- Home

- »

- Medical Devices

- »

-

Accelerometer Medical Sensors Market Share Report, 2030GVR Report cover

![Accelerometer Medical Sensors Market Size, Share & Trends Report]()

Accelerometer Medical Sensors Market Size, Share & Trends Analysis Report By Product (Wearable, Non-wearable), By Application (Wellness Monitoring), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-036-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global accelerometer medical sensors market accounted for USD 3,586.07 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of more than 14.15% over the forecast period from 2023 to 2030. The key factors attributing to the market growth include the increasing prevalence of chronic diseases and the growing geriatric population. Moreover, the rising health awareness amongst individuals has led to rise in the demand for home-based accelerometer medical sensors that are cost-effective and easy to operate. In addition, the rise in the number of individuals recording and tracking information about their health habits is expected to boost market growth during the forecast period.

According to the article by Commentary on Chronic Disease Prevention, released in April 2022, approximately 60.0% of U.S. citizen has a minimum of one chronic disease. Chronic diseases such as cardiovascular diseases, diabetes, and cancer are the leading causes of death in the U.S. Furthermore, 90.0% of the nation’s USD 3.8 trillion healthcare costs are attributed to people with chronic diseases such as heart disease, diabetes, strokes, cancer, and chronic obstructive pulmonary disease.

According to the American Cancer Society article published in January 2022, around 1.5 million novel cancer cases were recorded, and 609,360 deaths were expected. Cancer was recorded as the second leading cause of death in the U.S. after cardiovascular diseases. Moreover, in the same year around 5,500 adolescents were diagnosed with cancer. Brain cancer and other nervous system tumor are the leading types, accounting for about 20.0% of cancer in adolescents, which is followed by lymphoma which is 19.0%. Cancer of spinal metastasis often leads to spinal cord compression and induces paralysis, thus, resulting in a boost of the accelerometer medical sensor market across the world.

According to Muscular Dystrophy News article, published in January 2022, between 60.0% to 70.0% of individuals with Becker muscular dystrophy (BMD) develop cardiomyopathy mostly in their late 20s. Moreover, according to an article published by Single Care, in January 2022, around 50.0 to 70.0 million U.S. adults have a chronic sleep disorder. Sleep deprivation thus results in a higher risk of chronic health problems.

For instance, less than 7 hours of sleep increases the prevalence of arthritis, asthma, heart attack, coronary heart disease, chronic kidney disease, and diabetes by 28.8%, 16.5%, 4.8%, 4.7%, 3.3%, and 11.1% respectively. Furthermore, poor lifestyle such as stress, anxiety, alcohol & tobacco consumption, in addition to excessive LED exposure leads to sleep disorders.

These instances are anticipated to raise the demand for accelerometer medical sensors, to monitor and diagnose the difficulty in muscle movement caused due to various chronic disorders.

Product Insights

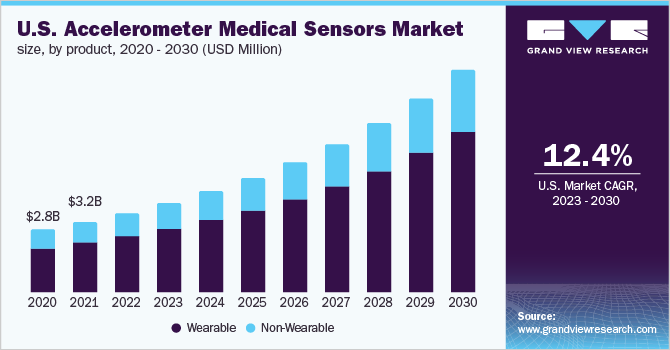

The wearable segment dominated the accelerometer medical sensors market with a market share of 69.65% in 2022 and is anticipated to expand at the highest CAGR during the forecast period. Wearable accelerometer medical sensors enable measuring and keeping track of the physiological and motion activities of individuals. Wearable accelerometer medical sensors can be fixed in outfits, shoes, headbands, and wristbands or attached straight to the body.

Wearable sensors are used to track, monitor, and record several healthcare pointers, such as blood pressure, pulse, calorie intake, heart rate, etc. Thus, due to the several benefits of wearable accelerometer medical sensors, the demand for these devices is anticipated to increase during the forecast period.

According to an article published by American Diabetes Association, in July 2022, every year around 1.5 million U.S. citizens are diagnosed with diabetes. Thus, to track and monitor diabetes, both Android and iOS mobile devices, have an app called “Diabetes Pal ” which is made specifically for people with type 2 diabetes. It enables the user to either manually enter the glucose values into the app or analyze their blood glucose measurements immediately from their glucose meter via Bluetooth.

