- Home

- »

- IT Services & Applications

- »

-

Accounting Services For Startup Market Size Report, 2033GVR Report cover

![Accounting Services For Startup Market Size, Share & Trends Report]()

Accounting Services For Startup Market (2026 - 2033) Size, Share & Trends Analysis Report By Type, By Delivery Model (Traditional, Hybrid (Human + AI)), By End Use (E-commerce, BFSI, Healthcare), By Region And Segment Forecasts

- Report ID: GVR-4-68040-835-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Accounting Services For Startup Market Summary

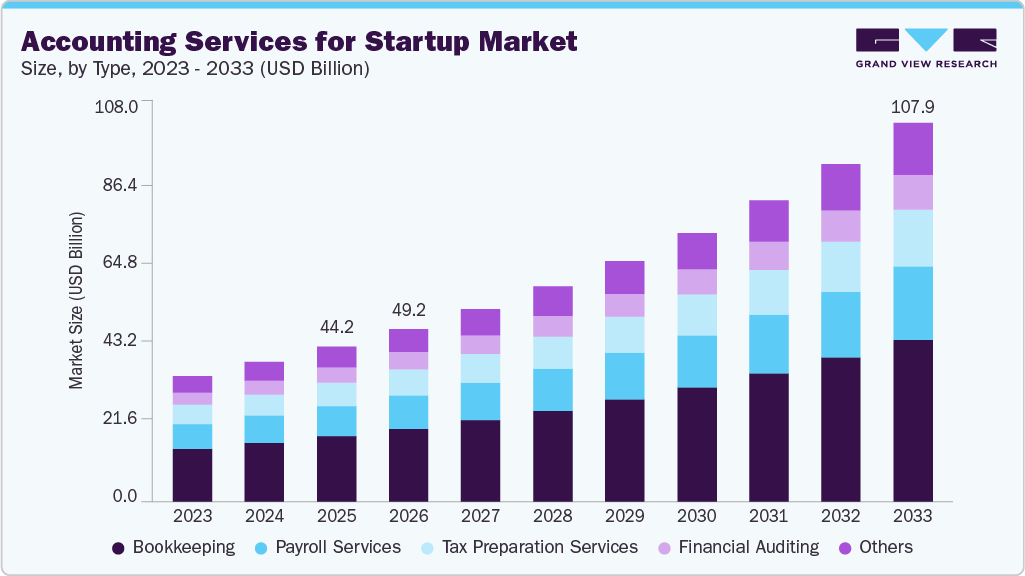

The global accounting services for startup market size was estimated at USD 44.17 billion in 2025, and is projected to reach USD 107.97 billion by 2033, growing at a CAGR of 11.9% from 2026 to 2033. The industry is gaining momentum, driven by rising demand for cost-efficient and scalable financial management solutions among early-stage and high-growth companies.

Key Market Trends & Insights

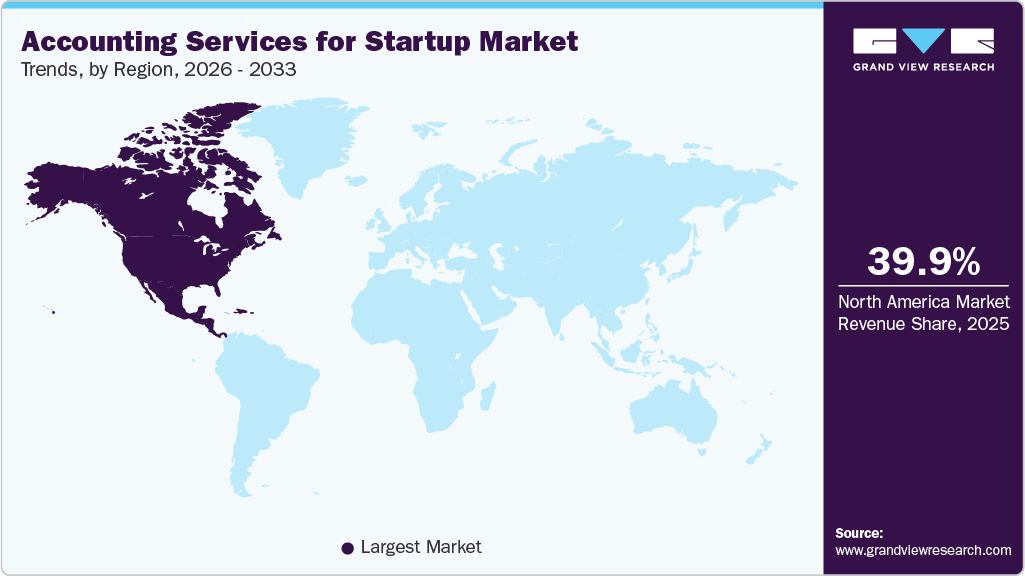

- The North America accounting services for startup market accounted for a 39.9% share of the overall market in 2025.

