- Home

- »

- Sensors & Controls

- »

-

Wearable Sensors Market Size, Share & Growth Report 2030GVR Report cover

![Wearable Sensors Market Size, Share & Trends Report]()

Wearable Sensors Market (2024 - 2030) Size, Share & Trends Analysis Report By Range, By Frequency (2X-GHz, 7X-GHz), By Engine, By Vehicle, By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-154-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wearable Sensors Market Summary

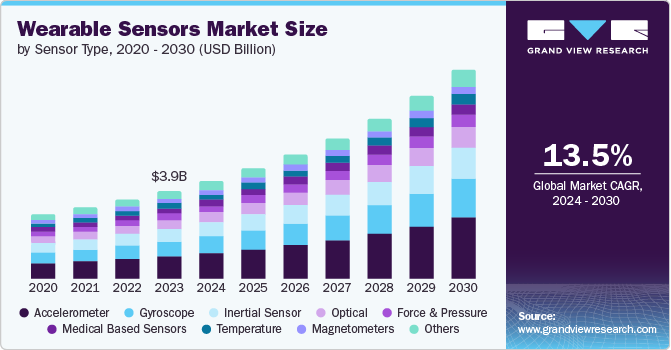

The global wearable sensors market size was valued at USD 3.88 billion in 2023 and is projected to reach USD 9.26 billion by 2030, growing at a CAGR of 13.5% from 2024 to 2030. Almost 66% of the global population, which is around 5.35 billion out of nearly 8 billion people, have internet access. As a result, there is growth in the penetration of internet-enabled smart gadgets in developing countries.

Key Market Trends & Insights

- North America wearable sensors market dominated the market with a revenue share of 38.70% in 2023.

- The U.S. wearable sensors market held a dominant position in 2023.

- By sensor type, accelerometer dominated the market in 2023.

- By device, smartwatch dominated the market with share of 34.1% in 2023.

- By end use, the consumer segment dominated the market in 2023 and is projected to grow at the fastest cagr of 14.8%.

Market Size & Forecast

- 2023 Market Size: USD 3.88 Billion

- 2030 Projected Market Size: USD 9.26 Billion

- CAGR (2024-2030): 13.5%

- North America: Largest market in 2024

Smartphones are one of top portable gadgets in wearable technology market, mainly utilized for gathering and monitoring health and fitness information for individuals aged between 0-9 and 60+. Moreover, wearable technology plays a crucial role in IoT, M2M and other platforms, which are driving the increase in connected devices globally.

Furthermore, advancements in power technology, wireless communication devices/technology, sensor technology, and other areas are driving the continuous growth of the wearable sensors market. Increasing use of wearable sensors for infants, advancements in sensor technology, and the growing adoption of home and remote patient monitoring are driving the market.

The rise in chronic illnesses is aiding in the expansion of the market. Wearable sensors are increasingly used into official healthcare systems, facilitating remote patient monitoring and telehealth services. This integration makes it easier to monitor patients with chronic conditions regularly, decreases the requirement for hospital appointments, and enables prompt medical interventions. In addition to traditional smartwatches and fitness bands, the market is witnessing a growth in various types of wearable sensors such as smart shoes, smart clothing, smart jewelry, and even implantable sensors. These varied shapes are designed for individual user requirements and tastes, broadening the uses of wearable technology.

Furthermore, utilized in sports and fitness settings, wearable sensors are commonly used to monitor athletes' development, prevent injuries, and improve training programs.

Sensor Type Insights

Accelerometer dominated the market in 2023. The segment growth is accredited to the increasing popularity of wearable devices in the market. Motion sensing with accelerometer sensors enhance the output and gives higher accuracy in tracking and monitoring user activities. The use of accelerometers in wrist-worn devices delivers fitness and wellness-related series and thus serves as a key source of market traction. Moreover, its ability to differentiate between when the user is taking a step or shaking just the wrist is a potential factor to segment growth.

