- Home

- »

- Pharmaceuticals

- »

-

Acromegaly Treatment Market Size, Industry Report, 2030GVR Report cover

![Acromegaly Treatment Market Size, Share & Trends Report]()

Acromegaly Treatment Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Class (Somatostatin Analogs, GHRA, Dopamine Agonists), By Distribution Channel (Hospitals & Clinics), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-053-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Acromegaly Treatment Market Summary

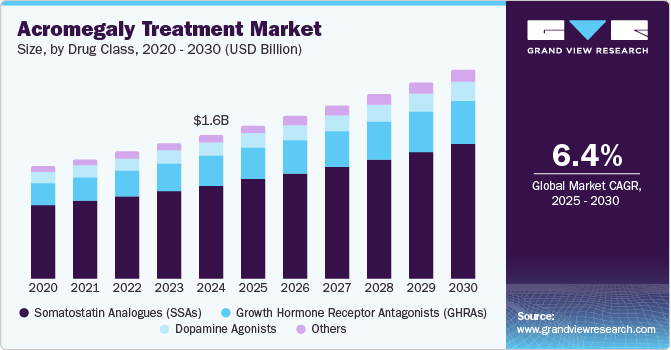

The global acromegaly treatment market size was estimated at USD 1,638.5 million in 2024 and is projected to reach USD 2,378.2 million by 2030, growing at a CAGR of 6.4% from 2025 to 2030. The market is driven by the rising prevalence of acromegaly and earlier diagnoses, supported by improved awareness, advancements in diagnostic tools such as MRI and IGF-1 tests, and a better understanding of the disease’s symptoms, all contributing to more timely detection.

Key Market Trends & Insights

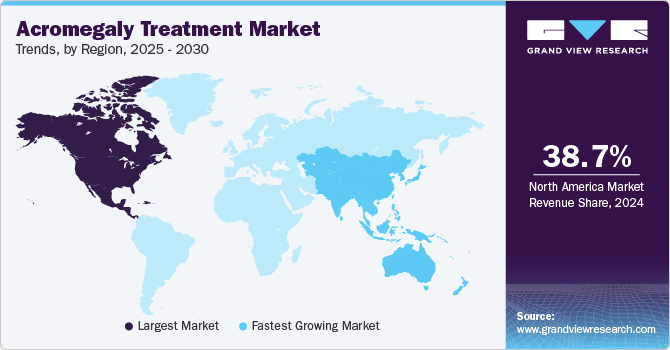

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, somatostatin analogues (ssas) accounted for a revenue of USD 1,064.2 million in 2024.

- Other Drug Types is the most lucrative drug class segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,638.5 Million

- 2030 Projected Market Size: USD 2,378.2 Million

- CAGR (2025-2030): 6.4%

- North America: Largest market in 2024

Moreover, advances in treatment options, including newer somatostatin analogs, growth hormone receptor antagonists, and personalized therapies, offer improved efficacy and fewer side effects. These innovations enhance patient outcomes and expand the treatment pool, fueling market demand and encouraging further investment in research and development.

In addition, the surging demand for personalized medicine is accelerating the acromegaly treatment industry by enabling tailored therapies that offer more effective, individualized care. Advances in genomics and diagnostics allow for precision treatments, improving patient outcomes and satisfaction. Moreover, better patient access to healthcare, especially in emerging markets, is expanding the reach of acromegaly therapies. Improved healthcare infrastructure, greater insurance coverage, and enhanced diagnostic tool availability enable more patients to seek treatment. These factors increase treatment adoption and foster market growth by broadening patient access to innovative therapies.

Drug Class Insights

The somatostatin analogues (SSAs) segment captured the largest market share of 65.0% in 2024, owing to their effectiveness in controlling growth hormone levels and managing symptoms. SSAs such as octreotide, lanreotide, and pasireotide have become the standard of care, significantly improving patient quality of life. Their ability to reduce tumor size and normalize hormone levels has made them the preferred choice for long-term management of acromegaly. In addition, supportive government policies and reimbursement programs have further solidified the dominance of SSAs in the market.

Moreover, the growth hormone receptor antagonists (GHRAs) segment is poised to register the fastest CAGR of 7.0% between 2025 and 2030 due to their targeted approach to blocking the action of growth hormones at the receptor level. GHRAs, such as pegvisomant, effectively manage acromegaly symptoms by normalizing insulin-like growth factor 1 (IGF-1) levels. The escalating prevalence of acromegaly and the demand for advanced treatment options are driving the growth of this segment. Besides, ongoing research and development efforts are expected to introduce new and improved GHRAs, further expanding their market presence.

