- Home

- »

- Advanced Interior Materials

- »

-

Acoustic Insulation Market Size, Share, Industry Report 2033GVR Report cover

![Acoustic Insulation Market Size, Share & Trends Report]()

Acoustic Insulation Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Glass Wool, Rock Wool, Foamed Plastic), By End-use (Building & Construction, Industrial, Transportation), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-256-3

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Acoustic Insulation Market Summary

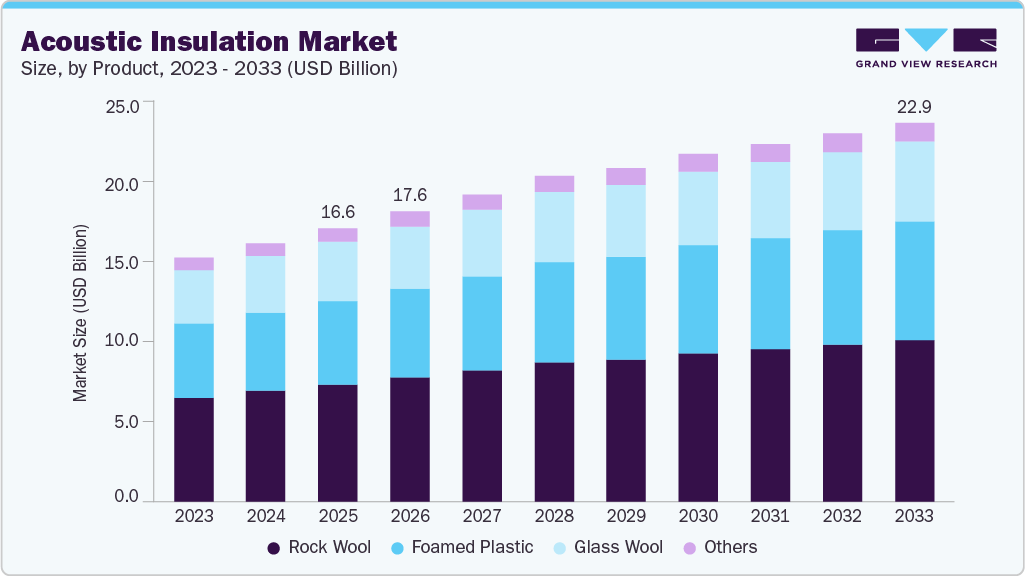

The global acoustic insulation market size was estimated at USD 16.55 billion in 2025 and is projected to reach USD 22.92 billion by 2033, growing at a CAGR of 3.9% from 2026 to 2033. Growing awareness about noise pollution, rising health consciousness among consumers and decision-makers, and improving standards of living are expected to substantially impact the global expansion of the acoustic insulation industry.

Key Market Trends & Insights

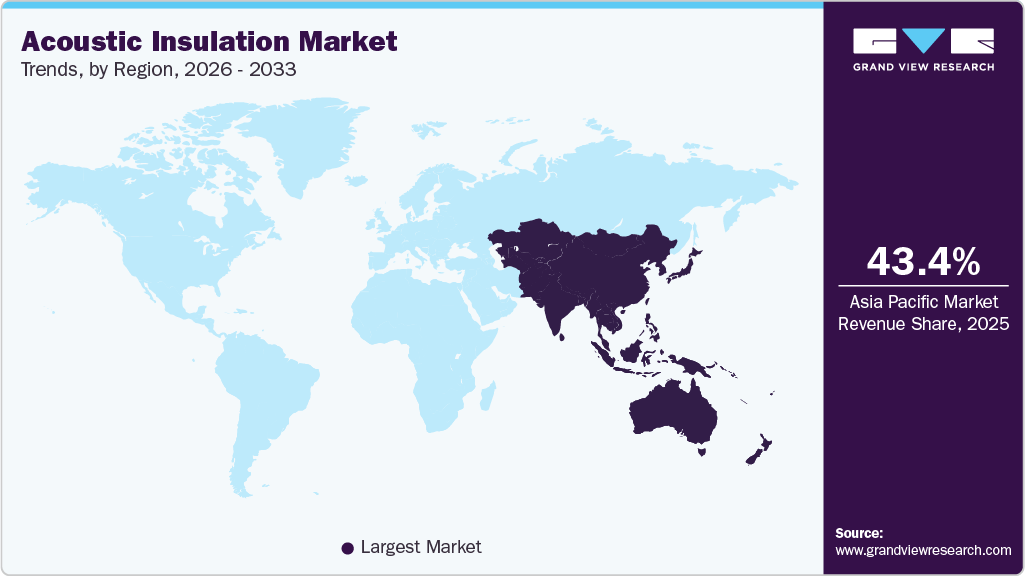

- Asia Pacific dominated the acoustic insulation market with the largest revenue share of 43.4% in 2025.

