, are gaining traction to reduce plasmid costs and enhance consistency. Advances in intensified bioprocessing, including perfusion systems, high-cell-density cultures, and single-use bioreactors, are enabling higher yields with reduced contamination risks. In terms of raw materials, the adoption of GMP-grade plasmids, chemically defined media, and specialized reagents for diverse AAV serotypes is becoming standard.

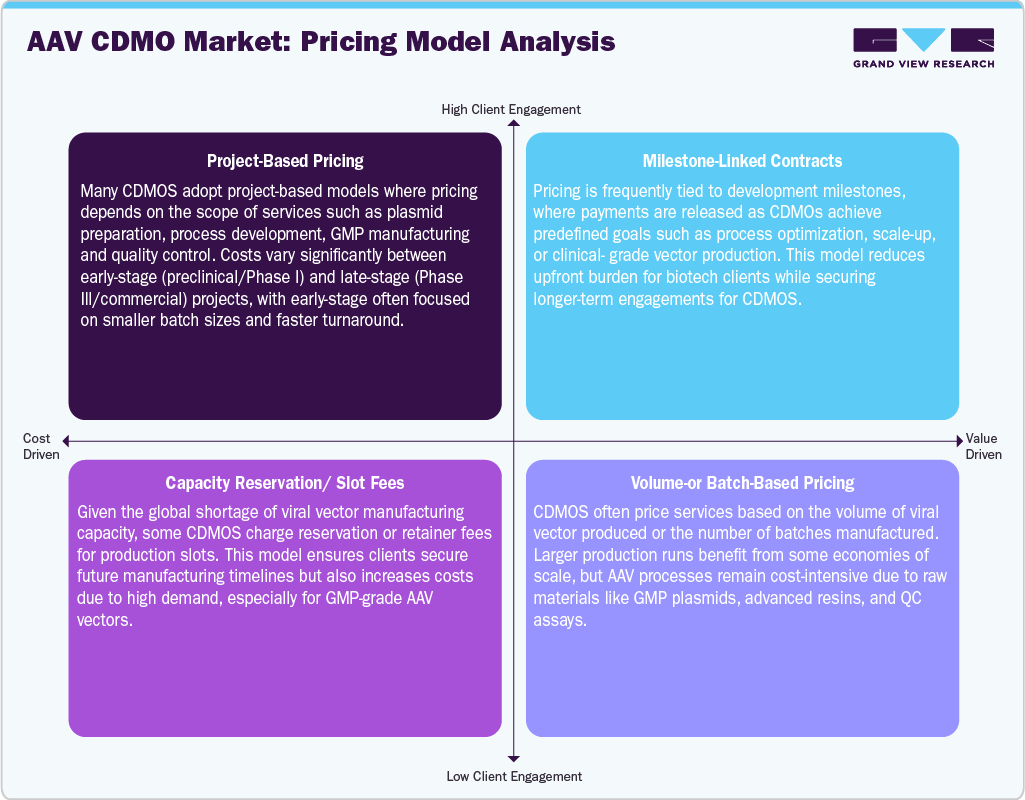

Pricing Analysis

Workflow Insights

Based on workflow, the market is classified into upstream processing and downstream processing. The downstream processing segment held the largest revenue share of 54.9% in 2024. The growth of the segment is due to the increasing complexity of purification requirements for AAV vectors, where achieving high yield and purity is critical for clinical and commercial use. Removal of impurities such as host cell DNA, host proteins, and empty capsids requires advanced purification methods, including affinity chromatography, ion-exchange, and ultrafiltration systems. Rising demand for high-quality vectors that meet stringent regulatory standards has pushed CDMOs to invest heavily in sophisticated downstream technologies, including serotype-specific affinity resins and advanced separation techniques.

The upstream processing segment is anticipated to grow at a lucrative CAGR during the forecast period. The segment growth is driven due to advancements in cell culture systems, transfection methods, and bioreactor technologies that enable higher productivity of AAV vectors. Increasing adoption of suspension-based HEK293 and Sf9 insect cell platforms has improved scalability and flexibility, making upstream operations more efficient for both clinical and commercial manufacturing.

Culture Insights

On the basis of culture, the market is segregated into adherent culture and suspension culture. The adherent culture segment dominated the market in 2024. The growth of the segment is due to its long-standing use as the traditional method for producing AAV vectors, particularly during early-stage research and clinical development. Adherent-based systems, often relying on HEK293 cells grown on fixed surfaces, are favored for their well-established protocols, reproducibility, and ability to generate high-quality viral vectors in smaller batch sizes.Many early clinical trials continue to utilize adherent cultures because of their suitability for low-to-medium scale production and the lower upfront infrastructure investment compared to suspension systems.

