- Home

- »

- Next Generation Technologies

- »

-

Accounting Software Market Size, Industry Report, 2030GVR Report cover

![Accounting Software Market Size, Share & Trends Report]()

Accounting Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (Cloud-based, On-premise), By Enterprise Size, By End-use (BFSI, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-626-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Accounting Software Market Summary

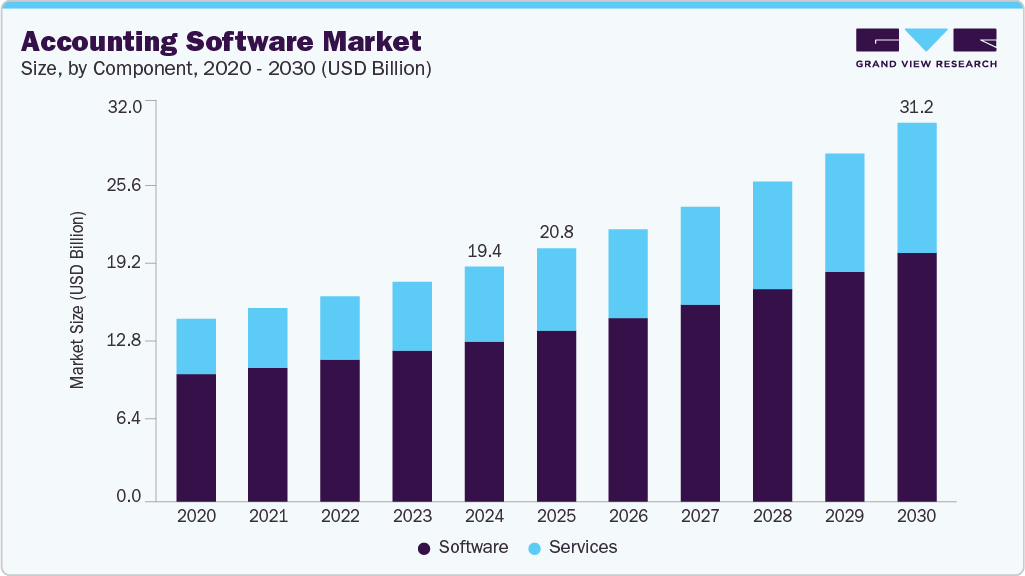

The global accounting software market size was estimated at USD 19.38 billion in 2024 and is projected to reach USD 31.25 billion by 2030, growing at a CAGR of 8.4% from 2025 to 2030. The market has been driven by a growing demand for automation, accuracy, and efficiency in financial operations across enterprises of all sizes.

Key Market Trends & Insights

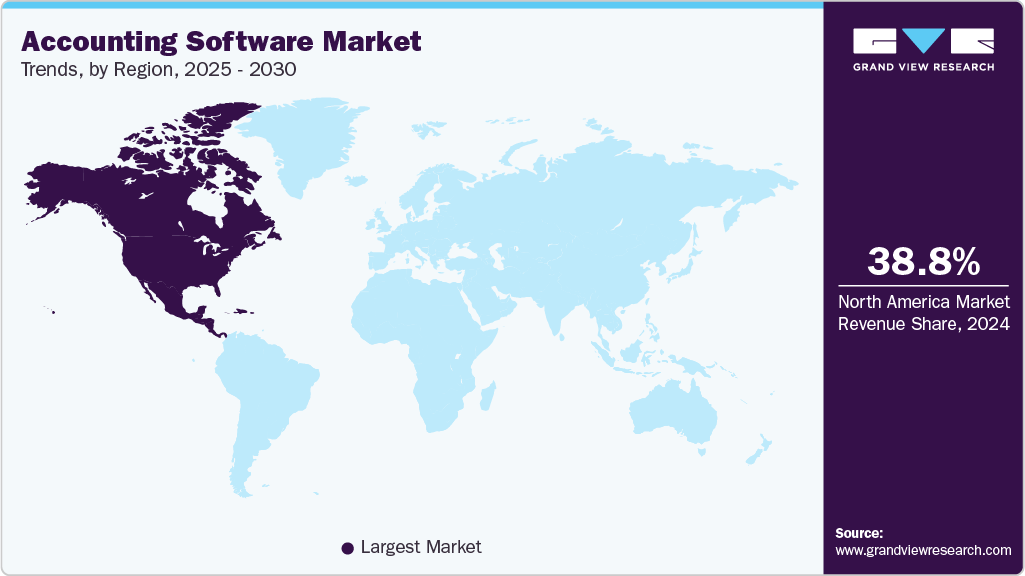

- The North America accounting software market dominated globally in 2024 with a share of 38.76%.