- The acoustic insulation market in China is expected to grow at a significant CAGR over the forecast period.

- By product, the foamed plastic segment is expected to grow at the fastest CAGR of 4.2% over the forecast period.

- By end use, the industrial segment is expected to grow at the fastest CAGR of 4.3% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 16.55 Billion

- 2033 Projected Market Size: USD 22.92 Billion

- CAGR (2026-2033): 3.9%

- Asia Pacific: Largest market in 2025

Human efficiency and health are closely related to the noise levels present in the work environment, highlighting the significance of sound barriers. Rapidly rising concerns about the comfort level of employees have created a strong demand for noise-cancelling solutions across commercial establishments. Improved standards of living are also anticipated to boost product popularity in the residential construction segment to achieve a quiet and peaceful atmosphere in households. Noise pollution is a significant issue that has become more prevalent due to industrialization and urbanization in today’s environment. It is responsible for conditions such as hearing loss, sleep disturbance, stress, cognitive impairment in children, and annoyance.According to the CDC, across all industries in the U.S., one out of four workers has faced exposure to hazardous noise, with over half of them reporting that they did not use hearing protection. Furthermore, the construction of buildings in proximity to busy places, such as railway stations, shopping malls, and stadiums, has meant that occupants face a constant exposure to loud outside noise, which can lead to several health issues in the long run. A study by the University of California, Berkeley, has stated that performance falls by 66% when people are exposed to distracting noises. Using acoustic insulation means that people living inside or working in a building can be protected from such undesirable sounds.

Besides the obvious benefit of protecting inhabitants from noise pollution, acoustic insulation materials also provide advantages such as comfort and privacy, as well as reduction of sound transmission & vibrations. Furthermore, acoustic insulation can play the role of an insulator effectively by preventing cold air from infiltrating the building, thus helping cut down energy costs. Acoustic insulation is available in the form of slabs, panels, granulates, and rolls, with the amount needed determined by the material chosen, the size of the insulated area, and the extent of sound transmission affecting that particular place.

Regulations related to noise control and isolation play a significant role in the development of this industry. For instance, the EPA has established specific standards to regulate noise emissions in transportation, as well as the sound insulation of building structures. Most countries in the European Union have implemented regulations for airborne, impact, and appliance noise levels.

Guidelines are also put in place to ensure maximum isolation from external sounds. In Italy, law no. 447 of 2/10/95 proposes suspension of public as well as private entities responsible for sound pollution. Meanwhile, Portuguese regulations define and control noise isolation from external sources inside a building. Sound generation from automobiles, planes, and ships is also regulated under various specified standards.

Market Concentration & Characteristics

The global industry is highly consolidated, with the top few players generating the majority of the global revenue; moreover, this market is expanding at a steady pace. The development of green buildings and the demand for sustainability have led companies to launch innovative products, such as bio-based insulation, which can be achieved using materials such as hempcrete, cork insulation, and recycled denim. Several start-ups have emerged in recent years, such as HTK Synergie and Artificial Ecosystems (both based in Germany), which focus on introducing innovative products to this market.

Mergers and acquisitions are key strategies adopted by major participants to increase their share as well as boost value chain integration. For instance, In February 2024, Saint-Gobain acquired International Cellulose Corporation (ICC), a major U.S. supplier of spray-applied acoustic and thermal insulation. The move strengthens Saint-Gobain’s sustainable insulation portfolio and expands its presence in the North American market.

There are several regulations implemented for noise reduction in buildings and establishments, as well as in the development of acoustic insulation products, which govern market growth. For instance, the Acoustical Society of America (ASA) has a set of recommended standards, drawing from the ANSI accreditation for acoustic design. Meanwhile, in the UK, Approved Document E of the Building Regulations focuses on four key areas – sound protection from other buildings, internal walls and floors, reverberations in common internal building parts, and acoustic conditions in schools.

