- Home

- »

- Plastics, Polymers & Resins

- »

-

Acrylonitrile Butadiene Styrene Market Share Report, 2030GVR Report cover

![Acrylonitrile Butadiene Styrene Market Size, Share & Trends Report]()

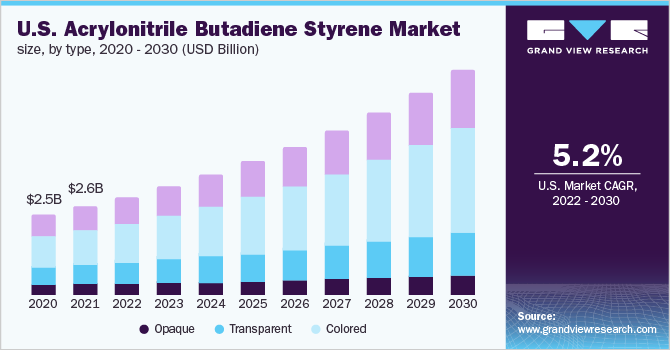

Acrylonitrile Butadiene Styrene Market Size, Share & Trends Analysis Report By Type (Opaque, Transparent, Colored), By Application (Appliances, Electrical & Electronics, Automotive), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: 978-1-68038-142-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2019 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

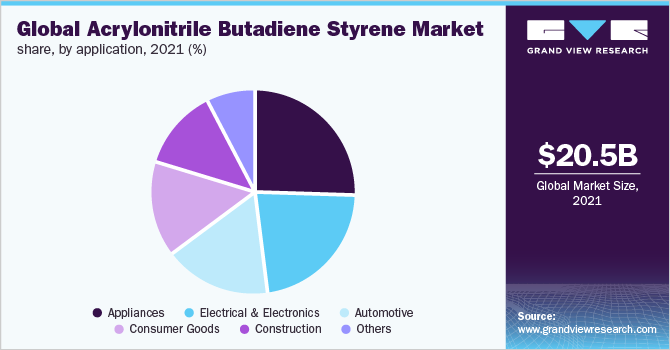

The global acrylonitrile butadiene styrene market size was valued at USD 20.54 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.6% from 2022 to 2030. The demand for acrylonitrile butadiene styrene (ABS) is likely to increase in the automotive industry owing to its lightweight properties. ABS is used to manufacture various automotive components including seating, bumper, interior trim, dashboard, center consoles, headliners, and lighting. About 12.5% of all automotive polymers used in the manufacturing of passenger automobiles are made of ABS. The developing automotive industry is likely to boost market growth over the forecast period. Moreover, ABS is used for pipes and fittings and vacuum construction owing to its properties such as excellent mechanical strength, resistance, and lightweight. ABS is widely used in the production of waste collector products owing to its superior corrosion resistance and long-lastingness. These factors are likely to boost the market growth globally in the forecast period.

To cater to the developing healthcare industry, ABS plastics are being utilized for providing higher stability to medical devices and products, such as masks, gloves, shoe and head covers, and gowns. Additionally, the market offers opportunities for the usage in varieties of construction products for deteriorating infrastructures such as broadband, bridges, roads, water systems, and power grids.

The effects of the spread of COVID-19 at the community level in the country in 2020 are projected to lead to an increased demand for various ABS products such as syringes, gloves, and mask cases, resulting in the surging demand for ABS plastics. The growth in demand for household appliances including vacuum cleaners, shavers, and food processors owing to the surge in the population will propel the ABS market growth over the forecast period.

Major players are continuously working on developing ABS components owing to the rising awareness regarding the rise in several chronic diseases such as cancer, heart disease, diabetes, arthritis, and stroke. For instance, in August 2021, LG Chem and Veolia announced their partnership for the production of ABS using recycled materials. Additionally, LG Chem planned to market low-carbon transparent ABS based on chemically recycled methylmethacrylate (MMA) to actively collaborate with Veolia R&E for process technology development and R&D to enhance the quality of recycled MMA.

Type Insights

Opaque dominated the global market and accounted for more than 40.0% share of the overall revenue in 2021. Opaque ABS has various physical properties including good chemical resistance, aging resistance, hardness, gloss, and rigidity, owing to which it has multiple uses in the automotive industry. In addition, owing to its properties, it is used in various applications including computer parts, automotive parts, luggage cases, and aircraft applications.

Opaque ABS is used to provide a smooth, long-lasting finish with high resistance to chemical and UV exposure. The hydrophobic nature of opaque ABS has led to the increased usage of ABS products being used in the automotive industry for the production of various parts such as bumpers, seating, dashboard, interior trim, headliners, center consoles, and lighting.

Factors such as suitable demographics for production and an increase in the population are expected to drive the market globally in the construction industry. Moreover, acrylonitrile butadiene styrene is used for vacuum construction and pipes and fittings due to its excellent mechanical strength and lightweight. These advantageous properties are anticipated to augment demand for opaque acrylonitrile butadiene styrene in the construction industry.

Application Insights

Appliances dominated the market and accounted for more than 25.0% share, in terms of revenue, in 2021. The rising demand for household appliances, such as microwave ovens, dryers, and washing machines, along with increasing consumer spending on appliances, is expected to boost the demand for acrylonitrile butadiene styrene in the appliances industry.