- The U.S. accounting software market held a dominant position in the region in 2024.

- By component, the software segment held the largest revenue share of 68.2% in 2024.

- By deployment, the cloud-based accounting software segment held the largest market share in 2024.

- By enterprise size, the large enterprises segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.38 Billion

- 2033 Projected Market Size: USD 31.25 Billion

- CAGR (2025-2033): 8.4%

- North America: Largest market in 2024

The increasing complexity of financial processes, coupled with the rising volume of transactional data, has necessitated the adoption of advanced digital solutions. Businesses are focusing on streamlining operations, reducing manual errors, and enhancing compliance, which has contributed to the widespread deployment of accounting software. Furthermore, the globalization of trade and the expansion of small and medium-sized enterprises (SMEs) have also been recognized as major contributors to market growth. Significant technological advancements have been observed in the accounting software industry, with cloud computing, artificial intelligence (AI), and machine learning being rapidly adopted. Cloud-based platforms have allowed for greater scalability, real-time access to financial data, and seamless collaboration across teams. The incorporation of AI and automation into accounting software has transformed traditional financial operations by enabling predictive analytics, intelligent reporting, and automated transaction processing. AI-powered systems can detect anomalies, flag discrepancies in real-time, and streamline repetitive tasks such as data entry and bank reconciliation. This enhances efficiency and minimizes human error.The global push for digital tax reporting and financial transparency has compelled businesses to adopt accounting software that ensures compliance with local and international regulations. Initiatives such as the EU's e-invoicing mandates, the UK's Making Tax Digital (MTD), and India's GST framework have made it essential for firms to implement software capable of real-time reporting and automated compliance checks. Vendors are responding by embedding compliance frameworks and audit trail features into their platforms. The government's efforts to modernize tax collection systems are driving a rapid increase in demand for regulation-ready accounting software.

The increasing reliance on mobile devices for business operations has led to growing demand for mobile-friendly accounting solutions. Users now expect the ability to issue invoices, track expenses, and monitor cash flow directly from their smartphones or tablets. Mobile apps with user-friendly dashboards and real-time alerts are empowering business owners and finance teams to manage their finances anytime, anywhere. This trend is especially prominent among freelancers, gig economy participants, and small business owners who value flexibility and speed. As mobile penetration deepens globally, accounting software providers are investing heavily in optimizing mobile functionality.

Despite the market's growth, several restraints have been identified. High initial implementation costs, especially for advanced enterprise-level solutions, have hindered adoption among cost-sensitive SMEs. Data security and privacy concerns, particularly in cloud-based deployments, have also raised concerns among users. In addition, a lack of skilled personnel to manage complex systems and resistance to change within traditional accounting departments have hindered the full-scale deployment of these technologies. As a result, while the market outlook remains positive, these challenges could hamper the growth of the market.

Component Insights

The software segment held the largest revenue share of 68.2% in 2024. The software segment is further bifurcated into commercial accounting software, enterprise accounting software, billing & invoice software, payroll management software, custom accounting software, and spreadsheets. The segment’s growth is fueled by increasing demand for automation, financial transparency, and operational efficiency across all business sizes. Companies are actively replacing legacy systems with modern, cloud-based platforms that offer real-time access to financial data, seamless integration with enterprise systems, and enhanced data security, thereby driving the segment’s growth.

The services segment is expected to witness the fastest CAGR over the forecast period. The services segment, including professional and managed services, is gaining traction as businesses seek tailored implementation, integration, training, and support to maximize the value of accounting software investments. With increasing complexity in financial regulations and diverse operational requirements across sectors, service providers are playing a crucial role in customizing accounting solutions and ensuring regulatory compliance. Managed services are particularly appealing to SMEs that lack in-house IT or finance expertise, enabling them to outsource ongoing system management. As accounting platforms become more sophisticated, the demand for value-added services is expected to rise steadily, contributing to sustained market growth.