In recent years, there have been numerous product developments that can restrain market growth in the future. The presence of several DIY solutions, such as egg cartons, towels, rugs, and blankets, can serve this purpose effectively, thus becoming a convenient option for homeowners looking for cheaper alternatives. Soundproof curtains, which are made of dense and noise-absorbing materials, are also being adopted by consumers, as they help reduce sound transmission in a structure.

Acoustic insulation materials are being extensively used across major industries, with the building and construction sector emerging as their biggest end user. There is a growing trend of homeowners demanding soundproofing for their households as a means to minimize outside noise. Simultaneously, workplaces are investing in modernizing their spaces by adding acoustic insulation solutions in order to improve work efficiency and focus of employees, while ensuring that meetings and seminars can be conducted smoothly without any disturbances. As a result, this area will continue to drive industry expansion.

Product Insights

In terms of product, rock wool accounted for the largest market share of 42.7% in 2025. Rock wool, also known as mineral wool, is widely used as an acoustic insulation material, providing thermal and acoustic padding, as well as fire resistance, while being easy to install. This product has witnessed strong demand from developing nations due to its economic nature. Increasing demand for this product from the transportation sector is expected to drive growth during the projection period. Its sound-isolating and flame-retardant properties have made it a mainstay in the construction industry for several years.

The foamed plastic segment is anticipated to expand at the fastest CAGR of 4.2% over the forecast period. Foamed plastic offers an improved noise barrier in a closed cell, and it can be easily injected into small pockets of ceilings and walls. They are very effective in sealing gaps as well as stopping air leaks. They are made out of several different forms of plastics, including polyurethane, polystyrene, and polyisocyanurate. Foamed plastics offer significant puncture resistance, dust & moisture resistance, and inhibit microbial & fungal growth, further driving their appeal.

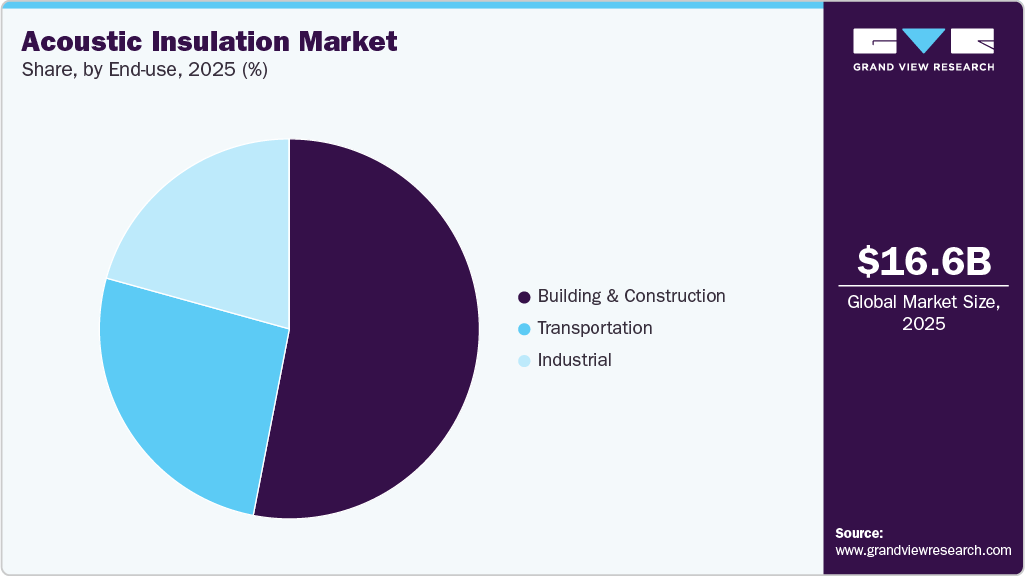

End-use Insights

The building & construction segment accounted for a dominant revenue share of 53.05% in 2025 and is expected to advance at a steady CAGR through 2033, with its dominance projected to continue during this period. A strong demand from the industry for these materials can be attributed to the significant amount of material required to enhance the acoustic insulation properties of a building. This sector experienced growth restraint during the COVID-19 outbreak, as government-imposed lockdowns led to a significant decline in construction activities globally. However, the scenario has become more positive in the post-pandemic period, as the real estate sector has picked up pace significantly.

The industrial segment is expected to grow at the fastest CAGR of 4.3% over the forecast period. Acoustic insulation systems help in reducing noise emissions to the environment when working with turbulent media. For instance, acoustic insulation can reduce noise in engine bays or equipment panels in the vehicle manufacturing industry.