Moreover, smart electronic devices, such as fitness bands, and activity trackers have accelerometer medical sensor technologies that are worn close to or on the skin, which detects or analyzes information concerned with human activity such as blood pressure, heart rate, body movements, and many more. Wearable accelerometer medical sensor technology has improved the capture of human health statistics for data-driven analysis in the field of health informatics.

Application Insights

The chronic illness & risk-monitoring segment dominated the accelerometer medical sensor market with a market share of 27.98% in 2022, owing to an increase in the disease burden of cardiovascular diseases such as CHF and hyperlipidemia. Moreover, factors such as a sedentary lifestyle, an increase in stress, and improper eating & sleeping patterns are also anticipated to increase the incidences of chronic diseases. Thus, the demand for more innovative sensors to monitor and track the progress of chronic diseases is increasing, resulting in a rise in the demand for the accelerometer medical sensor market.

The wellness monitoring segment is anticipated to grow at the highest CAGR during the forecast period. Wellness monitoring involves digitally monitoring and tracking healthcare indicators using devices such as Fitbit products and Apple Watch which help in tracking motion along with their intensity. The algorithm is intended to convert raw accelerometer statistics to significant information for better checks of the calories burned by the individual and also monitor the body movement during their sleep.

The algorithm also helps in tracking the heart rate and blood pressure of the individuals. For instance, in April 2022, Fitbit received clearance from the FDA for a novel PPG (photoplethysmography) algorithm to recognize atrial fibrillation (AFib). The algorithm would be influenced by the irregular rhythm of the heart notifications, featured on the Fitbit band. Various cancer research institutes are expected to use the few data points gained from the Fitbit band for monitoring individuals.

End-use Insights

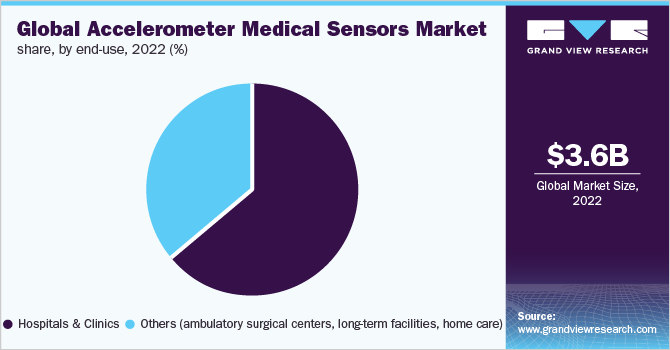

The Hospitals & clinics segment dominated the market for accelerometer medical sensors and accounted for a revenue share of 63.84% in 2022. This is attributed to an increase in the number of cardiovascular diseases that are boosting the number of coronary artery bypass surgeries which is one of the most common surgeries performed worldwide, and the procedure primarily occurs in hospitals & clinics.

This is likely to augment the segment during the forecast period. In sequential CABG procedure, anastomosis is performed usually end-to-side to connect the distal end of the graft and a target coronary artery. These types of surgeries account for more resources, used in the cardiovascular domain than any other procedure.

Others, which include ambulatory surgical centers, long-term facilities, home care expected to have the highest CAGR during the forecast period. According to Definitive Healthcare’s platform, in 2020, there were above 9,280 ambulatory surgical centers present in the U.S. and the number is most likely to rise in the coming years. This rapid growth trend reflects a rising preference for outpatient procedures. This kind of procedure performed in ambulatory centers has undergone substantial changes in recent years.

Regional Insights

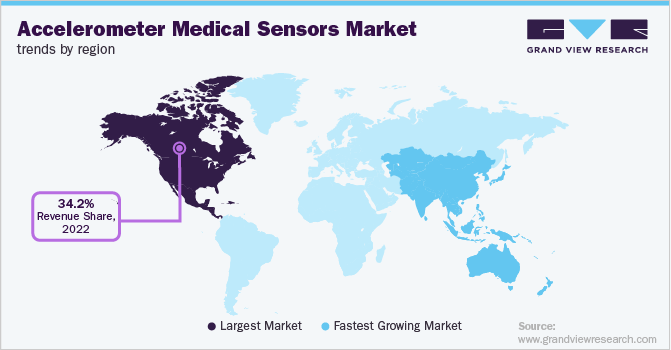

In 2022, North America dominated the accelerometer medical sensor market with a revenue share of 34.21% in terms of the revenue. This can be attributed to its well-established healthcare infrastructure, high healthcare expenditure, presence of dominant market players, and rapid adoption of advanced technologies. Other factors likely to boost market growth include the increasing prevalence of lifestyle-associated health conditions, accidents, and sports injuries.