Deployment Insights

The cloud-based accounting software segment held the largest market share in 2024. The shift toward cloud-based accounting platforms has significantly accelerated the segment’s growth. These solutions offer real-time data access, improved collaboration, and scalability, making them highly attractive to businesses of all sizes, especially SMEs and startups with limited IT infrastructure. Cloud platforms eliminate the need for extensive hardware, reduce maintenance costs, and offer automatic updates, which ensures that companies remain compliant with changing financial regulations. The ongoing shift toward remote work and digital transformation is making cloud-based accounting both a cost-effective solution and a strategic solution for agility and resilience in business operations.

The on-premise segment is expected to register a moderate CAGR of 5.9% during the forecast period. On-premise solutions provide enhanced control over data and customization, preferred by organizations with specific security or regulatory requirements. Despite the growing trend towards cloud computing, a significant portion of businesses continue to rely on on-premise accounting software. This preference is often due to the need for greater control over data, compliance with specific regulatory standards, and the ability to customize software to unique business processes.

Enterprise Size Insights

The large enterprises segment dominated the market in 2024. This dominance is attributed to their complex financial structures and need for advanced functionalities. They require sophisticated solutions to handle multi-currency transactions, compliance across jurisdictions, and integration with other enterprise systems. Their larger budgets enable investment in comprehensive and customizable software platforms, thereby driving the demand for accounting software.

The small and medium enterprises segment is expected to witness the fastest CAGR over the forecast period. SMEs are increasingly turning to digital accounting tools to manage their finances with greater precision and control. With growing awareness of the advantages of automation, even budget-conscious small businesses are investing in affordable cloud-based and subscription-model accounting software. These tools provide essential features such as invoicing, expense tracking, tax filing, and cash flow analysis, which were once accessible only to larger enterprises. SMEs prioritize cost-effective, user-friendly accounting software to streamline financial processes. The increasing availability of affordable, cloud-based solutions has accelerated greater adoption among SMEs.

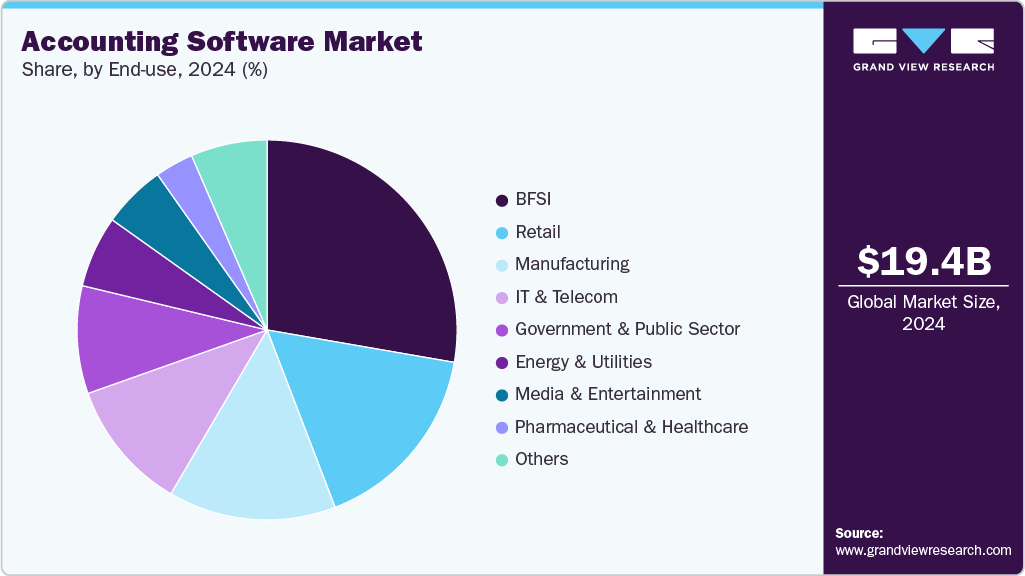

End-use Insights

The BFSI segment dominated the market in 2024. The BFSI sector holds a dominant position in the market due to its complex and highly regulated financial environment. Institutions in this sector manage vast volumes of transactions daily, requiring precise, real-time financial reporting, risk assessment, and audit trails. Accounting software enables the automation of routine tasks such as reconciliations, ledger management, and regulatory filings, thereby reducing errors and improving operational efficiency. The sector’s continuous push toward digital transformation and data-driven decision-making further strengthens its demand for advanced, integrated accounting platforms.