Regional Insights

The Asia Pacific acoustic insulation market is driven by rapid urbanization and large-scale infrastructure development. Growing investments in residential high-rises, commercial complexes, and transportation networks increase the need for noise control solutions. Rising population density in metropolitan areas amplifies concerns around sound pollution. Expanding manufacturing and industrial activities further support demand. Government regulations on building standards also encourage adoption.

The China acoustic insulation industry has gained traction from extensive construction activity and strict noise control regulations in urban centers. Rapid industrial growth and expansion of metro rail, airports, and commercial buildings fuel demand for acoustic insulation. Increasing focus on worker safety and indoor environmental quality plays a significant role. Modernization of existing buildings also contributes to market growth. Sustainability policies further influence material selection.

North America Acoustic Insulation Market Trends

The acoustic insulation industry in North America has gained impetus from growth in commercial construction and an increase in renovation projects. Rising awareness of acoustic comfort in offices, healthcare facilities, and educational institutions boosts adoption. Technological advancements in insulation materials enhance performance expectations. Building codes increasingly address noise reduction requirements. Demand is also supported by growth in mixed-use developments.

U.S. Acoustic Insulation Market Trends

The U.S. acoustic insulation industry is driven by stringent building regulations and demand for improved indoor comfort. The expansion of data centers, commercial offices, and multifamily housing fuels market growth. An increased focus on energy efficiency and sustainability supports the integration of insulation solutions. Renovation of aging buildings remains a key contributor. Consumer awareness of the health impacts of noise-related issues further accelerates demand.

Europe Acoustic Insulation Market Trends

The acoustic insulation industry in the Europe has witnessed stringent environmental and building noise regulations. Strong emphasis on energy-efficient and sustainable construction supports the use of advanced insulation materials. Renovation of aging residential and commercial structures creates consistent demand. Growing awareness of health impacts related to noise pollution strengthens market penetration. Technological innovation in eco-friendly materials also supports growth.

The Germany acoustic insulation industry is driven by advanced industrial activity and strict compliance with workplace noise standards. The country’s strong automotive and manufacturing sectors require effective acoustic solutions. High-quality construction practices emphasize soundproofing in residential and commercial buildings. Energy-efficient building codes further support the use of integrated insulation systems. The ongoing refurbishment of older infrastructure contributes to market demand.

Latin America Acoustic Insulation Market Trends

The acoustic insulation industry in Latin America has witnessed urban development and expanding construction activities in major cities. Growing middle-class populations increase demand for improved residential living standards. Commercial and hospitality sector growth supports acoustic insulation adoption. Industrial expansion also contributes to noise management requirements. Gradual implementation of building regulations strengthens long-term demand.

Middle East & Africa Acoustic Insulation Market Trends

The acoustic insulation industry in the Middle East & Africa is driven by large-scale infrastructure and commercial construction projects. The rapid development of smart cities, airports, and hospitality facilities increases the demand for sound insulation. Extreme climate conditions support the use of multifunctional insulation materials. Rising investments in healthcare and education infrastructure contribute to growth. Increasing regulatory focus on building quality further supports market expansion.

Key Acoustic Insulation Company Insights

Major industry participants generating significant revenue include Saint-Gobain, Rockwool, and Armacell. These companies are constantly focusing on capacity expansion strategies in high-growth potential markets.

-

Saint-Gobain, headquartered in Courbevoie, France, since its establishment in 1665, has expanded from mirror production to include high-performance materials for the construction, transportation, and industrial segments. Its ISOVER brand produces stone wool and glass wool solutions to improve noise insulation properties in buildings.

-

Armacell, founded in 2000 in Luxembourg, manufactures and supplies industrial foams as well as flexible insulation solutions. It is present across Europe, Asia, and North America, with expansion also occurring in the Middle East and South America. The company offers acoustic insulation solutions, including ArmaComfort, ArmaSound, and Tubolit, while also investing in R&D to drive further innovations in this area. Armacell serves commercial, residential, and transportation segments with regard to these products.

-

Rockwool A/S, headquartered in Denmark, is a multinational corporation with an extensive mineral wool product portfolio, providing acoustic insulation for floors, ceilings, and walls in buildings. Rockwool products aim to be sustainable, innovative, and cost-effective; notable offerings include ROCKWOOL AFB, ROCKWOOL Safe’n’Sound, and ROCKWOOL Conrock Series.