- The U.S. accounting services for startup industry held a dominant position in 2025.

- By type, the bookkeeping segment accounted for the largest share of 42.2% in 2025.

- By delivery model, the traditional segment held the largest market share in 2025.

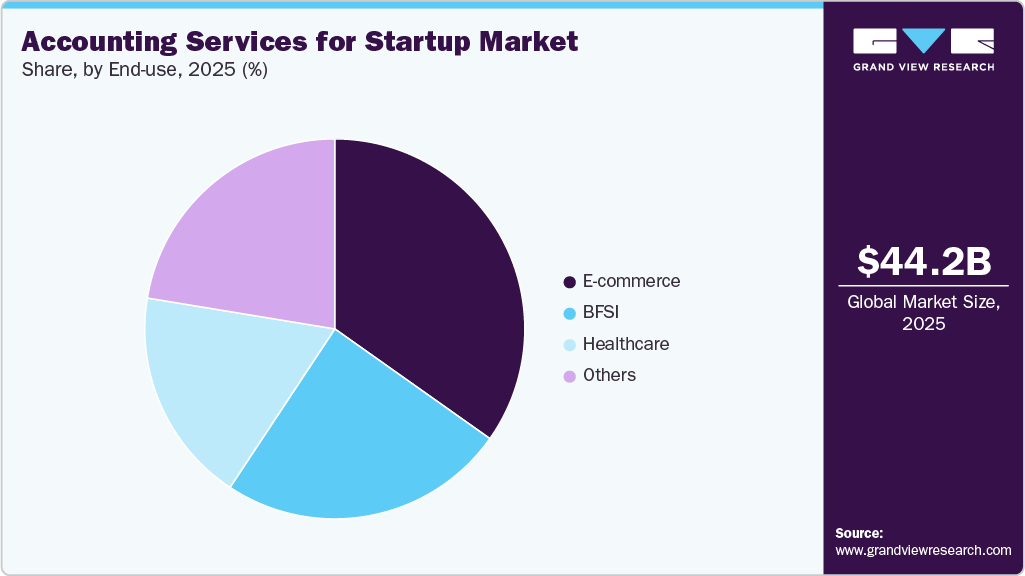

- By end use, the e-commerce segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 44.17 Billion

- 2033 Projected Market Size: USD 107.97 Billion

- CAGR (2026-2033): 11.9%

- North America: Largest market in 2025

Increasing adoption of cloud-based accounting platforms and AI-enabled tools is enabling real-time bookkeeping, automated payroll, and seamless tax compliance, further propelling market adoption. Besides, startups’ growing focus on regulatory compliance, cross-border expansion, and financial transparency is accelerating the deployment of outsourced accounting and advisory services.Advancements in workflow automation and artificial intelligence present significant opportunities to enhance accuracy, reduce manual effort, and improve decision-making for startup finance teams. However, high service costs, limited in-house financial expertise, and integration challenges with existing systems remain major barriers, particularly for bootstrapped and early-stage ventures.

Startups and early-stage companies are increasingly seeking cost-efficient and scalable financial management solutions to manage complex accounting, payroll, and tax operations without the overhead of full-time finance teams. Outsourced accounting services allow these companies to access professional expertise on-demand, enabling flexibility as their business scales. This expansion enhances global service capacity, allowing startups to manage cross-border compliance and finance functions efficiently. Such scalable solutions enable startups to maintain financial transparency, meet regulatory obligations, and optimize resource allocation while minimizing operational costs, thereby reinforcing the growing market demand for outsourced accounting services.