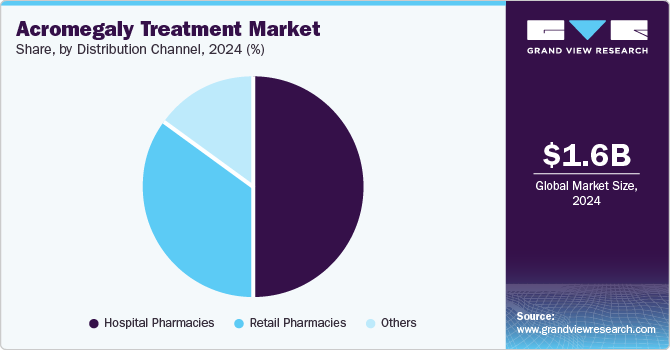

Distribution Channel Insights

The hospital pharmacies segment garnered the largest share of 49.8% in 2024, attributed to their critical role in providing immediate and specialized care. Hospital pharmacies ensure the availability of advanced medications, such as somatostatin analogs and growth hormone receptor antagonists, essential for effective acromegaly management. Their proximity to healthcare providers allows for timely administration and monitoring of treatments, leading to better patient outcomes. In addition, hospital pharmacies often have the infrastructure to handle complex therapies, making them the preferred choice for acromegaly treatment.

The retail pharmacies segment is anticipated to emerge as the fastest-growing segment and record a CAGR of 6.4% over the forecast period, spurred by their widespread accessibility and convenience. Patients benefit from easier access to necessary medications, enhancing adherence to prescribed therapies. Retail pharmacies offer personalized services, such as patient counseling and medication management, improving treatment outcomes. The expansion of retail pharmacies into specialty medications and partnerships with healthcare providers ensures comprehensive care for chronic conditions such as acromegaly.

Regional Insights

North America acromegaly treatment market recorded the largest share of 38.7% in 2024, due to the region’s advanced healthcare infrastructure, high awareness levels, and access to cutting-edge treatments. The region's strong diagnostic capabilities enable early detection of acromegaly, leading to timely treatment and better patient outcomes. Besides, the presence of major pharmaceutical companies drives innovation in drug development, particularly in somatostatin analogs and growth hormone receptor antagonists. With comprehensive healthcare coverage, including insurance plans, North American patients have greater access to medical therapies and surgical interventions, solidifying the region’s leading position in the global market.

U.S. Acromegaly Treatment Market Trends

The acromegaly treatment market in U.S. achieved a dominating share in 2024, propelled by its advanced healthcare infrastructure, extensive research and development efforts, and significant disease prevalence. The country benefits from ample investments in innovative therapies and state-of-the-art medical technologies. Besides, high awareness levels among healthcare providers and patients and supportive insurance policies and government initiatives for rare diseases have facilitated early diagnosis and effective treatment.

Strong healthcare infrastructure, advanced diagnostic capabilities, and growing awareness of rare diseases will make Canada a crucial market contributor by 2030. Focusing on patient-centered care, Canada ensures widespread access to effective treatments, including somatostatin analogs and surgical interventions. The country’s high-quality healthcare system, backed by government support, facilitates early diagnosis and long-term management of acromegaly. Moreover, ongoing research and the introduction of new therapies will further contribute to the market’s growth.

Europe Acromegaly Treatment Market Trends

Europe acromegaly treatment market is expected to experience a significant growth rate over the forecast period, attributed to the region’s advanced healthcare infrastructure, ample investment in medical research, and high prevalence of the disease. Countries such as Germany, France, and the UK have made substantial progress in developing innovative treatments and diagnostic tools. The region benefits from strong collaboration between academic institutions, research centers, and pharmaceutical companies. In addition, supportive government policies and healthcare systems ensure early diagnosis and comprehensive treatment for patients, contributing to the region's leading position in the acromegaly treatment market.

The UK is set to record a noteworthy CAGR over the forecast period, spurred by its advanced healthcare system, sizable investment in medical research, and high disease prevalence. The country's focus on developing innovative therapies and diagnostic tools has been pivotal. Collaboration between top universities, research institutions, and pharmaceutical companies further accelerates progress. Moreover, the NHS supports early diagnosis and comprehensive treatment, ensuring patients receive timely care.