Additionally, the growth in automotive production is likely to create demand for ABS in the automotive industry. According to OICA, the industry accounted for the worldwide production of 18.59 billion light commercial vehicles, an increase of 9% from the previous year. Factors such as growing economy, rapid urbanization, growing demand for electric vehicles, and advancements in technology are expected to drive demand over the coming years.

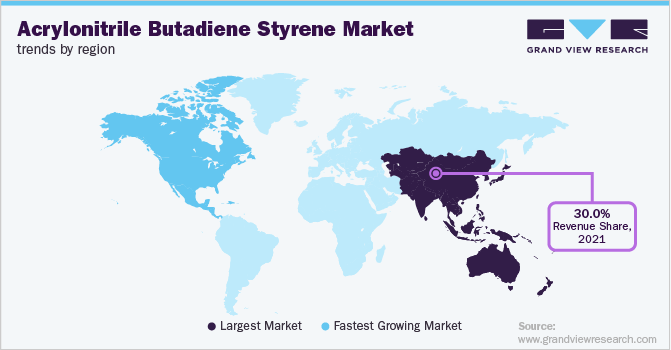

Regional Insights

Asia Pacific dominated the market in 2021 and accounted for more than 30.0% share of the overall revenue. China led the market in 2021, in terms of both volume and revenue, owing to the growth in the construction sector as a result of increasing cash flow and rising government investment in large infrastructural projects. The aforementioned factors are likely to propel the demand for ABS over the forecast period.

Furthermore, the automobile industry of China is the largest in the world in terms of unit vehicle volume produced. Even throughout the recession, production increased in the country. The increased per capita income of the government has led to an increase in demand for automobiles in the domestic market. The growth in automobile production is likely to positively impact the demand for ABS over the forecast period.

North America accounted for the second-largest revenue share in 2021 owing to increasing vehicle production in the region. Mexico is expected to witness significant growth in the automotive industry in light of increasing vehicle production and the presence of numerous major market players.

The automotive industry in the region is likely to witness a surge in vehicle export and production over the coming years. To manufacture various automotive models in huge quantities, top automakers including Honda, Nissan, and Mazda have established their manufacturing facilities in the country's central area.

Key Companies & Market Share Insights

The market has been characterized by the presence of key players along a few small and medium regional players. Due to the increasing demand for ABS components from the appliance and automotive industries, major manufacturers are continuously developing new polymers for the production of ABS.

A majority of the global companies are expected to increase their polymer offerings to Asia Pacific, Central and South America, and the Middle East and Africa owing to high market growth potential in these regions given the expansion of the ABS market. Some prominent players in the global acrylonitrile butadiene styrene market include:

-

LG Chemicals

-

Asahi Kasei Corporation

-

CHIMEI

-

Formosa Plastics Corporation

-

KUMHO PETROCHEMICAL

-

SABIC

-

Trinseo

-

INEOS Styrolution Group GmbH

-

BASF SE

-

DuPont

Acrylonitrile Butadiene Styrene Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 21.31 billion

Revenue forecast in 2030

USD 31.20 billion

Growth rate

CAGR of 4.6% from 2022 to 2030

Base year for estimation

2021

Historical data

2019 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India, Japan; Brazil; Argentina; GCC Countries; South Africa

Key companies profiled

LG Chemicals; Asahi Kasei; Chi Mei Corporation; Formosa Plastics; KKPC; SABIC; Styron; Styrolution; BASF SE; DuPont

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acrylonitrile Butadiene Styrene Market Segmentation

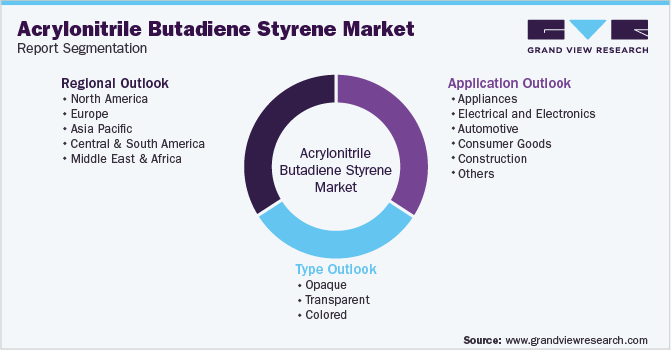

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global acrylonitrile butadiene styrene market report based on type, application, and region:

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

-

Opaque

-

Transparent

-

Colored

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

-

Appliances

-

Electrical and Electronics

-

Automotive

-

Consumer Goods

-

Construction

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global acrylonitrile butadiene styrene market size was estimated at USD 20.54 billion in 2021 and is expected to reach USD 21.31 billion in 2022.

b. The global acrylonitrile butadiene styrene market is expected to grow at a compound annual growth rate of 4.6% from 2022 to 2030 to reach USD 31.20 billion by 2022.

b. The appliance segment dominated the acrylonitrile butadiene styrene (ABS) market with a share of 25.5% in 2021. This is attributed to the changing consumption patterns of customers towards more discretionary spending.

b. Some key players operating in the acrylonitrile butadiene styrene market include LG Chemicals, Asahi Kasei Corporation, CHIMEI, Formosa Plastics Corporation, KUMHO PETROCHEMICAL, SABIC, Trinseo, and INEOS.

b. Key factors that are driving the market growth include a rising focus on lightweight automobiles & emission control and increasing demand from electrical & electronics applications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."