The shift toward cloud-based accounting platforms and AI-enabled tools is driving efficiency, accuracy, and real-time financial visibility for startups. Automation of bookkeeping, payroll processing, and tax compliance reduces the manual effort of finance teams, enabling them to focus on strategic decision-making. In November 2025, Zeni introduced its AI Accounting Agent, an autonomous system that handles transaction processing, reconciliations, flux analysis, and receipt matching with machine-level accuracy. By continuously syncing bank and credit card data and learning from user adjustments, this solution streamlines financial workflows and accelerates real-time reporting. The adoption of such technology empowers startups to manage complex financial operations at scale, while minimizing errors and operational overhead, thereby fueling the rapid market adoption of AI-enabled accounting services.

Advancements in workflow automation and AI present significant opportunities to transform startup accounting services by improving accuracy, reducing manual intervention, and enhancing decision-making. Startups often face resource constraints and a lack of in-house expertise, making automated solutions essential for timely financial reporting and compliance. In October 2025, Crowe launched Crowe Studio, an AI-native business unit designed to modernize the delivery of accounting, tax, and advisory services. Crowe Studio offers integrated digital workflows and AI-driven services that enable startups to scale efficiently while maintaining high levels of accuracy and operational agility. Leveraging AI and automation enables finance teams to focus on strategic insights, predictive planning, and risk mitigation, creating a strong opportunity for service providers to capture this growing market.

A key challenge in the global market is the high price sensitivity of early-stage companies, many of which operate on limited budgets and unpredictable revenue streams. Startups often face cash-flow constraints during their first few years, making them hesitant to invest in full-scale accounting or advisory services. As a result, they frequently rely on DIY financial tools, low-cost software, or part-time bookkeeping solutions. This price sensitivity constrains accounting service providers from offering premium packages or long-term retainers, particularly when competing with automated platforms that position themselves as cost-efficient alternatives for cost-conscious founders.

Type Insights

Based on type, the bookkeeping segment dominated the market in 2025, accounting for a 42.2% share of the market revenue. The segment’s leadership is driven primarily by cost efficiency, as startups and early-stage companies often operate with limited budgets and cannot afford the high salaries, benefits, and overhead associated with in-house accounting staff. Outsourced bookkeeping offers a flexible, on-demand solution, providing expert financial management without long-term commitments. Additional factors fueling adoption include the growing acceptance of cloud-based bookkeeping platforms, the increasing availability of automated reconciliation and transaction-matching tools, and a rising preference for real-time financial reporting that enables improved cash flow visibility and faster strategic decision-making.

The payroll services segment is expected to register a significant CAGR from 2026 to 2033. Modern payroll solutions integrate automation, real-time data synchronization, and seamless connectivity with HR, time-tracking, and accounting systems, making payroll management more efficient and accurate. Startups benefit from automated tax calculations, electronic filings, and timely payment processing, which reduce administrative burdens and mitigate compliance risks. The segment’s growth is further driven by increasing regulatory complexity across federal, state, and local payroll tax laws, as well as the rising adoption of contractor-heavy and hybrid workforce models. These trends are creating strong demand for specialized payroll services that ensure accurate classification, multi-state payroll processing, and streamlined onboarding.

Delivery Model Insights

Based on the delivery model, the traditional segment dominated the market in 2025. Its prominence is driven by startups’ preference for human expertise, personalized guidance, and hands-on support. Early-stage companies often seek direct interaction with experienced accountants who can interpret complex financial transactions, navigate regulatory requirements, and provide tailored advisory services that purely automated systems may not fully capture. This demand is particularly strong among startups expanding internationally, where local compliance and cross-border accounting knowledge are critical.

The hybrid delivery model segment is expected to grow at the fastest CAGR from 2026 to 2033. Growth in this segment is fueled by the adoption of AI-powered tools that automate repetitive tasks, such as data entry, reconciliations, invoicing, and expense tracking, reducing manual effort and errors. Human accountants then focus on complex financial scenarios, strategic insights, and decision-making, creating a synergistic model that combines efficiency with expertise. The convergence of AI automation and human oversight allows startups to achieve faster, more accurate, and scalable financial operations globally, supporting the segment's growth.