Key Acoustic Insulation Companies:

The following are the leading companies in the acoustic insulation market. These companies collectively hold the largest market share and dictate industry trends.

- Saint-Gobain S.A.

- ROCKWOOL Group

- Knauf Insulation

- Owens Corning

- Johns Manville Inc.

- Armacell

- BASF SE

- Paroc Group Oy

- Kingspan Group plc

Recent Developments

-

In June 2023, Armacell announced a joint venture with insulation solutions provider AIS for manufacturing insulating jackets in the United States. In addition to thermal insulation jackets for the HVAC market, Armacell AIS would also develop acoustic insulation jackets. These jackets would be manufactured in Armacell’s Yukon, Oklahoma facility and sold exclusively in the country.

Acoustic Insulation Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 17.56 billion

Revenue forecast in 2033

USD 22.92 billion

Growth rate

CAGR of 3.9% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Taiwan; South Korea; Brazil; Argentina; Saudi Arabia

Key companies profiled

Saint-Gobain; ROCKWOOL Group; Knauf Insulation; Owens Corning; Johns Manville Inc.; Armacell; BASF SE; Paroc; Kingspan Group plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acoustic Insulation Market Report Segmentation

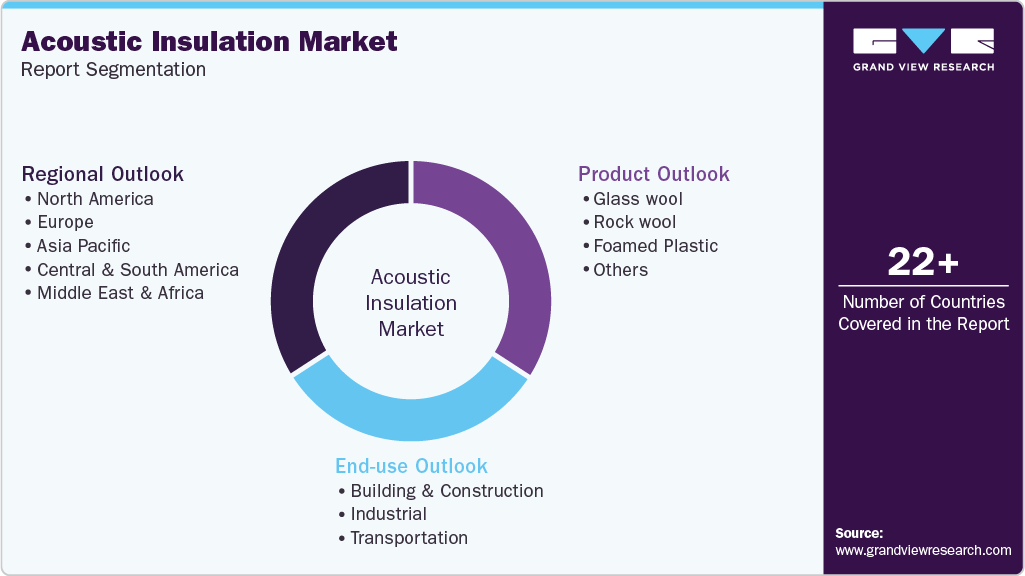

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global acoustic insulation market report based on product, end-use, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

Glass wool

-

Rock wool

-

Foamed Plastic

-

Others

-

-

End-use Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

Building & Construction

-

Industrial

-

Transportation

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Taiwan

-

South Korea

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global acoustic insulation market was estimated at USD 16.55 billion in 2025 and is expected to reach USD 17.56 billion in 2026.

b. The global acoustic insulation market is expected to grow at a compound annual growth rate a CAGR of 3.9 % from 2026 to 2033 to reach USD 22.92 billion by 2033.

b. In terms of product, rock wool accounted for the largest market share of 42.7% in 2025. Rock wool, also known as mineral wool, is extensively utilized as an acoustic insulation material as it provides thermal and acoustic padding, along with fire resistance, while also being easy to install.

b. Some key players operating in the acoustic insulation market include Saint-Gobain; ROCKWOOL Group; Knauf Insulation; Owens Corning; Johns Manville Inc.; Armacell; BASF SE; Paroc; Kingspan Group plc

b. Key factors driving market growth include rapid urbanization, increasing construction and infrastructure development, stricter building regulations, rising awareness of noise control and indoor comfort, and advancements in insulation materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.