The optical segment is anticipated to expand over the forecast period. The application of optical sensors has been associated as an integral part in the growth of wearable devices. They are incorporated in smart wearables and play a vital role in giving precise electrocardiogram (EKG) readings with the utmost accuracy. It enables highly sensitive measurement of health parameters and the surrounding environment, which is expected to boost its demand over the forecast period.

Device Insights

Smartwatch dominated the market with share of 34.1% in 2023 and is expected to grow at the fastest CAGR over the forecast period. The integration of high-tech sensors like GPS, accelerometers, and heart rate monitors enhances in-depth health and fitness tracking features.

Furthermore, evolutions from simple fitness trackers to different types of devices with features such as payments, notifications, and media control has expanded their popularity. The focus on aesthetics, along with the customized device features, attracts a wide range of customers, leading to an increase in market expansion.

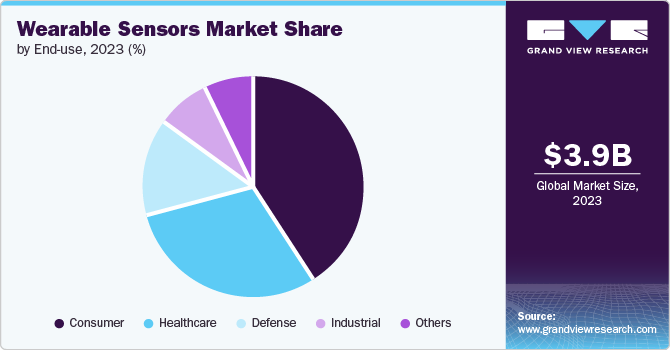

End Use Insights

The consumer segment dominated the market in 2023 and is projected to grow at the fastest CAGR of 14.8% over the forecast period. Demand for sensor-fused devices is gaining traction as awareness regarding remote monitoring of wellness and fitness is gaining popularity among users. Demand is driven by a wide variety of factors, such as availability of numerous wearables, technological advancement in sensors, and vendors’ ability to provide differentiated products.

The adoption of wearables among consumers will continue to dominate the market over the forecast period. An increase in demand for fitness, wellness, and lifestyle tracking devices is a key factor driving shipments of wearables in the recent past. Consumer preferences for wrist-worn, VR headsets, and smart clothing are positively impacting the market, and vendors are thus looking to innovate and provide optimum solutions to users

The segment is also expected to witness high growth with rising spending power among consumers, especially on electronics. Larger companies appear to be developing wearables focused on combining fashion as well as utility. Constant innovation will also benefit the growth of the consumer segment.

Regional Insights

North America wearable sensors market dominated the market with a revenue share of 38.70% in 2023. It is attributable to increasing health and fitness awareness in region, with wearable sensors playing a crucial role.

U.S. Wearable Sensors Market Trends

The U.S. wearable sensors market held a dominant position in 2023 due to increasing overweight and obese population. Around 41.9% adults are classified as obese across the country due to unhealthy eating habits and less physical activity. The rapid adoption of digital technology in the U.S. has allowed the region to account for a larger market share. Moreover, the healthcare sector in the region has been thriving, which is further anticipated to boost the adoption of wearable sensor-enabled products over the forecast period. An increase in the U.S. population along with significant health concern amongst youth as well as an aging portion is fueling need of healthcare activity monitoring devices. Wearable sensors are a vital component in a wearable device which provides accurate and reliable information on user activities and behavior. It detects activities by monitoring physical and physiological parameters along with other symptoms.

Europe Wearable Sensors Market Trends

The Europe wearable sensors market was identified as a lucrative region in 2023. Wearable sensors are utilized in diverse fields including fitness, healthcare, travel, defense, and sports. In the military segment, these sensors are employed for functions like a heads-up display. These sensors are utilized in video game consoles, movie theaters, and flight simulation devices in the entertainment sector.

The UK wearable sensors market is expected to grow rapidly in the coming years.