End Use Insights

Based on end use, the e-commerce segment dominated the market in 2025 and is anticipated to grow at the fastest CAGR from 2026 to 2033. Startups operating across multiple regions face complex multi-channel sales, high transaction volumes, and varying tax and regulatory requirements across countries. Platforms including Amazon, Shopify, and Etsy generate separate reports, fees, refunds, and tax obligations, which can overwhelm small finance teams. Outsourced accounting services enable these startups to reconcile transactions, maintain accurate financial records, ensure cross-border tax compliance, and provide real-time financial visibility. This enables founders and investors to make data-driven decisions and scale operations efficiently across multiple markets.

The BFSI segment is expected to experience substantial growth over the forecast period. Global fintech startups face stringent regulatory frameworks, including tax reporting, anti-money laundering (AML) regulations, data privacy, and financial disclosure compliance across various jurisdictions. High transaction volumes, multiple payment channels, and complex accounting for loans, investments, and customer payouts necessitate specialized financial services. Hybrid accounting models that combine AI automation with human oversight are increasingly being adopted, ensuring compliance, accurate reconciliation, and audit-ready reporting. These services allow BFSI startups to focus on product innovation and global expansion while maintaining robust financial management.

Regional Insights

The North America accounting services for startup industry accounted for 39.9% of the global share in 2025, driven by a high concentration of venture-backed startups and robust fintech, e-commerce, and SaaS ecosystems. Startups increasingly outsource accounting to manage multi-state tax obligations, complex payroll, and investor reporting. For example, U.S. founders leverage hybrid models combining AI tools with human expertise to gain real-time financial insights while controlling operational costs, supporting faster growth, and compliance.

U.S. Accounting Services For Startup Industry Trends

The U.S. accounting services for startup industry held a dominant position in 2025. The market is witnessing a significant transformation, driven by the growing demand for integrated financial and operational advisory services that extend beyond traditional bookkeeping. Startups are increasingly seeking providers who can combine accounting, payroll, tax compliance, and strategic advisory services into a single platform, enabling streamlined operations, faster decision-making, and real-time visibility into cash flows. The adoption of cloud-based platforms and AI-enabled tools is further enhancing accuracy, efficiency, and scalability for early-stage and high-growth companies.

The Canada accounting services for startup industry are fueled by strong regulatory compliance requirements and government incentives for small businesses. Startups rely on outsourced providers to navigate provincial and federal tax regulations, payroll compliance, and cross-border transactions with the U.S. This ensures startups maintain audit-ready financial records and scale efficiently without overburdening small in-house finance teams.

The accounting services for startup industry in Mexico are rapidly growing, particularly in e-commerce and fintech sectors, driving demand for specialized accounting services. Outsourced bookkeeping and payroll solutions help startups manage VAT, income tax compliance, and high transaction volumes, while providing real-time financial reporting. These services allow founders to focus on market expansion and strategic operations while minimizing errors and regulatory risks.

Europe Accounting Services For Startup Market Trends

The accounting services for startup industry in Europe emerged as a highly lucrative region in 2025. The market is transforming rapidly, driven by strong demand for cross-border financial management, multi-jurisdictional regulatory compliance, and scalable accounting solutions among early-stage and high-growth startups. European startups require service providers who can navigate complex tax regimes, payroll structures, and reporting obligations across multiple countries. In December 2025, TMF Group expanded its European footprint by acquiring Studio Ripamonti, a Milan-based firm specializing in accounting, payroll, and HR administration. This acquisition strengthened TMF’s local expertise in Italy and enhanced its ability to provide integrated, pan-European financial services for startups scaling across the continent.

The Germany accounting services for startup industry are driven by stringent tax regulations and payroll compliance requirements, prompting startups to adopt professional accounting solutions early. Startups increasingly use cloud-based platforms with automated tax and payroll calculations to maintain accuracy and efficiency. Firms such as RSM Germany and BDO Germany offer integrated accounting, payroll, and compliance services tailored to startups, enabling high-growth companies to maintain audit-ready records and scale operations across Germany and the EU.

The accounting services for startup industry in the UK are experiencing strong growth due to the rapid scale-up of fintech, SaaS, and e-commerce startups and the demand for real-time financial insights and compliance support. Firms such as Crowe UK and RSM UK are focusing on providing specialized advisory, investor reporting, and automated workflow solutions to help venture-backed startups optimize cash flow, reduce manual effort, and accelerate decision-making in a competitive market. Startups are increasingly utilizing AI-driven accounting tools integrated with cloud platforms, which enable automated transaction processing, payroll, and tax reporting.