According to a Tulane University article released in June 2021, there are 2,000 mobile clinics that help bridge the gap in healthcare delivery safety nets reaching vulnerable people in both urban and rural areas. Growing demand for effective emergency care and increasing adoption of mobile surgery centers are expected to drive the market during the forecast period.

Asia Pacific is anticipated to witness the fastest growth rate during the forecast period owing to the factors, such as the rising target disease burden, growing geriatric population, rising unhealthy lifestyle among youngsters, and increasing incidences of acute ischemic Chronic illness & at risk-monitoring. The rising incidences of cardiovascular diseases have generated a demand for accelerometer medical sensor tools in APAC countries.

Furthermore, with some of the highest diabetes rates in the world, India and China have been the most afflicted countries. According to the International Diabetes Federation (IDF)in December 2021, it was estimated that in the South-East Asia (SEA) Region of the IDF, around 90.0 million individuals (20-79) suffered from diabetes.

In addition, emerging economies such as China, South Korea, and India are expected to witness considerable growth during the forecast period. It is anticipated to boost the accelerometer medical sensor market growth.

Key Companies & Market Share Insights

Companies are focusing on the development of novel medical devices, expansions, and technological innovations. Moreover, mergers and acquisitions for new product development and strengthening of supply chain networks constitute some of the strategic initiatives implemented by the major players. For instance, in January 2021, Google acquired Fitbit for the smartwatches and fitness bands, to grow its accelerometer medical sensor market globally. Some of the key players operating in the global accelerometer medical sensor market include:

-

Koninklijke Philips N.V.

-

Analog Devices, Inc.

-

Fitbit Inc

-

Garmin

-

BMC medicals

-

Resmed

-

Somno medics

-

Compumedics

-

Cleveland

-

Matrix care

-

Nox medicals

-

Actigraph

-

Aetna Inc.

Accelerometer Medical Sensors Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.06 billion

Revenue forecast in 2030

USD 10.26 billion

Growth rate

CAGR of 14.15% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America: MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Denmark; Sweden; Norway; Spain; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Koninklijke Philips N.V.; Analog Devices, Inc.; Fit bit Inc.; Garmin; BMC medicals; Resmed; Somno medics; Compumedics; Cleveland; Matrix care; Nox medicals; Actigraph; Aetna Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Accelerometer Medical Sensors Market Segmentation

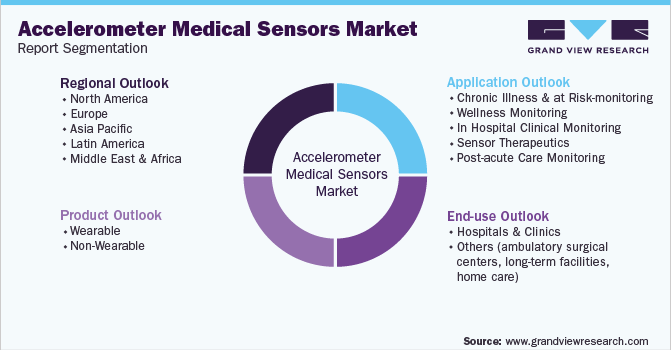

This report forecasts revenue growth at global, regional, and country levels in addition to provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global accelerometer medical sensors market based on the product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Wearable

-

Non-Wearable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic illness & at risk-monitoring

-

Wellness monitoring

-

In hospital clinical monitoring

-

Sensor therapeutics

-

Post-acute care monitoring

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & clinics

-

Others (ambulatory surgical centers, long-term facilities, home care)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global accelerometer medical sensors market size was estimated at USD 3,586.07 million in 2022 and is expected to reach USD 4.06 billion in 2023.

b. The global accelerometer medical sensors market is expected to grow at a compound annual growth rate of 14.15% from 2023 to 2030 to reach USD 10.26 billion by 2030.

b. North America dominated the accelerometer medical sensors market with a share of 34.21% in 2022. This is attributable to the rising adoption of cosmetic lift-ups and increasing demand for aesthetic surgeries along with high disposable income and increasing healthcare spending by patients.

b. Some of the key players operating in the accelerometer medical sensors market include Koninklijke Philips N.V., Analog Devices, Inc., Fitbit Inc, Garmin, BMC medicals, Resmed, Somno medics, Compumedics, Cleveland, Matrix care, Nox medicals, Actigraph, and Aetna Inc.

b. The key factors attributing to the market growth include the increasing prevalence of chronic diseases and the increasing geriatric population. Moreover, the rising health awareness amongst individuals has led to a rise in the demand for home-based accelerometer medical sensors that are cost-effective and easy-to-operate. In addition, the rise in the increase of individuals recording and tracking information about their health habits is expected to boost the market growth during the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."