Germany acromegaly treatment market is anticipated to establish a notable presence in the acromegaly treatment market in the coming years, propelled by its robust healthcare infrastructure, extensive medical research, and innovative treatment approaches. The country's commitment to developing advanced therapies and diagnostic tools is key. Collaborative efforts between leading universities, research institutions, and pharmaceutical companies are accelerating progress. Strong government support and healthcare policies also enhance early diagnosis and treatment accessibility.

Asia Pacific Acromegaly Treatment Market Trends

APAC acromegaly treatment market is set to witness the fastest CAGR of 8.0% over the forecast period, fueled by its rapid economic growth, increasing healthcare investments, and advancements in medical infrastructure. Rising awareness about acromegaly is leading to earlier diagnoses and a burgeoning demand for effective treatments. The large population and significant unmet medical needs present vast opportunities for market expansion. Furthermore, supportive government policies and initiatives encourage pharmaceutical investments and research, enhancing the development and availability of advanced therapies across the region.

Asia Pacific is poised to witness a remarkable CAGR over the forecast period, owing to fast-paced economic growth, increasing healthcare investments, and advanced medical infrastructure. Rising awareness about acromegaly has led to earlier diagnoses and a surging demand for effective treatments. Government initiatives and supportive regulations have encouraged pharmaceutical investments and research, enhancing the development and availability of advanced therapies.

Japan is projected to grow at a substantial CAGR from 2025 to 2030, driven by its state-of-the-art healthcare framework, robust medical facilities, and heightened emphasis on rare diseases. With a rising awareness of acromegaly, especially among the aging population, the demand for effective treatments is expanding. The country's strong pharmaceutical industry and government initiatives to improve healthcare access ensure the availability of therapies such as somatostatin analogs and surgical options. Moreover, ongoing innovations and research in acromegaly treatment are expected to boost the market further, making Japan a key region for future growth.

China acromegaly treatment market captured a considerable share in 2024, attributed to its rapidly advancing healthcare system, increasing healthcare investments, and growing awareness of rare diseases. With a vast population and improved access to diagnostic tools, early detection and treatment of acromegaly are becoming more common. The government’s focus on expanding healthcare coverage and improving medical infrastructure has enhanced the availability of treatments such as somatostatin analogs and surgical options. Furthermore, the rise of domestic pharmaceutical companies and better access to innovative therapies have solidified China’s dominance in the market.

Key Acromegaly Treatment Company Insights

Some of the key companies in the acromegaly treatment market include Novartis AG, Ipsen Pharma, Sun Pharmaceutical Industries Ltd, Chiasma, Inc., Peptron, Inc., WOCKHARDT, Dauntless Pharmaceuticals, Pfizer Inc., Ionis Pharmaceuticals, Inc., and others.

-

Novartis AG focuses on developing treatments for serious conditions such as cancer, cardiovascular diseases, and metabolic disorders. They strive to bring transformative therapies to patients worldwide.

-

Ipsen Pharma specializes in oncology, rare diseases, and neuroscience and is dedicated to providing therapies for high unmet medical needs, with a strong emphasis on patient well-being and scientific excellence.

Key Acromegaly Treatment Companies:

The following are the leading companies in the acromegaly treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Novartis AG

- Ipsen Pharma

- Sun Pharmaceutical Industries Ltd

- Chiasma, Inc.

- Peptron, Inc.

- WOCKHARDT

- Dauntless Pharmaceuticals

- Pfizer Inc.

- Ionis Pharmaceuticals, Inc.

Recent Developments

-

In September 2024, Crinetics Pharmaceuticals submitted a New Drug Application (NDA) to the FDA for paltusotine, a first-of-its-kind, once-daily, oral somatostatin receptor type 2 nonpeptide agonist. Paltusotine is being developed as a treatment and long-term maintenance therapy for acromegaly.

-

In August 2024, Crinetics is preparing for a 2025 U.S. launch of its acromegaly treatment and is launching a new campaign to raise awareness about the condition.

Acromegaly Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.74 billion

Revenue forecast in 2030

USD 2.37 billion

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Norway, Sweden, Japan, China, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Novartis AG, Ipsen Pharma, Sun Pharmaceutical Industries Ltd, Chiasma, Inc., Peptron, Inc., WOCKHARDT, Dauntless Pharmaceuticals, Pfizer Inc., Ionis Pharmaceuticals, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acromegaly Treatment Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global acromegaly treatment market report on the basis of drug class, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Somatostatin Analogues (SSAs)

-

Growth Hormone Receptor Antagonists (GHRAs)

-

Dopamine Agonists

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.