Consumers in the UK have adopted this technology, with fitness trackers in particular a common accessory found on people's wrists. Moreover, the elderly population faces higher chances of experiencing chronic illnesses, falls, disabilities, and other negative health consequences. It is estimated that by 2040, around 1 out of 7 individuals will be 75 years old or older.Asia Pacific Wearable Sensors Market Trends

The Asia Pacific wearable sensors market is anticipated to grow during the forecast period. Countries such as Japan, South Korea, and China are among the top technology centers in the Asia Pacific region. OEMs are making a substantial contribution to the development of IMUs, MEMS technology, and others, which can provide accuracy while keeping the price relatively lower for products developed through them. Many enterprises within China have been evolved in developing wearables at lower cost, which is attributed to the growing number of users in the market. The growing demand for home healthcare monitoring is anticipated to further propel the growth of the market across China.

Key Wearable Sensors Company Insights

Some of the key companies in the wearable sensors market include Robert Bosch GmbH, Panasonic Corporation, Sensirion AG and others. Companies are expanding their customer base to enhance their competitive advantage within the market. Hence, important stakeholders are implementing various strategic actions, such as mergers and acquisitions, and alliances with other prominent corporations.

-

InvenSense, a TDK Group subsidiary, offers sensing solutions. The organizations’ Sensing Everything targets industrial areas and consumer electronics with integrated Pressure, Sound, Motion, and Ultrasonic solutions.

Key Wearable Sensors Companies:

The following are the leading companies in the wearable sensors market. These companies collectively hold the largest market share and dictate industry trends.

- TE Connectivity

- NXP Semiconductors

- STMicroelectronics

- Robert Bosch GmbH

- Infineon Technologies AG

- InvenSense

- Knowles Electronics, LLC. Itasca, IL, USA.

- Panasonic Corporation

- Sensirion AG

- Asahi Kasei Microdevices Corporation

Recent Developments

-

In May 2024, Sensirion introduced SLD3x series, miniature liquid flow sensor platform, for delivering drugs subcutaneously. Sensirion’s customizable solutions ensure optimal closing, thereby enhancing patient safety for therapies requiring subcutaneous drug delivery.

Wearable Sensors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.33 billion

Revenue forecast in 2030

USD 9.26 billion

Growth rate

CAGR of 13.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sensor type, device, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France ,China, Japan, India, South Korea, Australia, Brazil, UAE, and South Africa

Key companies profiled

TE Connectivity; NXP Semiconductors; STMicroelectronics; Robert Bosch GmbH ;Infineon Technologies AG ; InvenSense ;Knowles Electronics, LLC. Itasca, IL, USA.; Panasonic Corporation ; Sensirion AG ; and Asahi Kasei Microdevices Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wearable Sensors Market Report Segmentation

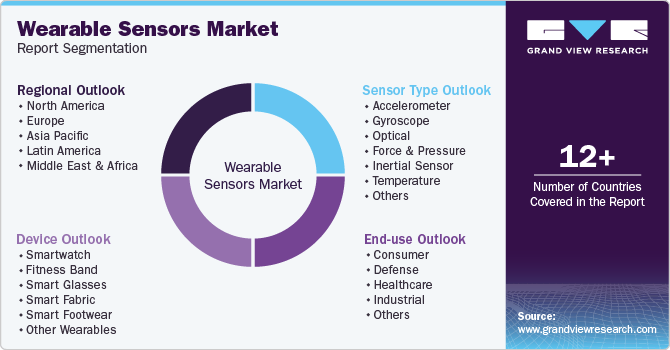

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wearable sensors market report based on sensor type, device, end use, and region:

-

Sensor Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Accelerometer

-

Gyroscope

-

Optical

-

Force & Pressure

-

Inertial Sensor

-

Temperature

-

Magnetometers

-

Medical Based Sensors

-

Others

-

-

Device Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smartwatch

-

Fitness Band

-

Smart Glasses

-

Smart Fabric

-

Smart Footwear

-

Other Wearables

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer

-

Defense

-

Healthcare

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

South Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.