The suspension culture segment is anticipated to grow at the fastest CAGR during the forecast period. The segment growth is due to its ability to support large-scale, cost-effective production of AAV vectors, which is essential as gene therapies advance into late-stage clinical trials and commercialization. Suspension-based systems, such as HEK293 or Sf9 cells in serum-free, stirred-tank bioreactors, offer higher volumetric productivity and easier scalability compared to traditional adherent cultures. The flexibility to rapidly adjust batch volumes and integrate automated bioprocessing makes suspension culture ideal for meeting increasing demand.

Application Insights

In terms of application, the market is segregated into cell & gene therapy development, vaccine development, biopharmaceutical and pharmaceutical discovery, and biomedical research. The cell & gene therapy development segment held the largest market share in 2024, owing to the rapid growth of gene therapy pipelines targeting rare genetic disorders, neurological conditions, and ophthalmic diseases. Increasing approvals of AAV-based therapies and a surge in clinical trials have fueled demand for high-quality viral vectors, driving reliance on CDMOs for scalable and compliant manufacturing.

The biopharmaceutical and pharmaceutical discovery segment is anticipated to grow at a lucrative CAGR during the forecast period. The segment growth is due to the increasing reliance of drug developers on AAV vectors for preclinical studies, target validation, and early-stage therapeutic development. Outsourcing vector production to CDMOs allows companies to focus on research and development while ensuring access to high-quality, reproducible viral vectors. Advances in vector engineering, including tissue-specific targeting and capsid optimization, are expanding the range of applications in drug discovery, further driving the segments demand.

End Use Insights

Based on end use, the market is segregated into pharmaceutical and biopharmaceutical companies and academic & research institutes segments. The pharmaceutical and biopharmaceutical companies segment held the largest market share in 2024, owing to the increasing outsourcing of AAV vector manufacturing to specialized CDMOs by firms developing gene therapies and advanced biologics. These companies require scalable, GMP-compliant production to support clinical trials and commercial launches, making CDMO partnerships essential. The high complexity of AAV production, coupled with the need for regulatory adherence and consistent quality, drives reliance on experienced contract manufacturers rather than in-house capabilities.

The academic & research institutes segment is anticipated to grow at a considerable CAGR during the forecast period. The segment growth is driven by the increasing adoption of AAV vectors in preclinical studies, gene function research, and proof-of-concept experiments. Academic labs and research organizations often lack the infrastructure and expertise for large-scale viral vector production, making outsourcing to CDMOs a cost-effective and efficient solution. Rising funding for genetic and rare disease research, coupled with collaborations between universities and biotech companies, is further boosting demand for reliable AAV manufacturing support.

Regional Insights

North America adeno-associated virus contract development and manufacturing organizations industry accounted for the largest revenue share of 40.8% in 2024. This is attributed tothe strong presence of leading biotech and pharmaceutical companies, advanced manufacturing infrastructure, and high investment in gene therapy R&D.

U.S. AAV Contract Development And Manufacturing Organizations Market Trends

The AAV contract development and manufacturing organizations industry in the U.S. held the largest share in 2024. The country’s growth is due tohigh concentration of biopharmaceutical and gene therapy companies, which require specialized AAV manufacturing expertise. The complexity of clinical- and commercial-grade vector production encourages outsourcing to CDMOs.

Europe AAV Contract Development And Manufacturing Organizations Market Trends

The adeno-associated virus contract development and manufacturing organizations industry in Europe is expected to grow significantly due to supportive regulatory frameworks, growing clinical trials, and strong biotech ecosystems. Companies in the region increasingly rely on CDMOs to handle complex vector manufacturing, ensuring quality and compliance while accelerating therapy development.

The AAV contract development and manufacturing organizations industry in Germany held a significant share in 2024, owing to the country’s strong biopharma R&D, clinical trial activity, and government incentives for advanced therapies. Its manufacturing base and skilled workforce make it a preferred hub for CDMO expansion.

The AAV contract development and manufacturing organizations industry in the UK held a significant share in 2024. The growth of the market is due to gene therapy research programs and early-stage clinical development. Biotech firms and academic institutions seek CDMOs for scalable, GMP-compliant vector production to move therapies from lab to clinic efficiently.

Asia Pacific AAV Contract Development And Manufacturing Organizations Market Trends

Asia Pacific AAVcontract development and manufacturing organizations industry is anticipated to witness the fastest CAGR over the forecast period, owing to increasing biotech activity, government incentives, and emerging clinical trial infrastructure. Cost-effective manufacturing, scalable solutions, and opportunities for technology transfer make CDMOs essential partners for both local and international companies.

The AAV contract development and manufacturing organizations industry in China held the largest share in 2024. The growth is due to a surge in biotech startups, government support for advanced therapies, and a growing clinical trial pipeline. CDMOs offering scalable, high-quality, and cost-effective AAV production are critical to meeting rising domestic and global demand.