Asia Pacific Accounting Services For Startup Market Trends

The accounting services for startup industry in the Asia Pacific expanded rapidly in 2025 due to a surge in cross-border startups, increasing adoption of cloud-based financial tools, and rising regulatory scrutiny in multiple countries. Providers focus on delivering scalable accounting, payroll, and tax solutions to startups across fintech, e-commerce, and SaaS sectors. Countries such as Australia, Singapore, and India are experiencing a high adoption of hybrid delivery models that combine AI tools with human expertise. Companies, including TMF Group and Flatworld Solutions, are emphasizing automation-driven bookkeeping, compliance management, and real-time reporting, helping startups streamline operations while navigating complex multi-jurisdictional regulations.

The China accounting services for startup industry are experiencing rapid growth in 2025, fueled by stringent local tax and payroll compliance requirements, the rise of digital finance ecosystems, and increasing venture-backed startup activity. Startups in e-commerce, fintech, and SaaS sectors rely on providers to manage VAT reporting, multi-channel transaction tracking, and payroll automation. Companies such as Invensis Technologies and Flatworld Solutions Private Limited focus on delivering cloud-based accounting solutions, automated reconciliations, and localized advisory services, enabling startups to maintain regulatory compliance while optimizing cash flow and supporting expansion across domestic and international markets.

The accounting services for startup industry in Japan held a significant position in 2025, driven by complex local taxation rules, high adoption of technology-enabled finance tools, and demand for accurate investor reporting among startups. Healthtech, fintech, and e-commerce startups increasingly leverage AI-driven bookkeeping, automated payroll, and integrated tax compliance platforms.

Firms such as RSM International and TMF Group offer tailored solutions for rapidly scaling startups, focusing on real-time financial monitoring, cross-border compliance, and support for regulatory audits. Japan’s focus on precision and reporting standards makes hybrid human-plus-AI delivery models particularly effective for early-stage companies navigating both domestic and global financial obligations.

Key Accounting Services For Startup Company Insights

Some of the key companies in the global market include TMF Group, Flatworld Solutions Private Limited, QX Global Group Limited, and others. The key participants focus on adopting strategies such as service differentiation, inclusion of customization and personalization in service offerings, and improved customer assistance to address growing competition.

-

TMF Group is a global provider of accounting, tax, payroll, and compliance services operating in more than 85 jurisdictions. The company has traditionally focused on multinational and enterprise clients, but it now also supports scaling startups expanding internationally. Its strengths include cross-border accounting, entity setup, payroll compliance, and finance administration. TMF’s broad geographic coverage and standardized delivery model make it well-suited for venture-backed startups entering multiple markets or managing complex global operations.

-

Flatworld Solutions Private Limited is a global outsourcing provider offering bookkeeping, tax preparation, payroll processing, AP/AR management, and virtual CFO services. With delivery centers across India and the Philippines and clients in over 150 countries, the company supports startups seeking scalable and cost-efficient accounting operations. The company combines trained accounting teams with workflow automation to manage high-volume financial processes, helping early-stage and growing businesses improve compliance, reporting accuracy, and overall financial visibility.

Key Accounting Services For Startup Companies:

The following are the leading companies in the accounting services for startup market. These companies collectively hold the largest Market share and dictate industry trends.

- TMF Group

- Flatworld Solutions Private Limited

- QX Global Group Limited (QX Accounting Services)

- Global FPO

- CapActix Business Solutions Private Limited

- RSM International Limited

- BDO International Limited

- Crowe Global

- Accace SE

- Invensis Technologies Private Limited

Recent Developments

-

In December 2025, TMF Group expanded its European footprint by acquiring Studio Ripamonti, strengthening its accounting, payroll, and HR administration capabilities in Italy. The deal enhances TMF’s global service capacity for startups needing cross-border financial and compliance support.

-

In October 2025, QX Accounting Services formed a Strategic Advisory Council to accelerate innovation across AI-enabled accounting, technology adoption, and growth strategy. The council will guide QX on enhancing digital transformation capabilities that support startups seeking scalable, tech-driven accounting solutions.

-

In August 2023, TMF Group launched a new global receivables collection service, expanding its accounting and tax portfolio across 86 jurisdictions. The service enhances cash-flow visibility, automates collection workflows, and supports faster payment cycles for growing businesses.