The IT and telecom segment is expected to witness the fastest CAGR over the forecast period. The IT and telecom sector leverages accounting solutions for project accounting, billing, and revenue recognition. These companies often deal with recurring revenue models, multi-tiered service pricing, and project-based billing, all of which demand advanced accounting functionalities. In addition, the sector’s reliance on international operations necessitates multi-currency support, global tax compliance, and scalable reporting tools. To manage large volumes of customer data, subscriptions, and vendor relationships, IT & telecom firms are increasingly turning to cloud-based, customizable accounting solutions that integrate seamlessly with CRM, ERP, and project management platforms, thereby driving the segment’s growth.

Regional Insights

The North America accounting software market dominated globally in 2024 with a share of 38.76% and is expected to register a moderate CAGR from 2025 to 2030. The region’s growth is driven by a mature business environment, high digital literacy, and widespread adoption of cloud-based financial tools. Enterprises across all sizes, from startups to large corporations, are leveraging advanced platforms for real-time financial reporting, automation, and compliance with strict regulatory standards. Innovation in AI and machine learning is further enhancing the capabilities of accounting solutions in the region. The demand for integrated and scalable platforms is driving continuous investment in product development and cloud infrastructure.

U.S. Accounting Software Market Trends

The U.S. accounting software industry held a dominant position in the region in 2024, driven by stringent regulatory frameworks such as GAAP, Sarbanes-Oxley, and evolving tax codes. A high concentration of technology firms and accounting service providers drives a competitive landscape, promoting continuous innovation in automation, AI integration, and industry-specific customization. The strong emphasis on digital finance transformation positions the U.S. as a global leader in accounting software technology adoption.

Europe Accounting Software Market Trends

Europe accounting software industry is expected to register a notable CAGR from 2025 to 2030. The region’s growth is driven by a well-established business ecosystem and strict compliance requirements under IFRS and GDPR. Adoption is being driven by mid-sized and large enterprises seeking solutions that ensure accurate financial reporting, tax compliance, and audit readiness. Cloud migration and SaaS-based offerings are gaining traction as companies modernize their legacy systems. In addition, regional government initiatives promoting digital tax submissions are accelerating market expansion across both Western and Eastern Europe.

The UK accounting software industry is expanding rapidly, driven by regulatory changes, including the Making Tax Digital (MTD) initiative led by HMRC. This has compelled businesses to adopt compliant digital accounting solutions capable of real-time reporting and seamless tax submission. Cloud-based platforms are witnessing robust growth, especially among SMEs and self-employed professionals.

The Germany accounting software industry held a substantial market share in 2024. The German market is characterized by its emphasis on precision, regulatory compliance, and enterprise integration. As one of Europe’s largest economies, Germany has a well-developed market for ERP-integrated accounting systems, particularly among manufacturing and export-oriented businesses. Adoption is growing for cloud and AI-enhanced platforms that support real-time financial planning and international tax standards. German enterprises are also increasingly prioritizing cybersecurity and data sovereignty, driving demand for localized and GDPR-compliant accounting software solutions.

Asia Pacific Accounting Software Market Trends

The Asia Pacific accounting software industry is anticipated to grow at a CAGR of 10.9% during the forecast period. The region is experiencing accelerated growth driven by the rapid digital transformation of businesses, rising government mandates for electronic invoicing, and increasing adoption among SMEs. Countries across the region are witnessing a shift toward cloud-based and mobile accounting solutions to enhance financial visibility and operational efficiency. The market is also supported by a growing startup ecosystem and expanding internet penetration, particularly in Southeast Asia.