The AAV contract development and manufacturing organizations industry in Japan is expected to grow over the forecast period. The country’s growth is due toregenerative medicine initiatives and gene therapy research. CDMOs providing process development, GMP-grade vector production, and regulatory support are increasingly sought to accelerate clinical programs.

The AAV contract development and manufacturing organizations industry in India is anticipated to grow at a lucrative CAGR over the forecast period. The country’s market growth is due to the lower operational costs, skilled scientific workforce, and growing R&D investments from both domestic and multinational companies.

Key AAV Contract Development and Manufacturing Organizations Company Insights

The major players operating across the market are focused on adopting in-organic strategic initiatives such as mergers, partnerships, acquisitions, among others. Moreover, companies focus on technological innovations to augment their market position. For instance, in October 2024, Thermo Fisher Inc. launched its Accelerator Drug Development platform, offering 360° CDMO and CRO services to streamline drug discovery and development.

Key AAV Contract Development and Manufacturing Organizations Companies:

The following are the leading companies in the AAV contract development and manufacturing organizations market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fischer Scientific, Inc.

- Creative Biogene

- Catalent Inc.

- Charles River Laboratories International, Inc.

- Danaher (Aldevron)

- Forge Biologics

- Genezen

- ViroCell Biologics

- Merck KGaA

- VIRALGEN

- Biovian Oy

- Esco Lifesciences (Esco Aster Pte. Ltd.)

- GenScript ProBio

- Porton Advanced Solution Ltd

- Ask Bio

- Showa Denko

- Takara Bio, Inc.

- ABL Manufacturing

- Oxford Biomedica

- Belief Biomed, Inc.

- Beijing Anlong Biomedicine Co., Ltd

- Forecyte Bio Limited

- Gene Pharma, Inc.

- Skyline Therapeutics

- TFBS Bioscience, Inc.

Recent Developments

-

In May 2024, Catalent entered into a partnership agreement with Siren Biotechnology, which aims to provide process development and cGMP manufacturing of Siren Biotechnology's AAV vector-based therapeutic candidates.

-

In July 2024, Charles River Laboratories entered into a partnership agreement with AAVantgarde to support their Stargardt’s disease program. The company will be responsible for developing the plasmid DNA required for the therapy.

AAV Contract Development And Manufacturing Organizations Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,028.9 million

Revenue forecast in 2033

USD 3,490.3 million

Growth rate

CAGR of 16.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Workflow, culture, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait; UAE; Oman; Qatar

Key companies profiled

Thermo Fischer Scientific, Inc.; Creative Biogene; Catalent Inc.; Charles River Laboratories International, Inc.; Danaher (Aldevron); Forge Biologics; Genezen; ViroCell Biologics; Merck KGaA; VIRALGEN; Biovian Oy; Esco Lifesciences (Esco Aster Pte. Ltd.); GenScript ProBio; Porton Advanced Solution Ltd.; Ask Bio; Showa Denko; Takara Bio, Inc.; ABL Manufacturing; Oxford Biomedica; Belief Biomed, Inc.; Beijing Anlong Biomedicine Co. Ltd.; Forecyte Bio Limited; Gene Pharma, Inc.; Skyline Therapeutics; TFBS Bioscience, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AAV Contract Development And Manufacturing Organizations Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AAV contract development and manufacturing organizations market report based on workflow, culture, application, end use, and region.

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Upstream Processing

-

Vector Amplification & Expansion

-

Vector Recovery & Harvesting

-

-

Downstream Processing

-

Purification

-

Fill Finish

-

-

-

Culture Outlook (Revenue, USD Million, 2021 - 2033)

-

Adherent Culture

-

Suspension Culture

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cell & Gene Therapy Development

-

Vaccine Development

-

Biopharmaceutical and Pharmaceutical Discovery

-

Biomedical Research

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical and Biopharmaceutical Companies

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global adeno associated virus contract development and manufacturing organizations market size was estimated at USD 862.7 million in 2024 and is expected to reach USD 1,028.9 million in 2025.

b. The global adeno-associated virus contract development and manufacturing organizations market is expected to grow at a compound annual growth rate of 16.5% from 2025 to 2033 to reach USD 3,490.3 million by 2033.

b. By application, the cell & gene therapy segment held a market share of 39.1% in 2024. Increasing application of AAV in cell & gene therapy coupled with growing investment across research & development of the same are a few of the factors boosting the segment's growth.

b. Some of the key players in the global AAV CDMO market are Thermo Fischer Scientific, Inc., Charles River Laboratories International, Inc., Catalent, Inc., Danaher, Oxford Biomedica, Merck KGaA, Biovian Oy, GenScript, and Ask Bio.

b. Increasing research and development to develop AAV-based therapeutics in cell and gene therapy and vaccines, and the rising number of corporate strategies such as expansion, merger & acquisitions, product launches drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.