Accounting Services For Startup Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 49.18 billion

Revenue forecast in 2033

USD 107.97 billion

Growth rate

CAGR of 11.9% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

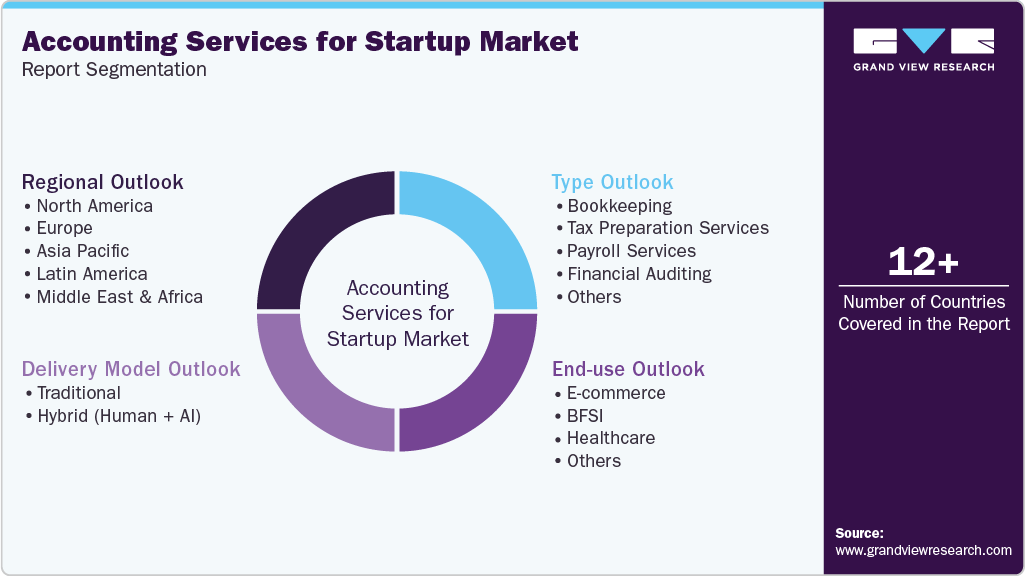

Segments covered

Type, delivery model, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

TMF Group; Flatworld Solutions Private Limited; QX Global Group Limited; Global FPO; CapActix Business Solutions Private Limited; RSM International Limited; BDO International Limited; Crowe Global; Accace SE; Invensis Technologies Private Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Accounting Services For Startup Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global accounting services for startup market report based on type, delivery model, end use, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Bookkeeping

-

Tax Preparation Services

-

Payroll Services

-

Financial Auditing

-

Others (CFO-as-a-service, advisory, integrations, automation)

-

-

Delivery Model Outlook (Revenue, USD Million, 2021 - 2033)

-

Traditional

-

Hybrid (Human + AI)

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

E-commerce

-

BFSI

-

Healthcare

-

Others (SaaS, consumer apps, marketplaces, hardware, industrial tech)

-

-

Regional Outlook (Revenue, USD Million, 2021- 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (Middle East and Africa)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global accounting services for startup market size was estimated at USD 44.17 billion in 2025, and is projected to reach USD 107.97 billion by 2033.

b. The global accounting services for startup market is expected to grow at a compound annual growth rate of 11.9% from 2026 to 2033 to reach USD 107.97 billion by 2033.

b. North America dominated the accounting services for startup market accounted for 39.9% of the global share in 2025, driven by high concentration of venture-backed startups and robust fintech, e-commerce, and SaaS ecosystems. Startups increasingly outsource accounting to manage multi-state tax obligations, complex payroll, and investor reporting.

b. Some key players operating in the accounting services for startup market include TMF Group, Flatworld Solutions Private Limited, QX Global Group Limited, Global FPO, CapActix Business Solutions Private Limited, RSM International Limited, BDO International Limited, Crowe Global, Accace SE, Invensis Technologies Private Limited.

b. Key factors that are driving the market growth include increasing demand for cost-efficient and scalable financial management solutions among early-stage and high-growth companies. Increasing adoption of cloud-based accounting platforms and AI-enabled tools is enabling real-time bookkeeping, automated payroll, and seamless tax compliance, further propelling market adoption

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.