India’s accounting software industry is expected to grow at the fastest growth rate during the forecast period. In India, the accounting software industry is being driven by the implementation of the Goods and Services Tax (GST) regime, which has increased the need for compliance-ready digital solutions. SMEs and mid-sized businesses are showing strong adoption rates, particularly of cloud-based platforms that offer GST integration, automated billing, and tax filing. The market is also benefiting from initiatives under the Digital India campaign, which promotes digital finance tools.

The China accounting software industry held a substantial market share in 2024, driven by ongoing enterprise digitization, regulatory reforms, and advancements in cloud infrastructure. The government's push for modern financial reporting standards and the increased demand for real-time data analytics among enterprises are creating strong demand for accounting software. The market is also supported by a robust manufacturing base and the growing need for financial transparency across supply chains.

Key Accounting Software Company Insights

Some of the key companies in the accounting software industry include Infor, Inc., Intuit, Inc., and Oracle Corporation, among others. These companies focus on innovation, scalability, and integration capabilities, while new entrants focus on affordability and specialized features for SMEs. Strategic partnerships, acquisitions, and localized offerings are commonly employed to strengthen market position and expand customer base across diverse industries and regions.

- Intuit Inc. is a global technology company renowned for its financial and accounting solutions tailored to small businesses, accountants, and individuals. Best known for its flagship product, QuickBooks, the company offers a comprehensive suite of tools for bookkeeping, payroll, invoicing, and tax preparation.

- Oracle Corporation is a global technology company known for its advanced cloud infrastructure and enterprise software solutions. Its Oracle NetSuite offering is one of the prominent cloud-based ERP platforms, providing comprehensive accounting, financial planning, and business management tools for mid-sized to large enterprises.

Key Accounting Software Companies:

The following are the leading companies in the accounting software market. These companies collectively hold the largest market share and dictate industry trends.

- Infor, Inc.

- Intuit, Inc.

- Patriot Software LLC

- Microsoft Corporation

- Oracle Corporation

- Sage Group Plc

- Zoho Corporation

- Xero Ltd.

- Tally Solutions Pvt Ltd.

- Workday

Recent Developments

-

In May 2025, MentisSoft, a prominent provider of next-generation technology solutions for businesses and educational institutions, announced the launch of FINACS.com, a comprehensive online school accounting software designed specifically for K-12 private and independent schools. Featuring powerful student billing capabilities and a full-service accounting suite, FINACS.com offers an intuitive, high-performance platform tailored to meet the practical needs of modern school finance teams.

-

In November 2024, IRIS Software Group introduced IRIS Elements Enterprise, a cloud-based accounting suite developed to help accountancy firms manage complex client demands. The platform is specifically designed to ensure firms remain compliant with evolving regulations, including the upcoming Making Tax Digital (MTD) mandates from HMRC.

Accounting Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.83 billion

Revenue forecast in 2030

USD 31.25 billion

Growth rate

CAGR of 8.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Infor, Inc.; Intuit, Inc.; Patriot Software LLC; Microsoft Corporation; Oracle Corporation; Sage Group Plc; Zoho Corporation; Xero Ltd.; Tally Solutions Pvt Ltd.; Workday

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Accounting Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global accounting software market report based on component, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Commercial Accounting Software

-

Enterprise Accounting Software

-

Billing & Invoice Software

-

Payroll Management Software

-

Custom Accounting Software

-

Spreadsheets

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail

-

Manufacturing

-

IT & Telecom

-

Government & Public Sector

-

Energy & Utilities

-

Media & Entertainment

-

Pharmaceutical & Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global accounting software market size was estimated at USD 19.38 billion in 2024 and is expected to reach USD 20.83 billion in 2025.

b. The global accounting software market is expected to grow at a compound annual growth rate of 8.4% from 2025 to 2030 to reach USD 31.25 billion by 2030.

b. The software segment accounted for the largest share of 68.2% in 2024. The segment’s growth is fueled by increasing demand for automation, financial transparency, and operational efficiency across all business sizes.

b. Some key players operating in the accounting software market include Infor, Inc., Intuit, Inc., Patriot Software LLC, Microsoft Corporation, Oracle Corporation, Sage Group Plc, Zoho Corporation, Xero Ltd., Tally Solutions Pvt Ltd., and Workday.

b. The accounting software market has been driven by a growing demand for automation, accuracy, and efficiency in financial operations across enterprises of all sizes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.